Global Cellulose Acetate Market Size By Type (Plastic, Fiber), By Application (Photographic Films, Cigarette Filters, Tapes And Labels, Textiles And Apparel), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Cellulose Acetate Market Insights Forecasts to 2033

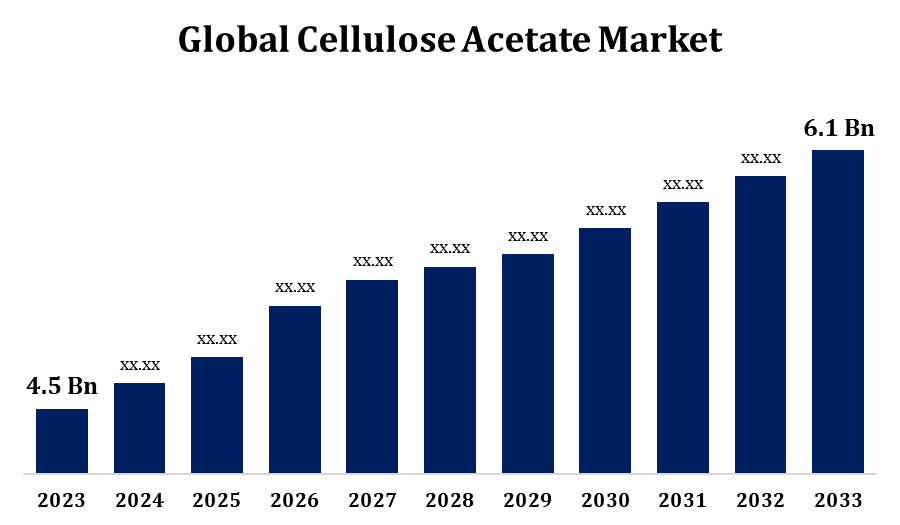

- The Global Cellulose Acetate Market Size was valued at USD 4.5 Billion in 2023.

- The Market Size is growing at a CAGR of 3.09% from 2023 to 2033

- The Worldwide Cellulose Acetate Market Size is expected to reach USD 6.1 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Cellulose Acetate Market Size is expected to reach USD 6.1 Billion by 2033, at a CAGR of 3.09% during the forecast period 2023 to 2033.

Sustainable materials are becoming more popular as environmental concerns grow. Because it is sourced from renewable sources, cellulose acetate is regarded more environmentally friendly than other polymers. Cellulose acetate is used in a variety of industries, including textiles (clothing and fabrics), packaging, and even the manufacture of cigarette filters. Its adaptability contributes to its growing popularity. Regulations promoting environmentally friendly procedures and materials aid in the expansion of cellulose acetate. Government policies and consumer attitudes are increasingly favouring environmentally friendly options.

Cellulose Acetate Market Value Chain Analysis

The extraction of natural cellulose, which is often sourced from wood pulp or cotton fibres, is the first step in the process. Suppliers are critical in maintaining a consistent and high-quality supply of raw materials. Acetylation is a chemical process in which raw cellulose interacts with acetic anhydride to generate cellulose acetate. The cellulose acetate produced may be further processed into intermediate goods suitable to certain industries. Cellulose acetate flakes, pellets, or fibres may be among these intermediary products. Manufacturers and researchers are working to create new formulations, improve characteristics, and discover new applications for cellulose acetate. A network of suppliers, distributors, and wholesalers distributes finished cellulose acetate products. The supply chain ensures that items flow efficiently from manufacturers to end users.

Cellulose Acetate Market Opportunity Analysis

Exploring and developing new cellulose acetate uses might open up new possibilities. This might involve studies into its applicability in 3D printing, improved packaging solutions, or even medical applications. Because of its biocompatibility, cellulose acetate has applications in the pharmaceutical and medical industries. Applications could include medication delivery systems, medicinal fabrics, and bioresorbable implants. As the fashion industry emphasises sustainability, the usage of cellulose acetate in textiles may increase. It can be promoted as a sustainable and biodegradable alternative to traditional fabrics, which may appeal to environmentally aware consumers. Consumers can be educated about the benefits of cellulose acetate, its sustainability, and its diverse applications, which can lead to increased demand. Increased understanding can influence consumer purchasing decisions towards environmentally friendly items.

Cellulose Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.09% |

| 2033 Value Projection: | USD 6.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region, By Geographic Scope |

| Companies covered:: | BASF SE, Kemira, Ecolab, Solenis, Mitsubishi Chemical Holdings Corporation, Akzo Nobel N.V., Sappi Europe SA, Baker Hughes Company, Solvay, Dow, SNF, SUEZ, Eastman Chemical Company, Celanese Corporation, Chembond Chemicals Limited, China Tobacco., Samco, Daicel Corporation, VASU Chemicals LLP, Merck KGaA, Rayonier Advanced Materials, Johnson Matthey, and Other Key Vendors. |

| Growth Drivers: | Growing market for natural plastics |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Cellulose Acetate Market Dynamics

Growing market for natural plastics

One of the most important benefits of cellulose acetate is its biodegradability. As consumers and industry seek materials that degrade naturally, cellulose acetate becomes a popular option, particularly in situations where single-use plastics are common. The utilisation of renewable raw materials in the production of cellulose acetate, such as wood pulp or cotton fibres, increases its attractiveness. Unlike traditional plastics manufactured from fossil fuels, this contributes to a more sustainable supply chain. Because of its adaptability, cellulose acetate can be used in a wide range of applications, from textiles to packaging. As demand for natural plastics develops in various industries, cellulose acetate may find new and extended applications. Collaboration with well-known businesses and use of natural plastics into their products can increase cellulose acetate's market reach.

