Canada Wound Care Market Size, Share, and COVID-19 Impact Analysis, By Product (Advanced Wound Dressing, Surgical Wound Care, Traditional Wound Care, and Wound Therapy Devices), By Wound Type (Chronic Wound and Acute Wound), By End-Use (Hospitals, Specialty Clinics, Home Healthcare, Physician’s Office, Nursing Homes, and Others), and Canada Wound Care Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareCanada Wound Care Market Insights Forecasts to 2033

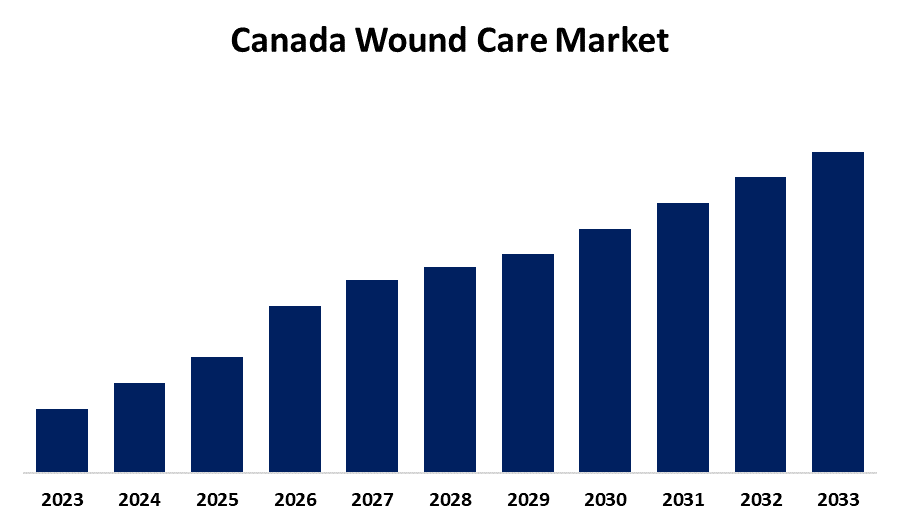

- The Market Size is Growing at a CAGR of 5.75% from 2023 to 2033

- The Canada Wound Care Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Canada Wound Care Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 5.75% from 2023 to 2033. The increasing diabetes & obese population, rising chronic wounds & ulcers, and rising technological advancements are driving the Growth of the wound care Market in Canada.

Market Overview

Wound care is a method of removing dead tissue, and cleaning the wound, thereby providing a protective environment owing to the disruption of structural and functional integrity of tissue. It is ultimately required to prevent infection and speed up the body’s healing process. There is a rising shift towards outpatient wound care for improving patient outcomes and reducing costs. This has led to surging demand for home healthcare products and services, including portable negative pressure wound therapy devices, resulting in driving the market growth. Furthermore, the focus on prevention and early intervention drives the development of products such as smart dressings and wearable sensors for early detection and monitoring of wounds. The increasing R&D activities in advanced wound care products that provide absorption, hydration, and antibacterial activities are providing lucrative market opportunities.

Report Coverage

This research report categorizes the market for the Canada wound care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Canada wound care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Canada wound care market.

Canada Wound Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.75% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Wound Type, By End-Use |

| Companies covered:: | 3M Company, B. Braun Melsungen AG, Cardinal Health, Inc., Coloplast A/S, ConvaTec Group PLC, Integra Lifesciences, Medtronic PLC, Molnlycke Health Care, Smith & Nephew, Medline Industries, Inc, Teleflex Incorporated, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Obese and diabetic patients are affected by chronic ulcers which impact their quality of life and increase the risk of hospital readmission. Thus, the increasing diabetes and obese population are significantly responsible for driving the market demand for wound care. The rising chronic wounds & ulcers including pressure ulcers (bed sores), diabetic foot ulcers, leg ulcers (venous stasis and arterial ulcers), and ulcers resulting from blood disorders are escalating the market. Furthermore, the rising technological advancements such as biodegradable dressing materials are propelling the market growth.

Restraining Factors

The lack of awareness about good quality care of wounds is challenging the Canada wound care market. Further, the high cost of advanced wound care products is expected to restrain the wound care market growth.

Market Segmentation

The Canada Wound Care Market share is classified into product, wound type, and end-use.

- The advanced wound dressing segment accounted for the largest market share in 2023.

The Canada wound care market is segmented by product into advanced wound dressing, surgical wound care, traditional wound care, and wound therapy devices. Among these, the advanced wound dressing segment accounted for the largest market share in 2023. Hydrogel, alginate, and foam are some of the advanced wound dressing products that are used to manage and reduce the risk of infection in large wounds. The growing incidence of chronic wounds including diabetic foot ulcers, pressure ulcers, and venous leg ulcers is driving the market.

- The chronic wound segment dominated the market with the largest market share in 2023.

The Canada wound care market is segmented by wound type into chronic wound and acute wound. Among these, the chronic wound segment dominated the market with the largest market share in 2023. Chronic wounds are hard to heal and can be identified by the length of time it takes for the wound to heal or by symptoms such as the loss of skin or surrounding tissue. The majority of chronic wound-associated conditions are found in older than younger individuals. The increasing aging population with concerns regarding chronic wounds is driving the market.

- The hospitals segment accounted for the largest revenue share of the Canada wound care market in 2023.

The Canada wound care market is segmented by end-use into hospitals, specialty clinics, home healthcare, physician’s office, nursing homes, and others. Among these, the hospitals segment accounted for the largest revenue share of the Canada wound care market in 2023. The increasing prevalence of hospital-acquired ulcers leads to an increase in hospital admissions, thereby driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Canada wound care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- B. Braun Melsungen AG

- Cardinal Health, Inc.

- Coloplast A/S

- ConvaTec Group PLC

- Integra Lifesciences

- Medtronic PLC

- Molnlycke Health Care

- Smith & Nephew

- Medline Industries, Inc

- Teleflex Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, Kane Biotech entered into an exclusive agreement to distribute XSONX’s Wound Hygiene System in Australia, Canada, New Zealand and the Gulf Cooperation Council countries.

- In August 2024, Kane Biotech Inc. announced that it has signed a three-year distribution agreement with Razan Medical & Surgical Equipment Trading LLC for its revyve Antimicrobial Wound Gel in the United Arab Emirates (UAE) wound care market.

- In January 2024, Swift Medical, a digital health technology company serving wound care providers, announced the successful closing of an $US8M round of financing co-led by current investors BDC Capital’s Women in Technology Venture Fund and funds managed by Virgo Investment Group.

- In October 2022, Healthium Medtech announced that the company has launched a new wound dressing portfolio Theruptor Novo for the management of chronic wounds like diabetic foot ulcers and leg ulcers.

- In February 2021, Telewound Care Canada Initiative launched to Enable Virtual Wound Care for Patients During COVID-19.

Market Segment

This study forecasts revenue at Canada, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Canada Wound Care Market based on the below-mentioned segments:

Canada Wound Care Market, By Product

- Advanced Wound Dressing

- Surgical Wound Care

- Traditional Wound Care

- Wound Therapy Devices

Canada Wound Care Market, By Wound Type

- Chronic Wound

- Acute Wound

Canada Wound Care Market, By End-Use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Physician’s Office

- Nursing Homes

- Others

Need help to buy this report?