Global Cell to Pack Battery Market Size, Share, and COVID-19 Impact Analysis, By Battery Form (Prismatic, Pouch, Cylindrical), By Technology (Blade, LiSER), By Vehicle (Passenger Cars, Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Cell to Pack Battery Market Insights Forecasts to 2033

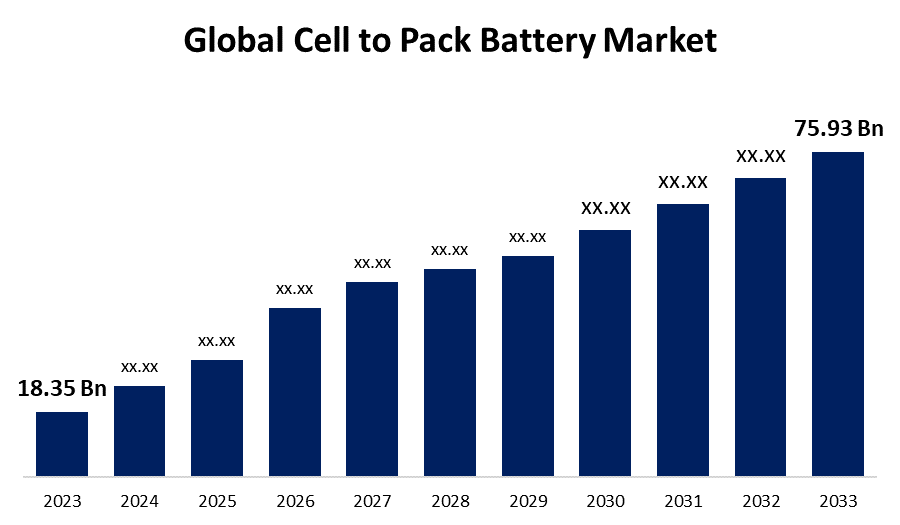

- The Global Cell to Pack Battery Market Size was Valued at USD 18.35 Billion in 2023

- The Market Size is Growing at a CAGR of 15.26% from 2023 to 2033

- The Worldwide Cell to Pack Battery Market Size is Expected to Reach USD 75.93 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Cell to Pack Battery Market Size is Anticipated to Exceed USD 75.93 Billion by 2033, Growing at a CAGR of 15.26% from 2023 to 2033.

Market Overview

The term cell-to-pack battery market refers to the economy sector that manufactures, supplies and applies cutting-edge battery solutions in which individual battery cells are directly integrated into larger battery packs without the need for additional modules or components. Streamlining the battery production process reduces costs, enhances energy density, and improves efficiency. CTP batteries are utilized in various industries, with electric vehicles (EVs) being the primary demand generator. The method allows EV manufacturers to make smaller, more energy-dense battery packs, extending driving range and improving performance. To assist in effective energy management and the absorption of renewable energy sources, CTP batteries are also utilized in energy storage systems, ranging from basic household setups. Technological improvements have also played a significant role in driving the cell-to-pack battery market. Manufacturers have been able to build more efficient and cost-effective cell-to-pack batteries as technology has advanced. This has raised the demand for cell-to-pack batteries. Government initiatives to promote electric vehicles have also fueled the cell-to-pack battery sector. Many nations are providing incentives and subsidies to encourage electric car adoption, which has increased demand for cell-to-pack batteries.

Report Coverage

This research report categorizes the market for the cell to pack battery market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cell to pack battery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cell to pack battery market.

Cell to Pack Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 18.35 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 15.26% |

| 023 – 2033 Value Projection: | USD 75.93 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Battery Form, By Technology, By Vehicle, By Region |

| Companies covered:: | Panasonic Corporation, Tesla Inc, Contemporary Amperex Technology Co Limited, Samsung SDI Co Ltd, SK Innovation Co Ltd, LG Energy Solution, Silver Power Systems, Henkel, BYD Company Limited, Sion Power, XPeng Inc, C4V, Tianjin EV Energies., Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Another significant driver driving the cell to pack battery industry is the growing use of renewable energy sources such as wind and solar. Renewable energy sources require a significant quantity of energy storage, and cell-to-pack batteries offer an efficient and cost-effective option. Furthermore, several nations give incentives and subsidies to stimulate the use of renewable energy sources, which has increased the demand for cell-to-pack batteries.

Restraining Factors

Moisture, severe temperatures, and shock must all be kept out of the cells. This can be difficult to accomplish, especially in industrial and automotive applications that require reliable and powerful cell protection.

Market Segmentation

The cell to pack battery market share is classified into battery form, technology and vehicle.

- The prismatic segment is expected to hold the largest share of the cell to pack battery market during the forecast period.

Based on the battery form, the cell to pack battery market is categorized into prismatic, pouch, and cylindrical. Among these, the prismatic segment is expected to hold the largest share of the global cell to pack battery market during the forecast period. As the most chosen cell shape for this technology, prismatic cells will lead the cell to pack battery market by battery form segment. This is primarily because prismatic cells have several advantages over cylindrical type cells, including larger size, increased energy density, and a more compact structure since the interior layers of the anode, cathode, and separators are folded into a flattened spiral or cubic shape.

