Global Chemical Licensing Market Size, Share, Growth, and Industry Analysis, By Type (C1 Derivatives, C2 Derivatives, C3 Derivatives, C4 Derivatives), By End-Use (Oil & Gas Industry, Chemical Industry, Pharmaceutical Industry), and By Regional Chemical Licensing and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Chemical Licensing Market Insights Forecasts to 2033

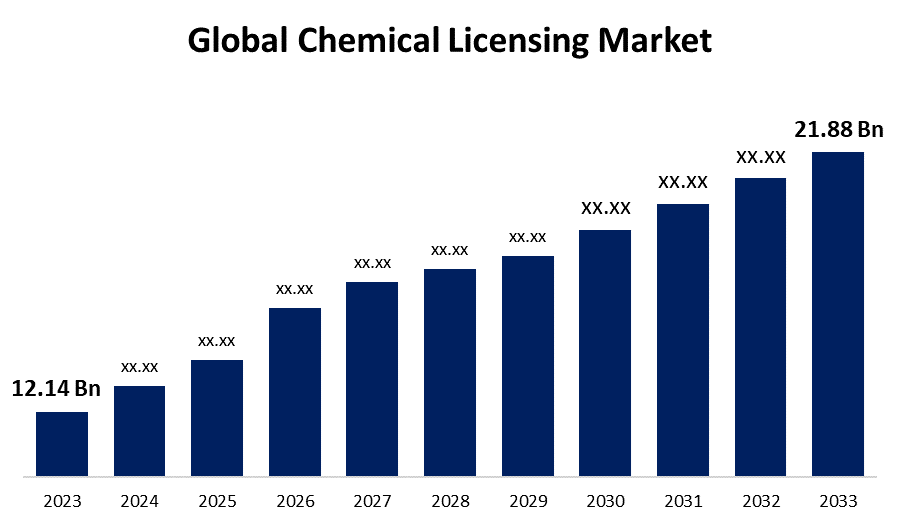

- The Global Chemical Licensing Market Size was Valued at USD 12.14 Billion in 2023

- The Market Size is Growing at a CAGR of 6.07% from 2023 to 2033

- The Worldwide Chemical Licensing Market Size is Expected to Reach USD 21.88 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Chemical Licensing Market Size is Anticipated to Exceed USD 21.88 Billion by 2033, Growing at a CAGR of 6.07% from 2023 to 2033.

CHEMICAL LICENSING MARKET REPORT OVERVIEW

The privilege of using a specific chemical technology for a predetermined amount of time is known as chemical licensing. In return for a set of fees or royalties, a licensee is given permission to use a certain chemical technology or product by the licensor, who holds the intellectual property rights to it. Industrial policy refers to the laws, rules, guidelines, and policies that are created by the government and certain regulatory organizations to oversee and manage industrial activities inside a country. Policies pertaining to the industry include chemical licensing. All businesses and organizations that manufacture chemicals must obtain a chemical license in light of the rapid industrialization and liberalization that has taken place. Identifying and protecting legitimate commerce in chemicals and other substances is crucial in order to prevent these substances from being used for illicit activities. The goal is to prevent the unlawful trafficking of drugs and the infringement of patents on chemical substances and the exclusive technology used in their production. There is likely to be a probably be a strong global demand for pharmaceutical and medical medications, which would propel the chemical licensing industry. The market for chemical licensing is expected to grow due to the increase in chronic illnesses among the global population. A chemical license is required for manufacturers who produce drugs for the pharmaceutical and medical industries. Furthermore, it is anticipated that the chemical industry's technological developments in response to consumer demands and specifications might continue to drive this market. Chemical licensing is the process of patenting each chemical manufacturing company's unique, environmentally beneficial, and sustainable proprietary technology.

Report Coverage

This research report categorizes the market for the global chemical licensing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global chemical licensing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global chemical licensing market.

Global Chemical Licensing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.14 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.07% |

| 2033 Value Projection: | USD 21.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 232 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End use |

| Companies covered:: | Chevron Phillips Chemical Company, Eastman Chemical Company, Exxon Mobil Corporation, Huntsman Corporation, Johnson Matthey, Mitsubishi Chemical Corporation, Nova Chemicals Corporation, Sumitomo Chemical, LyondellBasell and Shell, Oriental Carbon & Chemicals, Linde, Pidilite Industries Ltd., SABIC, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

DRIVING FACTORS:

The growing number of chemical manufacturing businesses can promote market expansion.

As a result of increasingly strict government requirements in different countries, businesses are concentrating on creating environmentally friendly and sustainable technologies for chemical production. In the future, there is likely to be a significant need for medicines and medical drugs worldwide, which would propel the market for chemical licensing. It is anticipated that the rise of chronic illnesses across global populations is going to propel the chemical licensing business. A chemical license is required for manufacturers who produce medications for the pharmaceutical and medical sectors.

RESTRAINING FACTORS

The growth of the chemical licensing sector is being impeded by the high cost of chemical-making procedures.

The end-user-driven in-house technological development, cost optimization, and high license costs are expected to impede market expansion during the projection period.

Market Segmentation

The chemical licensing market share is classified into type and end-use.

The C2 derivatives segment has the highest share of the market over the forecast period.

