Global Ceramic Coated Piping in Mining Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Ceramic Coatings, Composite Ceramic Coatings), By Application (Slurry Transportation, Tailings Management, Abrasive Material Handling, Corrosion Resistance, Others), By End-Use (Open-pit Mining, Underground Mining, Mineral Processing Plants, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Ceramic Coated Piping in Mining Market Insights Forecasts to 2033

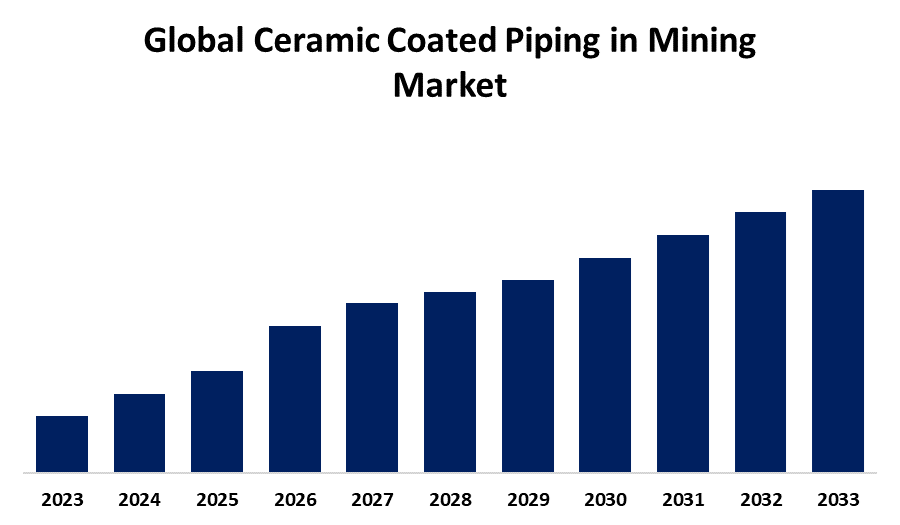

- The Market Size is Growing at a CAGR of 6.20% from 2023 to 2033

- The Worldwide Ceramic Coated Piping in Mining Market Size is Expected to Reach Significant Share by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Ceramic Coated Piping in Mining Market Size is Anticipated to Hold a Significant Share by 2033, Growing at 6.20% CAGR from 2023 to 2033.

Market Overview

Ceramic-coated piping in mining refers to pipes that are coated with a layer of ceramic material to enhance their durability, abrasion resistance, and corrosion protection. These coatings are typically applied to metal or other base material pipes used in mining operations, particularly for transporting abrasive slurries, handling corrosive materials, and managing high-pressure flows. The ceramic-coated piping market in mining is expanding due to its durability, abrasion resistance, and corrosion protection. These pipes are ideal for handling harsh conditions, extending the system lifespan, and reducing maintenance costs. Technological advancements and resource demand further drive their adoption.

Ceramic-coated piping is crucial in mining for slurry transportation, tailings management, and handling corrosive fluids. It offers wear resistance, corrosion protection, and durability, ensuring smooth material flow and minimal maintenance costs.

Report Coverage

This research report categorizes the market for ceramic coated piping in mining based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ceramic coated piping in mining market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ceramic coated piping in mining market.

Ceramic Coated Piping in Mining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.20% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Material Type, By Application, By End-Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Saint-Gobain, Blasch Precision Ceramics, CerCo LLC, Carbo Ceramics Inc., A&A Coatings, Almatis GmbH, Metso Outotec Corporation, Weir Group PLC, Kennametal Inc., Corrosion Engineering Inc. and Others key vendors. |

Get more details on this report -

Driving Factors

The ceramic coated piping in the mining market is propelled by several factors including the superior durability, abrasion, and corrosion resistance of ceramic-coated pipes, which make them ideal for harsh mining environments. These pipes offer long-term cost savings by reducing maintenance needs and extending service life. As global demand for minerals rises, mining operations are scaling up, increasing the need for durable, efficient piping systems. Technological advancements in ceramic coatings, combined with a growing focus on sustainability and regulatory compliance, are also fueling adoption. Furthermore, the expansion of mining activities in emerging markets is further contributing to the market's growth.

Restraining Factors

The growth of the ceramic-coated piping in the mining market is hindered by several factors including high initial costs, limited technical expertise, and the potential fragility of ceramic coatings under mechanical stress. The cost of ceramic-coated pipes can be prohibitive for cost-sensitive operations, especially in emerging markets. The lack of standardization and slower market penetration also contributes to the slower adoption rate of ceramic-coated piping in mining.

Market Segmentation

The ceramic coated piping in mining market share is classified into material type, application, and end-use.

