Global Ceramic Sputtering Targets Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (Planar Target, Rotary Target), By Application (Flat Panel Display, Solar Energy, Others); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

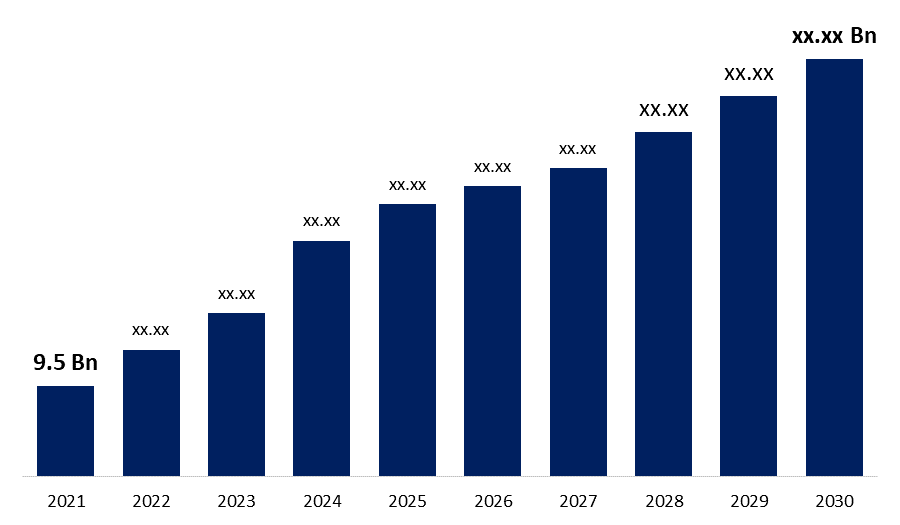

Industry: Semiconductors & ElectronicsThe Global CERAMIC Sputtering Targets Market Size was over USD 9.5 billion globally in 2021 and is estimated to grow over 7.5% CAGR between 2021 and 2030. CERAMIC (indium tin oxide) sputtering targets are core and critical materials in the electronic information area, mainly for the manufacture of flat-panel liquid crystal displays, touch panel, thin-film transistors, solar cells, transparent electrodes, and multifunction glass. Currently, global CERAMIC sputtering targets are almost monopolized by a small minority of enterprises such as JX Nippon Mining & Metals, Mitsui Mining, Tosoh, Samsung, Heraeus Umicore, in which Japanese and Korean companies account for nearly 80% of the market share. Chinese CERAMIC sputtering target enterprises are still small in production scale and basically in trial production or small batch production for lack of core technology.

Get more details on this report -

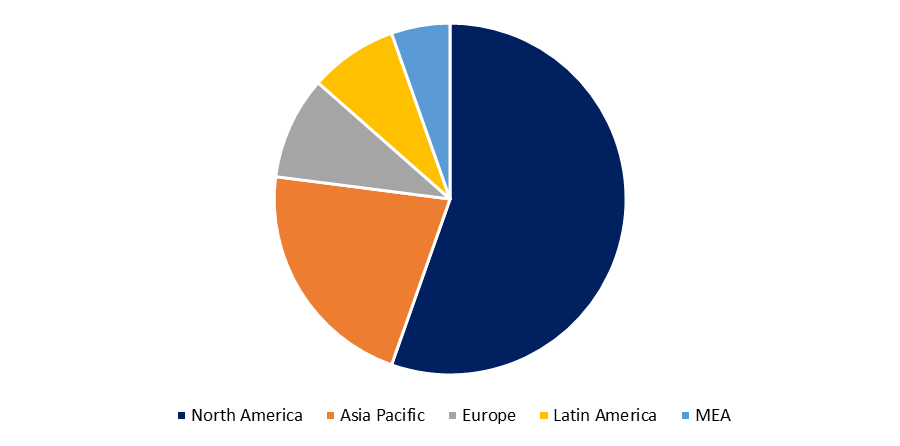

Global CERAMIC sputtering target demand mainly comes from Japan, South Korea, mainland China, and other Asian countries, of which China accounts for more than 35% of the total. Benefited from the rapid development of downstream industries such as flat-panel displays, touch panels, global CERAMIC sputtering target demand hit 2,500 tons or so by 2016, of which China's demand exceeds 40%, as it is estimated. In addition to the supply & demand market influence, CERAMIC sputtering targets are also directly affected by the raw material indium market. 70% of the global indium is used for CERAMIC sputtering target production, but the indium resource is scarce, with basic reserves of merely 16,000 tons. While the current global annual consumption is about 1,400 tons, thus, long-term supply of indium suffers from bottlenecks..

China is rich in indium globally, whose basic reserves make up 62% of the world's total. Slow developments in downstream deep processing industries, especially in CERAMIC sputtering target market, lead to substantial indium export in China, while CERAMIC sputtering target present a high dependence on import.