Restraints & Challenges

Traditional petrochemical-based polymers compete with cellulose acetate. The cost and performance disparities between cellulose acetate and standard polymers pose a barrier to wider use. The overall lack of information about cellulose acetate and its benefits among consumers and industries is a challenge. It is critical to educate the market on the material's qualities, sustainability, and applications in order to gain wider acceptance. When compared to some common plastics, the manufacture of cellulose acetate can be more expensive. Price sensitivity in certain businesses could be an issue, especially if cellulose acetate is viewed as a more expensive option. The reliance on a consistent supply of natural cellulose raw materials can result in supply chain weaknesses. External variables impacting the supply of wood pulp or cotton fibres may have an impact on the manufacture of cellulose acetate.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Cellulose Acetate Market from 2023 to 2033. North America controls a sizable portion of the worldwide cellulose acetate market. Demand from various industries, such as textiles, packaging, and consumer goods, drives the region's market size. North American customers are becoming more conscious of environmental issues and the consequences of their purchasing decisions. This awareness promotes demand for environmentally friendly products, which contributes to the increased use of cellulose acetate in a variety of consumer goods. North America's numerous industries, including as fashion, pharmaceuticals, and packaging, all contribute to the need for cellulose acetate. Because of its versatility, the material is suited for a wide range of applications in these industries. The market in North America is competitive, with both domestic and international companies. Companies aim to distinguish themselves by product quality, environmental activities, and technical advances.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region dominates the worldwide cellulose acetate market. The market is significant, owing to the region's vast population and diversified industry. Rapid industrialization in nations such as China and India is driving up demand for materials like cellulose acetate. It's utilised in a variety of industries, including textiles, packaging, and consumer goods. In the Asia-Pacific area, the textile sector is a major consumer of cellulose acetate. The substance is utilised in the manufacture of fibres and fabrics, and the region's thriving textile sector plays a large role in the market. In some nations, rising disposable income leads to increased consumer spending on items, especially those produced of cellulose acetate. This adds to the expansion of industries that use the material.

Segmentation Analysis

Insights by Type

The fiber segment accounted for the largest market share over the forecast period 2023 to 2033. Cellulose acetate fibres are widely used in the textile industry to make textiles and garments. Because of its unique qualities, including as softness, drapability, and a silk-like look, cellulose acetate fabrics have gained in popularity. The dyeability of cellulose acetate fibres is outstanding, allowing for bright and long-lasting colours in textiles. The fibres also have a smooth surface, giving garments a luxury feel. Both garments and household textiles can employ cellulose acetate fibres. These fibres have a wide range of applications in the textile and fashion industries, from dresses and blouses to curtains and bed linens. The use of cellulose acetate fibres in the collections of well-known fashion labels and designers increases the visibility and acceptance of these fibres.

Insights by Application

The textiles and apparel segment accounted for the largest market share over the forecast period 2023 to 2033. Cellulose acetate is an environmentally beneficial alternative to typical textiles and clothing materials, particularly synthetic fibres made from petrochemicals. The fact that it is biodegradable appeals to ecologically minded consumers. Cellulose acetate fibres are soft and drapable, making them ideal for crafting elegant and pleasant garments. This feature increases the appeal of cellulose acetate in the manufacture of high-quality clothes. The incorporation of cellulose acetate into the collections of prominent fashion designers and companies contributes to its visibility and acceptance in the fashion industry. High-profile endorsements can help push the material's mainstream adoption.

Recent Market Developments

- In November 2020, Sappi, the world's largest dissolving pulp firm, has announced a collaboration with Birla Cellulose, a key manufacturer in the textile value chain.

Competitive Landscape

Major players in the market

- BASF SE

- Kemira

- Ecolab

- Solenis

- Mitsubishi Chemical Holdings Corporation

- Akzo Nobel N.V.

- Sappi Europe SA

- Baker Hughes Company

- Solvay

- Dow

- SNF

- SUEZ

- Eastman Chemical Company

- Celanese Corporation

- Chembond Chemicals Limited

- China Tobacco.

- Samco, Daicel Corporation

- VASU Chemicals LLP

- Merck KGaA

- Rayonier Advanced Materials

- Johnson Matthey

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Cellulose Acetate Market, Type Analysis

- Plastic

- Fiber

Cellulose Acetate Market, Application Analysis

- Photographic Films

- Cigarette Filters

- Tapes And Labels

- Textiles And Apparel

Cellulose Acetate Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Cellulose Acetate Market?The Global Cellulose Acetate Market Size is expected to grow from USD 4.5 Billion in 2023 to USD 6.1 Billion by 2033, at a CAGR of 3.09% during the forecast period 2023-2033.

-

2. Who are the key market players of the Cellulose Acetate Market?Some of the key market players of market are BASF SE, Kemira, Ecolab, Solenis, Mitsubishi Chemical Holdings Corporation, Akzo Nobel N.V., Sappi Europe SA, Baker Hughes Company, Solvay, Dow, SNF, SUEZ, Eastman Chemical Company, Celanese Corporation, Chembond Chemicals Limited, China Tobacco., Samco, Daicel Corporation, VASU Chemicals LLP, Merck KGaA, Rayonier Advanced Materials and Johnson Matthey.

-

3. Which segment holds the largest market share?The fiber segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Cellulose Acetate Market?North America is dominating the Cellulose Acetate Market with the highest market share.

Need help to buy this report?