Global Cancer Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Type (Laboratory Tests, Genetic Tests, Imaging, Endoscopy, Biopsy, and Others), By Application (Breast Cancer, Lung Cancer, Liver Cancer, Cervical Cancer, Kidney Cancer, Ovarian Cancer, and Others), By End User (Hospitals and Diagnostic Laboratories), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Cancer Diagnostics Market Insights Forecasts to 2033

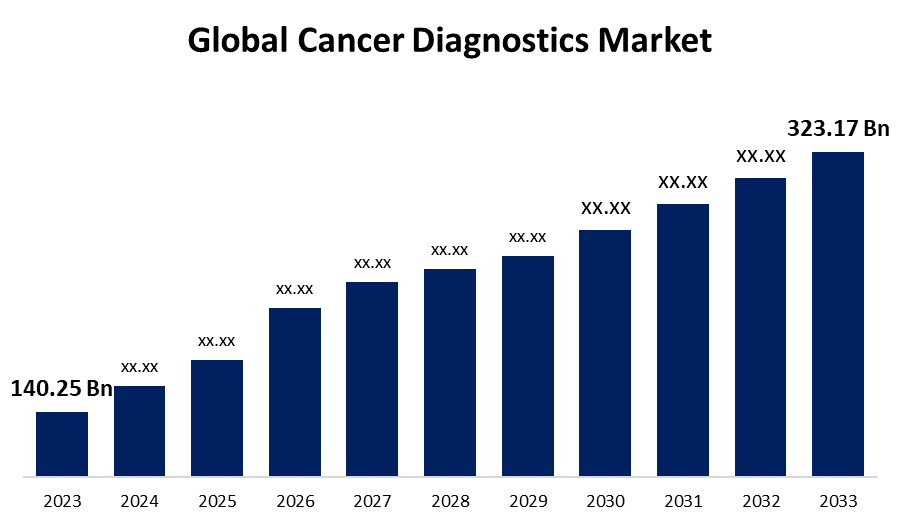

- The Global Cancer Diagnostics Market Size was Valued at USD 140.25 Billion in 2023

- The Market Size is Growing at a CAGR of 8.71% from 2023 to 2033

- The Worldwide Cancer Diagnostics Market Size is Expected to Reach USD 323.17 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cancer Diagnostics Market Size is Anticipated to Exceed USD 323.17 Billion by 2033, Growing at a CAGR of 8.71% from 2023 to 2033.

Market Overview

Cancer diagnostics is a procedure of determining biomarkers, proteins, and other indicators that lead to the discovery of a cancerous tumor. Detection of specific biomarkers and proteins common in cancer disease is vital to the diagnosis procedure, helping in the timely and precise identification of the disease. The increased number of deaths was caused by issues including excessive drinking, smoking, leading an unhealthy lifestyle, being physically unfit, and other illnesses like diabetes, which can all result in different types of cancer. The mortality rate can be reduced if cancer is identified at an early stage. There are some common types of tests used to aid diagnose cancer, such as blood chemistry tests, cytogenic analysis, immunophenotyping, liquid biopsy, tumor marker tests, urinalysis, imaging tests, and urine cytology. One of the leading causes of death globally is cancer, and its incidence is rapidly rising. To lower the incidence level, medical professionals are focusing on creating effective treatment and diagnostic strategies. Treatment regimen success rates are increased with early discovery. As a result, through various awareness campaigns, medical facilities and companies are promoting regular checkups. Increases in the incidence of various types of cancer, like lung cancer, breast cancer, kidney cancer, and cervical cancer, may drive the growth of the market during the predicted period.

Report Coverage

This research report categorizes the market for the global cancer diagnostics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global cancer diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global cancer diagnostics market.

Global Cancer Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 140.25 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.71% |

| 2033 Value Projection: | USD 323.17 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By End User, By Region |

| Companies covered:: | Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, QIAGEN N.V., Roche Diagnostics, Philips Healthcare, BioMérieux SA, Volpara Solutions Limited, Canon Medical Systems Corporation, BioNTech Diagnostics GmbH, Agilent Technologies, Inc., Illumina, Inc., GE Healthcare, Abbott Laboratories, Inc., Siemens Healthcare, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major factors driving the growth of the market, such as the increasing cases of cancer globally, the rising cases of cancer diagnosis, and the developments in cancer diagnostics in the range of biomarkers and screening diagnoses. Furthermore, the advanced technologies in diagnostic testing are predicted to drive the market growth. Moreover, the use of AI in the detection of cancer is also expected to drive the growth of the market. Researchers have created AI technologies to support screening tests for some types of cancer, mainly breast cancer. In addition, an increase in partnerships and procurement related to cancer diagnostics products further drives the expansion of the cancer diagnostics market.

Restraining Factors

Several hospitals in economically developing countries cannot spend on diagnostic imaging equipment because of high expenses and financial limitations. Despite, the growing demand for diagnostic imaging procedures in these nations, hospitals do not have the funds to buy new and innovative imaging systems for reassembled ones. Thus, these factors restrain the growth of the cancer diagnostics market.

Market Segmentation

The global cancer diagnostics market share is classified into type, application, and end user.

- The imaging segment is anticipated to hold the largest share of the global cancer diagnostics market during the forecast period.

