Global Canned Alcoholic Beverages Market Size, Share, and Trend Analysis, By Product (Wine, RTD Cocktails and Hard Seltzers), By Distribution Channel (On-trade, Liquor Stores, Online, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Canned Alcoholic Beverages Market Insights Forecasts to 2033

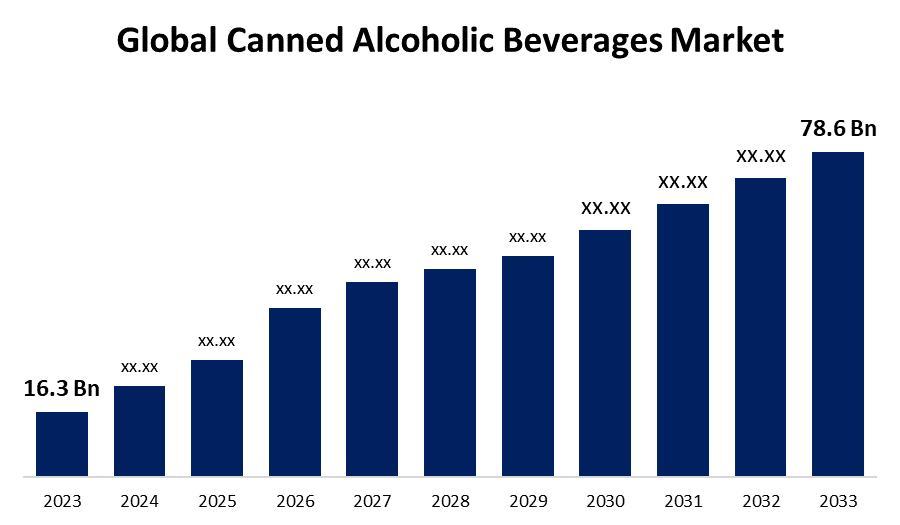

- The Global Canned Alcoholic Beverages Market Size was Valued at USD 16.3 Billion in 2023

- The Market Size is Growing at a CAGR of 17.04% from 2023 to 2033

- The Worldwide Canned Alcoholic Beverages Market Size is Expected to Reach USD 78.6 Billion by 2033

- Asia Pacific is Expected to Grow at the fastest CAGR during the forecast period.

Get more details on this report -

The Global Canned Alcoholic Beverages Market Size is Anticipated to Exceed USD 78.6 Billion by 2033, Growing at a CAGR of 17.04% from 2023 to 2033.

Market Overview

Diluted alcoholic beverages, such as beer, wine, cocktails, and hard seltzers, have metal cans and are known as canned alcoholic beverages. Due to their sustainability, portability, and ease of use, they are a well-liked option. The primary market factors boosting the market growth are consumers' growing preference for simple packaging and their growing attention to eco-friendly and sustainable solutions. Cans of alcoholic beverages are a popular choice for consumers seeking convenience and sustainability in their beverage selections because they offer a single-serving option that satisfies these trends and is lightweight, portable, and convenient. Demand for hard seltzers is primarily being driven by consumers' growing health consciousness and growing desire for convenience. In order to gain a larger market share, manufacturers are concentrating on releasing products with natural ingredients. These days, consumers are most drawn to low-calorie drinks that contain natural ingredients. In comparison, can manufacturing uses less energy than glass bottle manufacturing. This implies that fewer greenhouse gases, a factor in climate change, are produced during the canning process. These metal cans are also less expensive than glass bottles and have a much higher recycling rate than glass bottles. Consequently, it is anticipated that the industry will grow during the course of the forecast period.

Report Coverage

This research report categorizes the canned alcoholic beverages market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the canned alcoholic beverages market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the canned alcoholic beverages market.

Global Canned Alcoholic Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 16.3 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 17.04% |

| 2033 Value Projection: | USD 78.6 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution Channel, By Region |

| Companies covered:: | Anheuser-Busch InBev, Diageo, Brown-Forman Corporation, Treasury Wine Estates, Bacardi Limited, Union Wine Company, E. & J. Gallo Winery, Asahi Group Holdings, Ltd., Pernod Ricard, Integrated Beverage Group LLC (IBG), Sula Vineyards, Kona Brewing Co., Suntory Holdings Limited, Barefoot Cellars, Constellation Brands., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

The market is expected to be driven during the forecast period by the growing demand for flavored drinks with low alcohol content as a result of growing health concerns. Due to their wide range of flavors including ready-to-drink (RTD) cocktails flavored with ginger, rose, and lavender these beverages are the most popular alcoholic beverages among customers. The major players are benefiting from the increased demand for non-alcoholic beverages brought on by growing health concerns. Demand for hard seltzers is primarily being driven by consumers' growing health consciousness and growing desire for convenience. In order to gain a larger market share, manufacturers are concentrating on releasing products with natural ingredients. These days, consumers are most attracted to low-calorie drinks that contain natural ingredients.

