Global Cargo Ship Building Market Size, Share, and COVID-19 Impact Analysis, By Ship Type (Container Ships, Tanker, Roll on/Roll off Ships, Bulk Carriers, General Cargo Vessel, and Others), By Propulsion Type (Diesel & Gasoline, Nuclear, Hydrogen, Hybrid, LNG, Electric, and Others), By Material Type (Aluminum Alloys, Composites, Steel, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Cargo Ship Building Market Insights Forecasts to 2033

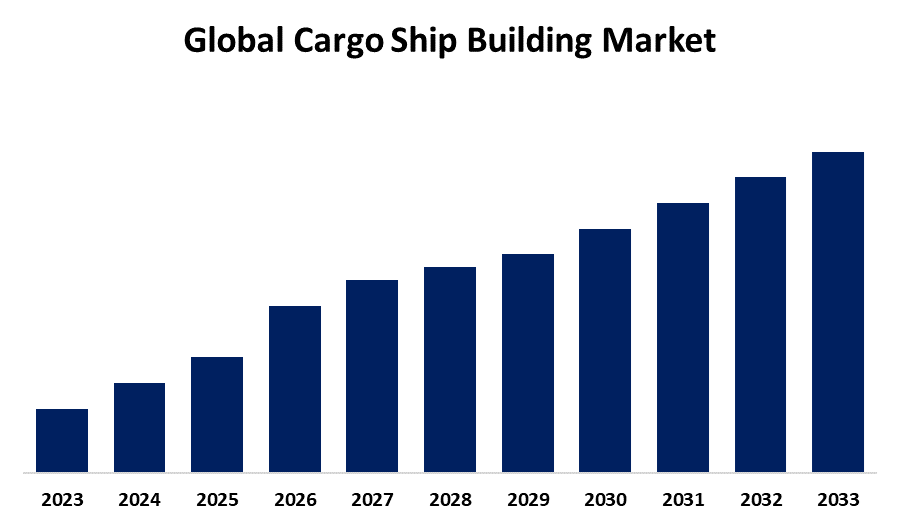

- The Market Size will Grow at a Substantial CAGR from 2023 to 2033.

- The Worldwide Cargo Vessel Building Market Size is Expected to Reach a Significant Share By 2033.

- Middle East and Africa is Expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Global Cargo Vessel Building Market Size is anticipated to reach a significant share by 2033, at a substantial CAGR during the forecast period 2023-2033. The global cargo ship building market represents huge opportunities arising from increasing demand for environmentally friendly vessels, boosted by IMO regulations and the move towards LNG, hydrogen, and hybrid-electric propulsion. Rising global trade, especially in developing economies, also fuels demand for advanced container ships, bulk carriers, and tankers. Technology advancement in automation, digitalization, and AI-driven ship design increases efficiency, safety, and operational sustainability for shipbuilding into the future.

Market Overview

The global cargo ship building market or the global cargo vessel building market, in which various kinds of commercial cargo vessels are designed, developed, manufactured, and commissioned for use in transporting goods and raw materials across global trade routes. In fact, it is an essential industry that has helped facilitate international commerce by ensuring the efficient transportation of bulk commodities, containerized goods, oil & gas, and other types of specialized cargo across oceans and waterways. Transformative trends are witnessed in the global cargo ship building market with regard to sustainability, digitalization, and efficiency improvement. The growth of green shipbuilding technologies like LNG, hydrogen, and ammonia-fueled vessels is speeding up to adhere to IMO emission regulations. For instance, in June 2024, South Korean shipbuilder HJ Shipbuilding & Construction (HJSC) secured a $220 million contract to build two environmentally friendly methanol-ready 7,900 TEU containerships for an unidentified European shipping firm. The firm has an option to order another two vessels that could bring the total value of the contract up to $432 million. Furthermore, automation and AI-based navigation systems enhance operational efficiency by reducing human error and optimizing fuel consumption. Growing global trade and e-commerce have increased demand for larger and more fuel-efficient container ships.

Report Coverage

This research report categorizes the cargo ship building market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cargo vessel building market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cargo ship building market.

