Canada Hospital Acquired Disease Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Test (Molecular and Conventional), By Infection (UTI, Pneumonia, Surgical site infection, Bloodstream infections, and Others), By Product (Consumables and Instruments), By Type (Blood tests and Urinalysis), and Canada Hospital Acquired Disease Diagnostics Market Insights Forecasts 2023 - 2033.

Industry: HealthcareCanada Hospital Acquired Disease Diagnostics Market Insights Forecasts to 2033

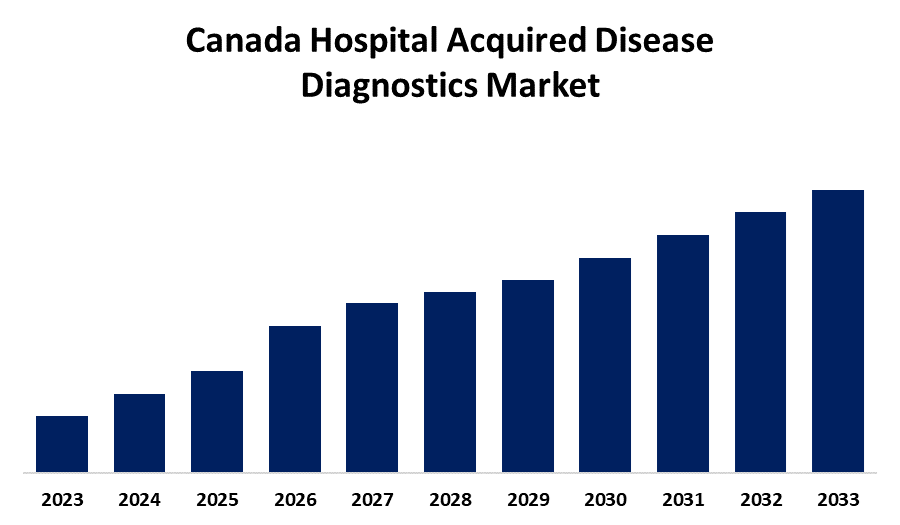

- The Canada Hospital Acquired Disease Diagnostics Market Size is Growing at 5.4% CAGR from 2023 to 2033.

- The Canada Hospital Acquired Disease Diagnostics Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The Canada Hospital Acquired Disease Diagnostics Market Size is expected to reach a significant share by 2033, growing at a 5.4% CAGR from 2023 to 2033.

Market Overview

The Canada hospital-acquired disease diagnostic market refers to the market for diagnostic tools, tests, and technologies used to detect infections and diseases acquired in hospitals. It includes diagnostic products for diseases such as pneumonia, bloodstream infections, surgical site infections, and urinary tract infections. Demand is driven by increasing hospital admissions, stringent infection control regulations, advances in diagnostic technology in equipment, and increasing Canadian hospital-acquired infection (HAI) rates. The Canadian hospital-acquired disease diagnostics market has huge opportunities with increasing healthcare consciousness, increasing hospital infection rates, and advances in diagnostics. Government efforts towards infection control, improved reimbursement policies, and rising healthcare infrastructure also drive the market's growth. Adopting rapid diagnostic tests, artificial intelligence-based diagnosis, and molecular testing allows for earlier diagnosis and treatment. Additionally, the requirement for cost-effective and efficient diagnostics in hospitals and labs offers room for market leaders to expand their presence. The Government of Canada put $6.6 million into August 2024 under the Enhanced Surveillance for Chronic Disease Program to address public health evidence gaps. This funding supports projects to improve data gathering and analysis of harms related to substances, and mental health.

Report Coverage

This research report categorizes the market for the Canada hospital acquired disease diagnostics market based on various segments and regions forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada hospital acquired disease diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada hospital acquired disease diagnostics market.

