Canada Oilfield Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Corrosion & Scale Inhibitors, Demulsifiers, Biocides, Surfactants, and Polymers), By Application (Drilling, Production, Cementing, Enhanced Oil Recovery, Water Treatment, Hydraulic Fracturing, and Workover & Completion), and Canada Oilfield Chemicals Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsCanada Oilfield Chemicals Market Insights Forecasts to 2033

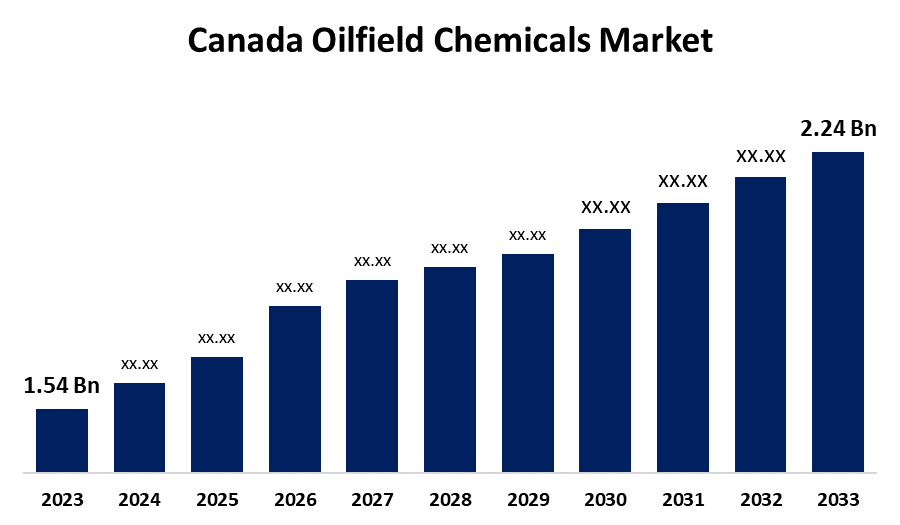

- The Canada Oilfield Chemicals Market Size was valued at USD 1.54 Billion in 2023

- The Market is Growing at a CAGR of 3.82% from 2023 to 2033

- The Canada Oilfield Chemicals Market Size is Expected to reach USD 2.24 Billion by 2033

Get more details on this report -

The Canada Oilfield Chemicals Market Size is anticipated to exceed USD 2.24 Billion by 2033, Growing at a CAGR of 3.82% from 2023 to 2033. The increasing domestic demand, shift towards hydrocarbon resources, and advancement in drilling & production technologies are driving the growth of the oilfield chemicals market in Canada.

Market Overview

Oilfield chemicals are the chemical components applied in oil and gas extraction operations to improve the efficiency and productivity of the oil drilling process and petroleum refining. This aids in maximizing the recovery of oil and gas reserves and minimizing environmental impact. Demulsifiers and anti-corrosion agents or corrosion inhibitors are the oilfield chemicals that aid in the separation of oil from other liquids and solids and protect against corrosion and oil leakage respectively. The use of these oilfield chemicals reduces unnecessary costs and improves industrial profit margins. The need for oilfield chemicals is expected to increase as a result of better deep-water drilling and oil and gas development. Further, the advancement in reservoir performance using smart chemicals is offering market opportunities for oilfield chemicals.

Report Coverage

This research report categorizes the market for the Canada oilfield chemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada oilfield chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada oilfield chemicals market.

Canada Oilfield Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.54 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.82% |

| 2033 Value Projection: | USD 2.24 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 91 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | BASF, Dow, DuPont, Croda International Plc, The Lubrizol Corporation, Akzo Nobel N.V., Stepan Company, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing emphasis on newer technologies such as automation and digital means that enhance performance as well as the safety and environmental impact of the industry are driving the market growth. The inclination towards EOR (enhanced oil recovery) methods for extracting oil is propelling the market. Further, the rising demand for regulatory compliance and environmental sustainability in oil and gas operations for enhanced operational efficiency are driving the market growth. In addition, the increasing investment in technological advancement in drilling and production technologies is escalating the market growth.

Restraining Factors

The inclination towards the transition to renewable energy in order to accelerate progress towards a low-carbon future is restraining the Canada oilfield chemicals market.

Market Segmentation

The Canada Oilfield Chemicals Market share is classified into product and application.

- The corrosion & scale inhibitors dominated the market with the largest market share in 2023.

The Canada oilfield chemicals market is segmented by product into corrosion & scale inhibitors, demulsifiers, biocides, surfactants, and polymers. Among these, the corrosion & scale inhibitors dominated the market with the largest market share in 2023. The Western Canadian Sedimentary Basin (WCSB) is where about 95% of Canada's oil production, occurs. The WCSB frequently experiences high temperatures, high pressures, and corrosive fluids, which makes corrosion and scale inhibitors even more important for preventing rust and degradation on metal surfaces. The rising demand for the oil and gas industry is contributing to driving the market demand.

- The production segment dominated the Canada oilfield chemicals market in 2023.

Based on the application, the Canada oilfield chemicals market is divided into drilling, production, cementing, enhanced oil recovery, water treatment, hydraulic fracturing, and workover & completion. Among these, the production segment dominated the Canada oilfield chemicals market in 2023. Crude oil, improved oil recovery, hydraulic fracturing, and other production techniques all heavily rely on oilfield production chemicals. The complexity of managing oilfields and technological advancements are driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada oilfield chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF

- Dow

- DuPont

- Croda International Plc

- The Lubrizol Corporation

- Akzo Nobel N.V.

- Stepan Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, In a unique state-university-industry collaboration, Dow, the State of Wyoming and the University of Wyoming have come together to launch The Wyoming Gas Injection Initiative (WGII), a program designed to enhance oil well productivity and recovery from existing fields and wells in Wyoming.

- In May 2024, BASF invested in the capacity expansion of the Basoflux range of paraffin inhibitors. This investment would enable BASF’s Oilfield Chemicals business to meet the current and future demand of novel paraffin inhibitors for the Oil and Gas industry.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Oilfield Chemicals Market based on the below-mentioned segments:

Canada Oilfield Chemicals Market, By Product

- Corrosion & Scale Inhibitors

- Demulsifiers

- Biocides

- Surfactants

- Polymers

Canada Oilfield Chemicals Market, By Application

- Drilling

- Production

- Cementing

- Enhanced Oil Recovery

- Water Treatment

- Hydraulic Fracturing

- Workover & Completion

Need help to buy this report?