Global Carbon Battery Bank Market Size, Share, and COVID-19 Impact Analysis, By Capacity (500 Ah to 1000 Ah, 1000 Ah to 2000 Ah, 2000 Ah - 5000 Ah, More Than 5000 Ah), By Battery Type (Lithium-Carbon, Sodium-Carbon), By End-Use (Residential, Commercial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Machinery & EquipmentGlobal Carbon Battery Bank Market Insights Forecasts to 2033

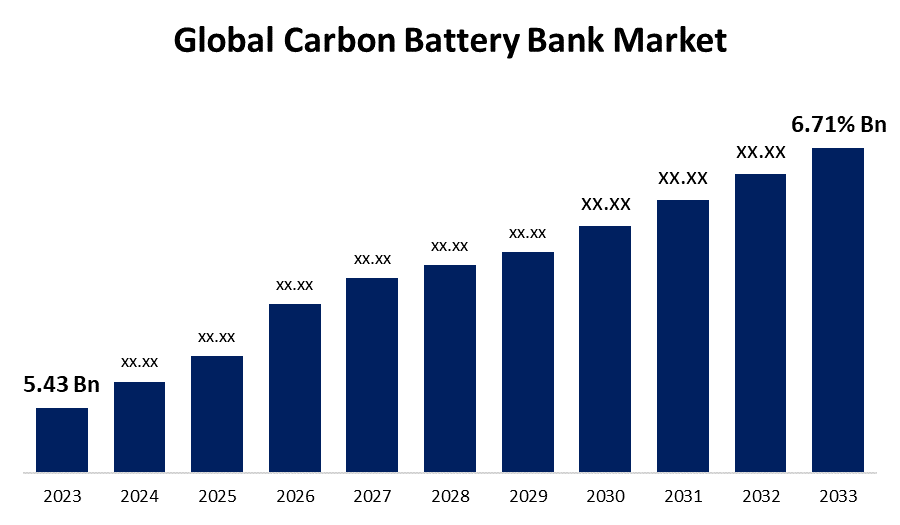

- The Global Carbon Battery Bank Market Size was Valued at USD 5.43 Billion in 2023

- The Market Size is Growing at a CAGR of 6.71% from 2023 to 2033

- The Worldwide Carbon Battery Bank Market Size is Expected to Reach USD 10.4 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Carbon Battery Bank Market Size is Anticipated to Exceed USD 10.4 Billion by 2033, Growing at a CAGR of 6.71% from 2023 to 2033.

Market Overview

A carbon battery bank is a sustainable energy storage system that uses carbon-based materials to store electrical energy and power electric vehicles (EVs). Carbon battery banks are also known as carbon-based energy storage systems. It is more efficient than other energy storage options and has a longer lifespan than other batteries. It is also easier to recycle compared to other battery banks.

The global carbon battery bank is an essential component in the energy storage system, it is driven by increasing demand for renewable energy sources and the need for efficient energy management solutions. Carbon battery banks are known for their high energy density, long life cycles, and better performance in varied temperatures. It has a wide range of applications, from electric vehicles (EVs) to residential and commercial energy storage systems, carbon battery banks are essential in pivoting to sustainable energy solutions. The growing focus on reducing carbon emissions and achieving energy security fuels the adoption of carbon battery banks. Furthermore, technological advancements and the invention and development of cost-effective production methods have enhanced its affordability boosting its sales and adoption. Key market players are focusing on innovation and strategic partnerships to increase their market presence and cater to the changing demands of users. Overall, the global carbon battery bank market is expected to grow significantly in the coming years, offering various opportunities to businesses across the industry.

Report Coverage

This research report categorizes the market for the global carbon battery bank market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global carbon battery bank market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global carbon battery bank market.

