Canada Parkinson’s Disease Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Decarboxylase Inhibitors, Dopamine Agonists, Monoamine Oxidase Type B (MAO-B) Inhibitor, and Catechol-O-Methyltransferase (COMT) Inhibitors), By Route of Administration (Oral, Injection, and Transdermal), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Canada Parkinson’s Disease Drugs Market Insights Forecasts 2023 - 2033.

Industry: HealthcareCanada Parkinsons Disease Drugs Market Insights Forecasts to 2033

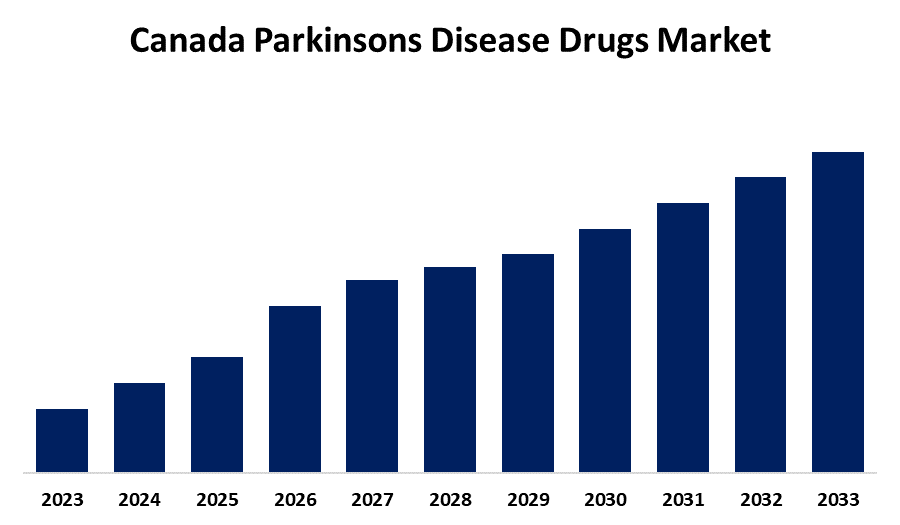

- The Canada Parkinsons Disease Drugs Market Size is Growing at 3.5% CAGR from 2023 to 2033.

- The Canada Parkinsons Disease Drugs Market Size is Expected to Reach a Significant Share By 2033.

Get more details on this report -

The Canada Parkinsons Disease Drugs Market Size is Expected to reach a significant share By 2033, Growing at a 3.5% CAGR from 2023 to 2033.

Market Overview

The Canada Parkinsons disease drugs market is the pharmaceutical industry dedicated to the research, development, manufacture, and sale of drugs utilized to treat Parkinson's disease in Canada. The market encompasses several drug classes such as dopaminergic agents, MAO-B inhibitors, COMT inhibitors, anticholinergics, and others that are used to reduce motor and non-motor symptoms. Growth is fueled by increasing disease prevalence, drug therapy innovation, and a growing geriatric population, combined with continued research into neuroprotective therapies. The Canada Parkinsons Disease Drugs market offers high opportunities fueled by a growing population and increasing disease prevalence. Innovation in drug development, such as new therapies such as gene and stem cell treatments, provides potential for growth. Growing healthcare funding, government policies, and increased research partnerships fuel innovation further. Increasing awareness, diagnosis advancements at an early stage, and the need for personalized medicines drive market opportunities. Moreover, the growth of digital health solutions and telemedicine to treat diseases opens new opportunities for pharmaceutical firms to widen their market opportunity. In May 2023, Health Canada approved a 24-hour subcutaneous infusion of levodopa-based therapy, Vyalev, which provides a non-surgical therapy option for late-stage Parkinson's disease patients. Furthermore, efforts by the government to enhance access and quality of healthcare are stimulating growth in the market for Parkinson's disease drugs.

Report Coverage

This research report categorizes the market for the Canada Parkinsons disease drugs market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada Parkinson’s disease drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada Parkinson’s disease drugs market.

