Global Chemical Distribution Market Size, Share, Growth, and Industry Analysis, By Type (Specialty Chemicals, and Commodity Chemicals), By End User (Automotive, Construction, Oil & Gas, Petroleum, and Other), and Regional Chemical Distribution and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Chemical Distribution Market Chemical Distribution Forecasts to 2033

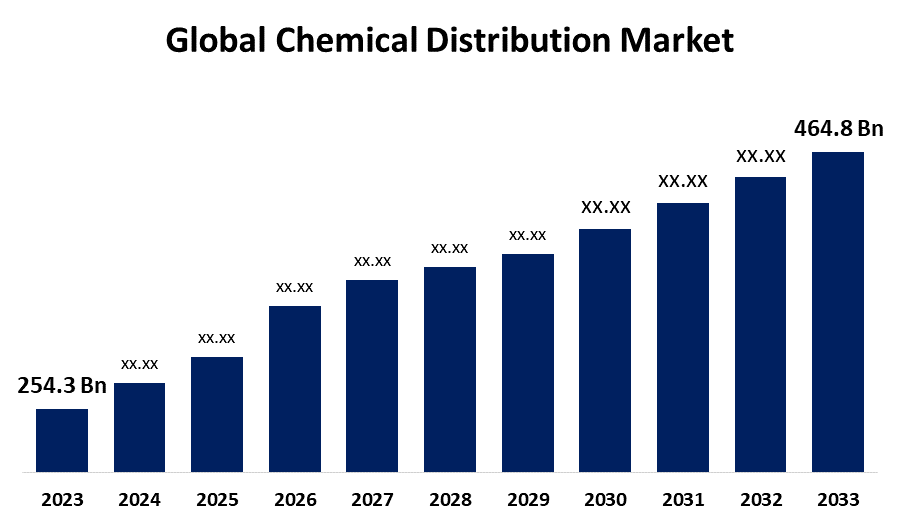

- The Global Chemical Distribution Market Size was Valued at USD 254.3 Billion in 2023

- The Market Size is Growing at a CAGR of 6.22% from 2023 to 2033

- The Worldwide Chemical Distribution Market Size is Expected to Reach USD 464.8 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Chemical Distribution Market Size is Anticipated to Exceed USD 464.8 Billion by 2033, Growing at a CAGR of 6.22% from 2023 to 2033.

CHEMICAL DISTRIBUTION MARKET REPORT OVERVIEW

The chemical distribution industry is highly broad, covering a wide range of industries and offering specialized solutions. A distributor strategy is essential for success in the chemicals sector since it helps businesses access a variety of markets, manage complex situations, and promote long-term growth. Through comprehension of distributor types and benefits and the development of performance-based relationships, businesses can open up new opportunities for success in the face of dynamically changing market conditions. Understanding distributor strategy is crucial to staying ahead of the curve and taking advantage of growth prospects in an environment characterized by change and competition. Chemical distributors are enthusiastic about digitization since it is an excellent opportunity to reevaluate customer relationships in addition to providing a business model for achieving operational excellence through increased supply chain efficiencies. For instance, sage X3 ERP is used in the chemical industry. It combines advanced accounting, CRM, storage, and distribution capabilities with features tailored specifically for chemical manufacturers and distributors. Chemical consumption is increasing in many end-use industries, including textiles, construction, automobiles, agriculture, and medicines. This is driving an exponential increase in the size of the worldwide chemical distribution industry. Chemical distribution facilities provide a vital conduit between manufacturers and smaller customers in underdeveloped regions.

Report Coverage

This research report categorizes the market for the global chemical distribution market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global chemical distribution market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global chemical distribution market.

Global Chemical Distribution Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 254.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.22% |

| 2033 Value Projection: | USD 464.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End User |

| Companies covered:: | Nordmann Rassmann GmbH, HSH Chemie GmbH, CHErbslöh Polska Sp. Z.o.o, Elton Chemicals, Sera Chemicals, ART Chemicals, Donauchem GmbH, Dafcochim Distribution, Afco Solutions, Vermont, Bridgexim, Resinex Group, Contilinks Romania SRL, Interallis Chemicals, Ubimedia, Polichem Trade & Shipping SRL, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

DRIVING FACTORS:

The growing industrialization can boost the market growth.

It is expected that the diverse end consumers of the fast-growing worldwide chemical industry would become the primary force behind the chemical distribution market. The long-term market expansion is expected to be aided by an increase in demand from several end-use industries, such as the pharmaceutical, construction, gadgets, automobiles and transportation sectors. To obtain a competitive edge in the market, foreign distributors are also implementing several tactics, including improving their product knowledge, utilizing local and regional expertise, and building trustworthy logistical networks.

RESTRAINING FACTORS

The lack of transparency in supply could restrict the market growth.