To break bottlenecks in technology and capacity and utilize indium resources effectively, Chinese enterprises have accelerated R&D and introduces CERAMIC sputtering technology, and multiple high-end CERAMIC sputtering target localization projects have been launched.

Type Outlook

As one of the key materials in the field of electronic information, CERAMIC (indium tin oxide) sputtering targets see stable growth in demand worldwide thanks to the development of LCD TVs, smart phones, tablet PCs and other downstream industries. The demand exceeded 2,000 tons in 2015, 1.7 times that in 2010; it is expected to surpass 3,000 tons by 2020. Currently, the global CERAMIC sputtering targets market is concentrated in Japan, South Korea, Mainland China and other Asian countries; among them, China accounts for more than 35% of the total global demand. As China vigorously promotes the flat panel display industry chain localization policy, the country's demand for CERAMIC sputtering targets and other flat panel display materials will continue to rise, and that for CERAMIC sputtering targets is expected to approximate 1,200 tons by 2020. Although CERAMIC sputtering targets are promising in China, technical limitations lead to a small scale of production herein. Besides, the CERAMIC sputtering targets used for high-end TFT-LCD and touch screens are almost imported. Furthermore, the reserves of indium which is the main raw material of CERAMIC sputtering targets (roughly 70% of global indium is used for CERAMIC sputtering targets) rest in a low level; meanwhile, conventional CERAMIC films are not suitable for flexible applications, light transmittance and conductivity problems are not easy to overcome, so that silver nanowires, metal meshes, carbon nanotubes, graphene and other CERAMIC alternative materials are being developed and applied in recent years..

Global Ceramic Sputtering Targets Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 9.5 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 7.5% |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis Report, By Type, By Region, By Application, |

| Companies covered:: | JX Nippon Mining, Mitsui Mining & Smelting, Tosoh SMD, Samsung Corning Advanced Glass, Umicore, LT Metal, Vital Material, Ulvac, Inc., Advanced Nano Products Co., Ltd, Solar Applied Materials Technology, Guangxi Crystal Union Photoelectric, Beijing Yeke Nano Tech Co., Ltd., Fujian Acetron New Materials Co., Ltd, Materion (Heraeus), Angstrom Sciences |

| Growth Drivers: | 1)Currently, the global CERAMIC sputtering targets market |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Application Outlook

The global CERAMIC sputtering targets market is monopolized by JX Nippon Mining & Metals, Mitsui Mining & Smelting, Tosoh, Samsung, as well as a handful of companies in Germany and the United States, wherein Chinese, Japanese and South Korean players have seized more than 80% market share. There are over 10 enterprises engaged in the production of CERAMIC sputtering targets in China, but the vast majority of them are at the stage of small batch production, R&D or pilot production. Beijing Yeke Nano Tech Co., Ltd. is China's largest manufacturer of CERAMIC sputtering targets with annual design capacity of 100 tons. Its 60 t/a CERAMIC sputtering targets industrialization project with total investment of RMB43 million passed EIA review in July 2016 and will be put into operation by the end of 2017. Zhuzhou Smelter Group can produce 20 tons of CERAMIC sintered targets annually. In 2016, a 60 t/a CERAMIC sintered targets industrialization project is under way..

Regional Outlook

Currently, the global CERAMIC sputtering targets market is concentrated in Japan, South Korea, Mainland China and other Asian countries; among them, China accounts for more than 35% of the total global demand. As China vigorously promotes the flat panel display industry chain localization policy, the country's demand for CERAMIC sputtering targets and other flat panel display materials will continue to rise, and that for CERAMIC sputtering targets is expected to approximate 1,200 tons by 2020. Although CERAMIC sputtering targets are promising in China, technical limitations lead to a small scale of production herein. Besides, the CERAMIC sputtering targets used for high-end TFT-LCD and touch screens are almost imported. Furthermore, the reserves of indium which is the main raw material of CERAMIC sputtering targets (roughly 70% of global indium is used for CERAMIC sputtering targets) rest in a low level; meanwhile, conventional CERAMIC films are not suitable for flexible applications, light transmittance and conductivity problems are not easy to overcome, so that silver nanowires, metal meshes, carbon nanotubes, graphene and other CERAMIC alternative materials are being developed and applied in recent years...

Get more details on this report -

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. For instance the CERAMIC sputtering targets used for high-end TFT-LCD and touch screens are almost imported. Furthermore, the reserves of indium which is the main raw material of CERAMIC sputtering targets (roughly 70% of global indium is used for CERAMIC sputtering targets) rest in a low level; meanwhile, conventional CERAMIC films are not suitable for flexible applications, light transmittance and conductivity problems are not easy to overcome, so that silver nanowires, metal meshes, carbon nanotubes, graphene and other CERAMIC alternative materials are being developed and applied in recent years.

Market Segmentation of Global CERAMIC sputtering targets Market

By Type

- Planar Target

- Rotary Target

By Application

- Flat Panel Display

- Solar Energy

- Others

Need help to buy this report?