Global Carbon Battery Bank Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.43 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.71% |

| 2033 Value Projection: | USD 10.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Capacity, By Battery Type, By End-Use, By Region |

| Companies covered:: | Hitachi Chemical, Leading Edge Power, CDN Solar, Shandong Sacred Sun Power Sources Co., Ltd., Sunergy Solar, IPS Integrated Power Systems Inc., Jiangxi JingJiu Power Science & Technology Co., Ltd., Helios Power Solutions, VISION UPS Systems S.à.r.l. (batterx), C&D Technologies, Inc., Narada Asia Pacific Pte. Ltd., Azimuth Solar Products Inc., EverExceed Industrial Co. Ltd, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The global carbon battery bank market is driven by several environmental, technological, and economic factors. A main driving factor is the rising focus on reducing carbon emissions and enhancing sustainability globally. Governments and organizations worldwide are implementing strict policies and providing incentives to promote cleaner energy solutions, making carbon battery banks an attractive solution for industries. Technological innovation in carbon battery materials and manufacturing is also a major driving factor and it is expected to improve the efficiency, lifespan, and cost-effectiveness of carbon battery banks, making them better alternatives over traditional lithium-ion batteries. Furthermore, the rising global energy demand, paired with the need for reliable energy storage and management solutions, is boosting the demand for carbon battery banks. Carbon battery banks are necessary for stabilizing energy grids, especially with the growing adoption of renewable energy sources like solar and wind. With the decreasing manufacturing cost and technological advancements, carbon battery banks are becoming more economically viable and accessible for residential, commercial, and industrial applications. Strategic partnerships and investments in research and development, along with supportive government policies, are expected to fuel carbon battery bank market growth in the coming years.

Restraining Factors

Some of the challenges anticipated to restrain the growth of the global carbon battery bank market. The major market growth restraining factors are the availability of raw materials and the high costs associated with sourcing high-quality carbon materials for manufacturing these battery banks. The competition from traditional battery technologies, particularly lithium-ion batteries is a significant hurdle, as they already have a widespread market presence and their continued technological advancements. Furthermore, the technology adoption rate is quite low, and integrating new carbon-based storage solutions into existing energy systems requires significant investments, which could restrain the market growth. Market players need to overcome regulatory frameworks and environmental compliances, which can vary by region, adding hindrances to global market growth. Furthermore, despite decreasing production costs, the initial investment required for carbon battery banks could be substantial based on the use case, limiting adoption among small and medium-sized enterprises (SMEs).

Market Segmentation

The global carbon battery bank market share is classified into capacity, battery type, and end-use.

- The capacity range of more than 5000 Ah segment is expected to hold the largest share of the global carbon battery bank market during the forecast period.

Based on the capacity, the global carbon battery bank market is divided into 500 Ah to 1000 Ah, 1000 Ah to 2000 Ah, 2000 Ah - 5000 Ah, and more than 5000 Ah. Among these, the capacity range of more than 5000 Ah segment is expected to hold the largest share of the global carbon battery bank market during the forecast period. The segment’s growth is due to the growing demand for reliable energy storage solutions that can provide uninterrupted power supply across various industrial and commercial sectors. Battery banks in this capacity range offer a good balance between storage capability and operational efficiency, making them suitable for large-scale applications. Industries require significant energy reserves to maintain continuous operations and ensure stability in case of power fluctuations, and a carbon battery bank in this capacity range delivers the necessary power without compromising efficiency. Moreover, the innovations in carbon batteries have improved the performance and lifespan of these high-capacity batteries, boosting the segment’s growth.

- The lithium-carbon segment is expected to hold the largest share of the global carbon battery bank market during the forecast period.

Based on battery type, the global carbon battery bank market is divided into lithium-carbon and sodium-carbon. Among these, the lithium-carbon segment is expected to hold the largest share of the global carbon battery bank market during the forecast period. The growth of this segment is driven by several factors. Lithium-carbon batteries combine the high energy density and efficiency of lithium-ion technology with the environmental benefits and cost-effectiveness of carbon components. This approach significantly enhances the performance, lifespan, and charging speed of carbon battery banks, making them exceptionally suitable for a wide range of applications such as consumer electronics, electric vehicles (EVs), and energy grid storage. Due to the growing adoption of renewable energy systems, the Lithium-Carbon battery segment is highly in demand because of their superior energy retention and stability.

- The commercial segment is expected to hold the largest share of the global carbon battery bank market during the forecast period.

