Canada Gastrointestinal Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Antiemetic & Antinauseants, Antidiarrheal & Laxatives, Anti-Inflammatory Drugs, Biologics, Acid Neutralizers, and Others), By Route of Administration (Rectal, Parenteral, and Oral), By Application (Gastroenteritis, Celiac Disease, Crohn’s Disease, Irritable Bowel-Syndrome, Inflammatory, Ulcerative-Colitis, and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), and Canada Gastrointestinal Drugs Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Gastrointestinal Drugs Market Insights Forecasts to 2033

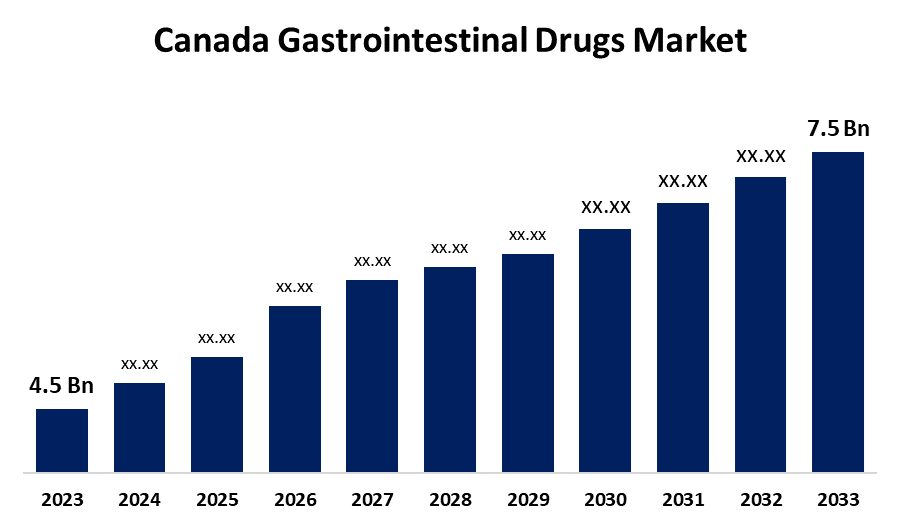

- The Canada Gastrointestinal Drugs Market Size was valued at USD 4.5 Billion in 2023.

- The Market is growing at a CAGR of 5.24% from 2023 to 2033

- The Canada Gastrointestinal Drugs Market Size is expected to reach USD 7.5 Billion by 2033

Get more details on this report -

The Canada Gastrointestinal Drugs Market is anticipated to exceed USD 7.5 Billion by 2033, growing at a CAGR of 5.24% from 2023 to 2033. The increasing prevalence of gastrointestinal disorders, the aging population, lifestyle changes & dietary habits, and technological advancements are driving the growth of the gastrointestinal drugs market in the Canada.

Market Overview

Gastrointestinal drugs are used to treat gastrointestinal disorders. These drugs include antiemetics, promotility drugs, laxatives, antimotility drugs, and drugs for acid-related disorders. The market growth is attributed to the increasing prevalence of gastrointestinal disorders, including irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD) in addition to an increase in research and development activities that resulted in the creation of advanced therapeutics for the treatment of various gastrointestinal conditions. The growing public health issues of acute gastrointestinal illness (AGI) with many pathogen sources and modes of transmission lead to bolster the market demand for these drugs. Further, the growing number of drug approvals of innovative gastrointestinal therapeutic medications is propelling the market growth. For instance, in November 2023, the FDA approved a novel therapy, potassium-competitive acid blocker Vonoprazan that treats adults with all grades of erosive esophagitis, maintains healing all grades of erosive GERD, and relieves the associated heartburn.

Report Coverage

This research report categorizes the market for the Canada gastrointestinal drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada gastrointestinal drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada gastrointestinal drugs market.

