Global Carbon Market Size, Share, and COVID-19 Impact Analysis, By Market Type (Voluntary Market, Compliance Market), System Type (Cap & Trade, Baseline & Credit, Carbon Offset Programs), By End-Use Industry (Energy & Power, Petrochemical, Industrial, Utilities, Aviation, Transportation, Buildings, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Energy & PowerGlobal Carbon Market Insights Forecasts to 2032

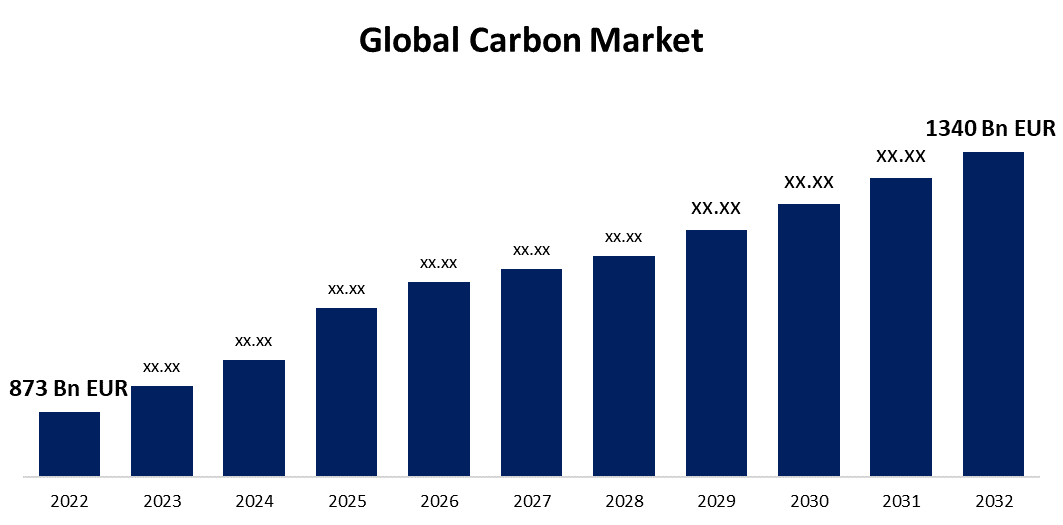

- The Global Carbon Market Size was valued at USD USD 873 Billion Euros in 2022.

- The Market is Growing at a CAGR of 4.38% from 2022 to 2032

- The Worldwide Carbon Market Size is expected to reach USD USD 1340 Billion Euros by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Carbon Market Size is expected to reach USD 1340 Billion Euros by 2032, at a CAGR of 4.38% during the forecast period 2022 to 2032. The demand for organizations to decrease their greenhouse gas emissions, more stringent environmental regulations, and growing recognition of the effects of climate change are all likely to lead to significant growth in the global carbon market throughout the forecast period.

The global carbon market, also known as the carbon trading market or the emissions trading market, is an initiative for reducing the production of greenhouse gases and mitigating climate change. It functions on the premise of imposing a monetary value on carbon emissions, encouraging businesses and governments to minimize their carbon footprint. In addition, measures such as the deployment of low-carbon technologies notably EVs, abatement subsidies for fossil fuels, a carbon pricing system, and the purchase and manufacture of green energy and EE products are proactive actions made by most countries throughout the world to reduce carbon emissions. The carbon market operates by enacting cap-and-trade systems or carbon offset programs. In a cap-and-trade system, the government establishes a restriction or cap on the total quantity of carbon dioxide and other greenhouse gas emissions that certain industries or sectors can emit. Carbon offset programs, on the other hand, enable organizations to buy carbon offsets from initiatives that reduce greenhouse gas emissions. These projects could be in renewable energy, forestry, or energy efficiency. Businesses and private individuals can efficiently compensate for their own emissions by purchasing offsets and supporting projects that cut emissions elsewhere.

Global Carbon Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 873 Billion Euros |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.38% |

| 2032 Value Projection: | USD 1340 Billion Euros |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Market Type, By System Type, By End-Use Industry, By Region. |

| Companies covered:: | Carbonfund, NativeEnergy, Climate Partner GmbH, South Pole Group, Climeco LLC, EKI Energy Services Ltd., Climetrek Ltd., Moss.Earth, TEM, ForestCarbon, Natureoffice GmbH, Climetrek Ltd., Terrapass, Finite Carbon, Climate Impact Partners, CarbonBetter, Carbon Credit Capital, Carbon Care Asia Limited, Environmental Markets and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The carbon market is a worldwide phenomenon, with numerous regional and international carbon markets in operation. The European Union Emissions Trading System (EU ETS) is the largest and most well-known carbon market, covering over 11,000 power plants and industrial installations throughout 31 European Union countries. The global carbon market's purpose is to encourage emissions reductions, promote greener technology, and accelerate the shift to a low-carbon economy. The market's goal in implementing a price on carbon emissions is to absorb the environmental costs of releasing greenhouse gases and promote investments in clean and sustainable activities. Furthermore, some nations have established domestic carbon markets, whereas others contribute to international processes or use a variety of measures for controlling emission levels.

