Canada Nutraceuticals Market Size, Share, and COVID-19 Impact Analysis, By Type (Functional Food, Functional Beverages, Dietary Supplements, and Others), By Distribution Channel (Online Retail Stores, Offline Retail Stores, and Others), and Canada Nutraceuticals Market Insights Forecasts 2023 - 2033

Industry: Consumer GoodsCanada Nutraceuticals Market Insights Forecasts to 2033

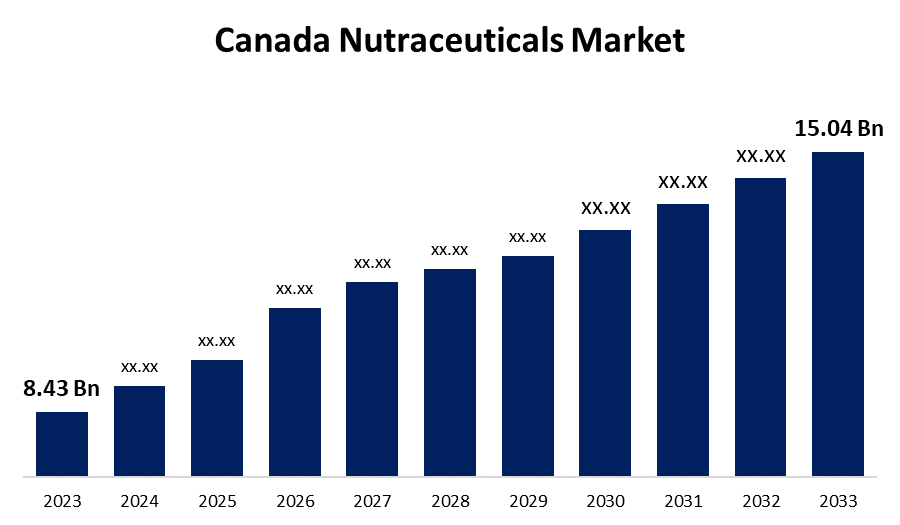

- The Canada Nutraceuticals Market Size was valued at USD 8.43 Billion in 2023

- The Market Size is Growing at a CAGR of 5.96% from 2023 to 2033.

- The Canada Nutraceuticals Market Size is Expected to Reach USD 15.04 Billion by 2033.

Get more details on this report -

The Canada Nutraceuticals Market size is expected to reach USD 15.04 Billion by 2033, at a CAGR of 5.96% during the forecast period 2023 to 2033.

Market Overview

The words nutrition and pharmaceuticals are combined to form the term nutraceuticals. These include pharmaceuticals (drugs), food additives, and dietary supplements that are used medicinally but aren't always connected to food. It prolongs life, guards against chronic illnesses, and maintains the overall strength of the body's structure. Nutraceuticals have become a prominent trend in the healthcare business in recent years in the Canadian nutraceuticals market. With a growing aging population and a greater emphasis on preventative healthcare, the Canadian nutraceuticals market has grown steadily in recent years. In addition, dietary supplement intake is predicted to increase as working professionals in Canada become more aware of the importance of maintaining balanced nutrition in the body. Furthermore, strong acceptance rates for herbal medicines among Canadians, driven by increased concerns about the risks connected with traditional pharmaceuticals, are likely to contribute to market growth throughout the projection period.

Report Coverage

This research report categorizes the market for the Canada nutraceuticals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada nutraceuticals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada nutraceuticals market.

Canada Nutraceuticals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.43 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.96% |

| 2033 Value Projection: | USD 15.04 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel. |

| Companies covered:: | ADM, Cargill Incorporated, Nestlé, DuPont de Nemours, Inc., Innophos, Inc., General Mills, Inc., The Kellogg Company, Amway Corp., W.R. Grace & Co., Avrio Health L.P, Alva-Amco, Pfizer Inc., Abbott Laboratories, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary drivers of the Canada nutraceuticals market is the increasing demand for nutraceuticals with medicinal advantages. They contain antioxidants, probiotics, and polyunsaturated fatty acids, which aid in the management of health conditions such as obesity, cardiovascular disease, cancer, cholesterol, arthritis, and diabetes. One of the most important nutraceutical industry trends is the growing preference for individualized nutrition, which might drive market expansion even further. Furthermore, preventative healthcare has become a top priority in recent years, as healthcare expenses have risen and consumers strive to avoid sickness before it develops. Nutraceuticals, which promote general health and wellness, are an ideal fit for this trend. As a result, the rising emphasis on preventative healthcare is propelling growth in the Canadian nutraceuticals market.

