Canada Endoscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Endoscope, Visualization & Documentation Systems, Mechanical Endoscopy Equipment, Accessories, and Others), By Hygiene (Single-Use, Reprocessing, and Sterilization), By Application (Bronchoscopy, Arthroscopy, Laparoscopy, Urology Endoscopy, Neuroendoscopy, Gastrointestinal Endoscopy, Gynecology Endoscopy, ENT Endoscopy, and Others), By End User (Hospitals, Ambulatory Surgery Centers & Clinics, and Others), and Canada Endoscopy Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Endoscopy Devices Market Insights Forecasts to 2033

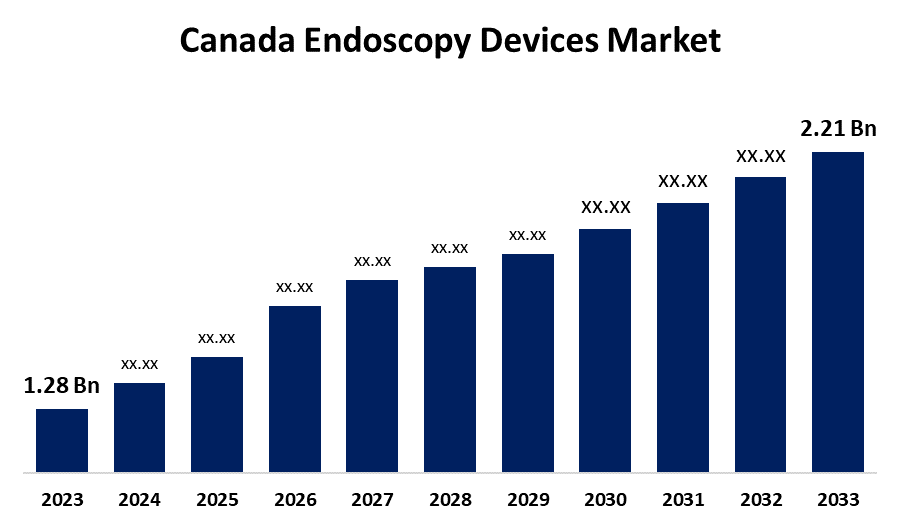

- The Canada Endoscopy Devices Market Size was valued at USD 1.28 Billion in 2023.

- The Market is Growing at a CAGR of 5.61% from 2023 to 2033

- The Canada Endoscopy Devices Market Size is Expected to reach USD 2.21 Billion by 2033

Get more details on this report -

The Canada Endoscopy Devices Market Size is anticipated to exceed USD 2.21 Billion By 2033, Growing at a CAGR of 5.61% from 2023 to 2033. The increasing preference for minimally invasive surgeries and technological advancements are driving the growth of the endoscopy devices market in the Canada.

Market Overview

Endoscopy is a nonsurgical procedure used for examining the digestive tract by using a long, thin tube with a light and a camera on the end. In 2020, around 26,900 Canadians had a colorectal cancer diagnosis; 93% of cases occur in persons over 50. Further, the most common cause of cancer-related mortality is intestinal tumors. The gold standard for identifying gastrointestinal cancers is endoscopy. Therefore, the market is anticipated to be driven by the expansion of endoscopic procedures for the early diagnosis of gastrointestinal cancers. Because of the rising incidence of cancer, endoscopic equipment is necessary, which propels the market's expansion. The technological advancements in endoscopy devices for improving patient safety and enhancing diagnosis and treatment are creating lucrative market opportunities for endoscopy devices.

Report Coverage

This research report categorizes the market for the Canada endoscopy devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada endoscopy devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada endoscopy devices market.

Canada Endoscopy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.28 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.61% |

| 2033 Value Projection: | USD 2.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Hygiene, By Application, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | Boston Scientific Corporation, Fujifilm Holdings, Instrumed Surgical, Medtronic PLC, Johnson and Johnson, KARL STORZ, Olympus Corporation, Hoya Corporation (Pantax Medical), Stryker Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing preference for minimally invasive surgeries owing to less pain and scarring, faster recovery, and lowered risk of complications are driving the market growth for endoscopy devices. Further, technological advancement including the integration of AI solutions for assisting endoscopy is driving the market growth.

