Canada Voice Banking Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (On-Premise and Cloud), By Technology (Machine Learning, Deep Learning, Natural Language Processing, and Others), By Application (Banks, NBFCs, Credit Unions, and Others), and Canada Voice Banking Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialCanada Voice Banking Market Insights Forecasts to 2033

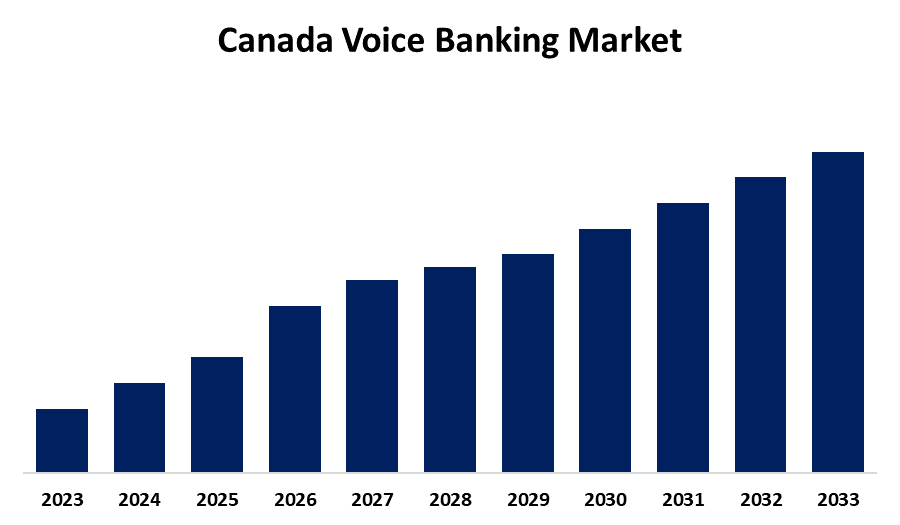

- The Canada Voice Banking Market Size is Growing at a CAGR of 14.64% from 2023 to 2033

- The Canada Voice Banking Market Size is Expected to Reach a Significant Share by 2033

Get more details on this report -

The Canada Voice Banking Market Size is anticipated to reach a significant share by 2033, Growing at a CAGR of 14.64% from 2023 to 2033.

Market Overview

Canada voice banking market refers to the use of voice recognition and artificial intelligence (AI) technologies to provide personalized financial services to individuals, particularly those with disabilities or the elderly. This technology leverages natural language processing (NLP) and machine learning to enable seamless and secure interactions. The benefits of voice banking in Canada are significant, particularly for people with mobility impairments, visual disabilities, or age-related challenges, as it offers an accessible and efficient alternative to traditional banking methods. Additionally, voice banking enhances customer convenience by enabling hands-free access to banking services, making it ideal for those with busy lifestyles or limited time. The Canadian government has supported this innovation through various initiatives aimed at promoting digital inclusivity and accessibility, such as funding for tech startups and creating policies that encourage financial institutions to adopt advanced technologies like voice banking. As Canadians increasingly demand more accessible and user-friendly financial solutions, the voice banking market is poised for rapid growth, making banking more inclusive, secure, and convenient for all citizens.

Report Coverage

This research report categorizes the market for the Canada voice banking market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada voice banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada voice banking market.

Canada Voice Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 14.64% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Technology, By Application. |

| Companies covered:: | NatWest Group, Acapela Group, U.S. Bank, Emirates NBD Bank, HSBC, DBS Bank, Central 1 Credit Union, IndusInd Bank, Axis Bank, BankBuddy, Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing demand for convenient and accessible banking solutions is fueling the adoption of voice banking technologies. As consumers seek more seamless and efficient ways to manage their finances, voice recognition offers a hands-free, easy-to-use alternative to traditional methods. This is particularly appealing to the aging population and individuals with disabilities, as voice banking improves accessibility and enables them to conduct transactions independently.

Restraining Factors

The need for substantial investments in infrastructure and system upgrades by financial institutions, which can be a barrier, especially for smaller banks.

Market Segmentation

The Canada voice banking market share is classified into deployment mode, technology, and application.

- The cloud segment accounted for the leading revenue share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Canada voice banking market is segmented by deployment mode into on-premise and cloud. Among these, the cloud segment accounted for the leading revenue share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segment is driven because cloud-based voice banking solutions offer several advantages, including scalability, flexibility, and cost-effectiveness, which are crucial for financial institutions looking to integrate voice recognition technologies into their services.

- The natural language processing segment accounted for the largest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The Canada voice banking market is segmented by technology into machine learning, deep learning, natural language processing, and others. Among these, the natural language processing segment accounted for the largest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because natural language processing plays a crucial role in enabling voice banking systems to understand, interpret, and respond to user commands in natural language. As it allows for more intuitive and efficient communication between customers and banking systems, the demand for NLP-driven voice banking solutions has been steadily increasing.

- The banks segment accounted for the major market share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The Canada voice banking market is segmented by application into banks, NBFCs, credit unions, and others Among these, the banks segment accounted for the major market share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The segment growth can be attributed to the integration of AI, machine learning, and natural language processing technologies into banking operations further enhances the user experience by providing quick responses and facilitating complex transactions. The growing focus on digital transformation and improving customer engagement is driving banks to invest in innovative technologies like voice banking.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada voice banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NatWest Group

- Acapela Group

- U.S. Bank

- Emirates NBD Bank

- HSBC

- DBS Bank

- Central 1 Credit Union

- IndusInd Bank

- Axis Bank

- BankBuddy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada voice banking market based on the below-mentioned segments:

Canada Voice Banking Market, By Deployment Mode

- On-Premise

- Cloud

Canada Voice Banking Market, By Technology

- Machine Learning

- Deep Learning

- Natural Language Processing

- Others

Canada Voice Banking Market, By Application

- Banks

- NBFCs

- Credit Unions

- Others

Need help to buy this report?