Global Cardiac Prosthetic Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Heart Valves and Pacemaker), By End-Use (Hospitals, Ambulatory Surgical Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Cardiac Prosthetic Devices Market Insights Forecasts to 2033

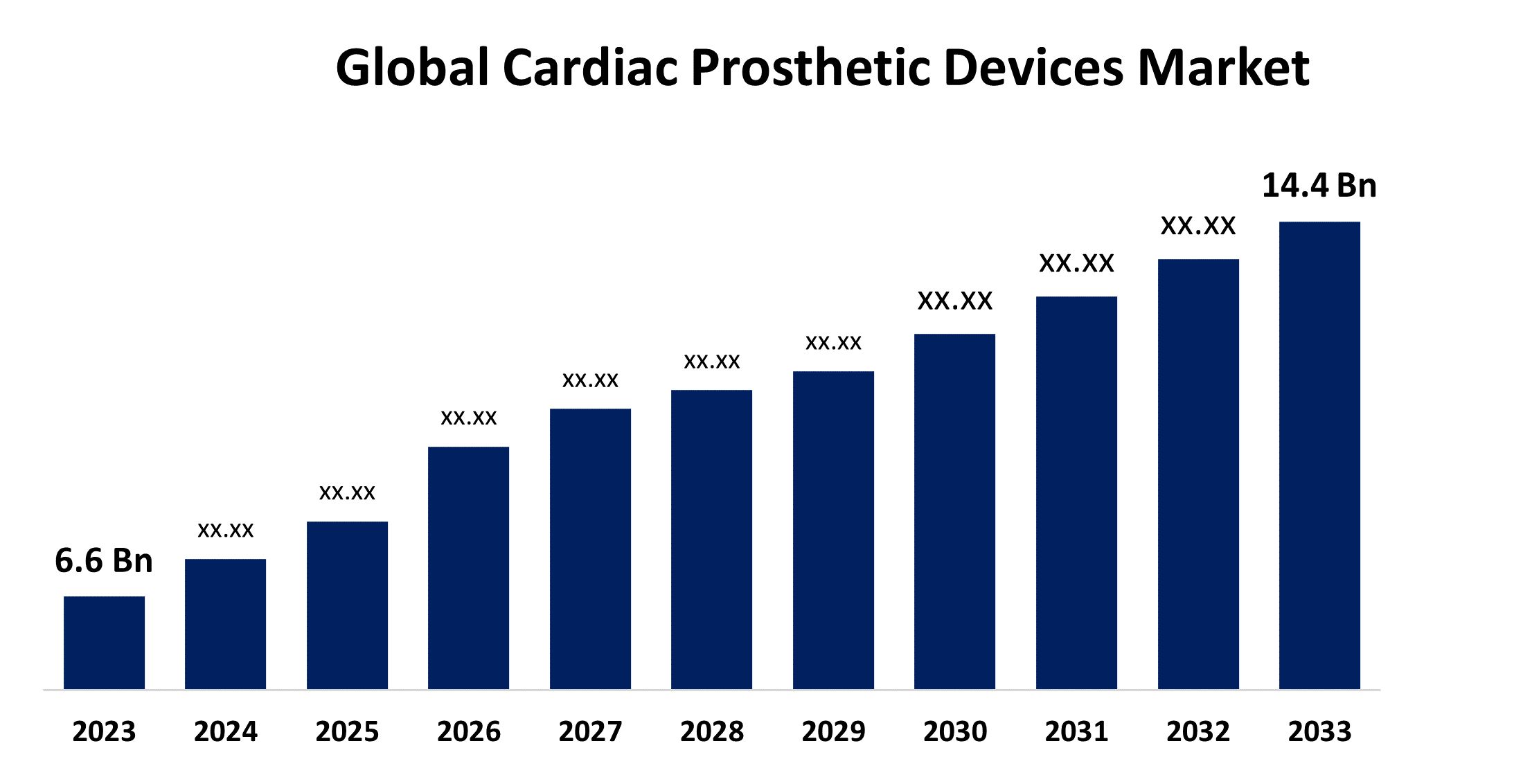

- The Global Cardiac Prosthetic Devices Market Size was Valued at USD 6.6 Billion in 2023

- The Market Size is Growing at a CAGR of 8.11% from 2023 to 2033

- The Worldwide Cardiac Prosthetic Devices Market Size is Expected to Reach USD 14.4 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cardiac Prosthetic Devices Market Size is Anticipated to Exceed USD 14.4 Billion by 2033, Growing at a CAGR of 8.11% from 2023 to 2033.

