Global Chemical Catalyst Market Size, Share, Growth, and Industry Analysis, By Type (Heterogeneous, and Homogeneous), By Material (Metal and Metal Oxides, Zeolites, and Chemical Compound), By Form (Powder, Bead, Extrudate, and Other), and Regional Chemical Catalyst and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Chemical Catalyst Market Chemical Catalyst Forecasts to 2033

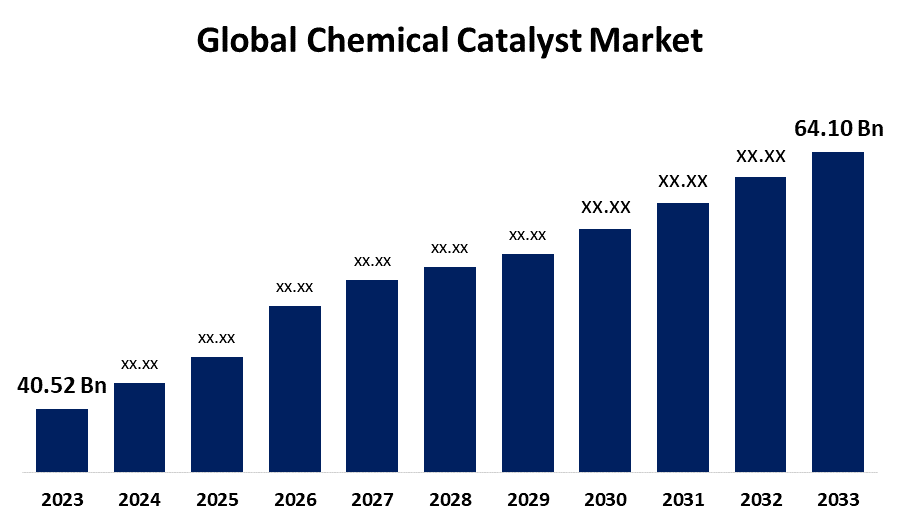

- The Global Chemical Catalyst Market Size was Valued at USD 40.52 Billion in 2023

- The Market Size is Growing at a CAGR of 4.69% from 2023 to 2033

- The Worldwide Chemical Catalyst Market Size is Expected to Reach USD 64.10 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Chemical Catalyst Market Size is Anticipated to Exceed USD 64.10 Billion by 2033, Growing at a CAGR of 4.69% from 2023 to 2033.

CHEMICAL CATALYST MARKET REPORT OVERVIEW

Report Coverage

This research report categorizes the market for the global chemical catalysis market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global chemical catalysis market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global chemical catalysis market.

Global Chemical Catalyst Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 40.52 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.69% |

| 2033 Value Projection: | USD 64.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Type, By Material, By Form, and Regional Chemical Catalyst |

| Companies covered:: | W. R. Grace & Co., Evonik Industries AG, Haldor Topsoe A/S, Arkema SA, UOP LLC, ExxonMobil Corporation, Sinopec Catalyst Company, LyondellBasell Industries N.V., Royal Dutch Shell PLC, DuPont de Nemours, Inc., Chevron Phillips Chemical Company LLC, BASF SE, Clariant AG, Johnson Matthey PLC, Albemarle Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

DRIVING FACTORS:

The growing emphasis on environmentally friendly and sustainable green catalysts can boost market growth.

The possibility of large-scale manufacturing of green catalysts is ecologically benign and has several advantages when utilized in industrial settings. They usually use conveniently accessible and fairly priced resources, cut waste, and increase overall process efficiency. These catalysts are crucial to the renewable energy industry due to the facilitating conversion of biomass into biofuels, a step toward the development of sustainable energy sources. Furthermore, using green methods in the manufacturing of pharmaceuticals Additionally, the pharmaceutical sector uses green catalysis to produce active pharmaceutical ingredients demonstrating the flexibility and adaptability of these catalysts in difficult chemical reactions.

RESTRAINING FACTORS

The growing prices of raw materials could restrict the market growth.

The primary consequence of rising raw material costs is cost inflation. Chemical catalysts are often made from a variety of metals, rare earth elements, and other specialized compounds. Any increase in the price of these components directly affects the cost of creating catalysts. Increased expenses associated with procuring, transforming, and polishing raw materials into catalysts would eventually compel producers to augment the cost of their final products.

Market Segmentation

The chemical catalyst market share is classified into type, material, and form.

The heterogenous segment having the highest share of the market over the forecast period.

Based on type, the chemical catalyst is classified into heterogeneous, and homogeneous. The ease of separation and reusability of heterogeneous catalysts makes them popular in industrial processes like chemical synthesis and petrochemical refining. The increasing petrochemical sector and the need for more effective and clean chemical transformations are the main drivers of demand. A few benefits of heterogeneous catalysts are their low cost, facile product/catalyst separation, easy reusability, and increased reaction rate and selectivity. These factors have led to an increasing interest in the development of solid-phase transesterification catalysts. The current research compares microalgal oil to other readily available feedstocks and focuses on the utilization of heterogeneous catalysts for the dependable manufacture of biodiesel from microalgal oil.

