Global Carbon Offset/Carbon Credit Market Size, Share, and COVID-19 Impact Analysis, By Type (Voluntary Market, Compliance Market), By Project Type (Avoidance/Reduction Projects, Removal/Sequestration Projects [Nature-based Projects and Technology-based Projects]), By End User (Energy, Power, Transportation, Industrial, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Carbon Offset/Carbon Credit Market Insights Forecasts to 2033

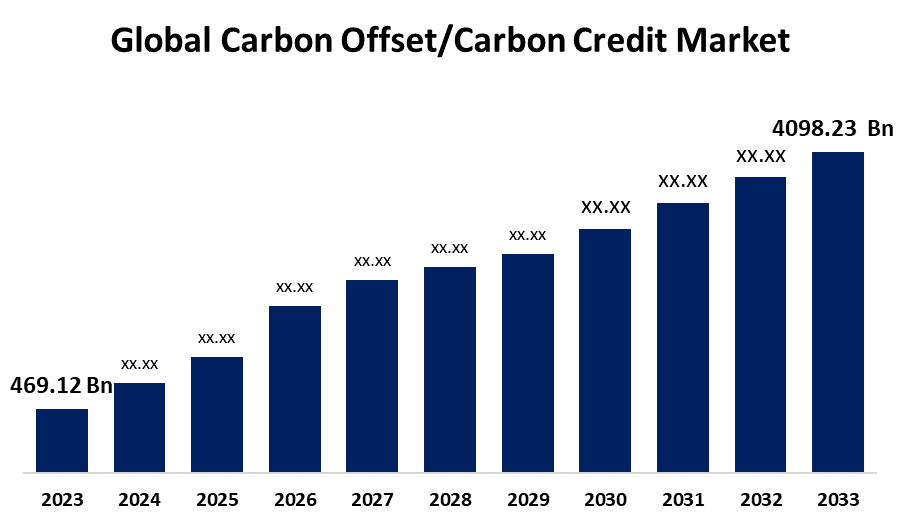

- The Global Carbon Offset/Carbon Credit Market Size was Valued at USD 469.12 Billion in 2023

- The Market Size is Growing at a CAGR of 24.32% from 2023 to 2033

- The Worldwide Carbon Offset/Carbon Credit Market Size is Expected to Reach USD 4098.23 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Carbon Offset/Carbon Credit Market Size is Anticipated to Exceed USD 4098.23 Billion by 2033, Growing at a CAGR of 24.32% from 2023 to 2033.

Market Overview

A carbon credit is also known as carbon offset which means reducing the intensity of carbon dioxide and other hazardous gases. A carbon offset is a calculable evasion or removal of harmful gases. Rather than paying more than what would be necessary to invest in a company's operations, customers can sponsor greenhouse gas reduction strategies used by individuals to lower their carbon tax liability by funding carbon offset programs. Carbon offsets or carbon credits are market-based mechanisms aimed at lowering greenhouse gas emissions. Governments or regulatory bodies establish caps on greenhouse gas emissions. Some businesses cannot afford to immediately reduce their emissions. As a result, businesses can purchase carbon credits to meet the emission cap. Additional carbon credits are typically awarded to businesses that have carbon offsets. Possible projects to reduce pollution can be funded by selling credit surpluses. To provide carbon credits, carbon offset projects are assessed and built according to certain guidelines and procedures. In voluntary carbon credit markets, liability about the kinds of processes used to improve carbon credits may also be exchanged. Offset projects can be categorized based on the technology used, the kind of greenhouse gas savings, or the particular method used to create the project.

Report Coverage

This research report categorizes the market for the global carbon offset/carbon credit market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global carbon offset/carbon credit market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global carbon offset/carbon credit market.

Global Carbon Offset/Carbon Credit Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 469.12 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 24.32% |

| 2033 Value Projection: | USD 4098.23 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Project Type, By End User and By Region |

| Companies covered:: | South Pole Group, 3Degrees, Finite Carbon, EKI Energy Services Ltd, Native Energy, Carbon Trade Exchange (CTX), Carbon Streaming Corporation, Brookfield Renewable Partners, Gold Standard, ClimateCare, Terrapass, WGL Holdings, Inc., Enking International, Green Mountain Energy, Cool Effect, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is driven by the rising amount of tree plantations and the escaping of production from the air to eliminate carbon. The emission is reduced by the carbon credits which aid in removing carbon from the atmosphere. Further, the market is boosted by the ability of organizations to buy carbon credits to limit greenhouse gas emissions. Also, the increasing demand for carbon credits is anticipated to drive the market growth. The market is growing during the projected period, because of the low supply of carbon credit which makes the companies to pre-purchase the carbon credits to cover their emission limits. Companies are shifting towards low carbon dioxide emissions in their projects, which helps them lower costs using carbon credits. The remaining carbon credits can be utilized in another project. This helps them not only in saving costs but also in investing in more carbon credits in the future whenever it is essential.