Global Cargo Ship Building Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Propulsion Type ,and By Region and By Region |

| Companies covered:: | Hyundai Heavy Industries (HHI), Daewoo Shipbuilding & Marine Engineering (DSME), Samsung Heavy Industries (SHI), China Shipbuilding Industry Corporation (CSIC), China State Shipbuilding Corporation (CSSC), Mitsubishi Heavy Industries (MHI), Imabari Shipbuilding, Shoei Kisen Kaisha, STX Offshore & Shipbuilding, Oshima Shipbuilding, China Merchants Industry Holdings, Fincantieri S.p.A., ThyssenKrupp Marine Systems, Samsung Heavy Industries (SHI), Navantia, Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global cargo ship building market is primarily influenced by macroeconomic, regulatory, and industry-specific variables that influence demand and production. Rising global population and urbanization are increasing the demand for bulk raw material transportation, which is driving demand for large-capacity cargo ships. Furthermore, government regulations and subsidies in major shipbuilding nations such as China, South Korea, and Japan promote domestic production and technological growth. Geopolitical variables including trade agreements, altering supply chain strategies, and regional crises all have an impact on vessel building demand and fleet expansion. Aging fleet replacement cycles are also an important factor, as older ships are phased out due to inefficiency and noncompliance with new environmental regulations. Furthermore, developments in shipyard capabilities, including as robotics, automation, and modular shipbuilding techniques, are lowering production costs and increasing efficiency, moving the cargo vessel building industry forward.

Restraining Factors

The global cargo vessel building market is constrained by high capital investment, extended production cycles, and labor shortages, making entrance and expansion challenging. Stringent environmental rules raise costs, while variable raw material prices affect profitability. Geopolitical concerns, trade uncertainty, and fluctuating fuel prices all contribute to market instability, which has an impact on ship demand. Furthermore, economic downturns and shifting supply chains cause delays in new ship orders, further limiting industry growth.

Market Segmentation

The cargo ship building market share is classified into ship type, propulsion type, and material type.

- The container ships segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the ship type, the cargo vessel building market is divided into container ships, tanker, roll on/roll off ships, bulk carriers, general cargo vessel, and others. Among these, the container ships segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growing trend of giant container ships necessitates the use of modern production technologies to accommodate their size and complexity. Shipyards are investing in cutting-edge technologies to build larger ships with higher fuel efficiency and cargo capacity, in response to industry needs for cost-effective operations. Furthermore, container ships play an important part in global supply chains, thus shipyards are improving their production capabilities to develop vessels that are compatible with global port infrastructure and intermodal transportation systems. This integration ensures the building of ships that can handle current logistics, increasing their market relevance and demand.

- The LNG segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the propulsion type, the cargo ship building market is divided into diesel & gasoline, nuclear, hydrogen, hybrid, LNG, electric, and others. Among these, the LNG segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. LNG is more cost-effective than traditional maritime fuels in the long run because of its lower price volatility and better energy density. Shipbuilders and shipping corporations are expanding their investment in LNG-powered vessels since the long-term fuel savings outweigh the higher initial capital expenditures associated with LNG infrastructure and technology. Furthermore, the construction of LNG bunkering infrastructure at key ports across the world increases the viability of LNG-powered vessels. Shipbuilders can manufacture LNG ships more effectively since fueling infrastructure is becoming more readily available, lowering operational hazards and fuel supply costs.

- The steel segment held the largest share in 2023 and is estimated to grow at a substantial CAGR during the predicted timeframe.

Based on the material type, the cargo vessel building market is divided into aluminum alloys, composites, steel, and others. Among these, the steel segment held the largest share in 2023 and is estimated to grow at a substantial CAGR during the predicted timeframe. Continuous advances in high-strength and corrosion-resistant steel are enhancing the performance and longevity of steel-based ships. Advanced coatings and steel alloys are being developed to better survive extreme maritime environments, such as rust, corrosion, and wear. These technical developments help to make ships live longer and require less maintenance, making steel a more appealing material. Furthermore, steel is one of the most economical materials for shipbuilding. Steel is the most cost-effective material for building large cargo ships due to its abundant availability and relatively low production costs when compared to alternative materials such as aluminum alloys and composites.

Regional Segment Analysis of the Cargo Ship Building Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