Regulatory measures, voluntary business activities, rising carbon prices, and technology improvements are essential driving forces in the global carbon market's growth and development. Furthermore, the success and general impact of carbon markets in reducing emissions are determined by factors such as the stringency of caps or targets, monitoring and verification methods, and market integration across multiple regions. Additionally, global agreements on climate change, carbon offsetting and carbon neutrality targets, investor desire for ESG aspects, and many others are boosting the market demand. Moreover, increased expenditures in carbon capture technologies and renewable energy usage are driving the market.

Restraining Factors

The rising cost of carbon credits could operate as a market barrier during the anticipated period. The selling prices are fluctuating, and as a result, growing pricing and demand lead to larger transaction volumes. Carbon prices have risen considerably in the preceding year, according to the World Bank, owing primarily to rising demand as decarbonization efforts rapidly. The explosive rise in the value of offsets reflects both growing prices and rising corporate buyer demand, which could also result in bigger transacted offset volumes.

Market Segmentation

By Market Type Insights

The compliance market segment is dominating the market with the largest revenue share over the forecast period.

On the basis of market type, the global carbon market is segmented into the voluntary market and compliance market. Among these, the compliance market segment is dominating the market with the largest revenue share of 53.6% over the forecast period. This market operates inside regulatory frameworks established by governments or supranational organizations, such as the European Union Emissions Trading System (EU ETS). Compliance market participants are often entities that have obligatory emission reduction targets, such as large enterprises or power plants. They must maintain sufficient carbon allowances to cover their emissions or risk fines. Carbon allowances can be traded among market participants.

Furthermore, the voluntary market is the fastest growing category and is predicted to dominate the carbon market during the projection period. Regulations imposed by authorities in the compliance market are absent in the voluntary market. The voluntary carbon market operates independently of legislative constraints, allowing enterprises or people to offset their emissions voluntarily by purchasing carbon credits. Companies, governments, and individuals who want to minimize their carbon footprint can all participate in the voluntary market. The voluntary market credits are often used to fund projects that decrease or eliminate greenhouse gas emissions, such as renewable energy projects, afforestation initiatives, or energy efficiency programs.

By System Type Insights

The cap & trade segment is witnessing significant CAGR growth over the forecast period.

On the basis of system type, the global carbon market is segmented into cap & trade, baseline & credit, and carbon offset programs. Among these, the cap & trade segment is witnessing significant CAGR growth over the forecast period. The cap & trade system allows the marketplace to set a carbon price, which drives decisions concerning investments and the development of markets. As a result, it increases demand for the carbon market. The cap & trade system establishes a monetary value on emissions. Companies that own carbon credits can resell them for a profit, providing industries with a new revenue stream. As a result, this category is predicted to increase at a faster rate throughout the projection period.

By End-Use Industry Insights

The utilities segment accounted for the largest revenue share of more than 46.1% over the forecast period.

On the basis of end-use industry, the global carbon market is segmented into energy & power, petrochemical, industrial, utilities, aviation, transportation, buildings, and others. Among these, the utilities segment is dominating the market with the largest revenue share of 46.1% over the forecast period. Power firms are now focused on ecology and adopting novel techniques and global standard procedures to drastically reduce carbon emissions. Companies' environmental commitment is demonstrated through the employment of greater efficiency conventional fuel technologies and less emission-intensive fuels, as well as the evaluation and implementation of new and renewable energy sources. Carbon emissions from the power sector and electrical industries are fast expanding; thus, there is a critical requirement for decarbonization within these sectors, which ultimately accelerates demand for carbon credits, leading to the rise of the carbon market.

