Canada Plant Protein Market Size, Share, and COVID-19 Impact Analysis, By Protein Type (Hemp Protein, Oat Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, and Wheat Protein), By End-User (Animal Feed, Personal Care & Cosmetics, Food & Beverages, and Supplements), and Canada Plant Protein Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesCanada Plant Protein Market Insights Forecasts to 2033

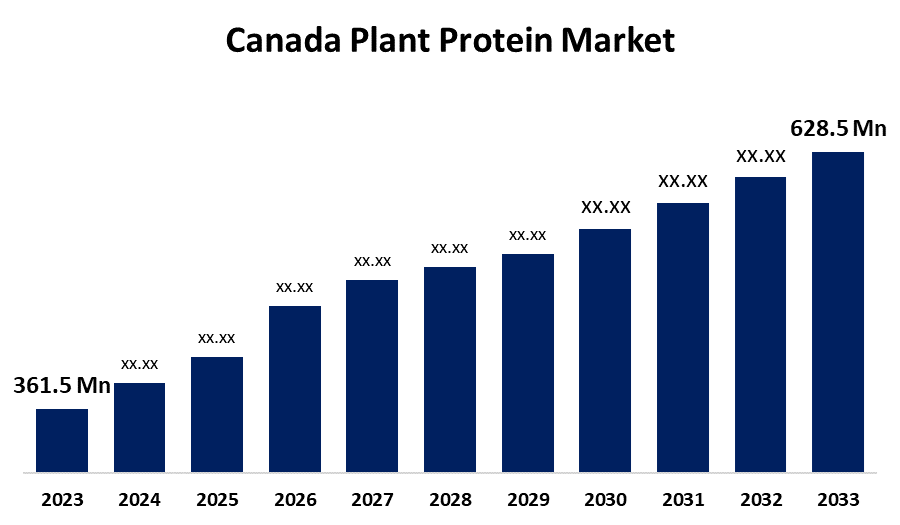

- The Canada Plant Protein Market Size was valued at USD 361.5 Million in 2023.

- The Market is growing at a CAGR of 5.69% from 2023 to 2033

- The Canada Plant Protein Market Size is Expected to reach USD 628.5 Million by 2033

Get more details on this report -

The Canada Plant Protein Market Size is anticipated to exceed USD 628.5 Million by 2033, Growing at a CAGR of 5.69% from 2023 to 2033. The increasing demand for plant-based food & beverages and the growing application in animal feed are driving the growth of the plant protein market in Canada.

Market Overview

Plant protein is a food source of proteins derived from plants such as pulses, tofu, soya, tempeh, seitan, nuts, seeds, certain grains, and peas. These are important alternatives for vegetarians, vegans, and patients suffering from obesity and cardiovascular diseases. The higher digestibility and bioavailability of plant proteins satisfy human nutritional needs and preserve healthy bodily structure and function. Soy protein concentrate had the largest market share of all plant-based protein products (51.9%), followed by vegetable proteins (1.0%), gluten (31.1%), soy protein isolate (10.4%), and pea protein (5.6%) as per the data by Agriculture and Agri-food Canada. In 2023, Canada exported 423.7 thousand tons (Can$2.4 billion) worth of animal and plant protein ingredients worldwide (which consist of a composition of 73.4% of food preparations). The changing lifestyle and evolving urbanization enhanced the consumer preference for more nutritious and health-conscious food options, enhancing the market growth for plant protein.

Report Coverage

This research report categorizes the market for the Canada plant protein market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada plant protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada plant protein market.

Canada Plant Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 361.5 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.69% |

| 2033 Value Projection: | USD 628.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Protein Type, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Archer Daniels Midland Company, Cargill Inc, Roquette Freres, The Scoular Company, Kerry Group PLC, DuPont de Nemours Inc., Axiom Foods, Merit Functional Foods, Glanbia Plc, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Products in Canada with high sources of protein ingredients registered total plant-based products (Can$1.6 billion) in 2022. The increasing awareness about the significance of proteins among health-conscious consumers as well as the availability of a large variety of food and drink categories are driving the market growth. The rising use of plant proteins such as oilseed meals and grain legumes in bulk form for livestock feeds is driving the market growth.

Restraining Factors

The higher cost of production of plant proteins leads to increased prices of plant-based proteins which hinder their adoption, ultimately leading to restraining the plant protein market. Further, unfavorable political and socio-economic factors may restrain the market growth.

Market Segmentation

The Canada Plant Protein Market share is classified into protein type and end-user.

- The pea protein segment is anticipated to grow at the fastest CAGR during the forecast period.

The Canada plant protein market is segmented by protein type into hemp protein, oat protein, pea protein, potato protein, rice protein, soy protein, and wheat protein. Among these, the pea protein segment is anticipated to grow at the fastest CAGR during the forecast period. Pea proteins are high-quality proteins with a great source of iron and rich in arginine and branched-chain amino acids, aid in muscle growth, and weight management, and maintain heart health. The various health benefits associated with pea proteins along with its allergen-free nature are driving the market demand in the pea protein segment.

- The food & beverages segment dominated the Canada plant protein market with the largest market share during the forecast period.

Based on the end-user, the Canada plant protein market is divided into animal feed, personal care & cosmetics, food & beverages, and supplements. Among these, the food & beverages segment dominated the Canada plant protein market with the largest market share during the forecast period. Plant-based drinks are popular choices as dairy-free alternatives offering nutritional benefits. Further, there are evolving consumer preferences for healthier diets that surge the demand for plant-based food products, especially for the prevention of chronic diseases and obesity. This leads to propel the market growth in the food & beverages segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada plant protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company

- Cargill Inc

- Roquette Freres

- The Scoular Company

- Kerry Group PLC

- DuPont de Nemours Inc.

- Axiom Foods

- Merit Functional Foods

- Glanbia Plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Protein Industries Canada announced a new project to advance the development of pea and fava protein ingredients and food products. A total of $7.7 million has been committed to the project, with Protein Industries Canada investing $3.3 million.

- In May 2024, Protein Industries Canada announced a collaborative initiative with Lupin Platform, the first commercially grown lupin in North America, PURIS Holdings, and YOSO Canada to bolster the lupin value chain in Canada.

- In February 2024, Louis Dreyfus Company, a merchant and processor of agricultural goods, planned to build a pea protein production facility in Canada.

- In May 2022, Canadian Ag-tech plant-based processor, PIP International (PIP), announced a new product that they have created from plant proteins. The technology has reportedly improved upon the pea protein’s poor taste, color, texture, and compromised performance.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Plant Protein Market based on the below-mentioned segments:

Canada Plant Protein Market, By Protein Type

- Hemp Protein

- Oat Protein

- Pea Protein

- Potato Protein

- Rice Protein

- Soy Protein

- Wheat Protein

Canada Plant Protein Market, By End-User

- Animal Feed

- Personal Care & Cosmetics

- Food & Beverages

- Supplements

Need help to buy this report?