Canada Tire Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Light Commercial Vehicles, Passenger Cars, Medium & Heavy Commercial Vehicles, Off the Road (OTR), Two Wheelers), By Demand Category (Replacement and OEM), By Sales Channel (Online, Dealer/Exclusive Outlets, Others), and Canada Tire Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationCanada Tire Market Insights Forecasts to 2033

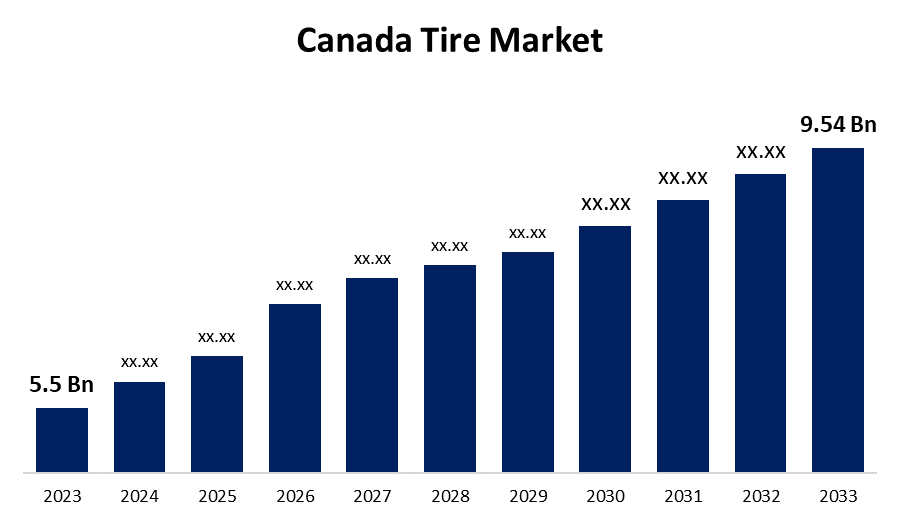

- The Canada Tire Market Size was valued at USD 5.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.6% from 2023 to 2033.

- The Canada Tire Market Size is expected to reach USD 9.54 Billion by 2033.

Get more details on this report -

The Canada Tire Market is anticipated to exceed USD 9.54 Billion by 2033, growing at a CAGR of 5.6% from 2023 to 2033.

Market Overview

The rubber-based, circular automobile tire is used to protect the rim of the wheel. The tire's principal function is to share tractive force between the vehicle and the road surface as well as protect the wheel rim. Since it is made of rubber, it provides a flexible cushion that reduces the impact of vibrations and absorbs vehicle shock. Tires are crucial components of vehicles, as they directly affect performance, handling, and safety. They come in various sizes, designs, and compositions tailored to different types of vehicles and road conditions. Even though local tire production in Canada has historically been greater than the total volume of vehicle and component imports, the Canada tire market is the second-largest market in North America. Sales of passenger, commercial, and electric vehicles, among other types of vehicles, are increasing across the country, benefiting the tire industry as a whole. Furthermore, the market's rapid growth is mostly owing to the nation's rapidly expanding car fleet in recent years. Furthermore, the replacement sector is expected to drive up tire demand.

Report Coverage

This research report categorizes the market for the Canada tire market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the tire market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the tire market.

Canada Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.6% |

| 2033 Value Projection: | USD 9.54 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Demand Category, By Sales Channel |

| Companies covered:: | Kumho Tire Canada, Pirelli Tire Inc., Goodyear Canada Inc., Bridgestone Canada, Hankook Tire Canada Corporation, Michelin, Yokohama Tire Inc., Toyo Tire Canada Inc., Cooper Tire & Rubber Company Canada Ltd., Continental AG, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Innovations in tire manufacturing technology result in more durable, efficient, and ecologically friendly tires. Low-rolling-resistance tires, for example, are helping to improve fuel efficiency while lowering carbon emissions, which is in line with rising customer and regulatory demand for environmentally friendly vehicles. These improvements are attracting environmentally concerned consumers and generating new market sectors, such as the growing electric vehicle (EV) market, which needs specialist tires to meet the unique needs of EVs. Canada's diversified and frequently harsh climate necessitates a wide range of tire types to assure safety and performance under varying conditions, driving up market demand. Additionally, the developing businesses and market leaders in many growing sectors across the country, such as e-commerce and the food sector, have driven up demand for transport and delivery solutions, resulting in a rise in the production of commercial vehicles such as trucks, tractors, and trailers. Heavy-duty vehicle production is expanding, which drives up demand for automotive tires.

Restraining Factors

The growth rate of the Canada tire market is expected to be limited in the coming years due to the tire and automotive industries' reliance on raw materials such as rubber and crude oil. Price fluctuation, which is reducing the nation's tire output and, as a result, expanding demand-supply spaces, is another important factor that may hinder market growth in the coming years. All of those challenges limit the market's potential growth.

Market Segmentation

The Canada tire market share is classified into vehicle type, demand category, and sales channel.

- The passenger cars segment is expected to hold a significant share of the Canada tire market during the forecast period.

Based on the vehicle type, the Canada tire market is segmented into light commercial vehicles, passenger cars, medium & heavy commercial vehicles, off the road (OTR), and two wheelers. Among these, the passenger cars segment is expected to hold a significant share of the Canada tire market during the forecast period. Increased interest in fuel-efficient vehicles in Canada is driving the expansion of the Canada tire market. Furthermore, passenger car sales and production in Canada are steadily expanding, which will help them maintain their dominance.

- The OEM segment is expected to hold the largest share of the Canada tire market during the forecast period.

Based on the demand category, the Canada tire market is divided into replacement and OEM. Among these, the OEM (Original Equipment Manufacturer) segment is expected to hold the largest share of the Canada tire market during the forecast period. OEM tires are consistently of the finest quality and appropriate for universal use. It's intended to be quiet, efficient on roadways, and durable, and it performs brilliantly outside of the showroom. Furthermore, OEMs are currently spending in R&D to produce lightweight, environmentally friendly tires that comply with government regulations. This boosts the OEM segment to dominate the market share in the coming years.

- The online segment is expected to hold the largest share of the Canada tire market during the forecast period.

Based on the sales channel, the Canada tire market is divided into online, dealer/exclusive outlets, and others. Among these, the online segment is expected to hold the largest share of the Canada tire market during the forecast period. Tire manufacturers have established web portals for marketing tires online. The growing trend of increasing sales via e-commerce platforms such as Amazon, eBay, and others that function as sales channels. Collectively, these factors drive the projected development of the Canada tire market over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada tire market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kumho Tire Canada

- Pirelli Tire Inc

- Goodyear Canada Inc

- Bridgestone Canada

- Hankook Tire Canada Corporation

- Michelin

- Yokohama Tire Inc.

- Toyo Tire Canada Inc.

- Cooper Tire & Rubber Company Canada Ltd.

- Continental AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Toyo Tires unveiled its Sustainable Concept Tire at the Tokyo Auto Salon. The tire, made from 90% recyclable materials, is a step toward facilitating future mobility. Currently, the highest use rate of renewable resources in one of their tires was 50%.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada tire market based on the below-mentioned segments:

Canada Tire Market, By Vehicle Type

- Light Commercial Vehicles

- Passenger Cars

- Medium & Heavy Commercial Vehicles

- Off The Road (OTR)

- Two Wheelers

Canada Tire Market, By Demand Category

- Replacement

- OEM

Canada Tire Market, By Sales Channel

- Online

- Dealer/Exclusive Outlets

- Others

Need help to buy this report?