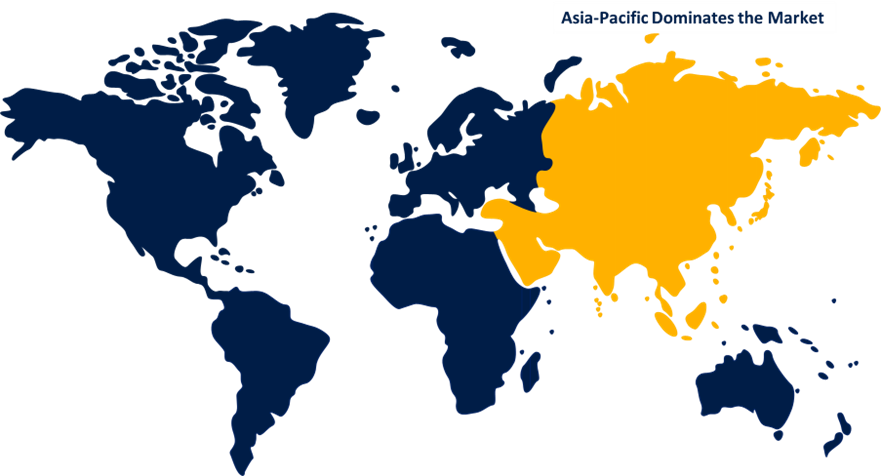

Asia-Pacific is anticipated to hold the largest share of the cargo vessel building market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the cargo ship building market over the predicted timeframe. Countries such as China, South Korea, and Japan have long been world leaders in shipbuilding, having well-established shipyards and huge industrial capabilities. These countries have invested considerably in innovative infrastructure and technologies, allowing them to build a diverse range of cargo vessels economically and on a huge scale. Furthermore, Asian governments, particularly those in China and South Korea, give significant support to the maritime industry through subsidies, incentives, and favorable laws. These policies promote investment in shipbuilding infrastructure, technical innovation, and environmentally friendly solutions, thereby consolidating the region's dominance. In addition, as global trade grows, the Asia-Pacific area is well positioned to lead in cargo vessel manufacturing. Its closeness to major international shipping routes and extensive port infrastructure facilitates the speedy building and delivery of vessels to satisfy the demands of multinational shipping corporations.

Middle East and Africa is expected to grow at the fastest CAGR growth of the cargo vessel building market during the forecast period. Several MEA nations, particularly Saudi Arabia, the UAE, and Qatar are making significant investments in maritime infrastructure as part of their long-term economic diversification strategies. For instance, the Saudi Vision 2030 project and the UAE's growth of its ports and shipyards have resulted in increased capacity and technological breakthroughs in shipbuilding, establishing the region as a rising hub for cargo vessel construction. Furthermore, Middle Eastern governments aggressively encourage the development of the maritime and shipbuilding industries through incentives, subsidies, and favorable laws. These policies have aided in attracting both domestic and international investment in the region's shipbuilding sector, resulting in increased growth. The MEA region is also adopting sustainable shipbuilding techniques and technical improvements in production. Investments in environmentally friendly vessels, such as those powered by LNG and designed for energy efficiency, are garnering international interest and investment, positioning the region as a hub for next-generation shipbuilding technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cargo ship building market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hyundai Heavy Industries (HHI)

- Daewoo Shipbuilding & Marine Engineering (DSME)

- Samsung Heavy Industries (SHI)

- China Shipbuilding Industry Corporation (CSIC)

- China State Shipbuilding Corporation (CSSC)

- Mitsubishi Heavy Industries (MHI)

- Imabari Shipbuilding

- Shoei Kisen Kaisha

- STX Offshore & Shipbuilding

- Oshima Shipbuilding

- China Merchants Industry Holdings

- Fincantieri S.p.A.

- ThyssenKrupp Marine Systems

- Samsung Heavy Industries (SHI)

- Navantia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, The Union Minister of Ports, Shipping and Waterways announced major initiatives to increase capacity at Kandla Port, totaling over Rs 57,000 crore. The two major announcements include the construction of a new Mega Shipbuilding Project worth Rs 30,000 crore. A new cargo terminal outside Kandla Creek, worth Rs 27,000 crores, will increase Kandla Port's capacity by 135 MTPA. The new Mega Shipbuilding Facility at Kandla Port will develop the country's technical capability to manufacture large Very Large Crude Carrier (VLCC) or similar class vessels with DWT capacities of up to 3,20,000 tonnes. Every year, the facility has the capacity to build 32 new ships and repair 50 existing ones.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the cargo vessel building market based on the below-mentioned segments:

Global Cargo Ship Building Market, By Ship Type

- Container Ships, Tanker

- Roll on/Roll off Ships

- Bulk Carriers

- General Cargo Vessel

- Others

Global Cargo Vessel Building Market, By Propulsion Type

- Diesel & Gasoline

- Nuclear

- Hydrogen

- Hybrid

- LNG

- Electric

- Others

Global Cargo Ship Building Market, By Material Type

- Aluminum Alloys

- Composites

- Steel

- Others

Global Cargo Vessel Building Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cargo ship building market over the forecast period?The cargo vessel building market Size will Grow at a Substantial CAGR from 2023 to 2033.

-

2. What is the market size of the cargo ship building market?The Global Cargo Vessel Building Market Size is expected to reach a significant share by 2033, at a substantial CAGR during the forecast period 2023-2033.

-

3. Which region holds the largest share of the cargo ship building market?Asia-Pacific is anticipated to hold the largest share of the cargo vessel building market over the predicted timeframe.

Need help to buy this report?