Based on type, the chemical licensing is classified into C1 derivatives, C2 derivatives, C3 derivatives, and C4 derivatives. In the chemical licensing market, the C2 derivatives section is the biggest. The manufacturing processes for polyethylene and EDC-PVC, which are in high demand in the market, fall under the C2 derivative. The chemical licensing market's C2 derivatives segment is expanding due to this need. Technological developments in polyethylene and EDC-PVC are highly sought after in the industry, driving the chemical licensing market's C2 derivatives segment ahead. The developments in polyethylene and EDC-PVC technology are highly sought after; polyethylene finds application in tubes, films, plastic components, and laminates, while ethylene dichloride (EDC) finds usage as a solute in the adhesives, textile, and metal cleansing industries.

The chemical industry segment has owing to the greatest market share throughout the forecast period.

Based on end-use, chemical licensing is classified into the oi l & gas industry, chemical industry, and pharmaceutical industry. The industrial sector's expansion and development are significantly influenced by the chemical industry. The chemical industry has a higher value-added than the majority of other industry sectors. Furthermore, licensing bulk organic compounds and petrochemicals accounts for a significant amount of the money generated by process innovations for chemical businesses. These days, petrochemical goods are used in almost every aspect of daily life, including packaging, electronics, electrical devices, medical equipment, automobiles, furniture, clothes, housing, buildings, and many other items. Due to the extensive usage of petrochemicals, the chemical industry is going to require more chemical licenses in the foreseeable future.

Regional Segment Analysis of the Global Chemical Licensing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

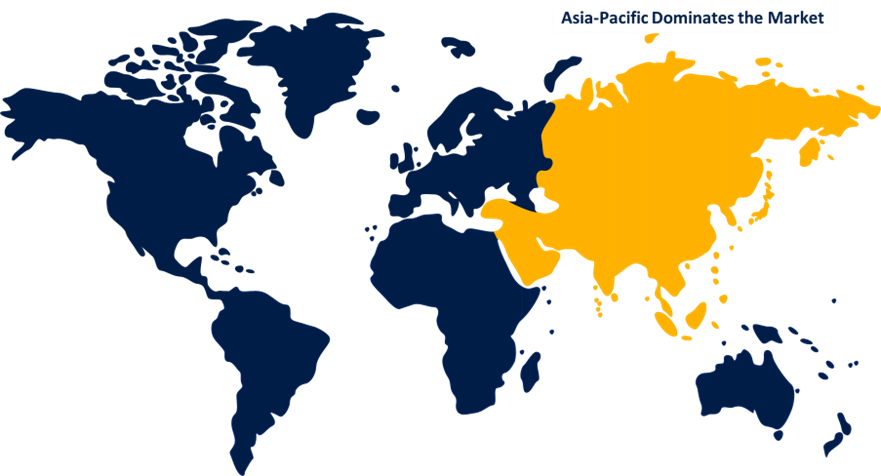

Asia-Pacific has the biggest share of the chemical licensing market throughout the forecast period.

Get more details on this report -

The increasing number of small and medium-sized businesses in the area that have various chemical production and manufacturing facilities is responsible for this expansion. It is anticipated that the region's chemical licensing industry will continue to grow due to increased efficiency in manufacturing and rapid industrialization. Due to the region's secondary industries' increasing demand for process licensing, the region is also expected to have increased development of the chemical licensing industry throughout the anticipated timeframe. The demand for the chemical licensing market in the region is expected to rise due to the expanding number of refineries in nations like South Korea, China, and India.

North America is the fastest-growing region over the projected timeframe.

The chemical industry's innovation, research and development, and technological improvements are projected to keep North America as the second largest shareholder in the chemical licensing market during the projection period. North America's dominance in the licensing business has been attributed to the fact that it is home to numerous prestigious chemical corporations and research organizations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global chemical licensing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chevron Phillips Chemical Company

- Eastman Chemical Company

- Exxon Mobil Corporation

- Huntsman Corporation

- Johnson Matthey

- Mitsubishi Chemical Corporation

- Nova Chemicals Corporation

- Sumitomo Chemical

- LyondellBasell and Shell

- Oriental Carbon & Chemicals

- Linde

- Pidilite Industries Ltd.

- SABIC

- Others

Key Market Developments

- In June 2021, A license agreement for the use of Enviro Tech Chemical Services, Inc.'s (ETCS) U.S. Patent No. 10,912,321—Methods of Using Peracetic Acid to Treat Poultry in a Chill Tank During Processing—has been granted to PeroxyChem by the Modesto, California-based firm.

- In April 2021, the US patent for its peptide-based New Chemical Entities (NCEs) and the licensing of pre-IND filings were announced by ISSAR Pharmaceuticals, a leader in peptide technology and medication research. It is anticipated that this partnership will assist ISSAR Pharmaceuticals in designing and creating novel peptide-based medications that can be utilized to treat a range of upcoming illnesses.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global chemical licensing market based on the below-mentioned segments:

Global Chemical Licensing Market, By Type

- C1 Derivatives

- C2 Derivatives

- C3 Derivatives

- C4 Derivatives

Global Chemical Licensing Market, By End-Use

- Oil & Gas Industry

- Chemical Industry

- Pharmaceutical Industry

Global Chemical Licensing Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?