Global Chemical Logistics Market Size, Share, Growth, and Industry Analysis, By Mode of Transportation (Roadways, Railways, Airways, Waterways, and Pipelines), By Services (Transportation and Distribution, Storage & Warehousing, Customs & Security, Green Logistics, and Consulting & Management Services), By End-User (Chemical Industry, Pharmaceutical Industry, Cosmetic Industry, and Oil & Gas Industry), and By Regional Chemical Logistics and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Chemical Logistics Market Forecasts to 2033

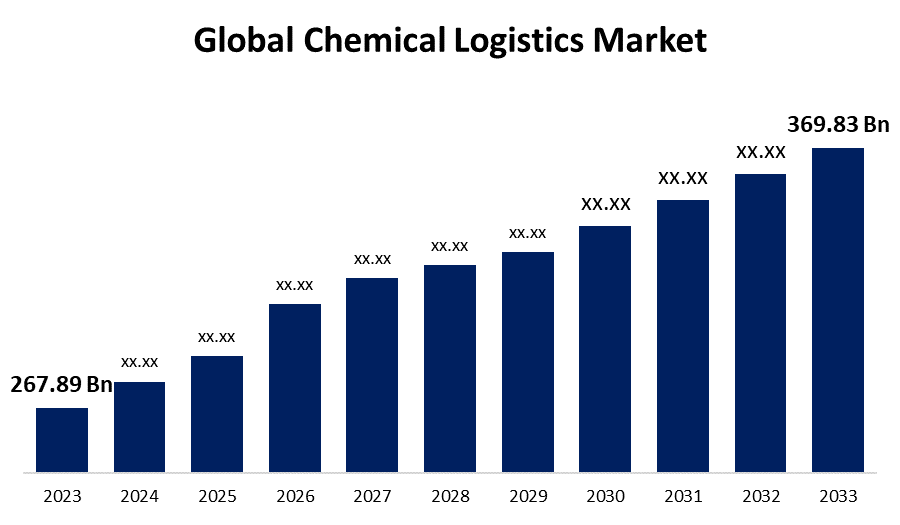

- The Global Chemical Logistics Market Size was Valued at USD 267.89 Billion in 2023

- The Market Size is Growing at a CAGR of 3.28% from 2023 to 2033

- The Worldwide Chemical Logistics Market Size is Expected to Reach USD 369.83 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Chemical Logistics Market Size is Anticipated to Exceed USD 369.83 Billion by 2033, Growing at a CAGR of 3.28% from 2023 to 2033.

CHEMICAL LOGISTICS MARKET REPORT OVERVIEW

The organizing and controlling the movement of chemicals and related materials from suppliers to manufacturers and consumers is known as chemical logistics. The proper chemicals are delivered at the appropriate times to the appropriate locations for this technique. Chemical logistics encompasses the domains of inventory management, transportation, storage, and security. The creation of new business models by utilizing digital tools like artificial intelligence (AI) would become increasingly significant in the evolution of logistics. Many logistics organizations now provide integrated digital concepts to increase productivity, either through process automation or by improving customer and staff usability and transparency. These technologies' primary benefits are their ability to assist individuals in making decisions and free them from repetitive duties. The rise in chemical manufacturing is anticipated to propel advancements in the chemical logistics sector. The growing production of chemicals to support a variety of industries, such as food preparation, drug manufacturing, automobile manufacturing, and engineering, is making secure logistics and distribution networks for increasingly important. The environment, safety, and health are receiving more attention. A greater emphasis is being placed on health, safety, and the environment. In logistics, responsible care is of most importance, particularly in the chemical industry. All chemical logistics providers must hold a responsible care certification. The research and development expenditures in chemical logistics are expected to increase as more operational areas are investigated to find cost-effective solutions for the growing demand.

Report Coverage

This research report categorizes the market for the global chemical logistics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global chemical logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global chemical logistics market.

Global Chemical Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 267.89 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.28% |

| 2033 Value Projection: | USD 369.83 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Mode of Transportation, By Services, By End-User, By Regional |

| Companies covered:: | FedEx, GEODIS, Kuehne + Nagel, Maersk Logistics, Nippon Express, Rhenus Logistics, Sinotrans, UPS Supply Chain Solutions, XPO Logistics, Brenntag, C.H. Robinson, DB Schenker, DHL Global Forwarding, A&R Logistics, Agility, and other key companies. |

| Growth Drivers: | The digitization process and advances in technology could promote market expansion. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

DRIVING FACTORS:

The digitization process and advances in technology could promote market expansion.

