Canada Patient Monitoring Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Blood Glucose Monitoring Systems, Cardiac Monitoring Devices, Multi-Parameter Monitoring Devices, Respiratory Monitoring Devices, Hemodynamic/Pressure Monitoring Devices, Weight Monitoring Devices, Fetal & Neonatal Monitoring Devices, Neuromonitoring Devices, and Temperature Monitoring Devices), By End User (Hospitals & Clinics, Ambulatory Surgical Centers, Home Care Settings, and Others), and Canada Patient Monitoring Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Patient Monitoring Devices Market Insights Forecasts to 2033

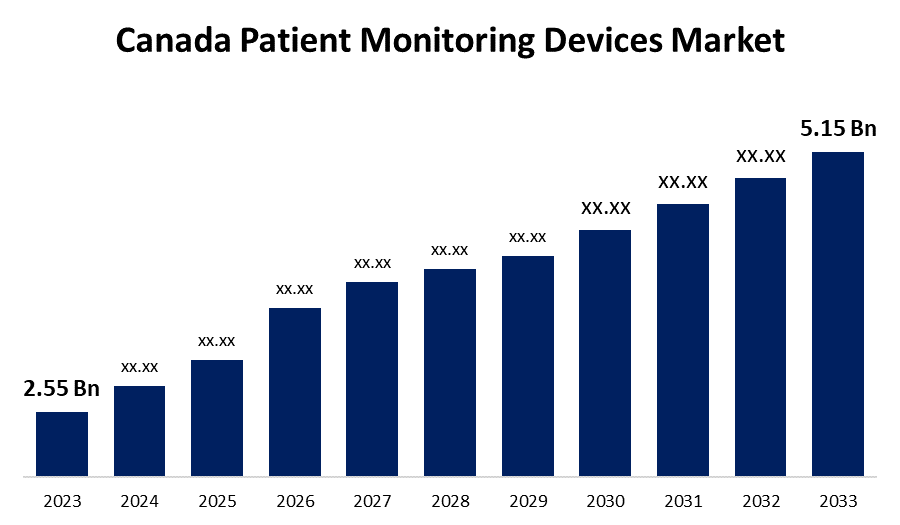

- The Canada Patient Monitoring Devices Market Size was valued at USD 2.55 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.28% from 2023 to 2033

- The Canada Patient Monitoring Devices Market Size is expected to reach USD 5.15 Billion by 2033

Get more details on this report -

The Canada Patient Monitoring Devices Market Size is anticipated to exceed USD 5.15 Billion by 2033, Growing at a CAGR of 7.28% from 2023 to 2033. The increasing burden of chronic diseases due to lifestyle changes and preference for home & remote monitoring are driving the growth of the patient monitoring devices market in the Canada.

Market Overview

Patient monitoring devices are the equipments used for monitoring patients through various vital signs and warning systems to detect and record changes in patient well being. It allows continuous monitoring of patient vital signs and aids in enhancing patient care. Canada is renowned for its strong healthcare system, leading the way in incorporating cutting-edge patient monitoring technologies to improve patient care. There is evolving technological developments including remote patient monitoring (RPM) and integration of electronic health records (EHRs) with patient monitoring systems for effective management of patient care in real time, providing data to healthcare professional that enable them to take appropriate decision on patient treatment regimes. The AI integration for real time data analysis and personalized treatment plans are providing market opportunities for patient monitoring devices. Furthermore, there is driving trend of wearable technology & Internet of Medical Things and telehealth expansion for improved and efficient patient care.

Report Coverage

This research report categorizes the market for the Canada patient monitoring devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada patient monitoring devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada patient monitoring devices market.

