Canada HVAC Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Heating Equipment, Cooling Equipment, and Air Delivery Equipment), By End-user Industry (Residential and Commercial), and Canada HVAC Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingCanada HVAC Equipment Market Insights Forecasts to 2033

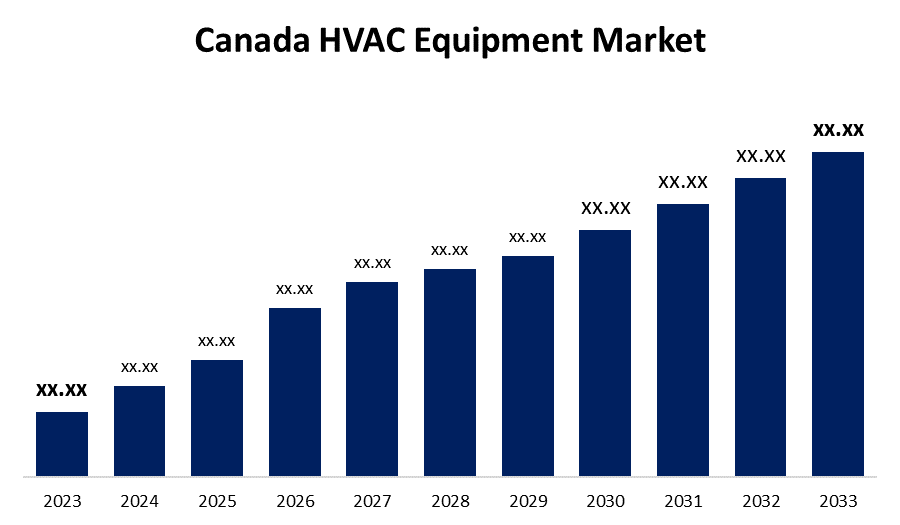

- The Market Size is Growing at a CAGR of 3.5% from 2023 to 2033

- The Canada HVAC Equipment Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Canada HVAC Equipment Market is anticipated to hold a significant share by 2033, growing at a CAGR of 3.5% from 2023 to 2033. The increasing construction activity is driving the growth of the HVAC equipment market in Canada.

Market Overview

HVAC equipment is a technology used to control the temperature, humidity, and purity of the air, providing thermal comfort and acceptable indoor air quality. In newly built areas, HVAC equipment is crucial for preserving indoor air quality and guaranteeing occupant comfort. The FMI Corporation estimates that in 2023, the total construction spending in Canada was expected to reach over USD 360.33 billion. It is anticipated to surpass USD 401 billion by 2027. The growing construction sector in the country is responsible for market growth. The cost-effective solution provided by HVAC equipment industry to cater to the energy needs of industrial and commercial customers are bolstering the market growth. The integration of IoT in HVAC industry offers real-time information about environmental factors including energy consumption, temperature, and humidity, thereby enabling effective and accurate performance.

Report Coverage

This research report categorizes the market for the Canada HVAC equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada HVAC equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada HVAC equipment market.

Canada HVAC Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By End-user |

| Companies covered:: | Daikin Industries Ltd, LG Electronics Inc., Rheem Manufacturing Company Inc., Nortek Air Solutions LLC, Trane Technologies PLC, Engineered Air, Johnson controls International PLC, Carrier Corporation, Mitsubishi Electric Corporation, Gree Canada, Others, and |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The increased construction sector in the country is significantly responsible for driving the market growth for HVAC equipment. Further, the technological advancements, energy efficiency regulations, and increasing awareness about the environmental sustainability are driving the market. In addition, the integration of Internet of Things (IoT) technology for remote monitoring and control for enhanced efficiency and comfort are contributing to propel the market growth.

Restraining Factors

The high maintenance and repair costs of HVAC system is restraining the Canada HVAC equipment market.

Market Segmentation

The Canada HVAC Equipment Market share is classified into product type and end-user industry.

- The cooling equipment segment accounted for the largest market share during the forecast period.

The Canada HVAC equipment market is segmented by product type into heating equipment, cooling equipment, and air delivery equipment. Among these, the cooling equipment segment accounted for the largest market share during the forecast period. Cooling equipments comprises of chillers and air conditioning equipments. There is an increasing demand for cooling equipment in order to improve of standard of living in hot climates and reducing food waste.

- The residential segment dominated the Canada HVAC equipment market with the largest market share in 2023.

Based on the end-user industry, the Canada HVAC equipment market is divided into residential and commercial. Among these, the residential segment dominated the Canada HVAC equipment market with the largest market share in 2023. There is driving demand for HVAC systems in residential sector owing to government controls on energy emissions from residential buildings. The increasing number of luxury residential infrastructure projects and the increased urbanization with growing per capita income in the country are contributing to drive the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada HVAC equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daikin Industries Ltd

- LG Electronics Inc.

- Rheem Manufacturing Company Inc.

- Nortek Air Solutions LLC

- Trane Technologies PLC

- Engineered Air

- Johnson controls International PLC

- Carrier Corporation

- Mitsubishi Electric Corporation

- Gree Canada

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Samsung Electronics Co., Ltd. announced that it has agreed to form a joint venture with Lennox, a leading provider of innovative climate solutions in the HVACR industry, to sell ductless HVAC systems in the United States and Canada.

- In May 2024, ABB and Powrmatic announced new agreement for electrical distribution solutions on Canadian market. Powrmatic of Canada Ltd. is Eastern Canada's most respected distributor of residential, commercial and industrial equipment, and are recognized for its quality standards in the HVAC, electrical and hearth industries for over 75 years.

- In March 2024, LG introduced air to water heat pump to canadian market. The LG R32 Air-to-Water Heat Pump Monobloc system provides ease of installation by seamlessly integrating hydronic components, using water pipes to eliminate the need for refrigerant piping.

- In February 2024, Rheem, a leading global manufacturer of water heating and HVACR products, announced the launch of its newest heat pump, Endeavor Line Classic Plus Series Universal Heat Pump RD17AZ.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada HVAC Equipment Market based on the below-mentioned segments:

Canada HVAC Equipment Market, By Product Type

- Heating Equipment

- Cooling Equipment

- Air Delivery Equipment

Canada HVAC Equipment Market, By End-user Industry

- Residential

- Commercial

Need help to buy this report?