Canada Refrigerated Warehousing Market Size, Share, and COVID-19 Impact Analysis, By Type (Private & Semi-Private and Public), By Temperature Range (Chilled (0°C to 15°C), Frozen (-18°C to -25°C), and Deep-frozen (Below -25°)), By Application (Food & Beverages, Pharmaceuticals, and Others), and Canada Refrigerated Warehousing Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologyCanada Refrigerated Warehousing Market Insights Forecasts to 2033

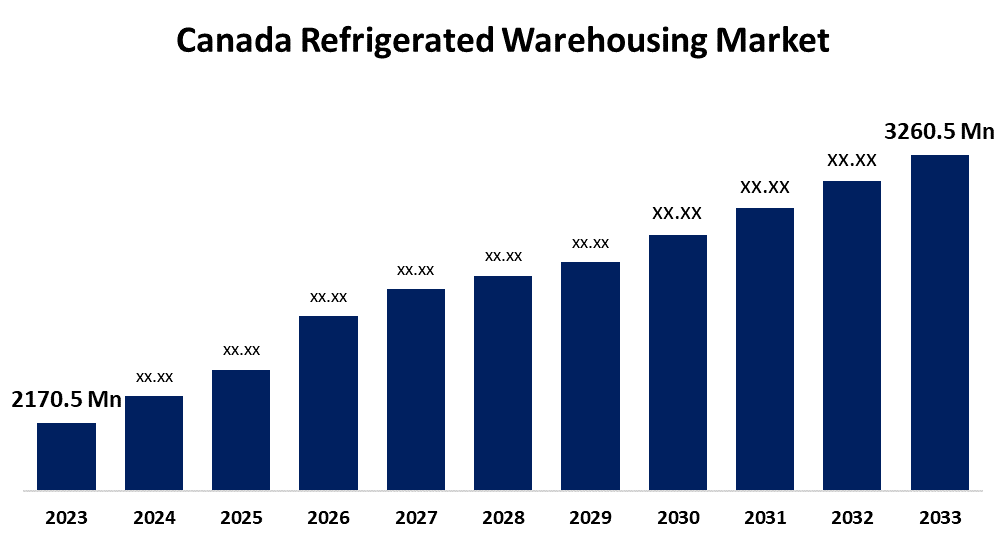

- The Canada Refrigerated Warehousing Market Size was valued at USD 2170.5 Million in 2023.

- The Market Size is Growing at a CAGR of 4.15% from 2023 to 2033

- The Canada Refrigerated Warehousing Market Size is Expected to reach USD 3260.5 Million by 2033

Get more details on this report -

The Canada Refrigerated Warehousing Market Size is anticipated to Exceed USD 3260.5 Million by 2033, growing at a CAGR of 4.15% from 2023 to 2033. The increasing demand for frozen foods, fresh produce, and other temperature-sensitive food products, the need for refrigerated storage solutions, and development in food & beverage sectors are driving the growth of the refrigerated warehousing market in the Canada.

Market Overview

Refrigerated warehousing refers to cold storage facilities that maintain a controlled temperature to preserve the quality of perishable goods. It is an industrial complex equipped with the necessary infrastructure and technology that provide temperature-controlled storage solutions to a range of industries, including producers, retailers, and food service providers. Food products, beverages, pharmaceuticals, biologically sensitive materials, and personal care products are the various products stored in refrigerated warehouses, ensuring their integrity and longevity while facilitating distribution and supply. Integrating automation and robotics in refrigerated warehousing for better operational speed, accuracy, and reduced labor costs offers lucrative market opportunities. The emphasis on the development of energy-efficient refrigeration systems and green insulation materials to reduce carbon footprints is escalating the market growth for refrigerated warehousing.

Report Coverage

This research report categorizes the market for the Canada refrigerated warehousing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada refrigerated warehousing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada refrigerated warehousing market.

Canada Refrigerated Warehousing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2170.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.15% |

| 2033 Value Projection: | USD 2170.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Temperature Range, By Application |

| Companies covered:: | VersaCold Logistics, Congebec Logistics, MTC Cold storage, Hanson Canada, Gibson Energy, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Fresh items, which are generally thought to be healthier, have displaced frozen goods as the preferred option for customers, especially those who have strong disposable income. The increasing demand for frozen foods among Canadians leads to driving the market demand for refrigerated warehousing. Processed food and beverage products are exported to almost 200 countries from Canada with a growing annual rate of 9.2% during the last five years as per the data of Agriculture and Agri-Food Canada. The development in the food & beverage sectors in the country is contributing to driving the market demand.

Restraining Factors

The high initial capital investment needed to construct and maintain specialized refrigerated storage facilities is challenging the Canada refrigerated warehousing market.

Market Segmentation

The Canada Refrigerated Warehousing Market share is classified into type, temperature range, and application.

- The public segment dominated the market with the largest market share in 2023.

The Canada refrigerated warehousing market is segmented by type into private & semi-private and public. Among these, the public segment dominated the market with the largest market share in 2023. Public refrigerated warehousing provides a variety of services as well as transportation and temperature-controlled storage space. These consist of pallet exchange, cross-docking, blast freezing, load consolidation, and inventory control. The adaptability, cost-effectiveness, and convenience of public refrigerated warehousing are driving the market.

- The frozen (-18°C to -25°C) segment dominated the market with the largest revenue share in 2023.

The Canada refrigerated warehousing market is segmented by temperature range into chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C). Among these, the frozen (-18°C to -25°C) segment dominated the market with the largest revenue share in 2023. To maintain the quality, temperature-sensitive foodstuffs like poultry, cattle, pig, and bakery and confections must be stored at frozen temperatures. The demand for storing perishable products to preserve their quality and safety throughout storage and distribution is driving the market.

- The food & beverages segment accounted for the largest revenue share of the Canada refrigerated warehousing market in 2023.

The Canada refrigerated warehousing market is segmented by application into food & beverages, pharmaceuticals, and others. Among these, the food & beverages segment accounted for the largest revenue share of the Canada refrigerated warehousing market in 2023. A sophisticated network of production, distribution, storage, and retail is essential in the food & beverage industry for ensuring the safety, quality, and availability of a vast array of perishable goods. The increasing food and beverage processing industry in the country is responsible for driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada refrigerated warehousing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- VersaCold Logistics

- Congebec Logistics

- MTC Cold storage

- Hanson Canada

- Gibson Energy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Lineage Logistics announced the expansion of a cold storage facility in Calgary, Canada, that would boost its total capacity to more than 200,000 sq.ft and over 24,000 pallet positions.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Refrigerated Warehousing Market based on the below-mentioned segments:

Canada Refrigerated Warehousing Market, By Type

- Private & Semi-Private

- Public

Canada Refrigerated Warehousing Market, By Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°)

Canada Refrigerated Warehousing Market, By Application

- Food & Beverages

- Pharmaceuticals

- Others

Need help to buy this report?