Canada Hospital Acquired Disease Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.4% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Test, By Infection, By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | bioMérieux S.A., Abbott., Hoffmann-La Roche Ltd., Siemens Healthcare Private Limited., BD (Becton, Dickinson, and Company), Bioscience, Inc., QIAGEN. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Canada hospital-acquired disease diagnostics market is fueled by some of the main drivers. Increased hospital-acquired infections (HAIs), such as MRSA, C. difficile, and pneumonia, are making healthcare centers adopt advanced diagnostic technologies. Infection control and surveillance policies from the government also drive the growth of the market. Increasing antimicrobial resistance calls for rapid and accurate diagnostic methods to deliver appropriate treatment on time. Technological advances like PCR-based diagnostic solutions and AI-enabled diagnostic solutions are improving the speed and efficiency of detection. A growing population of people who are older and thus more prone to infection is also increasing the demand for diagnostic solutions. Increased growth in healthcare costs and the growth of healthcare facilities are also speeding up market penetration. Increased vigilance among patients and medical professionals towards infection control is also a key driver of the need for effective diagnostics in Canadian hospitals.

Restraining Factors

The Canadian hospital-acquired disease diagnostics market is restricted by exorbitant diagnosis costs, strict regulatory procedures, and limited healthcare expenditures. Inadequate infection control procedures, lack of awareness, and resistance to adopting advanced diagnostic technology are also obstacles to growth in the market. Resistance to screening on a routine basis and false positive issues are also barriers to adoption on a large scale in healthcare providers.

Market Segment

- The conventional test segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the test, the Canada hospital acquired disease diagnostics market is divided into molecular and conventional. Among these, the conventional test segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because it is cost-effective, readily available in large numbers, and well-tested in hospitals. Its expected growth comes as a result of rising hospital-acquired infections, a need for standardized testing protocols, and delayed uptake of the more advanced molecular diagnostics as they are expensive and face regulatory difficulties.

- The UTI segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe.

Based on the infection, the Canada hospital acquired disease diagnostics market is divided into UTI, pneumonia, surgical site infection, bloodstream infections, and others. Among these, the UTI segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe. This is due to its high prevalence among hospitalized patients, particularly those with catheters or weakened immune systems. Growth is driven by rising hospital admissions, increased awareness of hospital-acquired infections, and advancements in rapid diagnostic methods, ensuring timely detection and treatment to reduce complications.

- The consumables segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the Canada hospital acquired disease diagnostics market is divided into consumables and instruments. Among these, the consumables segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is attributed to the consistent demand for test kits, reagents, and culture media in the diagnostics of hospital-acquired infections. Its expansion is driven by mounting infection rates, frequent testing demands, developments in diagnostic consumables, and the constant replenishment cycle, assuring constant market demand over the forecast period.

- The blood tests segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe.

Based on the type, the Canada hospital acquired disease diagnostics market is divided into blood tests and urinalysis. Among these, the blood tests segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe. This is attributed to its precision, quick detection, and vital function in the diagnosis of serious hospital-acquired infections such as sepsis. Its expansion is fueled by rising infection rates, improvements in blood-based diagnostics, and growing demand for early and accurate disease detection in healthcare facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada hospital acquired disease diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- bioMérieux S.A.

- Abbott.

- Hoffmann-La Roche Ltd.

- Siemens Healthcare Private Limited.

- BD (Becton, Dickinson, and Company)

- Bioscience, Inc.

- QIAGEN.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2023 to 2033. Spherical Insights has segmented the Canada hospital acquired disease diagnostics market based on the below-mentioned segments:

Canada Hospital Acquired Disease Diagnostics Market, By Type

- Molecular

- Conventional

Canada Hospital Acquired Disease Diagnostics Market, By Infection

- UTI

- Pneumonia

- Surgical site infection

- Bloodstream infections

- Others

Canada Hospital Acquired Disease Diagnostics Market, By Product

- Consumables

- Instruments

Canada Hospital Acquired Disease Diagnostics Market, By Type

- Blood tests

- Urinalysis

Need help to buy this report?