Global Cargo Transportation Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Land Cargo Insurance, Air Cargo Insurance), By Application (Import and Export Trade Enterprises, Processing Trade Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Cargo Transportation Insurance Market Insights Forecasts to 2033

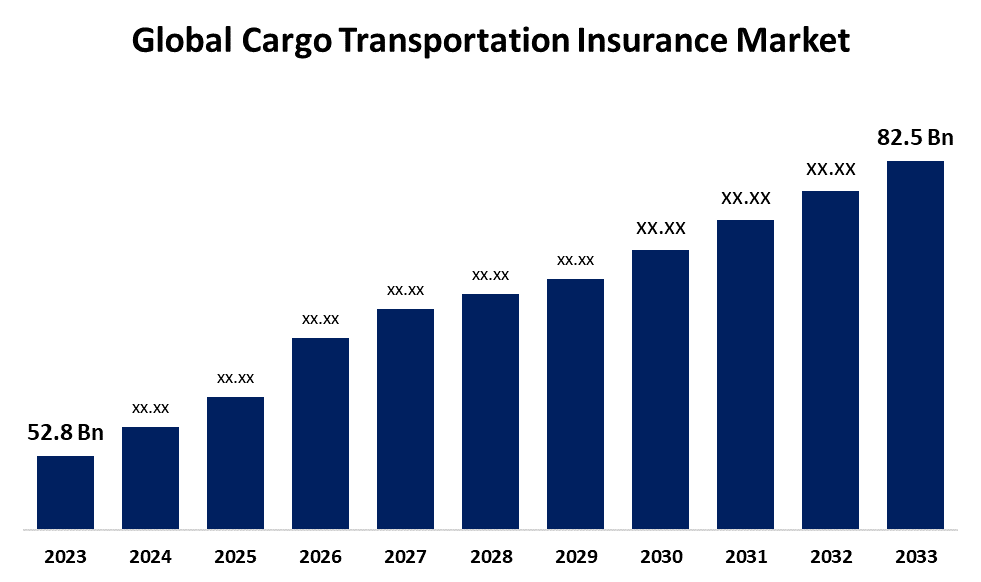

- The Global Cargo Transportation Insurance Market Size was Valued at USD 52.8 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.56% from 2023 to 2033

- The Worldwide Cargo Transportation Insurance Market Size is Expected to Reach USD 82.5 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cargo Transportation Insurance Market size was valued at USD 52.8 Billion in 2023 and is predicted to cross USD 82.5 Billion by 2033, Growing at a CAGR of 4.56% from 2023 to 2033. The cargo transportation insurance market is growing due to increased global trade, growth in e-commerce, and improvements in infrastructure. Key players such as Allianz, AIG, and Chubb are capitalizing on the rising demand for secure cargo shipping, especially amidst growing risk factors.

Market Overview

The cargo transportation insurance market covers goods transported over roads, railways, air, or sea. Shippers, cargo owners, and logistics companies have this insurance, covering them in cases of transit loss, damage, theft or liabilities through transport mishaps to minimize loss on the part of the covered company. Moreover, growing cargo thefts and expansion in e-commerce are creating greater demand for cargo insurance due to globalization. Increased security due to tracking and blockchain technologies further augment growth in the market. Additionally, regulatory requirements and innovations in the insurance space drive the demand further. For instance, in February 2022, Redkik, a software company in Finland, announced it would focus on streamlining the marine cargo insurance industry and had raised a seed funding round of US$ 3.3 Mn. The company is conducting leading-edge research and development to enhance its business. Growing economic activities in developing markets and the risk posed by climate change-induced disruption also stimulate the demand. Furthermore, the process of consolidation among industries enhances demand for full-range insurance services, especially in high-value shipment volumes. Moreover, opportunities in the cargo insurance market also include broadened coverage of new risks, which include cyber risks, climate risks, and others. Other trends include AI in data analytics that will enhance a company's capabilities in terms of risk assessment as well as tailor-made insurance to suit diversified supply chains. For instance, in April 2024, Global insurance intermediary Howden launched cargo war risk coverage against drone and missile attacks by Yemeni militia groups on vessels traveling through the Bab al Mandab Strait, Red Sea, and Indian Ocean. It offers up to $50 million per vessel, with limits up to $150 million.

Report Coverage

This research report categorizes the cargo transportation insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cargo transportation insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cargo transportation insurance market.

Global Cargo Transportation Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 52.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.56% |

