Canada Home Appliance Market Size, Share, and COVID-19 Impact Analysis, By Type (Major Appliances, Small Appliances, and Smart Home Appliances), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online/E-commerce, and Others), and Canada Home Appliance Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsCanada Home Appliance Market Insights Forecasts to 2033

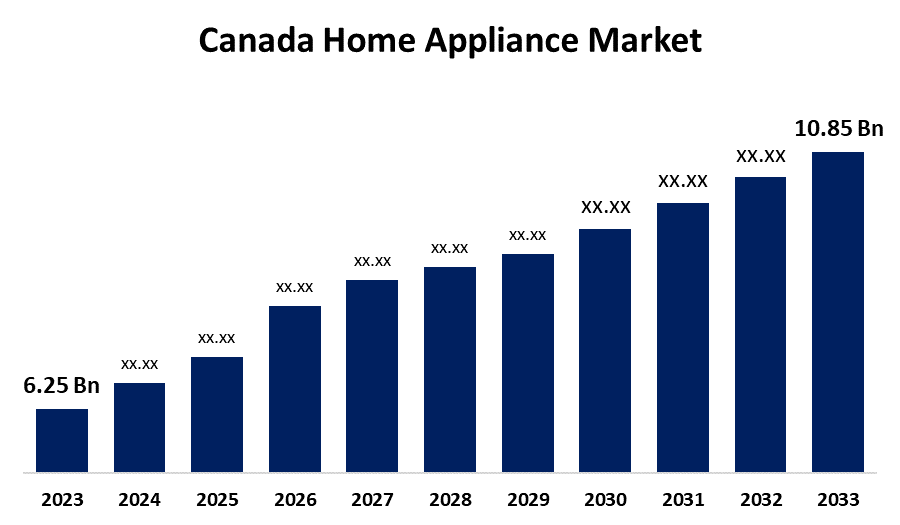

- The Canada Home Appliance Market Size was valued at USD 6.25 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.67% from 2023 to 2033

- The Canada Home Appliance Market Size is Expected to reach USD 10.85 Billion by 2033

Get more details on this report -

The Canada Home Appliance Market Size is anticipated to Exceed USD 10.85 Billion by 2033, Growing at a CAGR of 5.67% from 2023 to 2033. The increasing advancement in products to provide convenience, high consumer spending, shifting consumer demand, and improving quality of life are driving the growth of the home appliance market in Canada.

Market Overview

Home appliance is a broadly used device intended for domestic use like cooking, cleaning, and food preservation. The improvement in people's quality of life, rising consumer expenditure, including per capita income, and changing consumer needs are some of the factors driving the expansion of the home appliance industry. During the pandemic, work-from-home culture gained popularity, which increased demand for white goods. Businesses are concentrating on building flexible cost structures, driving digital transformation, and implementing agile operations. The use of advanced technologies like artificial intelligence, the Internet of Things, touchless tech, and integrated smart home tech that give several benefits to homes are promoting market growth. The introduction of green or sustainable homes for maximizing energy efficiency and minimizing the impact on the environment surges the demand for energy-efficient household appliances which is driving the market opportunities for home appliances.

Report Coverage

This research report categorizes the market for the Canada home appliance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada home appliance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada home appliance market.

Canada Home Appliance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 6.25 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.67% |

| 2033 Value Projection: | USD 10.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 157 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Whirlpool Corporation, Electrolux AB, LG Electronics, Samsung Electronics, Panasonic Corporation, Robert Bosch GmbH, Viking Range, LLC, Kenmore, Danby, Hamilton Beach Brands Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The introduction of seamless connectivity and advanced automation in home appliances for enhanced convenience and efficiency are driving the market growth. The high consumer spending is also responsible for driving the market growth. For instance, Alberta was the province with the highest average annual household appliance expenditure, with each household spending an average of 938 Canadian dollars on these items. The shifting consumer spending preferences for improving their quality of life and well-being are responsible for propelling the home appliance market.

Restraining Factors

The high maintenance cost of home appliances such as refrigerators, microwaves, stoves, dishwashers, and washers and dryers that need to be paid by the consumers (homeowner or renter) is anticipated to restrain the market. Further, the risk of household appliance hazards and accidents may hamper the home appliance market.

Market Segmentation

The Canada Home Appliance Market share is classified into type and distribution channel.

- The major appliances segment dominated the market with the largest market share in 2023.

The Canada home appliance market is segmented by type into major appliances, small appliances, and smart home appliances. Among these, the major appliances segment dominated the market with the largest market share in 2023. Major home appliances include items such as refrigerators and washing machines. The rapid urbanization, surging housing developments, and investment by consumers in appliances are driving the market in the major appliances segment.

- The online/e-commerce segment is expected to grow at the fastest CAGR rate during the forecast period.

The Canada home appliance market is segmented by distribution channel into supermarkets & hypermarkets, specialty stores, online/e-commerce, and others. Among these, the online/e-commerce segment is expected to grow at the fastest CAGR rate during the forecast period. By 2028, the internet share of the Canadian household appliance retail market is anticipated to grow from 46.0% to 48.1% on average. The consumer inclination toward smart equipment and the increasing purchasing power of customers are propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada home appliance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Whirlpool Corporation

- Electrolux AB

- LG Electronics

- Samsung Electronics

- Panasonic Corporation

- Robert Bosch GmbH

- Viking Range, LLC

- Kenmore

- Danby

- Hamilton Beach Brands Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Samsung Electronics Co., Ltd. announced its latest home appliance lineup at a series of special launch events, ‘Welcome to ‘BESPOKE AI’, held in New York City, Seoul and Paris.

- In February 2024, BORA partnered with Whirlpool Corporation within the scope of KBIS and informed local partners, in particular, about the continuation of the ‘kitchen revolution’. BORA and Whirlpool Corporation want to use this strategic partnership to transform the appliance industry with revolutionary induction cooktops and cooktop extractors.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Home Appliance Market based on the below-mentioned segments:

Canada Home Appliance Market, By Type

- Major Appliances

- Small Appliances

- Smart Home Appliances

Canada Home Appliance Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online/E-commerce

- Others

Need help to buy this report?