Market Overview

Cardiac prosthetic devices are medical devices intended to assist parts of the cardiovascular system such as the heart, arteries, or veins, by replacing and repairing malfunctioning or damaged heart valves. These are implantable or external devices, that work just like normal cardiovascular organs, and maintain the proper functionality of the heart by restoring proper blood flow within the heart (facilitate ventricular filling and contractions) and improving its overall function. Prosthetic cardiac devices improve survival and greatly increase the quality of life in most patients. The application of prosthetic devices for cardiac surgeries involves coronary artery bypass in which prosthetic grafts are required. They possess a broad range of properties including strength, viscoelasticity, biocompatibility, blood compatibility, and biostability. The power source of cardiac prosthetics includes external sources such as batteries or a generator. The internal power source can be obtained from the patient's blood supply. The combination of cardiac prostheses and cardiovascular monitoring systems has proven very useful to cardiologists, and improvise surgical techniques. More novel technologies like smaller pacemakers and improvements in medical technology are anticipated to create new market opportunities for cardiac prosthetic devices.

Report Coverage

This research report categorizes the market for the global cardiac prosthetic devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global cardiac prosthetic devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global cardiac prosthetic devices market.

Global Cardiac Prosthetic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.11% |

| 2033 Value Projection: | USD 14.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-Use, By Region |

| Companies covered:: | Abbott Laboratories, Edwards Lifesciences Corporation, Medtronics Plc., Boston Scientific Corporation, LivaNova, Biotronik, Siemens Healthcare GmbH, Lepu Medical Technology Co. Ltd., Meril Lifesciences Pvt. Ltd., Abiomed, Inc., AtriCure, Inc., Labcor Laboratrios, Lifetech Scientific, MicroPort Scientific, CryoLife, Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of cardiovascular diseases such as valvular heart diseases and coronary artery diseases is responsible for driving the global prosthetic devices market. The rising number of minimally invasive surgeries among the aging population owing to various lower incidences of postoperative cardiac complications and shorter recovery time is driving the market. The growing awareness regarding cardiovascular devices and technologically advanced diagnostic techniques for the early detection and diagnosis of heart diseases leading to drive the market. It was reported that more than 200,000 heart valve replacement surgeries are performed annually worldwide according to the National Library of Medicine with a predicted increment to 8,50,000 per year by 2050. Thus, the increasing number of cardiovascular surgeries is expected to drive the market demand for cardiac prosthetic devices.

Restraining Factors

The high cost of the devices and rigidness in approval of medical devices are restraining the global cardiac prosthetic devices market. Further, the risk of complications associated with the implantation of cardiovascular prosthetic devices, including infection, stroke, and death hamper the market growth. Further, the lack of skilled healthcare professionals in the field of cardiovascular prosthetics is impeding the market.

Market Segmentation

The global cardiac prosthetic devices market share is classified into product and end-use.

- The pacemakers segment accounted for the largest revenue share of the global cardiac prosthetic devices market in 2023.

Based on the product, the global cardiac prosthetic devices market is categorized into heart valves and pacemakers. Among these, the pacemakers segment accounted for the largest revenue share of the global cardiac prosthetic devices market in 2023. The use of pacemakers in the management of congestive heart failure (CHF) plays a major role in improving the heart’s pumping ability and regulating its rhythm. The growing prevalence of cardiac diseases with an increasing geriatric population is driving the market demand as the growing age fuels the risk of heart disorder.

- The hospitals segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end-use, the global cardiac prosthetic devices market is categorized into hospitals, ambulatory surgical centers, and others. Among these, the hospitals segment is anticipated to grow at the fastest CAGR during the forecast period. There is a growing healthcare spending by the government for the development of healthcare infrastructure. The increase in the number of populations suffering from cardiovascular diseases is fueling the demand for prosthetic devices ultimately leading to drive the market growth.

Regional Segment Analysis of the Global Cardiac Prosthetic Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