Canada Gastrointestinal Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.24% |

| 2033 Value Projection: | USD 7.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Drug Class, By Route of Administration, By Application, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Johnson & Johnson, Pfizer Inc., AbbVie Inc., Takeda Pharmaceutical Company Limited, AstraZeneca PLC, Eli Lilly and Company, GlaxoSmithKline plc, Merck & Co., Inc., Bristol Myers Squibb Company and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Canada has one of the highest rates of IBD worldwide with a forecasted rising prevalence of 2.44% per year. Thus, the increasing prevalence of gastrointestinal disorders is responsible for driving the market demand. Aging is associated with motility changes at different levels of the GI tract including impaired esophageal sphincter, slowing of gastric emptying, and increased colonic transit time. The increasing population of seniors in the country is significantly contributing to driving the market growth. The increasing risk factors associated with lifestyle which is responsible for gastrointestinal symptoms include weight change, supplement, and multivitamin intake, and reduced physical activities are propelling the gastrointestinal drugs market. Further, the emerging technologies in gastrointestinal drug delivery are driving the market growth.

Restraining Factors

The side effects and safety concerns associated with gastrointestinal drugs are challenging the gastrointestinal drugs market. Further, the generic competition and stringent regulatory environment are impeding the market growth. In addition, the inclination towards non-pharmacological approaches including lifestyle modifications and dietary changes is restraining the gastrointestinal drugs market.

Market Segmentation

The Canada Gastrointestinal Drugs Market share is classified into drug class, route of administration, application, and distribution channel.

- The biologics segment dominated the market with the largest market share during the forecast period.

The Canada gastrointestinal drugs market is segmented by drug class into antiemetic & antinauseants, antidiarrheal & laxatives, anti-inflammatory drugs, biologics, acid neutralizers, and others. Among these, the biologics segment dominated the market with the largest market share during the forecast period. Biologics treatment provides an alternative for people who do not respond to typical treatments such as 5-aminosalicylates or corticosteroids and also reduces the risk of surgery. The efficacy, convenience, and favorable safety profile of proton pump inhibitors are driving the market growth.

- The oral segment dominated the Canada gastrointestinal drugs market with the largest market share during the forecast period.

Based on the route of administration, the Canada gastrointestinal drugs market is divided into rectal, parenteral, and oral. Among these, the oral segment dominated the Canada gastrointestinal drugs market with the largest market share during the forecast period. The oral route is the most common route of administration that can be used for both systemic drug delivery and treating local gastrointestinal diseases. The rising incidence of various gastrointestinal disorders is driving the market demand.

- The Crohn’s disease segment accounted for the largest market share during the forecast period.

The Canada gastrointestinal drugs market is segmented by application into gastroenteritis, celiac disease, Crohn’s disease, irritable bowel-syndrome, inflammatory, ulcerative-colitis, and others. Among these, the Crohn’s disease segment accounted for the largest market share during the forecast period. Therapeutic drugs for Crohn’s disease include steroids (such as prednisolone), liquid diet (enteral nutrition), immunosuppressants drugs, and biological medicines. The development of novel therapies with better clinical profiles and new biomarkers for diagnosis of this disease are driving the market growth.

- The retail pharmacies segment dominated the market with the largest market share through the forecast period.

Based on the distribution channel, the Canada gastrointestinal drugs market is divided into hospital pharmacies, online pharmacies, and retail pharmacies. Among these, the retail pharmacies segment dominated the market with the largest market share through the forecast period. Retail pharmacies aid in integration of many healthcare components in order to enhance the purchasing convenience of medicines to the customer. The rising demand for OTC medications such as antacids, anti-emetics, and laxative preparations and unclean dietary habits are driving the market in the retail pharmacies segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada gastrointestinal drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson

- Pfizer Inc.

- AbbVie Inc.

- Takeda Pharmaceutical Company Limited

- AstraZeneca PLC

- Eli Lilly and Company

- GlaxoSmithKline plc

- Merck & Co., Inc.

- Bristol Myers Squibb Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Gastrointestinal Drugs Market based on the below-mentioned segments:

Canada Gastrointestinal Drugs Market, By Drug Class

- Antiemetic & Antinauseants

- Antidiarrheal & Laxatives

- Anti-Inflammatory Drugs

- Biologics

- Acid Neutralizers

- Others

Canada Gastrointestinal Drugs Market, By Route of Administration

- Rectal

- Parenteral

- Oral

Canada Gastrointestinal Drugs Market, By Application

- Gastroenteritis

- Celiac Disease

- Crohn’s Disease

- Irritable Bowel-Syndrome

- Inflammatory

- Ulcerative-Colitis

- Others

Canada Gastrointestinal Drugs Market, By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Need help to buy this report?