Canada Generic Drug Market Size, Share, and COVID-19 Impact Analysis, By Type (Simple Generics and Super Generics), By Indication (Central Nervous System (CNS), Cardiovascular, Dermatology, Oncology, Respiratory, and Others), By Route of Administration (Oral, Topical, Parenteral, and Others), By Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy), and Canada Generic Drug Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Generic Drug Market Insights Forecasts to 2033

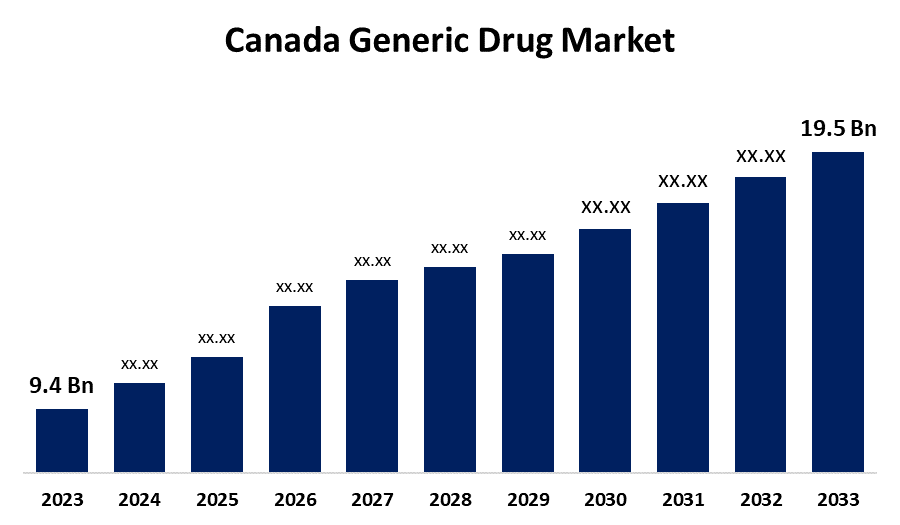

- The Canada Generic Drug Market Size was valued at USD 9.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.57% from 2023 to 2033

- The Canada Generic Drug Market Size is Expected to reach USD 19.5 Billion by 2033

Get more details on this report -

The Canada Generic Drug Market Size is anticipated to Exceed USD 19.5 Billion by 2033, Growing at a CAGR of 7.57% from 2023 to 2033. The increasing demand for artificial intelligence (AI) technology and the thriving pharmaceutical industry are driving the growth of the generic drug market in the Canada.

Market Overview

Generic drug is identical to a branded drug in dosage form, safety, strength, route of administration, effectiveness, stability, and quality. Drug manufacturers do not have to repeat the initial clinical trials for safety and efficacy, thus the generic drugs are incredibly economical. They are readily accessible, and patients don’t have to look far to locate substitutes for well-known non-generic medications. Further, the demand for generic medications is increasing in Canada since insurance companies typically cover them because of their low cost. There is an increasing focus on generic drugs by the Canadian Health Authority (Health Canada) for making them more affordable, safe, and accessible. In addition, the market expansion is expected to drive owing to the expanding generic portfolio by many multinational pharmaceutical and small companies. These factors are providing market opportunities for generic drugs in Canada.

Report Coverage

This research report categorizes the market for the Canada generic drug market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada generic drug market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada generic drug market.

Canada Generic Drug Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 9.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.57% |

| 2033 Value Projection: | USD 19.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 168 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Indication, By Route of Administration, By Distribution Channel |

| Companies covered:: | Apotex Inc., Pharmascience Inc., Sandoz AG, Sun Pharma Industries Ltd., Mylan Pharmaceuticals ULC, Teva Pharmaceutical Industries Limited, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The application of artificial intelligence in generic drug companies for finding drug biosimilars, researching drug compound crystal structures, and salt & polymorph screening are driving the market growth. Almost three-fourths of all prescription medications prescribed in Canada each year are generic versions. The rapid population growth, increasing incomes, and rising population of over 65 in Canada are contributing to propelling the generic drug market. The initiatives by government and non-government organizations to reduce the prices of prescribed drugs are contributing to driving the market.