Restraining Factors

Since isolated carbon can be released back into the atmosphere, carbon offset projects carry a high risk of having an adverse environmental impact. As a result, market demand is anticipated to be restrained. For example, there is a chance that after clearing trees for palm oil and soy, the land will be authorized by the government to be used for production.

Market Segmentation

The global carbon offset/carbon credit market share is classified into type, project type, and end user.

- The voluntary market segment is expected to dominate the global carbon offset/carbon credit market with the major revenue share during the forecast period.

Based on the type, the global carbon offset/carbon credit market is divided into voluntary market and compliance market. Among these, the voluntary market segment is expected to dominate the carbon offset/carbon credit market with the major revenue share during the forecast period. This market works on a worldwide basis, which permits companies and customers from different areas to be involved and support carbon offset creativities universally. This global reach allows everyone to fund sustainable projects around the world and makes it easier to cooperate universally.

- The removal/sequestration projects is anticipated to dominate the market during the projected period.

Based on the project type, the global carbon offset/carbon credit market is divided into avoidance/reduction projects, and removal/sequestration projects. The removal/sequestration projects is further divided into nature-based projects and technology-based projects. Among these, the removal/sequestration projects is anticipated to dominate the market during the projected period. These projects effectively capture and store carbon dioxide from the air. Removal/sequestration is a tangible way to reduce the carbon dioxide level from the environment, hence, being more eye-catching for counteracting emissions.

- The industrial segment is anticipated to dominate the market during the forecast period.

Based on the end user, the global carbon offset/carbon credit market is divided into energy, power, transportation, industrial, and others. Among these, the industrial segment is anticipated to dominate the market during the forecast period. Industries regularly participate in carbon offset projects to reimburse for their productions. The industrial sector's productions can be extensive, making it an important sponsor of the demand for carbon offsets and credits.

Regional Segment Analysis of the Global Carbon Offset/Carbon Credit Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to dominate the global carbon offset/carbon credit market over the forecast period.

Get more details on this report -

Europe is anticipated to dominate the global carbon offset/carbon credit market over the forecast period. This is due to the stringent government rules and goals to decrease greenhouse gas emissions, which increased the requirement for carbon offsets. Moreover, European countries claim a long past of ecological consciousness and sustainability practices, guiding to a better acceptance and thoughtful of carbon offset creativities. Additionally, Europe's dominance in the carbon offset/carbon credits market has been strengthened by the region's abundance of well-established carbon offset projects and organizations. This includes measures like methane capture, reforestation, and installation of renewable energy. Therefore, the demand for these projects is being driven by a rising number of European firms and people who are ready to invest in carbon credits to offset their emissions.

Asia Pacific region is estimated to be the fastest-growing region in the global carbon offset/carbon credit market during the predicted period. Asia Pacific region has the world’s major economies such as China, India, and Japan, all of which have a noteworthy carbon footprint. There is a growing demand for carbon offsets and credits because these countries are progressively concentrating on sustainability and climate change moderation. In addition, the Asia-Pacific area offers a variety of carbon offset initiatives, such as waste management, renewable energy, and forest conservation, all of which contribute to the market's explosive expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global carbon offset/carbon credit market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- South Pole Group

- 3Degrees

- Finite Carbon

- EKI Energy Services Ltd

- Native Energy

- Carbon Trade Exchange (CTX)

- Carbon Streaming Corporation

- Brookfield Renewable Partners

- Gold Standard

- ClimateCare

- Terrapass

- WGL Holdings, Inc.

- Enking International

- Green Mountain Energy

- Cool Effect, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Microsoft and ClimateSeed have teamed together to introduce a new platform that will help companies buying carbon balances to neutralize their carbon vestiges. Businesses will have access to a variety of carbon-neutralized systems through the platform, similar to forestry, energy effectiveness, and renewable energy enterprises.

- In August 2023, to speed its trip towards net zero, Johnson Controls, a colonist in erecting technology and results encyclopedically, has partnered with 3Degrees. Johnson Controls' net zero objects will be expedited by the cooperation through carbon reduction services, similar to carbon negativing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the carbon offset/carbon credit market based on the below-mentioned segments:

Global Carbon Offset/Carbon Credit Market, By Type

- Voluntary Market

- Compliance Market

Global Carbon Offset/Carbon Credit Market, By Project Type

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

- Nature-based Projects

- Technology-based Projects

Global Carbon Offset/Carbon Credit Market, By End User

- Energy

- Power

- Transportation

- Industrial

- Others

Global Carbon Offset/Carbon Credit Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?