Canada Parkinsons Disease Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 141 |

| Segments covered: | By Drug Class, By Route of Administration, By Distribution Channel |

| Companies covered:: | AbbVie, Merck, GlaxoSmithKline, Novartis, Teva Pharmaceutical Industries, UCB, ACADIA Pharmaceuticals, Impax Laboratories, Lundbeck, Vertical Pharmaceuticals, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Canadian Parkinsons disease drug market is influenced by several drivers. The increase in the prevalence of Parkinson's disease, especially among the elderly, is one of the major drivers since age is one of the primary risk factors. Improved drug development, such as new drugs like gene therapy, dopamine agonists, and enzyme inhibitors, is increasing treatment opportunities and enhancing patient outcomes. Support for research on neurological disorders by the government and growing healthcare spending further fuel market growth. Further, increased awareness of Parkinsons disease and efforts in early diagnosis result in greater demand for drugs. Growing specialty clinic coverage and greater access to healthcare services further accelerate drug uptake. Further, heightened interest in combination therapies that improve symptom control also drives market growth. Pharmaceutical firms are also making investments in clinical studies and novel formulations of drugs, including extended-release drugs, thus furthering the growth of the market in Canada.

Restraining Factors

The Canadian Parkinsons disease drugs market is faced with a number of inhibiting factors, including the high cost of drug development, rigorous regulatory approvals, and poor access to disease-modifying drugs. The market is also hindered by high treatment costs, potential side effects of existing drugs, and delayed adoption of new treatments. Delayed diagnosis of the disease, poor patient awareness, and competition from alternative treatment options also hinder market growth and access.

Market Segment

- The dopamine agonists segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the drug class, the Canada Parkinson’s disease drugs market is divided into decarboxylase inhibitors, dopamine agonists, monoamine oxidase type B (MAO-B) inhibitor, and catechol-O-methyltransferase (COMT) inhibitors. Among these, the dopamine agonists segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to their effectiveness in managing Parkinson’s symptoms, especially in early-stage patients. Their ability to reduce motor fluctuations, delayed need for levodopa, and fewer side effects drive demand. Advancements in drug formulations and increasing Parkinson’s prevalence further support its significant CAGR growth.

- The oral segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe.

Based on the route of administration, the Canada Parkinsons disease drugs market is divided into oral, injection, and transdermal. Among these, the oral segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe. The segmental growth is attributed to its convenience, high patient compliance, and wide availability of Parkinson’s disease medications in tablet and capsule forms. Cost-effectiveness, ease of self-administration, and advancements in extended-release formulations further drive demand. Growing prescriptions and preference for non-invasive treatment support its significant CAGR growth.

- The hospital pharmacy segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the Canada Parkinson’s disease drugs market is divided into hospital pharmacy, retail pharmacy, and online pharmacy. Among these, the hospital pharmacy segment accounted for the majority of the share in 2023 and is estimated to grow at a significant CAGR during the projected timeframe. The segmental growth is attributed to the increasing number of Parkinson’s disease diagnoses requiring specialist supervision and advanced medication management. Hospitals provide access to a wide range of prescription drugs, ensuring proper dosage and treatment monitoring. Rising hospital visits and improved drug availability drive its significant CAGR growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada Parkinson’s disease drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie

- Merck

- GlaxoSmithKline

- Novartis

- Teva Pharmaceutical Industries

- UCB

- ACADIA Pharmaceuticals

- Impax Laboratories

- Lundbeck

- Vertical Pharmaceuticals

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Canada Parkinson's disease drugs market based on the below-mentioned segments:

Canada Parkinson’s Disease Drugs Market, By Drug Class

- Decarboxylase Inhibitors

- Dopamine Agonists

- Monoamine Oxidase Type B (MAO-B) Inhibitor

- Catechol-O-Methyltransferase (COMT) Inhibitors

Canada Parkinson’s Disease Drugs Market, By Route of Administration

- Oral

- Injection

- Transdermal

Canada Parkinson’s Disease Drugs Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Need help to buy this report?