| 2033 Value Projection: | USD 82.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | ACE NEWMARK, Allianz SE, Everest Reinsurance Company, AIG, Chubb, AXANEWPARALiberty Mutual Insurance Group, HDI Global, Zurich Insurance Group, W. R. Berkley Corporation, Arch Capital Group Ltd., Tokio Marine Nichi, Navigators Group, Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The driving factors of the cargo transportation insurance market include increasing volumes in transportation because of global trade, increased risk exposure due to geopolitical tensions and natural disasters, and the growth of specialized logistics services. In addition, growing awareness about financial protection, the need for efficient risk management solutions, and advancements in digital platforms, which streamline processes and offer cost-effective options, also contribute to the growing demand for cargo insurance across various industries. For instance, in March 2020, Loadsure raised £1.1M in funding led by Insurtech Gateway for its freight cargo insurance solution. The company offers a fully automated, end-to-end digital process, reducing per-load insurance costs by 5x and speeding up claim settlements from days to hours.Moreover, some ways to boost the motor truck cargo and logistics services insurance are through offering tailored coverage in the cargo transportation insurance market, improvement in risk assessment through technology, claims streamlining, competitive pricing, and partnerships with logistics providers for better customer trust and adoption. For instance, in February 2024, Columbia Motor Truck Cargo and Logistics Services Insurance Loadsure's new product aims at market-leading coverage for damage to cargo for motor carriers, freight brokers, and freight forwarders.To enhance regulatory compliance and legal demands in the cargo insurance market, insurers can make sure that their products are according to international standards, provide clear documentation, and offer compliance training. In addition, staying updated on changing regulations and offering adaptive, flexible policies can help businesses meet legal obligations and foster growth.

Restraints & Challenges

The restraints in the cargo insurance market include high premiums, complicated policy terms, and challenges to assess risks correctly. Regulatory differences between regions, fraud, and a lack of awareness about insurance benefits also deter market growth and adoption.

Market Segmentation

The cargo transportation insurance market share is classified into type and application.

- The land cargo insurance segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the type, the cargo transportation insurance market is divided into land cargo insurance and air cargo insurance. Among these, the land cargo insurance segment accounted for the highest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This is mainly because road and rail transportation are the most common means of transporting goods both within the country and in the regions. Land transportation is the most preferred and cheapest mode for most commodities, especially in areas with robust infrastructure networks. The growth of e-commerce and regional trade also increases the demand for land cargo insurance, making it the dominant segment in the market.

- The import and export trade enterprise segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the cargo transportation insurance market is divided into import and export trade enterprises and processing trade enterprises. Among these, the import and export trade enterprise segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. This is owing to the persistent growth in volumes of international trades and the consequent need for securing goods, especially during shipping across borders; hence, their demand for cargo insurance. Imports and exports experience more risks attributed to long-distance conveyance, going through customs clearing procedures, and damage risks, among many others, prompting cargo insurance needs to protect any valuable cargo undergoing transit.

Regional Segment Analysis of the Cargo Transportation Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the cargo transportation insurance market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the cargo transportation insurance market over the predicted timeframe. This is because the region has significantly contributed to global trade with countries like China, India, Japan, and South Korea as significant exporters and importers. E-commerce growth, expansion of logistics infrastructure, and increased industrial production in these countries are some factors driving the demand for cargo insurance. Moreover, the strategic location of the region for maritime trade routes and its emergence as an economic power add to the demand for comprehensive cargo transportation coverage. For instance, in May 2024, the People's Insurance Company of China, or PICC, disclosed that its marine insurance portfolio rose by 8%. This can be attributed to the increase in exports and Belt and Road Initiative projects. These projects boost maritime trade between China and other countries within Asia, Europe, and Africa. Such increased demand for the routes puts a strain on the use of marine insurance.

North America is expected to grow at a rapid CAGR of the cargo transportation insurance market during the forecast period. North America, particularly the U.S., maintains a robust trade relationship with other parts of the world, which makes cargo transportation very high in demand. Its infrastructural development also includes efficient ports, highways, and rail networks to support extensive logistics operations. With the growth of e-commerce in the U.S. and Canada, the requirement for secure cargo shipping increases, hence boosting insurance demand. A well-established regulatory framework and industry standards also enhance the cargo transportation insurance market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cargo transportation insurance market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACE NEWMARK

- Allianz SE

- Everest Reinsurance Company

- AIG

- Chubb

- AXANEWPARALiberty Mutual Insurance Group

- HDI Global

- Zurich Insurance Group

- W. R. Berkley Corporation

- Arch Capital Group Ltd.

- Tokio Marine Nichi

- Navigators Group, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2022, HW Kaufman Group's RB Jones expanded its ocean cargo capacity by acquiring the Smart Cargo Insurance business from Corvus Insurance. The cargo would include temperature-sensitive goods such as food and pharmaceuticals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the cargo transportation insurance market based on the below-mentioned segments:

Global Cargo Transportation Insurance Market, By Type

- Land Cargo Insurance

- Air Cargo Insurance

Global Cargo Transportation Insurance Market, By Application

- Import and export trade enterprises

- Processing trade enterprises

Global Cargo Transportation Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cargo transportation insurance market over the forecast period?The global cargo transportation insurance market size was valued at USD 52.8 billion in 2023 and is slated to cross USD 82.5 billion by 2033, growing at a CAGR of 4.56% from 2023 to 2033.

-

2. Which region holds the largest share of the cargo transportation insurance market?Asia Pacific is estimated to hold the largest share of the cargo transportation insurance market over the predicted timeframe.

-

3. Who are the top key players in the global cargo transportation insurance market?ACE NEWMARK, Allianz SE, Everest Reinsurance Company, AIG, Chubb, AXA, NEWPARA, Liberty Mutual Insurance Group, HDI Global, Zurich Insurance Group, W. R. Berkley Corporation, Arch Capital Group Ltd., Tokio Marine Nichi, Navigators Group, Inc., and Others.

Need help to buy this report?