Canada Wind Power Market Size, Share, and COVID-19 Impact Analysis, By Installation (Onshore and Offshore), By Turbine Capacity (100 KW, 100 KW to 500 KW, 500 KW to 1 MW, 1MW to 3 MW, and Less than 3 MW), By Application (Residential, Industrial, and Commercial), and Canada Wind Power Market Insights Forecasts 2023 - 2033

Industry: Energy & PowerCanada Wind Power Market Insights Forecasts to 2033

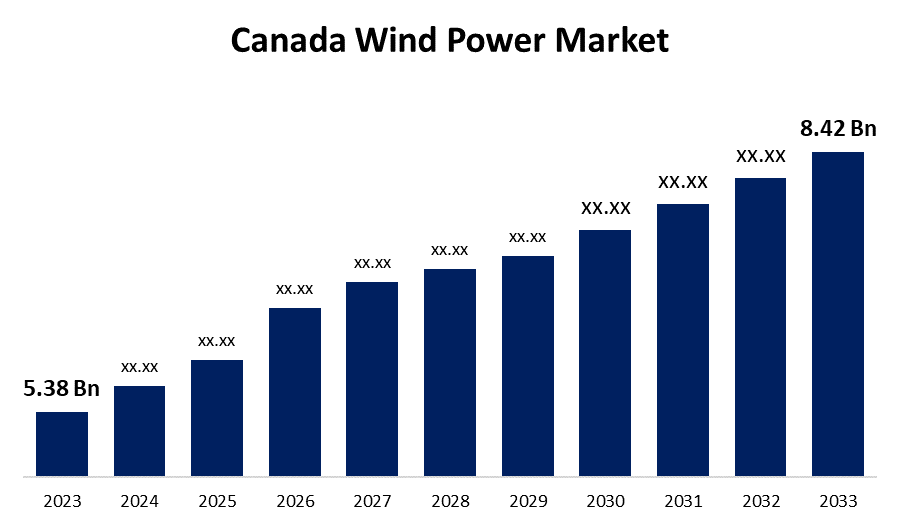

- The Canada Wind Power Market Size was valued at USD 5.38 Billion in 2023

- The Market Size is Growing at a CAGR of 4.58% from 2023 to 2033.

- The Canada Wind Power Market Size is Expected to Reach USD 8.42 Billion by 2033.

Get more details on this report -

The Canada Wind Power Market size is expected to reach USD 8.42 Billion by 2033, at a CAGR of 4.58% during the forecast period 2023 to 2033.

Market Overview

Wind power is a type of energy conversion in which wind energy is transformed into mechanical or electrical energy through the use of turbines. Wind power is a renewable energy source that uses the power of the wind to generate electricity. It entails using wind turbines to convert the rotating motion of blades propelled by moving air (kinetic energy) into electrical energy. This necessitates the use of specific technologies, such as a generator located at the top of a tower, behind the blades, in the wind turbine's head (nacelle). The wind power market in Canada has grown significantly in recent years, with one of the primary drivers being the government's commitment to renewable energy development. The Canadian government, at both the federal and provincial levels, has implemented several policies and incentives to encourage the use of wind power and reduce the country's carbon footprint. Furthermore, government initiatives, such as renewable energy targets and incentives like feed-in tariffs and tax credits, are critical in promoting the development of wind projects. Additionally, growing concerns about climate change and the need for sustainable energy sources have fueled demand for wind power as a cleaner alternative to fossil fuels.

Report Coverage

This research report categorizes the market for the Canada wind power market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada wind power market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada wind power market.