The metal and metal oxides segment has the biggest market share over the forecast period.

Based on material, the chemical catalyst is classified into metal and metal oxides, zeolites, and chemical compounds. Metal catalysts are used in a wide range of processes, including the oxidation, hydrogenation, and production of hydrogen. These catalysts include those based on nickel, palladium, and platinum. The market demand is being driven by the growing applications of metal catalysts in the medicinal products and petroleum products industries metal oxides have become a significant component of decarbonization strategies and industrial growth. Along with the development of new catalytic techniques for performing non-thermal reactions, energy storage technologies, and restoration of the environment through the elimination or breakdown of hazardous chemicals released during production procedures.

The powder form of the category has the largest share of the market over the forecast period.

Based on form the chemical catalyst is classified into powder, bead, extrudate, others. In many different catalytic processes, including chemical synthesis, petrochemical refining, and environmental applications, powder catalysts are adaptable and extensively utilized. Their demand is driven by their enormous surface area and ease of handling. Synthetic zeolites are extensively employed in refining procedures as well as numerous petrochemical reactions as chemical catalyst. These materials need to first be molded from their powdered synthetic state before being used in industrial reactors. A group of scientists from the NUS Faculty of Science's Department of Chemistry, working with partners worldwide, have created a novel class of catalysts called heterogeneous geminal atom catalysts (GACs) that support more environmentally friendly and sustainably produced fine chemicals and pharmaceuticals. With two copper ion centers and a distinctive heptazine structure, the novel catalyst which is visible in powder form is dynamic and adaptive in chemical reactions, facilitating the efficient formation of chemical bonds.

Regional Segment Analysis of the Global Chemical Catalyst Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific will have the biggest share of the chemical catalyst market throughout the forecast period.

Get more details on this report -

Significant expenditures in the development of current capabilities and a growing emphasis on environmentally friendly products are the main drivers of the market's revenue growth in Asia Pacific. For example, BASF SE invested in its world-scale chemical catalysts production plant in the region to fulfill the growing demand for high-performance chemical catalysts in end-use industries in China and Asia Pacific The German group's plant in the Shanghai Chemical Industry Park in Caojing, China, makes adsorbents, customized catalysts, and base metal catalysts that are used in the olefins' purification process, as well as in the synthesis of fatty alcohols, sulfuric acid, and butanediol.

The Europe is fastest growing region during the projected timeframe.

One of the main factors propelling the market's revenue growth in this region is the growing emphasis on enhancing air quality through the use of catalytic emissions-reducing technologies and catalysts that use less energy. Furthermore, one of the main factors propelling the European market's revenue growth is the existence of well-known companies like Catalysts Europe and others that evaluate the effects of regulatory obligations on catalysts throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global chemical catalyst market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- W. R. Grace & Co.

- Evonik Industries AG

- Haldor Topsoe A/S

- Arkema SA

- UOP LLC

- ExxonMobil Corporation

- Sinopec Catalyst Company

- LyondellBasell Industries N.V.

- Royal Dutch Shell PLC

- DuPont de Nemours, Inc.

- Chevron Phillips Chemical Company LLC

- BASF SE

- Clariant AG

- Johnson Matthey PLC

- Albemarle Corporation

- Others

Key Market Developments

- In April 2024, the propane dehydrogenation catalyst CATOFIN 312 is the latest product from Clariant, a specialty chemical firm dedicated to sustainability. This catalyst offers substantial benefits, including improved selectivity and a lifespan extension of up to 20%.

- In September 2022, BASF presents CircleStarTM, a cutting-edge dehydration catalyst designed to handle renewable feedstocks. The new star-shaped catalyst converts ethanol to ethylene (E2E) with a 99.5% selectivity.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global chemical catalyst market based on the below-mentioned segments:

Global Chemical Catalyst Market, By Type

- Heterogeneous

- Homogeneous

Global Chemical Catalyst Market, By Material

- Metal and Metal Oxides

- Zeolites

- Chemical Compound

Global Chemical Catalyst Market, By Form

- Powder

- Bead

- Extrudate

- Others

Global Chemical Catalyst Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global chemical catalyst market over the forecast period?The global chemical catalyst market size is expected to grow from USD 40.52 Billion in 2023 to USD 64.10 Billion by 2033, at a CAGR of 4.69% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global chemical catalyst market?Asia-Pacific is projected to hold the largest share of the global chemical catalyst market over the forecast period.

-

3. Who are the top key players in the chemical catalyst market?W. R. Grace & Co, Evonik Industries AG, Haldor Topsoe A/S, Arkema SA, UOP LLZ, ExxonMobil Corporation, Sinopec Catalyst Company, LyondellBasell Industries N.V, Royal Dutch Shell PLC, DuPont de Nemours, Inc, Chevron Phillips Chemical Company LLC, BASF SE, Clariant AG, Johnson Matthey PLC, Albemarle Corporation, and Others.

Need help to buy this report?