Canada Patient Monitoring Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.55 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.28% |

| 2033 Value Projection: | USD 5.15 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End User. |

| Companies covered:: | Abbott Laboratories, Baxter International Inc., Boston Scientific Corporation, Masimo Corporation, Becton, Dickinson and Company, Johnson & Johnson, General Electric Company (GE Healthcare), Omron Corporation, Siemens Healthcare GmbH, Koninklijke Philips NV, Medtronic PLC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

It is reported that more than half of Canadian adults having one or more chronic illnesses including mental health disorders, lung disease, arthritis, and cardiovascular disease, either alone or in combination in the year 2018 as per the Health Care in Canada (HCIC) survey. The population of Canada is getting older. As a result, the prevalence of age-related chronic illnesses is rising and rising demand for disease management. The increasing burden of chronic diseases along with the rising ageing population are driving the market demand for patient monitoring devices for disease management. Further, there is increasing market for patient monitoring for home healthcare benefits of health remote monitoring systems (HRMS) including reduced patient load in hospitals and healthcare centers.

Restraining Factors

The resistance toward the adoption of patient monitoring systems owing to the concerns about privacy, reliability, and perceived complexity by the consumers is challenging the market. Further, the high cost of technology and stringent regulatory policies for products approval are challenging the Canada patient monitoring devices market

Market Segmentation

The Canada Patient Monitoring Devices Market share is classified into product and end user.

- The blood glucose monitoring systems (BGMS) segment dominated the market with the largest market share in 2023.

The Canada patient monitoring devices market is segmented by product into blood glucose monitoring systems, cardiac monitoring devices, multi-parameter monitoring devices, respiratory monitoring devices, hemodynamic/pressure monitoring devices, weight monitoring devices, fetal & neonatal monitoring devices, neuromonitoring devices, and temperature monitoring devices. Among these, the blood glucose monitoring systems (BGMS) segment dominated the market with the largest market share in 2023. Blood glucose monitoring systems (BGMS) devices aids in diabetes management, confirming acute hypoglycaemia or hyperglycemia by identifying blood glucose levels in order to enable adjustment of treatment plans. The evolving technological advancements and innovations such as continuous glucose monitoring are driving the market growth.

- The ambulatory surgical centers (ASCs) segment is projected to register the fastest CAGR growth during the forecast period.

The Canada patient monitoring devices market is segmented by end user into hospitals & clinics, ambulatory surgical centers, home care settings, and others. Among these, the ambulatory surgical centers (ASCs) segment is projected to register the fastest CAGR growth during the forecast period. Ambulatory surgical centers (ASCs) are convenient alternative to hospital based outpatient procedures that offers same day surgical care. The increasing advancements in diagnostic techniques and surgeries such as minimally invasive surgieries, endoscopy, and laproscopy are the factors contributing to drive the market in the ambulatory surgical centers (ASCs) segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada Patient Monitoring Devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Baxter International Inc.

- Boston Scientific Corporation

- Masimo Corporation

- Becton, Dickinson and Company

- Johnson & Johnson

- General Electric Company (GE Healthcare)

- Omron Corporation

- Siemens Healthcare GmbH

- Koninklijke Philips NV

- Medtronic PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, TELUS Health announced it has been selected to provide a Remote Care Management (RCM) solution in Ontario, a state-of-the-art solution to equip health practitioners with tools to actively monitor patients from a distance over time. Following the completion of a competitive bid process for an RCM solution, Ontario Health awarded the contract to TELUS Health.

- In August 2022, Teladoc Health, the global leader in whole-person virtual care, together with Cloud DX, a leading remote patient monitoring ("RPM") platform, announced that they have entered into a strategic partnership to better serve the remote monitoring needs of patients across Canada.

- In March 2022, The Ontario government is making it more affordable for Ontarians living with type 1 diabetes to monitor their blood glucose levels by providing coverage for real-time continuous glucose monitors, the latest technology in diabetes care, through the province’s Assistive Devices Program.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Patient Monitoring Devices Market based on the below-mentioned segments:

Canada Patient Monitoring Devices Market, By Product

- Blood Glucose Monitoring Systems

- Cardiac Monitoring Devices

- Multi-Parameter Monitoring Devices

- Respiratory Monitoring Devices

- Hemodynamic/Pressure Monitoring Devices

- Weight Monitoring Devices

- Fetal & Neonatal Monitoring Devices

- Neuromonitoring Devices

- Temperature Monitoring Devices

Canada Patient Monitoring Devices Market, By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Home Care Settings

- Others

Need help to buy this report?