Canada Wind Power Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 5.38 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.58% |

| 023 – 2033 Value Projection: | USD 8.42 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Installation, By Turbine Capacity, By Application |

| Companies covered:: | GE Renewable Energy Canada, Vestas Canadian Wind Technology, Suzlon Energy Canada, Siemens Gamesa Renewable Energy, Brookfield Renewable Partners L.P, Boralex Inc, TransAlta Renewables Inc, Innergex Renewable Energy Inc, Enercon Canada Inc, Northland Power Inc, and other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

A vital set of regulations boosting the wind energy industry in Canada are the Renewable Portfolio Standards (RPS) and Feed-in Tariff (FIT) initiatives. These regulations stipulate that a predetermined portion of the nation's electricity must originate from wind and other renewable energy sources. Investors find the RPS and FIT programs to be a financially appealing alternative since they offer wind power producers guaranteed prices and long-term contracts. To promote wind power projects, the federal government also provides grants and tax breaks. These programs foster an environment that is conducive to investment, drawing companies from the private sector to fund wind energy infrastructure. Furthermore, the constant technological advancements and cost reductions in the wind energy sector are another major factor propelling Canada's wind power market. The design, composition, and production techniques of wind turbines have evolved, improving wind power's economics and efficiency.

Restraining Factors

One of the most significant challenges for Canada's wind power market is integrating wind energy into the existing electrical grid and expanding transmission infrastructure. Wind power generation is frequently concentrated in remote and rural areas with abundant wind resources, while major population centers and industrial areas are located a distance away. As a result, it is critical to create an efficient and dependable transmission system to transport wind-generated electricity to where it is most needed.

Market Segment

- In 2023, the offshore segment accounted for the largest revenue share over the forecast period.

Based on installation, the Canada wind power market is segmented into onshore and offshore. Among these, the offshore segment has the largest revenue share over the forecast period. Technological developments are continuing as the offshore wind industry develops, especially about floating wind turbines, which can access deeper waters than traditional fixed-bottom structures can. The growth of the offshore segment in Canada wind power market depends on the development of supporting infrastructure, such as ports and marine logistics.

- In 2023, the 100 KW to 500 KW segment is witnessing significant growth over the forecast period.

Based on turbine capacity, the Canada wind power market is segmented into 100 KW, 100 KW to 500 KW, 500 KW to 1 MW, 1MW to 3 MW, and Less than 3 MW. Among these, the 100 KW to 500 KW segment is witnessing significant growth over the forecast period. A variety of stakeholders, such as small enterprises, rural communities, and perhaps even individual homes wishing to invest in renewable energy, will probably find this portion interesting. the 100 KW to 500 KW segment growth might be attributed to several factors, including favorable government regulations, technological breakthroughs, and growing public knowledge of the advantages of wind power.

- In 2023, the industrial segment is witnessing significant growth over the forecast period.

Based on application, the Canada wind power market is segmented into residential, industrial, and commercial. Among these, the industrial segment is witnessing significant growth over the forecast period. Canada's manufacturing industry consumes a substantial amount of electricity. It includes a diverse range of sub-industries such as automotive, aerospace, food processing, and others. Wind power can be a reliable and cost-effective source of electricity for manufacturing enterprises. It reduces operational expenses and carbon emissions, making it an appealing option for businesses looking to achieve sustainability goals. Many Canadian manufacturing firms have added wind power to their energy mix by negotiating power purchase agreements (PPAs) with wind farm operators. This enables them to profit from stable, long-term electricity pricing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada wind power market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Renewable Energy Canada

- Vestas Canadian Wind Technology

- Suzlon Energy Canada

- Siemens Gamesa Renewable Energy

- Brookfield Renewable Partners L.P

- Boralex Inc

- TransAlta Renewables Inc

- Innergex Renewable Energy Inc

- Enercon Canada Inc

- Northland Power Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, compared to the previous year's growth of 1 GW in 2021, Canada added more than 1.8 GW of new generation capacity in 2022. Shortly (2023-5), CanREA predicts the installation of more than 5 GW of wind, 2 GW of substantial solar, and 1 GW of energy storage capacity.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Canada wind power market based on the below-mentioned segments:

Canada Wind Power Market, By Installation

- Onshore

- Offshore

Canada Wind Power Market, By Turbine Capacity

- 100 KW

- 100 KW to 500 KW

- 500 KW to 1 MW

- 1MW to 3 MW

- Less than 3 MW

Canada Wind Power Market, By Application

- Residential

- Industrial

- Commercial

Need help to buy this report?