Canada Flexible Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Plastics, Paper, and Aluminium Foil), By Product Type (Pouches, Bags, Films & Wraps, and Others), By End-user (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Homecare, Industrial, E-commerce, and Others), and Canada Flexible Packaging Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsCanada Flexible Packaging Market Insights Forecasts to 2033

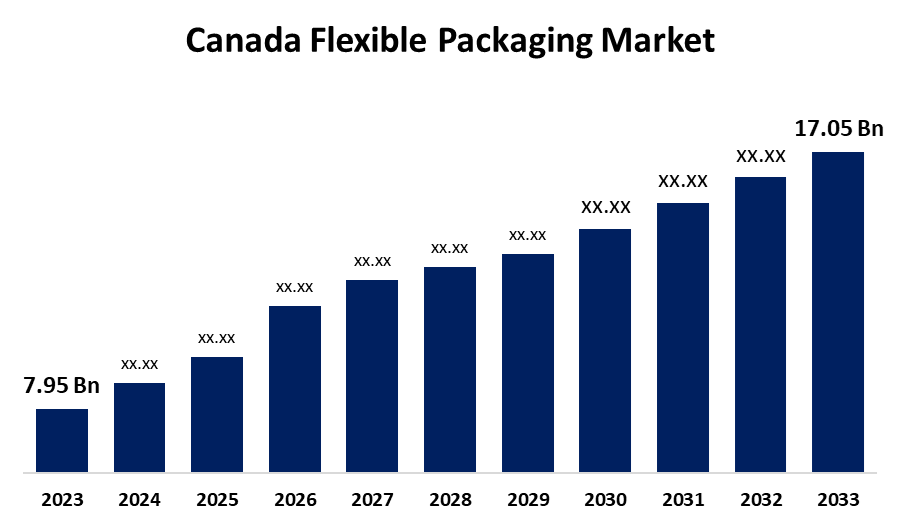

- The Canada Flexible Packaging Market Size was valued at USD 7.95 Billion in 2023.

- The Market is growing at a CAGR of 7.93% from 2023 to 2033

- The Canada Flexible Packaging Market Size is expected to reach USD 17.05 Billion by 2033

Get more details on this report -

The Canada Flexible Packaging Market Size is anticipated to exceed USD 17.05 Billion by 2033, growing at a CAGR of 7.93% from 2023 to 2033. The increasing demand for convenient packaging, changing demographics, and lifestyle factors are driving the growth of the flexible packaging market in Canada.

Market Overview

Flexible packaging is a non-rigid material packaging product produced from paper, plastic, film, aluminum foil, or any combination of these materials. They are particularly useful in industries that require versatile packaging including food & beverage, personal care, and pharmaceutical industries. The growing consumer inclination toward convenient products among those consumers who have hectic lifestyles and smaller home units necessitates this type of packaging. The increasing popularity of sustainable packaging such as fibre-based flexible packaging among consumers and manufacturers is escalating market growth opportunities. For instance, by 2025, 50% of Canada's plastic packaging will be recycled or composted, according to the Canada Plastics Pact, which was announced by more than 40 Canadian companies.

Report Coverage

This research report categorizes the market for the Canada flexible packaging market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canadian flexible packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canadian flexible packaging market.

Canada Flexible Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.95 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.93% |

| 2033 Value Projection: | USD 17.05 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Material Type, By Product Type |

| Companies covered:: | St. Johns Packaging, Sonoco Products Company, ProAmpac LLC, Covertech Flexible Packaging Inc., Emmerson Packaging, Cascades Flexible Packaging, Winpak Ltd, Constantia Flexibles, Sigma Plastics, Flair Flexible Packaging Corporation, Sit Group SpA, Transcontinental Inc., Mondi PLC, And Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The increasing use of flexible packaging for on-the-go consumption due to its convenience to store, open, and reseal is responsible for driving the market demand. With the increasing rural-urban migration, population growth, and working routine surges the demand for lightweight, on-the-go, ready-to-eat, and portable packaging that offers convenience is driving the market. In addition, the upsurging initiatives by governments and manufacturers to recycle packaging waste and reuse the material are significantly contributing to market growth.