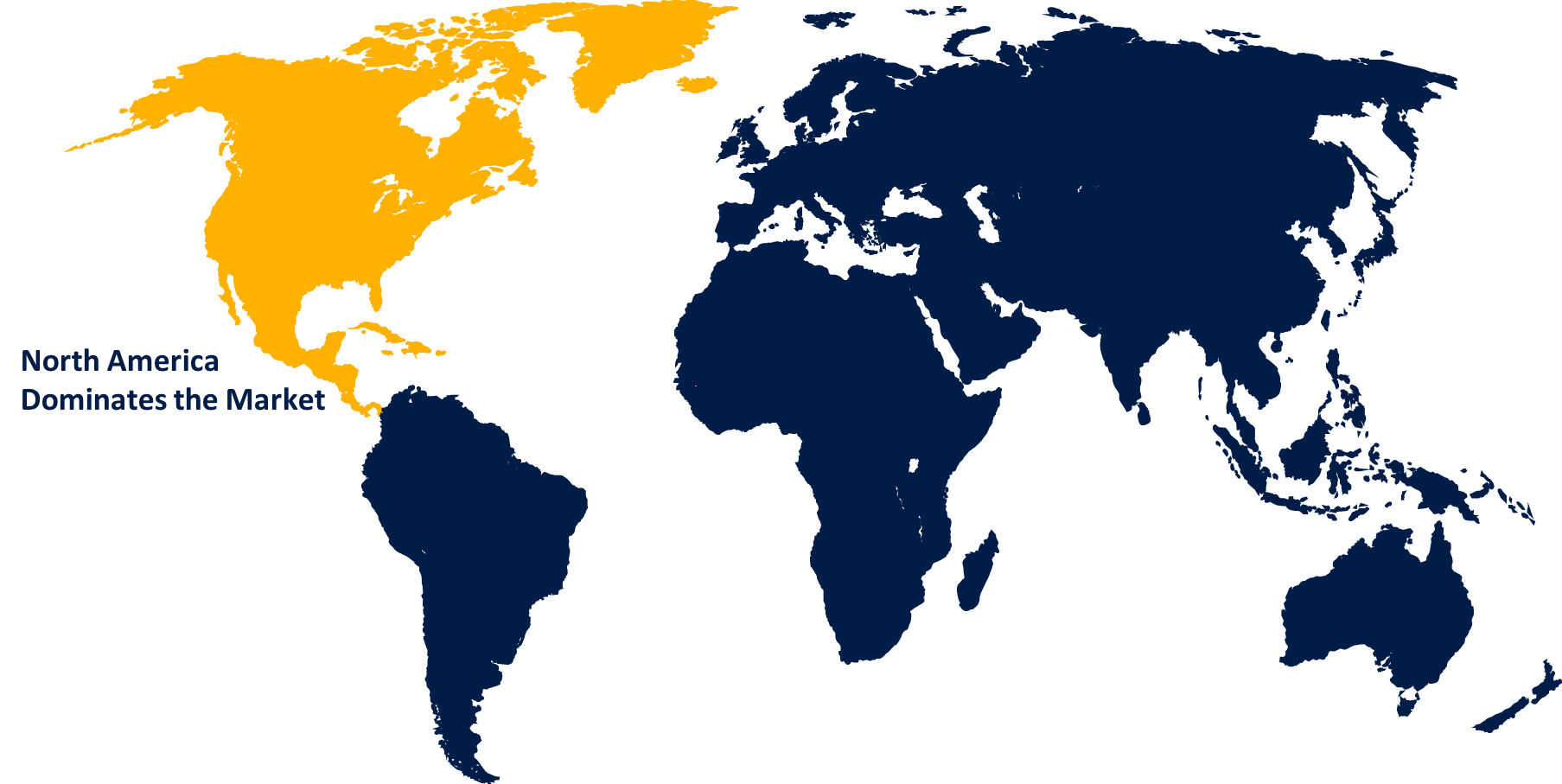

North America is anticipated to hold the largest share of the global cardiac prosthetic devices market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global cardiac prosthetic devices market over the forecast period. The increasing number of cardiovascular disease patients and the rising number of cardiovascular surgeries are driving the market. The growing number of product launches and product approvals for cardiovascular prosthetic devices are contributing to market growth. The growing number of collaborations, acquisitions, and partnerships by the key market players in the region are driving the market growth.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global cardiac prosthetic devices market during the forecast period. The rising prevalence of cardiovascular diseases with the growing geriatric populations is anticipated to drive the market demand as geriatric individuals are more prone to have coronary artery disorder. As per a report by the American Heart Association (AHA), around 4.5 lakh patients undergo angioplasty, each year, in India. The increased number of angioplasty surgeries is enhancing the market for cardiac prosthetic devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cardiac prosthetic devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Edwards Lifesciences Corporation

- Medtronics Plc.

- Boston Scientific Corporation

- LivaNova

- Biotronik

- Siemens Healthcare GmbH

- Lepu Medical Technology Co. Ltd.

- Meril Lifesciences Pvt. Ltd.

- Abiomed, Inc.

- AtriCure, Inc.

- Labcor Laboratrios

- Lifetech Scientific

- MicroPort Scientific

- CryoLife, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, Medtronic plc, a global leader in healthcare technology, announced that it had received approval from Japan's Ministry of Health, Labor and Welfare for the sale and reimbursement of the Micra AV Transcatheter Pacing System (TPS).

- In September 2021, Abbott announced that the U.S. Food and Drug Administration (FDA) has approved the company's Epic Plus and Epic Plus Supra Stented Tissue Valves to improve therapy options for people with aortic or mitral valve disease.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global cardiac prosthetic devices market based on the below-mentioned segments:

Global Cardiac Prosthetic Devices Market, By Product

- Heart Valves

- Pacemaker

Global Cardiac Prosthetic Devices Market, By End-Use

- Hospitals

- Ambulatory Surgical Centers

- Others

Global Cardiac Prosthetic Devices Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global cardiac prosthetic devices market over the forecast period?The global cardiac prosthetic devices market is projected to expand at a CAGR of 8.11% during the forecast period.

-

2.What is the projected market size & growth rate of the global cardiac prosthetic devices market?The global cardiac prosthetic devices market was valued at USD 6.6 Billion in 2023 and is projected to reach USD 14.4 Billion by 2033, growing at a CAGR of 8.11% from 2023 to 2033.

-

3.Which region is expected to hold the highest share in the global cardiac prosthetic devices market?The North America region is expected to hold the highest share of the global cardiac prosthetic devices market.

Need help to buy this report?