- The ceramic coatings segment is estimated to hold the highest market revenue share through the projected period.

Based on the material type, the ceramic coated piping in the mining market is classified into ceramic coatings and composite ceramic coatings. Among these, the ceramic coatings segment is estimated to hold the highest market revenue share through the projected period. The ceramic coating segments are attributed to their superior wear and corrosion resistance, making them ideal for the harsh conditions found in mining operations. These coatings extend the lifespan of pipes by protecting them from abrasive materials and corrosive substances, reducing maintenance costs and operational downtime. Their cost-effectiveness, combined with technological advancements that enhance durability and performance, makes them a preferred choice in the mining industry.

- The slurry transportation segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the ceramic coated piping in mining market is divided into slurry transportation, tailings management, abrasive material handling, corrosion resistance, and others. Among these, the slurry transportation segment is anticipated to hold the largest market share through the forecast period. The slurry transportation segment's prominence is due to the highly abrasive nature of mining slurries, which can quickly wear down pipes. Ceramic coatings provide superior resistance to abrasion, corrosion, and erosion, significantly extending the lifespan of pipes used in slurry systems. The durability and cost-effectiveness of ceramic-coated pipes make them the preferred choice for slurry transportation, particularly in large-scale mining operations where the handling of harsh, abrasive materials is a constant challenge.

- The open-pit mining segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the end-use, the ceramic coated piping in mining market is categorized into open-pit mining, underground mining, mineral processing plants, and others. Among these, the open-pit mining segment is anticipated to grow at the fastest CAGR growth through the forecast period. The segment's rapid growth is due to the large-scale nature of these operations and the need for efficient slurry transportation. Ceramic-coated pipes are ideal for handling the abrasive and corrosive slurries generated in open-pit mining, offering superior durability, reduced maintenance costs, and extended lifespan. As open-pit mining operations expand and focus on improving efficiency and reducing downtime, the demand for dependable and cost-effective piping solutions such as ceramic-coated pipes grow.

Regional Segment Analysis of the Ceramic Coated Piping in Mining Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the ceramic coated piping in mining market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the ceramic coated piping in mining market over the predicted timeframe. The region's large-scale operations require durable, high-performance piping systems, and ceramic-coated pipes offer superior wear resistance and cost-efficiency. Technological advancements, a focus on sustainability, and regulatory compliance further drive the adoption of ceramic coatings in North American mining. The region’s demand for durable materials and the presence of key industry players also contribute to its dominant position in the market over the forecast period.

Asia Pacific is expected to grow at the fastest CAGR growth of the ceramic-coated piping in mining market during the forecast period. Asia Pacific rapid expansion is attributed due to the region's expanding mining sector, particularly in countries like China, India, and Australia. The increasing demand for minerals, combined with the need for durable, cost-effective solutions, drives the adoption of ceramic-coated pipes. Technological advancements, a focus on sustainability, and government investments in mining infrastructure further contribute to the market's rapid growth in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ceramic coated piping in mining market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saint-Gobain

- Blasch Precision Ceramics

- CerCo LLC

- Carbo Ceramics Inc.

- A&A Coatings

- Almatis GmbH

- Metso Outotec Corporation

- Weir Group PLC

- Kennametal Inc.

- Corrosion Engineering Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, EACOP Ltd. unveiled a new coating factory in Tanzania to support thermal insulation and coatings of pipes for the project.

- In November 2023, Induron Protective Coatings announced the release of its latest product, Novasafe. Novasafe is a furfuryl-modified, thick film, ceramic-filled novolac epoxy that can withstand the most harsh conditions seen in treatment facilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the ceramic coated piping in mining market based on the below-mentioned segments:

Global Ceramic Coated Piping in Mining Market, By Material Type

- Ceramic Coatings

- Composite Ceramic Coatings

Global Ceramic Coated Piping in Mining Market, By Application

- Slurry Transportation

- Tailings Management

- Abrasive Material Handling

- Corrosion Resistance

- Others

Global Ceramic Coated Piping in Mining Market, By End-Use

- Open-pit Mining

- Underground Mining

- Mineral Processing Plants

- Others

Global Ceramic Coated Piping in Mining Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ceramic coated piping in mining market over the forecast period?The ceramic coated piping in mining market is projected to expand at a CAGR of 6.20% during the forecast period.

-

2. What is the market size of the ceramic coated piping in mining market?The Global Ceramic Coated Piping in Mining Market Size is Expected to Hold a Significant Share by 2033, Growing at 6.20% CAGR from 2023 to 2033.

-

3. Which region holds the largest share of the ceramic coated piping in mining market?North America is anticipated to hold the largest share of the ceramic coated piping in mining market over the predicted timeframe.

Need help to buy this report?