Regional Insights

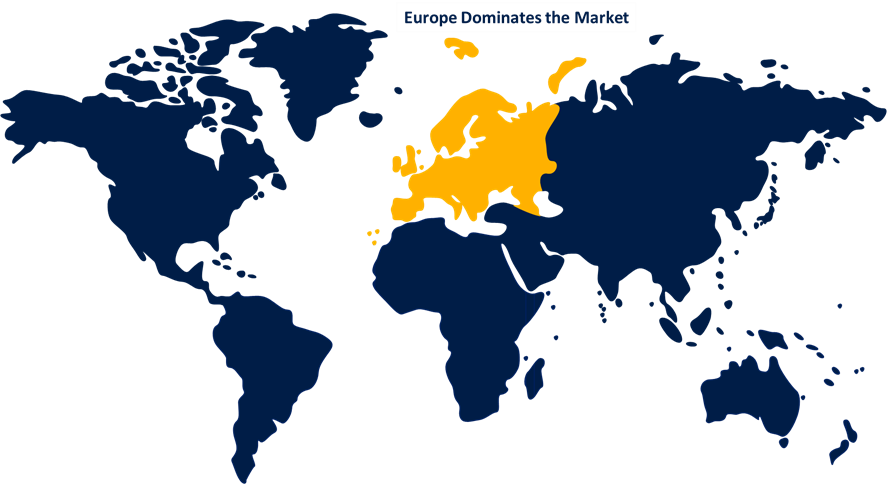

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Europe is dominating the market with more than 38.7% market share over the forecast period. Europe's ETS is a cornerstone of the EU's climate change policy and its primary tool for affordably lowering greenhouse gas emissions. It was the world's first major carbon market and continues to be the largest. It accounts for around 45% of the EU's greenhouse gas emissions. Furthermore, under the European Climate Law, EU member countries will collaborate to achieve climate neutrality by 2050. As a first step, the EU intends to reduce net emissions by at least 55% by 2030 in comparison to 1990. Thus, initiatives like these are projected to contribute to helping Europe maintain its dominant position in the global carbon market over the predicted period.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. The Republic of Korea has the most developed national emission trading system (ETS) in Asia Pacific. China is looking for an emission trading system (ETS) that corresponds to its setting, is adaptable, has no fundamental flaws, and is capable of enhancing operations. ETS could become an important climate policy tool to assist China in meeting its NDC to the Paris Agreement on Climate Change and its long-term low-carbon strategy. As a result, these factors are likely to propel the market's development in the region of Asia Pacific.

The North America market is expected to register a substantial CAGR growth rate during the forecast period. The Western Climate Initiative (WCI) and the Regional Greenhouse Gas Initiative (RGGI) are two tradable carbon markets in North America. WCI is the world's fourth-largest carbon market, with a link connecting California and Quebec. It intends to reduce greenhouse gas (GHG) emissions by 16% by 2020 and 40% by 2030 compared to 1990 levels. In addition, while a federal-level carbon market has yet to be established, a number of states, particularly California and the Northeastern states, have regional cap-and-trade programs in place to encourage lower greenhouse gas emissions and ecologically friendly activities in the United States.

List of Key Market Players

- Carbonfund

- NativeEnergy

- Climate Partner GmbH

- South Pole Group

- Climeco LLC

- EKI Energy Services Ltd.

- Climetrek Ltd.

- Moss.Earth

- TEM

- ForestCarbon

- Natureoffice GmbH

- Climetrek Ltd.

- Terrapass

- Finite Carbon

- Climate Impact Partners

- CarbonBetter

- Carbon Credit Capital

- Carbon Care Asia Limited

- Environmental Markets

Key Market Developments

- On July 2023, Emirates NBD, a major banking company in the MENAT area, has assumed the lead in the region in introducing carbon future contracts trading, meeting rising corporate demand to manage carbon emissions offsetting, and aligning with the UAE's Net Zero action plan. The Group intends to remain at the vanguard of the region's quickly expanding carbon trading ecosystem, giving clients the flexibility to deal in carbon credits as they work toward sustainability goals. The introduction of trading capacity in compliance carbon markets would also improve corporate access to sustainability-linked finance, which is in high demand.

- On May 2023, To further develop the world's carbon markets, GIGA Carbon Neutrality (GCN) formed a cooperation with the London-based Carbon Trade eXchange (CTX) and its Australian parent firm Global Environmental Markets (GEM). A global carbon market will be formed, powered by AI and blockchain technology, with carbon futures contracts based on dependable, high-quality carbon credits from hundreds of projects in numerous carbon registries, such as the UNFCCC CDM Registry. The collaboration will establish a worldwide carbon marketplace with carbon futures contracts based on trusted high-quality carbon credits from hundreds of projects across several carbon registries.

- On September 2022, AirCarbon Pte Ltd, a Singapore-based company that facilitates carbon credit trading, is considering expanding into India. AirCarbon requires a presence in India because it expects India to play a big role in the global carbon market. Carbon markets involve the purchase and sale of carbon credits (also known as carbon offsets). Carbon credits are given to companies (or even individuals) for taking steps that reduce carbon dioxide emissions or absorb carbon dioxide from the atmosphere.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Carbon Market based on the below-mentioned segments:

Carbon Market, Market Type Analysis

- Voluntary Market

- Compliance Market

Carbon Market, System Type Analysis

- Cap & Trade

- Baseline & Credit

- Carbon Offset Programs

Carbon Market, End-Use Industry Analysis

- Energy & Power

- Petrochemical

- Industrial

- Utilities

- Aviation

- Transportation

- Buildings

- Others

Carbon Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?