Restraining Factors

The concern related to the quality of generic drugs is challenging the Canada generic drug market. Further, the stringent regulations used in generic pharmaceuticals are limiting the market growth.

Market Segmentation

The Canada Generic Drug Market share is classified into type, indication, route of administration, and distribution channel.

- The simple generics segment is anticipated to hold the largest market share during the forecast period.

The Canada generic drug market is segmented by type into simple generics and super generics. Among these, the simple generics segment is anticipated to hold the largest market share during the forecast period. Simple generic drugs are more accessible and are frequently administered medication. The rising preference for simple generics with the rising prevalence of the chronic disease is contributing to driving the market.

- The oncology segment accounted for the largest market share during the forecast period.

The Canada generic drug market is segmented by indication into central nervous system (CNS), cardiovascular, dermatology, oncology, respiratory, and others. Among these, the oncology segment accounted for the largest market share during the forecast period. Cisplatin, carboplatin, and methotrexate are some of the chemotherapy drugs used as generic drugs for treating cancer. The expanding research-related activities and the prevalence of cancer cases are responsible for driving the market.

- The oral segment dominated the Canada generic drug market with the largest market share during the forecast period.

Based on the route of administration, the Canada generic drug market is divided into oral, topical, parenteral, and others. Among these, the oral segment dominated the Canada generic drug market with the largest market share during the forecast period. Benefits of oral dose forms include convenience of administration, no nursing needs, and increased patient acceptability, compliance, and effectiveness in treating illnesses such as respiratory infections and pneumonia. The lower acquisition cost of generic medicines contributes to driving the market demand.

- The retail pharmacy dominated the market with the largest market share during the forecast period.

The Canada generic drug market is segmented by distribution channel into hospital pharmacy, online pharmacy, and retail pharmacy. Among these, the retail pharmacy dominated the market with a significant market share during the forecast period. The widespread accessibility of generic drugs and the convenience offered by retail pharmacies are driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada generic drug market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apotex Inc.

- Pharmascience Inc.

- Sandoz AG

- Sun Pharma Industries Ltd.

- Mylan Pharmaceuticals ULC

- Teva Pharmaceutical Industries Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Sunshine Biopharma announced the launch of two new generic prescription drugs through its Canadian subsidiary, Nora Pharma Inc. The first product is Varenicline, a generic version of Champix, used for smoking cessation.

- In April 2024, Apotex, a Toronto-based generics maker, inked a deal to acquire fellow Canadian pharma company Searchlight Pharma.

- In February 2024, Devonian Health Group Inc., a clinical-stage botanical pharmaceutical corporation, focused on developing a unique portfolio of botanical pharmaceutical and cosmeceutical products, announced that its wholly-owned subsidiary, Altius Healthcare Inc.

- (“Altius”), has launched the first authorized generic of dexlansoprazole (Dexilant) in Canada to treat symptoms of gastroesophageal reflux disease (GERD).

- In October 2023, Drugmaker Panacea Biotec unveiled in the Canadian market Paclitaxel Protein-Bound Particles for Injectable Suspension (Albumin-Bound), which is indicated for the treatment of metastatic breast cancer, non-small cell lung cancer and adenocarcinoma of the pancreas.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Generic Drug Market based on the below-mentioned segments:

Canada Generic Drug Market, By Type

- Simple Generics

- Super Generics

Canada Generic Drug Market, By Indication

- Central Nervous System (CNS)

- Cardiovascular

- Dermatology

- Oncology

- Respiratory

- Others

Canada Generic Drug Market, By Route of Administration

- Oral

- Topical

- Parenteral

- Others

Canada Generic Drug Market, By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Need help to buy this report?