Restraining Factors

The increased price of raw materials including plastic, paper, and metals as well as polypropylene which is used in resins, bottles, and packaging films is challenging the Canada flexible packaging market. Further, the lack of good recycling infrastructure for recycling multi-layered flexible packaging products is restraining the market.

Market Segmentation

The Canada Flexible Packaging Market share is classified into material type, product type, and end-user.

- The plastics segment is dominating the market with the largest market share during the forecast period.

The Canadian flexible packaging market is segmented by material type into plastics, paper, and aluminum foil. Among these, the plastics segment is dominating the market with the largest market share during the forecast period. Plastics that are most commonly used in flexible packaging include low-density and high-density polyethylene (PE-LD and PE-HD) and polypropylene (PP). They can be printed and also turned into products like bags. The increasing application of bio-based PLA films for food, confectionary, and bakery packaging owing to their biodegradability and recyclability is driving the market demand.

- The bags segment is expected to dominate the Canadian flexible packaging market during the forecast period.

The Canadian flexible packaging market is segmented by product type into pouches, bags, films & wraps, and others. Among these, the bags segment is expected to dominate the Canada flexible packaging market during the forecast period. Three-side seal bags, stand-up bags, zipper bags, back-seal bags, back-seal accordion bags, four-side seal bags, eight-side seal bags, and specially shaped bags are examples of common plastic flexible packaging bag types used in packing. The rising urbanization, changing lifestyles, and increased disposable income are contributing to driving the market.

- The food & beverage segment dominated the Canadian flexible packaging market with the largest market share in 2023.

Based on the end-user, the Canada flexible packaging market is divided into food & beverage, pharmaceutical, personal care & cosmetics, homecare, industrial, e-commerce, and others. Among these, the food & beverage segment dominated the Canadian flexible packaging market with the largest market share in 2023. Flexible packaging is used to package a wide range of products such as baby food, chocolate & candy, beef jerky, grains & flour, cheese & meat products, seasonings & spices, etc. The rising consumption of processed and packed foods and drinks and the rising trend of online food ordering and home delivery are driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canadian flexible packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- St. Johns Packaging

- Sonoco Products Company

- ProAmpac LLC

- Covertech Flexible Packaging Inc.

- Emmerson Packaging

- Cascades Flexible Packaging

- Winpak Ltd

- Constantia Flexibles

- Sigma Plastics

- Flair Flexible Packaging Corporation

- Sit Group SpA

- Transcontinental Inc.

- Mondi PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Sev-Rend, a company specializing in sustainable and high-performance packaging, says it has acquired Wolarmann Enterprises in Barrie, Ontario.

- In March 2024, ProAmpac, a leading provider of flexible packaging solutions, entered into a definitive agreement to acquire Gelpac, a manufacturer specializing in polywoven packaging products and multi-walled paper. This strategic move aims to bolster ProAmpac's production capacity and broaden its product portfolio across the United States and Canada.

- In December 2023, Delaware, OH-based Inno-Pak, LLC, a designer, manufacturer, importer, and supplier of eco-friendly packaging for prepared and takeout foods, has acquired Albany Packaging Inc. of Markham, Ontario.

Market Segment

This study forecasts revenue at Canadian, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Flexible Packaging Market based on the below-mentioned segments:

Canada Flexible Packaging Market, By Material Type

- Plastics

- Paper

- Aluminium Foil

Canada Flexible Packaging Market, By Product Type

- Pouches

- Bags

- Films & Wraps

- Others

Canada Flexible Packaging Market, By End-user

- Food & Beverage

- Pharmaceutical

- Personal Care & Cosmetics

- Homecare

- Industrial

- E-commerce

- Others

Need help to buy this report?