On the basis of the type, the global cancer diagnostics market is divided into laboratory tests, genetic tests, imaging, endoscopy, biopsy, and others. Among these, the imaging segment is anticipated to hold the largest share of the global cancer diagnostics market during the forecast period. Modalities used in imaging, such as computed tomography scans and magnetic resonance imaging are fast, non-invasive, and painless diagnostic procedures. Prognostic and therapeutic system monitoring of metabolic and functional data, as well as imaging, are helpful in the staging of cancer. These benefits have led to a notable increase in the use of imaging modalities in cancer screening programs. The usage of advanced imaging procedures, such as magnetic resonance imaging and multi-photon microscopy, is growing on a global scale.

- The breast cancer segment is anticipated to grow at the fastest rate in the global cancer diagnostics market during the forecast period.

On the basis of the application, the global cancer diagnostics market is divided into breast cancer, lung cancer, liver cancer, cervical cancer, kidney cancer, ovarian cancer, and others. Among these, the breast cancer segment is anticipated to grow at the fastest rate in the global cancer diagnostics market during the forecast period. According to the United States Preventive Services Task Force, women between the ages of 50 and 74 are more likely to get breast cancer (USPSTF). Consequently, the USPSTF recommends mammograms for women over 40 every two years. In addition, some organizations including the National Breast Cancer Foundation, Inc. are initiating campaigns to increase public awareness about breast cancer, the advantages of early detection, and the range of treatment options. Rising demand for scanning solutions in breast cancer diagnosis is being driven by attempts to promote routine mammography and raise public awareness of the condition.

- The diagnostic laboratories segment is anticipated to hold the highest share of the global cancer diagnostics market during the forecast period.

On the basis of the end user, the global cancer diagnostics market is divided into hospitals and diagnostic laboratories. Among these, the diagnostic laboratories segment is anticipated to hold the highest share of the global cancer diagnostics market during the forecast period. A few of the main drivers anticipated to propel this market's growth include the rising need for cost-effective services, improved awareness of personalized medicine, and technological advancements. An increase in government activities to provide different services, like reimbursement for diagnostic testing, is another significant element driving the expansion of this industry. Moreover, efforts are being made by regulatory bodies to facilitate diagnosis and enhance clinical laboratory diagnostic services.

Regional Segment Analysis of the Global Cancer Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global cancer diagnostics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global cancer diagnostics market over the predicted timeframe. The key factor driving the diagnostic market in this region is the presence of several biotechnology and medical device companies. Due to rising R&D spending and significant adoption of new technologies, North America is expected to continue leading during the forecast period. Moreover, the market is expected to be improved by the region's high concentration of significant companies, expanding FDA approvals, strategic alliances, and significant investment in R&D activities. In addition, the creativities taken by the government in the North America region are predicted to propel the market growth. These factors drive the expansion of the cancer diagnostics market over the predicted timeframe.

Asia-Pacific is anticipated to grow at the fastest rate in the global cancer diagnostics market over the predicted timeframe. Several factors boost the growth of the market in this region, such as a large patient pool, the accessibility of skilled technicians at a low price, and a strong regulatory environment inspiring quicker product support. Moreover, the growing number of medical tourism professionals in nations, such as India and China are likely to surge demand for cancer diagnosis and treatment screening. The World Health Organization expects that by 2025, China may have diagnosed 4.7 million new cases of cancer. Cancer diagnostics are being used more frequently in China as a result of the rising incidence of obesity and hormone exposure-related cancers, like breast cancer in women, and lifestyle change-related diseases, such as prostate cancer in men. These occurrences might accelerate the growth of cancer diagnosis in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cancer diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- Thermo Fisher Scientific, Inc.

- Becton, Dickinson and Company

- QIAGEN N.V.

- Roche Diagnostics

- Philips Healthcare

- BioMérieux SA

- Volpara Solutions Limited

- Canon Medical Systems Corporation

- BioNTech Diagnostics GmbH

- Agilent Technologies, Inc.

- Illumina, Inc.

- GE Healthcare

- Abbott Laboratories, Inc.

- Siemens Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, in an all-cash purchase, Quest Diagnostics purchased Haystack Oncology to grow MRD testing services. The acquisition initially targeted colorectal, breast, and lung cancer to improve patient outcomes by detecting MRD early after treatment.

- In February 2023, F. Hoffmann-La Roche declared mounting its partnership with Janssen to advance tailored healthcare by concentrating on companion diagnostics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global cancer diagnostics market based on the below-mentioned segments:

Global Cancer Diagnostics Market, By Type

- Laboratory Tests

- Genetic Tests

- Imaging

- Endoscopy

- Biopsy

- Others

Global Cancer Diagnostics Market, By Application

- Breast Cancer

- Lung Cancer

- Liver Cancer

- Cervical Cancer

- Kidney Cancer

- Ovarian Cancer

- Others

Global Cancer Diagnostics Market, By End User

- Hospitals

- Diagnostic Laboratories

Global Cancer Diagnostics Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which region holds the largest share of the global cancer diagnostics market?North America is anticipated to hold the largest share of the global cancer diagnostics market over the predicted timeframe.

-

2.How big is the global cancer diagnostics market?The Global Cancer Diagnostics Market Size is Expected to Grow from USD 140.25 Billion in 2023 to USD 323.17 Billion by 2033, at a CAGR of 8.71% during the forecast period 2023-2033.

-

3.Who are the key players in the global cancer diagnostics market?The key players in the global cancer diagnostics market are Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, QIAGEN N.V., Roche Diagnostics, Philips Healthcare, BioMérieux SA, Volpara Solutions Limited, Canon Medical Systems Corporation, BioNTech Diagnostics GmbH, Agilent Technologies, Inc., Illumina, Inc., GE Healthcare, Abbott Laboratories, Inc., Siemens Healthcare, and Others.

Need help to buy this report?