Global Carob Powder Market Size, Share, and COVID-19 Impact Analysis, By Product (Natural and Organic), By Application (B2B and B2C), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Consumer GoodsGlobal Carob Powder Market Insights Forecasts to 2033

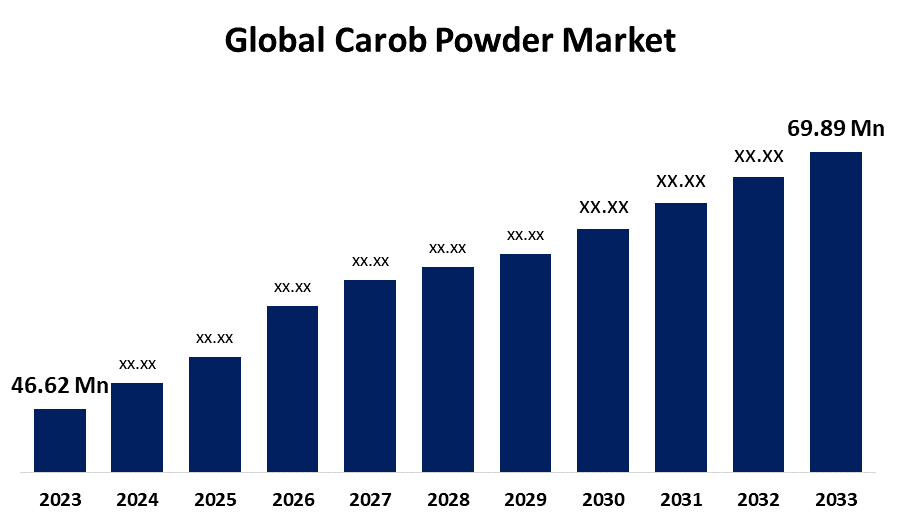

- The Global Carob Powder Market Size was Valued at USD 46.62 Million in 2023

- The Market Size is Growing at a CAGR of 4.13% from 2023 to 2033

- The Worldwide Carob Powder Market Size is Expected to Reach USD 69.89 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Carob Powder Market Size is Anticipated to Exceed USD 69.89 Million by 2033, Growing at a CAGR of 4.13% from 2023 to 2033.

Market Overview

A substitute for cocoa powder is carob powder, often known as carob flour. It resembles cocoa powder and is manufactured from roasted, dried carob tree pods. In baked foods, carob powder is frequently used as a natural sweetener. It tastes different and smells sweet. It's also high in fiber and free of gluten. Carob powder is beneficial for those with allergies or dietary restrictions because it lacks common allergens including dairy, soy, and nuts. It is also a common choice for vegans seeking to avoid using cocoa powder, which is made from cacao beans. Because carob powder is caffeine-free, it is very prevalent and perfect for those who cannot tolerate caffeine. As a result, it is being adopted by more individuals who are caffeine intolerant, which is propelling the market's expansion. The need for carob powder, which is well-known for its nutritional advantages and could be used in place of cocoa, is fueled by the growing trend towards health and well-being. The market for carob powder is growing as individuals grow more health conscious. Additionally, customer preferences for natural, allergy-free, and sustainable food options are the primary driving force behind the carob powder market.

Report Coverage

This research report categorizes the market for the carob powder market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the carob powder market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the carob powder market.

Carob Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 46.62 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.13% |

| 2033 Value Projection: | USD 69.89 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 243 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Product, By Application, and By Region |

| Companies covered:: | Frontier Co-Op, NOW Health Group, Inc., PANOS Brands, LLC (Chatfield’s), Lewis Confectionery Pty Ltd., Tootsi Impex Inc., Boublenza SARL, Industrias Ralda, Chatfield’s, OliveNation, NOW Foods, Ingredients UK, Jedwards International, Inc., Eurl Ouasdi International, Healthworks, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Expansion in the carob powder market is expected to be driven by the growing demand for natural and plant-based ingredients. Growing in health consciousness, consumers are actively searching for natural and plant-based ingredients for their meals and drinks. Theobromine and caffeine-containing cocoa powder can be substituted with the natural and healthful powder called carob. Furthermore, carob powder market expansion is predicted to be fueled by rising consumer awareness of carob powder's nutritional benefits. Rich in fiber, antioxidants, and additional minerals and vitamins, such as calcium and potassium, carob powder is a great source of nutrition.

Restraining Factors

Several factors confront the market, such as weather-related variations in the supply of raw materials that have a big impact on production. These fluctuations may cause uneven pricing and availability of carob, which would be detrimental to both producers and buyers. Furthermore, severe competition from natural sweeteners and other chocolate substitutes restricts market share.

Market Segmentation

The carob powder market share is classified into product and application.

- The natural segment accounted for the largest market revenue share over the forecast period.

Based on the product, the carob powder market is categorized into natural and organic. Among these, the natural segment accounted for the largest market revenue share over the forecast period. This segments dominance is due to the product's growing availability, popularity, and widespread penetration along with its health benefits. Additionally, artificial chocolates are made with this powder as a raw ingredient. Additionally, the affordable price of natural carob powders renders them easily available, which is a key driver of the market.

- The B2B segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the application, the carob powder market is categorized into B2B and B2C. Among these, the B2B segment is anticipated to grow at the highest CAGR during the forecast period. This is due to the confectionery the industry utilizes increasingly carob powder. Because its associates are investing in creating high-quality, a health-conscious artisanal product, the bakery industry has experienced tremendous development. As a product, carob powders are now a useful ingredient in baked product production.

Regional Segment Analysis of the Carob Powder Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the carob powder market over the predicted timeframe.

Get more details on this report -

Europe is projected to hold the largest share of the carob powder market over the forecast period. This is explained by the rising demand from consumers for healthier chocolate substitutes. Europe is one of the world's biggest markets for baked products and chocolates. Additionally, as customers gravitate more and more towards plant-based or plant-derived products, the number of vegans is rising. In the end, this is increasing the region's demand for these products.

Asia Pacific is expected to grow at the fastest CAGR growth in the carob powder market during the forecast period. The primary driver of product demand in the area is the increasing appreciation for carob powder due to its high nutritional value. In addition, as carob powder becomes more widely available in supermarkets and hypermarkets, demand will rise in the upcoming years. The rising incidence of diabetes in nations such as China and India is also anticipated to cause consumers' preferences for sugar-free options to change, which boost this ingredient's appeal in the years to come.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the carob powder market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Frontier Co-Op

- NOW Health Group, Inc.

- PANOS Brands, LLC (Chatfield's)

- Lewis Confectionery Pty Ltd.

- Tootsi Impex Inc.

- Boublenza SARL

- Industrias Ralda

- Chatfield’s

- OliveNation

- NOW Foods

- Ingredients UK

- Jedwards International, Inc.

- Eurl Ouasdi International

- Healthworks

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Missy J's Carob & Sweet Treats announced that the company has been acquired by Azure Standard, America's leading distributor of healthy foods and products for the home, health, and garden.

- In September 2021, Creta Carob, a leading carob product manufacturer, declared the expansion of its capacity for manufacturing with the addition of a new carob processing plant, which has increased the manufacture of carob powder and other carob products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the carob powder market based on the below-mentioned segments:

Global Carob Powder Market, By Product

- Natural

- Organic

Global Carob Powder Market, By Application

- B2B

- B2C

Global Carob Powder Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?