Restraining Factors

The concern regarding the infections caused by endoscopes among patients is challenging the Canada endoscopy devices market.

Market Segmentation

The Canada Endoscopy Devices Market share is classified into product, hygiene, application, and end user.

- The endoscope segment dominated the market with the largest market share in 2023.

The Canada endoscopy devices market is segmented by product into endoscope, visualization & documentation systems, mechanical endoscopy equipment, accessories, and others. Among these, the endoscope segment dominated the market with the largest market share in 2023. The rigid endoscope, flexible endoscope, capsule endoscope, and robot-assisted endoscope are further subcategories of the endoscope segment. The increasing prevalence of gastrointestinal diseases among the senior population is driving the market demand.

- The reprocessing segment accounted for the largest market share during the forecast period.

The Canada endoscopy devices market is segmented by hygiene into single-use, reprocessing, and sterilization. Among these, the reprocessing segment accounted for the largest market share during the forecast period. Reprocessing of endoscopic devices includes precleaning and high-level of disinfection by flushing with forced air and ethyl or isopropyl alcohol. The concerns about the risk of endoscope-associated infections due to contaminated endoscopes are driving the market demand.

- The gastrointestinal endoscopy segment dominated the Canada endoscopy devices market with the largest market share in 2023.

Based on the application, the Canada endoscopy devices market is divided into bronchoscopy, arthroscopy, laparoscopy, urology endoscopy, neuroendoscopy, gastrointestinal endoscopy, gynecology endoscopy, ENT endoscopy, and others. Among these, the gastrointestinal endoscopy segment dominated the Canada endoscopy devices market with the largest market share in 2023. Gastrointestinal endoscopy devices are used for study, diagnosis, and treatment of gastrointestinal diseases. The high prevalence of gastrointestinal disorders and increasing innovation in endoscopy devices for endoscopy are driving the market growth.

- The hospitals segment accounted for the largest revenue share of the Canada endoscopy devices market in 2023.

Based on the end user, the Canada endoscopy devices market is divided into hospitals, ambulatory surgery centers & clinics, and others. Among these, the hospitals segment accounted for the largest revenue share of the Canada endoscopy devices market in 2023. The availability of a wide range of endoscopy devices for the diagnosis and treatment of diseases and favorable reimbursement scenarios are driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada endoscopy devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation

- Fujifilm Holdings

- Instrumed Surgical

- Medtronic PLC

- Johnson and Johnson

- KARL STORZ

- Olympus Corporation

- Hoya Corporation (Pantax Medical)

- Stryker Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, PENTAX Medical, a healthcare industry leader in diagnostic and therapeutic endoscopy solutions, announced the Canadian launch of their new Performance Endoscopic Ultrasound (EUS) system; a combination of the new ARIETTA 65 PX ultrasound scanner and their best-in-class J10 Series Ultrasound Gastroscopes.

- In December 2021, Medtronic Canada ULC, a subsidiary of Medtronic plc, the world's leading medical technology company, announced it has received a Health Canada licence for the Hugo robotic-assisted surgery (RAS) system for use in use in urologic and gynecologic laparoscopic surgical procedures.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Endoscopy Devices Market based on the below-mentioned segments:

Canada Endoscopy Devices Market, By Product

- Endoscope

- Visualization & Documentation Systems

- Mechanical Endoscopy Equipment

- Accessories

- Others

Canada Endoscopy Devices Market, By Hygiene

- Single-Use

- Reprocessing

- Sterilization

Canada Endoscopy Devices Market, By Application

- Bronchoscopy

- Arthroscopy

- Laparoscopy

- Urology Endoscopy

- Neuroendoscopy

- Gastrointestinal Endoscopy

- Gynecology Endoscopy

- ENT Endoscopy

- Others

Canada Endoscopy Devices Market, By End User

- Hospitals

- Ambulatory Surgery Centers & Clinics

- Others

Need help to buy this report?