Canada Laundry Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Washing Machines, Dryers, Electric Smoothing Irons, and Others), By Technology (Automatic, Semi-Automatic/Manual, and Others), and Canada Laundry Appliances Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsCanada Laundry Appliances Market Insights Forecasts to 2033

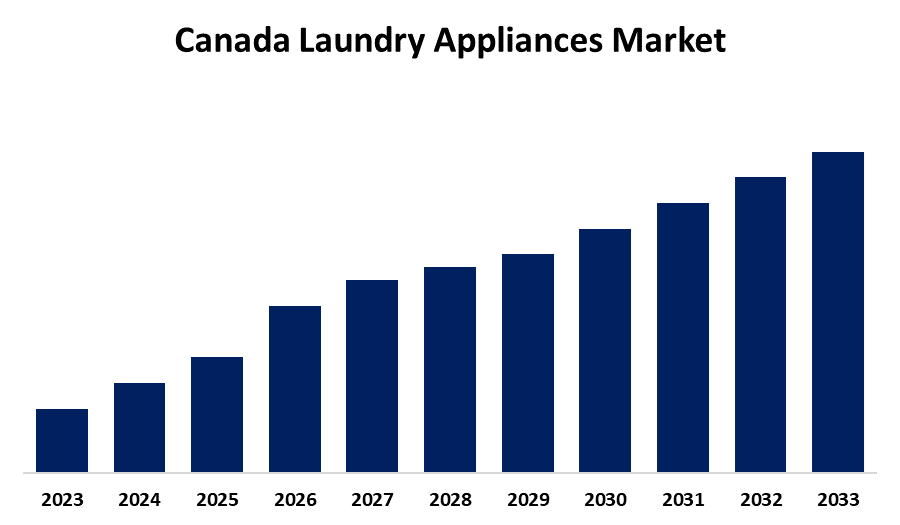

- The Market is Growing at a CAGR of 2.25% from 2023 to 2033

- The Canada Laundry Appliances Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Canada Laundry Appliances Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 2.25% from 2023 to 2033. The increasing online sales and the need for a smart laundry appliance as per current lifestyle in Canada are driving the growth of the laundry appliances market in the Canada.

Market Overview

Laundry appliances are the devices used for washing and drying clothes and textiles. These appliances include washing machines, dry-cleaners, driers, ironing and pressing appliances, that make laundry convenient and less time-consuming. The market for laundry is expanding as a result of a number of causes, such as the growing middle class, hanging lifestyles, rising disposable income, and the rise in working women. The market share of laundry appliances is anticipated to increase gradually as more people have access to higher standards of living. The advancements in fabric care technology including steam cleaning and specialized wash cycles are creating lucrative market growth opportunities. Further, the incorporation of IoT and smart washing machines and dryers for enhanced performance is escalating the laundry appliances market.

Report Coverage

This research report categorizes the market for the Canada laundry appliances market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada laundry appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada laundry appliances market.

Canada Laundry Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.25% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Product, By Technology and COVID-19 Impact Analysis. |

| Companies covered:: | LG, Whirlpool, Samsung, GE, Kenmore, Electrolux, Maytag, Haier, Panda, Pyle, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

With the presence of various online buying platforms owing to time efficiency, consumers prefer to buy appliances via online platforms, thereby enhancing product selling and resulting in driving market growth. Easy-to-use home appliances, higher living standards, and an enhanced quality of life are the factors responsible for driving the market growth. The introduction of smart technologies that allow users to control their appliances via smartphones and download custom wash cycles as per requirement is propelling the market growth.

Restraining Factors

The high initial costs required for smart technologies in laundry appliances are challenging the laundry appliances market. Further, the increasing energy consumption by the new laundry appliances is contributing to restraining the market.

Market Segmentation

The Canada Laundry Appliances Market share is classified into product and technology.

- The washing machines segment dominated the Canada laundry appliances market during the forecast period.

Based on the product, the Canada laundry appliances market is divided into washing machines, dryers, electric smoothing irons, and others. Among these, the washing machines segment dominated the Canada laundry appliances market during the forecast period. Washing machines are categorized as washers and dryers designed for residential purposes. The increasing trend toward energy-efficient with integrated new features such as large capacity, fast spin speeds, high energy consumption, and digital display in washing machines is driving the market growth.

- The automatic segment accounted for the largest market share during the forecast period.

The Canada laundry appliances market is segmented by technology into automatic, semi-automatic/manual, and others. Among these, the automatic segment accounted for the largest market share during the forecast period. Innovative technologies like water level detection and customizable wash settings are included in the fully automatic machine, which removes the need for human intervention in different wash cycles. Because of sophisticated automatic features that make using appliances even more comfortable, automatic laundry machines have been in high demand for over five years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada laundry appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG

- Whirlpool

- Samsung

- GE

- Kenmore

- Electrolux

- Maytag

- Haier

- Panda

- Pyle

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2021, Whirlpool Corporation announced it is investing more than $65 million over the next several years into its factory in Ottawa, Ohio as part of the company’s ongoing efforts to position the plant as the Premium Refrigeration Factory in its North American Region (NAR).

- In January 2021, LG Electronics (LG) introduced its most advanced innovation in laundry, deploying artificial intelligence to deliver precision washing for optimal results without guesswork. The new LG ThinQ front-load washing machine features an Artificial Intelligent Direct Drive (AI DD) motor.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Laundry Appliances Market based on the below-mentioned segments:

Canada Laundry Appliances Market, By Product

- Washing Machines

- Dryers

- Electric Smoothing Irons

- Others

Canada Laundry Appliances Market, By Technology

- Automatic

- Semi-Automatic/Manual

- Others

Need help to buy this report?