Restraining Factors

Producing new nutraceutical goods can be expensive, as companies must engage in research and development to guarantee that their products are safe and effective. Smaller enterprises might face a barrier to entry due to a lack of resources to engage in R&D. Furthermore, the high expenses of R&D might lead to increased consumer pricing, thus limiting market expansion.

Market Segment

- In 2023, the functional food segment accounted for the largest revenue share over the forecast period.

Based on type, the Canada nutraceuticals market is segmented into functional food, functional beverages, dietary supplements, and others. Among these, the functional food segment has the largest revenue share over the forecast period. There are several benefits connected with functional foods, including the immune system and blood lipid regulation, fatigue relief, and nutritional supplementation, which are expected to drive segment expansion. Companies in Canada are heavily involved in developing and producing new products for the market. For example, in January 2020, Nestlé created a joint venture with Burcon and Merit Functional Foods. This collaboration is expected to improve Nestlé's plant-based food and beverage offerings with functional plant proteins. As a result, collaborations between key firms and raw material suppliers in the country are expected to promote new product releases in the market, contributing to the growth of the functional food segment in the Canada nutraceuticals market over the forecast period.

- In 2023, the offline retail stores segment is witnessing significant growth over the forecast period.

Based on distribution channel, the Canada nutraceuticals market is segmented into online retail stores, offline retail stores, and others. Among these, the offline retail stores segment is witnessing significant growth over the forecast period. Pharmacies and medicine stores account for a significant amount of nutraceutical sales, particularly health and dietary supplements. Consumers favor this channel because it offers a large range of items, allowing them to choose based on their needs and compare the benefits. Furthermore, because of their high functional properties, nutraceuticals are more commonly sold at specialty stores around the country. According to Statistics Canada, as of 2021, there are 556 food supplement retailers in Ontario, which has the largest count in Canada. Furthermore, consumers choose supermarkets/hypermarkets for purchasing functional food and beverages due to the availability of a large range and low pricing with significant discounts. The personal touch that comes with purchasing various nutraceuticals, particularly supplements, through various offline retail channels has contributed to the expansion of the nutraceuticals industry in Canada.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada nutraceuticals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM

- Cargill Incorporated

- Nestlé

- DuPont de Nemours, Inc.

- Innophos, Inc.

- General Mills, Inc.

- The Kellogg Company

- Amway Corp.

- W.R. Grace & Co.

- Avrio Health L.P

- Alva-Amco

- Pfizer Inc.

- Abbott Laboratories

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2022, Nestlé and Nature’s Bounty joined the Canadian vitamins and supplements industry by launching the VitaBeans product line. In addition to being vegetarian, the beans are free of gluten, gelatin, and artificial colors and flavors.

- In June 2022, Kellogg Company announced a separation into three firms focused on cereals, snacks, and plant-based foods. According to Kellogg's, the "Global Snacking Co" intends to focus on snacking, cereal, noodles, and frozen breakfasts in North America. A "North American Cereal Company" would concentrate on cereal in the United States, Canada, and the Caribbean, while a "Plant Company" would specialize on plant-based products, led by MorningStar Farms.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Canada Nutraceuticals Market based on the below-mentioned segments:

Canada Nutraceuticals Market, By Type

- Functional Food

- Functional Beverages

- Dietary Supplements

- Others

Canada Nutraceuticals Market, By Distribution Channel

- Online Retail Stores

- Offline Retail Stores

- Others

Need help to buy this report?