Restraining Factors

The challenging regulatory landscape surrounding alcoholic beverages is one of the main barriers to the canned beverage market. The manufacturing, distributing, and retailing of alcoholic beverages are governed by laws and regulations specific to each nation. Regarding requirements for packaging, labeling, and alcohol content, these laws can differ greatly from one another. The market for canned alcoholic beverages may grow more slowly in some nations due to stringent laws governing the use of cans as a packaging option for alcoholic beverages.

Market Segmentation

The canned alcoholic beverages market share is classified into product and distribution channel.

- The hard seltzers segment is estimated to hold the largest market revenue share through the projected period.

Based on the product, the global canned alcoholic beverages market is classified into wine, RTD, cocktails, and hard seltzers. Among these, the hard seltzers segment is estimated to hold the largest market revenue share through the projected period. Hard Seltzers have contributed to drive the segment's growth because of their low calorie content. Among the factors anticipated to propel the hard seltzers market during the forecast period are the launch of new products, growing consumer demand for gluten-free alcoholic beverages, and an increase in health-related concerns.

- The liquor stores segment is estimated to hold the largest market revenue share through the projected period.

Based on the distribution channel, the global canned alcoholic beverages market is classified into on-trade, liquor stores, online, and others. Among these, the liquor stores segment is estimated to hold the largest market revenue share through the projected period. Liquor stores can have a lengthy and well-established history of distributing alcoholic beverages. Because these stores offer a wide variety of private label and premium brands, customers are drawn to purchase goods through these channels. Worldwide, liquor stores are starting to stock more and more cans of alcoholic beverages.

Regional Segment Analysis of the Canned Alcoholic Beverages Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the canned alcoholic beverages market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the canned alcoholic beverages market over the predicted timeframe. The market for canned alcoholic beverages has grown due to the wide range of alcoholic beverages that are available in the area. North America's growth is also expected to be sustained by the region's increasing consumption of alcoholic beverages. Moreover, the growth of canned alcoholic beverages in North America is being driven by the growing demand for premium and super-premium alcoholic beverages, especially beer and vodka.

Asia Pacific is expected to grow at the fastest CAGR growth of the canned alcoholic beverages market during the forecast period. The expansion of the canned beverage market in Asia Pacific is correlated with the accessibility of reasonably priced alcoholic beverages. Market expansion is expected to be driven by Asia Pacific's growing preference for canned beverages. In addition, China accounted for the largest share of the Asia-Pacific canned alcoholic beverage market, while India had the fastest-growing canned alcoholic beverage market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the canned alcoholic beverages market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anheuser-Busch InBev

- Diageo

- Brown-Forman Corporation

- Treasury Wine Estates

- Bacardi Limited

- Union Wine Company

- E. & J. Gallo Winery

- Asahi Group Holdings, Ltd.

- Pernod Ricard

- Integrated Beverage Group LLC (IBG)

- Sula Vineyards

- Kona Brewing Co.

- Suntory Holdings Limited

- Barefoot Cellars

- Constellation Brands.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, a new law was announced, allowing Pennsylvanians to purchase ready-to-drink cocktails, or canned alcoholic drinks, from a wider range of businesses. The law was delivered to Governor Josh Shapiros desk after the state senate approved it by a 32-17 vote. The bill allowed approximately 12,000 eateries, bars, grocery stores, convenience stores, beer wholesalers, and other establishments with an alcohol sales license to apply for special authorization to sell the canned drinks.

- In February 2023, Vita coco, a leading coconut water brand, and Captain Morgan, a rum brand, launched the RTD alcohol drink Vita Coco Spiked with Captain Morgan. The new product offered three rum-based cocktails- pina colada, strawberry, and lime mojito. The newly launched Vita Coco Spiked with Captain Morgan became commercially available across the United States.

- In February 2023, the fastest-growing beer company, Bira91, announced its entry into the hard seltzers category by launching the Grizly hard seltzers ale. The Grizly by Bira91 brought cocktails, wine, and beer in one can. The canned alcoholic beverage by Bira91 contained all-natural ingredients with low sugar content.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the canned alcoholic beverages market based on the below-mentioned segments:

Global Canned Alcoholic Beverages Market, By Product

- Wine

- RTD

- Cocktails

- Hard Seltzers

Global Canned Alcoholic Beverages Market, By Distribution Channel

- On-trade

- Liquor Stores

- Online

- Others

Global Canned Alcoholic Beverages Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?