Canada Health & Medical Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Provider (Public, Private, and Standalone Health Insurers), By Demographics (Minor, Adults, and Senior Citizen), By Provider Type (Preferred Provider Organizations, Point of Service, Health Maintenance Organizations, and Exclusive Provider Organizations), and Canada Health & Medical Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Health & Medical Insurance Market Insights Forecasts to 2033

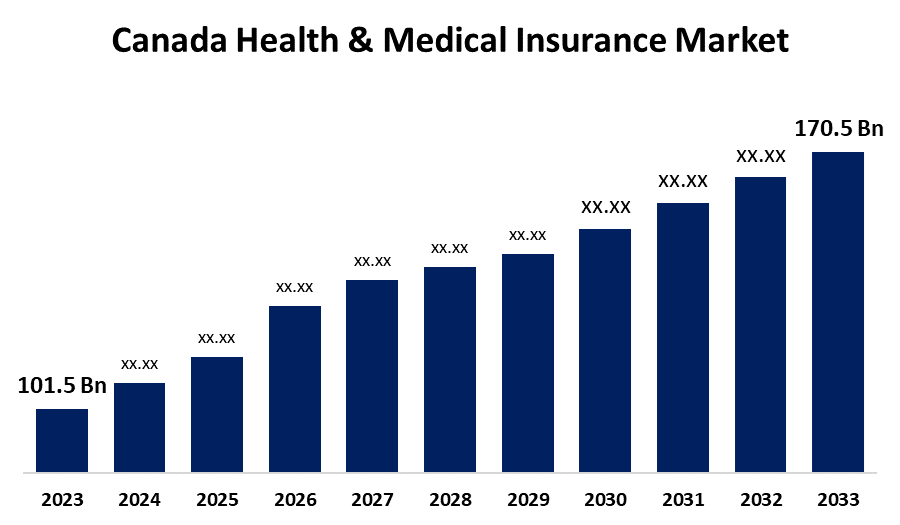

- The Canada Health & Medical Insurance Market Size was valued at USD 101.5 Billion in 2023.

- The Market is growing at a CAGR of 5.32% from 2023 to 2033

- The Canada Health & Medical Insurance Market Size is expected to reach USD 170.5 Billion by 2033

Get more details on this report -

The Canada Health & Medical Insurance Market is anticipated to exceed USD 170.5 Billion by 2033, growing at a CAGR of 5.32% from 2023 to 2033. The increasing cost of healthcare services, the prevalence of chronic disorders, and a rising aging population are driving the growth of the health & medical insurance market in Canada.

Market Overview

Health & medical insurance refers to the insurance that pays for an insured member’s medical expenses due to accident, illness, or injury. It is an effective guard against increasing medical costs, covering hospitalization costs and pre- and post-hospitalization expenses. It can be acquired through private companies, government initiatives, or employer-sponsored policies. The rising cost of medical services and daycare procedures are the factors responsible for bolstering the market demand for health & medical insurance. With the ever-increasing medical expenses in Canada, health insurance is of utmost importance as it secures individuals and their families from having to pay for unexpected medical expenses. Therefore, investing in a good health insurance policy is a wise decision that can offer peace of mind and financial security during unpredictable times.

Report Coverage

This research report categorizes the market for the Canada health & medical insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada health & medical insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada health & medical insurance market.

Canada Health & Medical Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 101.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.32% |

| 2033 Value Projection: | USD 170.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Insurance Provider, By Demographics, By Provider Type and COVID-19 Impact Analysis |

| Companies covered:: | Manulife, Sun life Financial, The Canada Life Assurance Company, Ontario Blue Cross, Group Medical Services and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The surging demand for healthcare among the growing aging population, expensive novel technologies & drugs, the prevalence of chronic diseases, and administrative insufficiencies are the factors responsible for driving the healthcare cost in Canada. The increasing cost of healthcare services leads to driving the market demand for health and medical insurance.

Restraining Factors

The high cost of premiums and the stringent documentation process for claim reimbursement are challenging the Canada health & medical insurance market.

Market Segmentation

The Canada Health & Medical Insurance Market share is classified into insurance provider, demographics, and provider type.

- The private segment is anticipated to grow at the fastest CAGR rate during the forecast period.

The Canada health & medical insurance market is segmented by insurance provider into public, private, and standalone health insurers. Among these, the private segment is anticipated to grow at the fastest CAGR rate during the forecast period. Private health insurance also known as personal health insurance covers the cost of preventive care or medical bills i.e. health-related expenses. The increasing health expenditure and surging demand for health insurance among those with individual health insurance portfolio is driving the market.

- The adults segment dominated the market with the largest market share during the forecast period.

The Canada health & medical insurance market is segmented by demographics into minor, adults, and senior citizen. Among these, the adults segment dominated the market with the largest market share during the forecast period. The increasing emphasis on health and medical insurance among young working professionals to safeguard against unforeseen medical expenses and comprehensive healthcare coverage is driving the market in the adult segment.

- The preferred provider organizations segment is expected to hold the largest market share during the forecast period.

Based on the provider type, the Canada health & medical insurance market is divided into preferred provider organizations, point of service, health maintenance organizations, and exclusive provider organizations. Among these, the preferred provider organizations segment is expected to hold the largest market share during the forecast period. Preferred provider organizations offer access to medical services such as consultations, hospitals, and medications, at a lower cost and are often provided by a private insurance carrier.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada health & medical insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Manulife

- Sun life Financial

- The Canada Life Assurance Company

- Ontario Blue Cross

- Group Medical Services

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, North American travel insurance provider Berkshire Hathaway Travel Protection (BHTP) announced that it has partnered with soNomad to provide Canadian travelers valuable travel medical insurance for unexpected health problems or sudden injuries while traveling.

- In October 2022, Canada Life announced the launch of Canada Life Index ETF Portfolios. These new passively managed funds offer the convenience of an all-in-one managed portfolio, together with the same protection benefits offered by segregated fund policies.

- In March 2022, APOLLO Insurance Solutions, Canada’s leading online policy provider, has partnered with Livelii to offer immediate digital products, specifically tailored to the independent workforce of Canada.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Health & Medical Insurance Market based on the below-mentioned segments:

Canada Health & Medical Insurance Market, By Insurance Provider

- Public

- Private

- Standalone Health Insurers

Canada Health & Medical Insurance Market, By Demographics

- Minor

- Adults

- Senior Citizen

Canada Health & Medical Insurance Market, By Provider Type

- Preferred Provider Organizations

- Point of Service

- Health Maintenance Organizations

- Exclusive Provider Organizations

Need help to buy this report?