Based on end-use, the global carbon battery bank market is divided into residential and commercial. Among these, the commercial segment is expected to hold the largest share of the global carbon battery bank market during the forecast period. The growth of commercial segment is mainly driven by the rising demand from businesses and industries. The commercial segment includes data centers, manufacturing plants, and office campuses and buildings. They require substantial energy reserves to maintain a continuous power supply for operations, which carbon battery banks can efficiently provide. The carbon batteries offer robust performance, longer life, and enhanced safety features, making them ideal for large-scale implementations. Additionally, the commercial sector is increasingly adopting sustainable energy storage practices and renewable energy integration, generating the need for carbon battery banks to stabilize and optimize energy storage and supply.

Regional Segment Analysis of the Global Carbon Battery Bank Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the global carbon battery bank market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global carbon battery bank market over the predicted timeframe. The Asia-Pacific region’s market is driven primarily by the rapid industrialization and urbanization in developing economies such as China, India, and Japan. These countries are experiencing a significant increase in energy demand, boosting the demand for solutions like carbon battery banks. Furthermore, strong government support through favorable policies and regulations, along with subsidies and investments in large-scale renewable energy projects, further propels market growth. For instance, in 2023, according to a report by global energy think tank Ember, India overtook Japan and became the third-largest solar power generator in 2023 (113 TWh). The well-established manufacturing infrastructure and continuous technological advancements in battery technology reduce the cost of manufacturing, further reducing the cost of purchasing, and boosting sales. Furthermore, the increasing adoption of carbon battery banks due to the focus on sustainable energy practices in Asia-Pacific supports the widespread solidifying of the region's dominant market share.

North America is expected to grow at the fastest pace in the global carbon battery bank market during the forecast period. This region’s rapid growth is driven by several key factors, including substantial investments in renewable energy and advanced battery technologies. Government initiatives, subsidies, and regulations aimed at reducing carbon emissions and promoting sustainable energy solutions are also playing a significant role in accelerating market expansion. Furthermore, the increasing adoption of electric vehicles (EVs) and smart grid technologies in the United States and Canada is boosting demand for carbon battery storage systems. The booming tech industry and strong R&D, support for continuous innovation, and improvements in carbon batteries are boosting the regional market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global carbon battery bank market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi Chemical

- Leading Edge Power

- CDN Solar

- Shandong Sacred Sun Power Sources Co., Ltd.

- Sunergy Solar

- IPS Integrated Power Systems Inc.

- Jiangxi JingJiu Power Science & Technology Co., Ltd.

- Helios Power Solutions

- VISION UPS Systems S.à.r.l. (batterx)

- C&D Technologies, Inc.

- Narada Asia Pacific Pte. Ltd.

- Azimuth Solar Products Inc.

- EverExceed Industrial Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, ESGEN Acquisition Corp. (“ESGEN”), a publicly-traded special purpose acquisition company, today announced the completion of its business combination (the “Business Combination”) with Sunergy Renewables, LLC (“Sunergy”), a leading Florida-based provider of residential solar and energy efficiency solutions.

- In August 2022, Allotrope Energy, UK, said it developed a lithium carbon battery for mopeds and scooters that can be recharged in as little as 90 seconds. The new battery is being supplied to manufacturers by Mahle Powertrain, a global Tier One supplier to the automotive and mobility market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global carbon battery bank market based on the below-mentioned segments:

Global Carbon Battery Bank Market, By Capacity

- 500 Ah to 1000 Ah

- 1000 Ah to 2000 Ah

Global Carbon Battery Bank Market, By Battery Type

- Lithium-Carbon

- Sodium-Carbon

Global Carbon Battery Bank Market, By End-Use

- Residential

- Commercial

Global Carbon Battery Bank Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Hitachi Chemical, Leading Edge Power, CDN Solar, Shandong Sacred Sun Power Sources Co., Ltd., Sunergy Solar, IPS Integrated Power Systems Inc., Jiangxi JingJiu Power Science & Technology Co., Ltd., Helios Power Solutions, VISION UPS Systems S.à.r.l. (batterx), C&D Technologies, Inc., Narada Asia Pacific Pte. Ltd., Azimuth Solar Products Inc., EverExceed Industrial Co. Ltd., and Others.

-

2. What is the size of the global carbon battery bank market?The Global Carbon Battery Bank Market is expected to grow from USD 5.43 Billion in 2023 to USD 10.4 Billion by 2033, at a CAGR of 6.71% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia-Pacific is anticipated to hold the largest share of the global carbon battery bank market over the predicted timeframe.

Need help to buy this report?