- The blade segment is expected to grow at the fastest CAGR during the forecast period.

Based on the technology, the cell to pack battery market is categorized into blade and LiSER. Among these, the blade segment is expected to grow at the fastest CAGR during the forecast period. Blade batteries have a special design that maximizes space and increases energy density by combining several cells into a single pack. Because of this consolidation, fewer modules and connectors are required, which streamlines production and lowers manufacturing costs. Because of their sophisticated thermal management systems and sturdy structural design, Blade Batteries provide improved safety features by reducing the possibility of thermal runaway and guaranteeing safer operation. Furthermore, Maruti and Toyota stated in October 2022 that they would be utilizing BYD Blade batteries in their forthcoming EV models in India by 2025.

- The passenger cars segment is expected to hold a significant share of the cell to pack battery market during the forecast period.

Based on the vehicle, the cell to pack battery market is categorized into passenger cars, and commercial vehicles. Among these, the passenger cars segment is expected to hold a significant share of the cell to pack battery market during the forecast period. When compared to conventional battery designs, CTP batteries often offer higher energy densities. This results in greater energy storage capacity per unit weight or volume, which allows EVs to have longer driving ranges. When fitted with CTP batteries, passenger cars can reach competitive ranges that are on par with or better than those of internal combustion engine vehicles.

Regional Segment Analysis of the Global Cell to Pack Battery Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the cell to pack battery market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the cell to pack battery market over the forecast period. China and Japan have the top two positions in the global market for rechargeable batteries and electric vehicles, respectively. The use of rechargeable batteries is increasing as a result of continuous improvements in the automotive and consumer electronics sectors. These batteries offer several benefits, including increased safety, reduced emissions, and higher power capacity. All of these reasons are expected to greatly increase the demand for rechargeable batteries in the Asia Pacific area throughout the projection period. Other significant manufacturers in the Asia-Pacific area, including Hyundai Motors, Daihatsu Motor Co., Ltd., and Toyota Motor Corporation, have said that they will introduce cell-to-pack battery technology in their next electric vehicle models starting in 2023–2024.

Europe is expected to grow at the fastest CAGR growth of the cell to pack battery market during the forecast period. The expansion of the cell-to-pack (CTP) battery market is mostly being driven by government legislation in the European region. The main goals of these laws are to decrease carbon emissions and promote environmental sustainability, which will encourage the use of electric cars (EVs). The automobile sector is in a good position to transition to electrification because of the EU's strict emission regulations and financial incentives like tax cuts and subsidies for electric vehicle consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cell to pack battery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Panasonic Corporation

- Tesla Inc

- Contemporary Amperex Technology Co Limited

- Samsung SDI Co Ltd

- SK Innovation Co Ltd

- LG Energy Solution

- Silver Power Systems

- Henkel

- BYD Company Limited

- Sion Power

- XPeng Inc

- C4V

- Tianjin EV Energies.

- Others

Key Market Developments

- On February 2024, Automotive and e-mobility provider BorgWarner established a collaboration with BYD subsidiary FinDreams Battery to expedite the integration of Lithium Iron Phosphate (LFP) battery packs in commercial vehicles. As per the terms of this agreement, BorgWarner will use Findreams Battery Blade cells solely to produce LFP battery packs for commercial vehicles, targeting markets in Europe, the Americas, and specific parts of Asia Pacific. The contract has an eight-year term.

- In November 2023, at a new plant in Hefei, China, Volkswagen Group China has started manufacturing battery systems for its MEB platform EVs domestically. This is the first factory in the VW Group to manufacture next-generation cell-to-pack (CTP) EV batteries and the first fully-owned battery manufacturing venture in China.

- In July 2023, Based on BYD Blade battery technology, the FAW-Fudi, a battery pack under the BYD (FinDreams) brand, has just come off the assembly line. The localization of power battery production was improved by this FAW-BYD expansion. The electric vehicles belonging to the FAW Group and joint ventures such as FAW-Volkswagen, FAW-Toyota, etc. will be powered by these batteries.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global cell to pack battery market based on the below-mentioned segments:

Global Cell to Pack Battery Market, By Battery Form

- Prismatic

- Pouch

- Cylindrical

Global Cell to Pack Battery Market, By Technology

- Blade

- LiSER

Global Cell to Pack Battery Market, By Vehicle

- Passenger Cars

- Commercial Vehicles

Global Cell to Pack Battery Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global cell to pack battery market over the forecast period?The Cell to Pack Battery Market Size is Expected to Grow from USD 18.35 Billion in 2023 to USD 75.93 Billion by 2033, at a CAGR of 15.26% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global cell to pack battery market?Asia Pacific is projected to hold the largest share of the cell to pack battery market over the forecast period.

-

3. Who are the top key players in the cell to pack battery market?Panasonic Corporation, Tesla Inc, Contemporary Amperex Technology Co Limited, Samsung SDI Co Ltd, SK Innovation Co Ltd, LG Energy Solution, Silver Power Systems, Henkel, BYD Company Limited, Sion Power, XPeng Inc, C4V, Tianjin EV Energies., and others.

Need help to buy this report?