Transparency is one of the main obstacles facing the chemical business. Inaccurate inventory counts result in higher costs and delayed deliveries to customers. In certain instances, it also results in a decline in quality when demands are not properly managed. The laws and regulations in the chemical sector are intricate and constantly changing. The chemical businesses have to follow new regulations set forth by government regulators or risk incurring heavy fines.

Market Segmentation

The chemical distribution market share is classified into type and end user.

The commodity chemicals owing to highest share of the market over the forecast period.

Based on type, the chemical distribution is classified into specialty chemicals, and commodity chemicals. The commodity segment having the highest share of the market over the forecast period. This is because these chemicals are being used more often in a range of end-use industries, such as personal hygiene, automotive, and transportation, which could have a positive effect on the marketplace. The ZDHC Foundation, which works toward zero discharge of hazardous chemicals, launched the commodity chemicals guide version 1.0 in May 2024 with the goal of promoting best practices in the textile dyeing and finishing sector.

The construction segment having the biggest share of market during the forecast period.

Based on end-user, the chemical distribution is classified into automotive, construction, oil & gas, petroleum, and other. The construction segment is most dominant in the market in terms of earnings and is anticipated to maintain its leadership during the anticipated time frame. The chemical compositions that are employed with cement, concrete, or other building materials during construction are referred to as construction chemicals since they help to hold the components together. To achieve specific desirable qualities in concrete, such as high workability, high compressive strength, high performance, and durability to satisfy the demands of the complexity of modern constructions, construction chemicals are utilized.

Regional Segment Analysis of the Global Chemical Distribution Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is having the biggest share of the chemical distribution market throughout the forecast period.

Get more details on this report -

The chemical distribution market in the Asia-Pacific area is made up of a complicated web of producers, distributors, dealers, and end consumers. Among the many chemicals produced by manufacturers to meet a variety of industrial and consumer demands are agrochemicals, industrial chemicals, and specialty chemicals. As go-betweens, distributors help get these chemicals from manufacturers to final consumers while guaranteeing effective supply chain management. Chemicals are essential to many sectors, such as agriculture and pharmaceuticals, and they foster growth and innovation in all of them.

The Europe is fastest growing region during the forecast period.

The industrial sector, which includes a wide range of businesses like manufacturing, building, and automobiles, is one of the main uses for chemical distribution. Chemical distributors play a major role in providing these sectors with necessary intermediates and raw materials. Europe's industries are changing and becoming more sustainable, which has increased demand for specialty chemicals that adhere to regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global chemical distribution market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nordmann Rassmann GmbH

- HSH Chemie GmbH

- CHErbslöh Polska Sp. Z.o.o

- Elton Chemicals, Sera Chemicals

- ART Chemicals

- Donauchem GmbH

- Dafcochim Distribution

- Afco Solutions

- Vermont

- Bridgexim

- Resinex Group

- Contilinks Romania SRL

- Interallis Chemicals

- Ubimedia

- Polichem Trade & Shipping SRL

- Others

Key Market Developments

- In July 2024, to broaden its offering, specialty chemical distributor Krahn Chemie Benelux and Mitsubishi Chemical Europe (MCE) are starting a new partnership. As per the agreement, a number of premium MCE products will be distributed by Krahn Chemie Benelux.

- In June 2024, an agreement has been signed by Azelis, a leading global innovation service provider in the food ingredients and specialty chemicals industries, to purchase all of the shares of CPS Chemicals (Coatings) Pty Ltd ("CPS Chemicals (Coatings)"), a distributor of specialty chemicals to the paint, ink, resins, paper, plastics, and rubber industries.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global chemical distribution market based on the below-mentioned segments:

Global Chemical Distribution Market, By Type

- Specialty Chemicals

- Commodity Chemicals

Global Chemical Distribution Market, By End-User

- Automotive

- Construction

- Oil & Gas

- Petroleum

- Other

Global Chemical Distribution Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global chemical distribution market over the forecast period?The global chemical distribution market size is expected to grow from USD 254.3 Billion in 2023 to USD 464.8 Billion by 2033, at a CAGR of 6.22% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global chemical distribution market?Asia-Pacific is projected to hold the largest share of the global chemical distribution market over the forecast period.

-

3. Who are the top key players in the chemical distribution market?Nordmann Rassmann GmbH, HSH Chemie GmbH, CHErbslöh Polska Sp. Z.o.o, Elton Chemicals, Sera Chemicals, ART Chemicals, Donauchem GmbH, Dafcochim Distribution, Afco Solutions, Vermont, Bridgexim, Resinex Group, Contilinks Romania SRL, Interallis Chemicals, Ubimedia, Polichem Trade & Shipping SRL, and Others.

Need help to buy this report?