The increasing digitalization and integration of cutting-edge technologies that improve the traceability, efficiency, and transparency of chemical supply chains is a major factor supporting the market's expansion. Accordingly, the growing use of IoT devices, RFID technology, and telematics that allow for real-time surveillance and tracking of chemical shipments and guarantee visibility at every stage of the logistics process are supporting market growth. The industry is also expanding due to the widespread use of cloud-based software and digital platforms that enable coordination and communication between different supply chain participants, such as manufacturers, logistics companies, and government agencies.

RESTRAINING FACTORS

The chemical logistics-related complexities could hamper the market expansion.

The chemical logistics companies provide services via air, sea, rail, and road. As a result, there are several challenges associated with product transportation. A few of these are an overloaded rail system, imprecise transit schedules, and a lack of adaptability in the transportation of chemicals due to different regulations, poor road conditions, and theft. These factors would prevent the chemical logistics market from growing.

Market Segmentation

The chemical logistics market share is classified into modes of transportation, service, and end-user.

The roadways segment has the highest share of the market over the forecast period.

Based on the mode of transportation, chemical logistics is classified into roadways, railways, airways, waterways, and pipelines. The road transportation of chemicals covered the largest market share due to companies involved in chemical transportation are spending money to increase the quality of their fleets for chemical logistics. To increase their ability to provide chemical logistics services in China, the top logistics companies are forming a joint venture, which is anticipated to enhance the need for highways. The second-largest share is intended to belong to the waterways area. One of the cheapest ways to move massive amounts of commodities from one area to another is via the waterways. According to projections by the American Chemistry Council by 2030, over one Billion extra chemical shipments annually are anticipated via truck, rail, and sea.

The transportation and distribution segment has owned the largest share of the market throughout the forecast period.

Based on service, chemical logistics is classified into transportation and distribution, storage & warehousing, customs & security, green logistics, and consulting & management services. Moving chemical products through different transportation modes, such as rail, roadways, and others, across national borders or around the world is referred to as transportation and distribution services. The chemical logistics market's transportation and distribution segment is being driven by partnerships between logistics companies to enhance and optimize chemical industry transportation infrastructures. The section responsible for storage and warehousing is anticipated to hold the second-largest chunk. The process of keeping a range of items in a storage facility or other specialized building, usually in a controlled atmosphere, is known as storage and warehousing.

The chemical industry segment having the biggest share of the market during the forecast period.

Based on end-user, chemical logistics is classified into the chemical industry, pharmaceutical industry, cosmetic industry, and oil & gas industry. Commodity or bulk chemicals make up the majority of the chemical industry. These chemicals are utilized as raw materials to make intermediate and specialty chemicals. These bulk chemicals also have the highest market shares in terms of chemical manufacturing and sales, along with high capital expenses. Businesses' concentration on local chemical manufacturing and the rising need for raw chemicals are expected to fuel the need for logistics services in the chemical industry. The pharmaceutical section covers some of the logistical services that are essential to the pharmaceutical industry, such as product logistics, freight forwarding, and warehousing, in addition to the planning and implementation of chemical supply chain management.

Regional Segment Analysis of the Global Chemical Logistics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific has the biggest share of the chemical logistics market throughout the forecast period.

Get more details on this report -

With the region's increasing development and economic growth, there has been a spike in chemical production and consumption. This trend is mostly driven by countries like China, India, and Southeast Asian nations, which call for sophisticated chemical logistics solutions. The efficiency and dependability of chemical logistics in the area have also increased as a result of investments made in ports, highways, and trains as well as the establishment of logistics centers. The growth of the chemical logistics industry in the region is being driven by the demand for effective domestic and regional distribution networks. To efficiently service local markets, companies are investing in the expansion of their distribution capacities. For example, FedEx improved the regional distribution of chemicals in the Asia Pacific region in May 2024 by expanding its road transportation network.

The Europe is fastest growing region during the projected timeframe.

A favorable picture for market expansion is being created by Europe's growing emphasis on sustainability, and requirement for effective supply chains to service a variety of markets. Alongside this, the market is being driven ahead by the increasing demand for chemical logistics due to the region's developing chemical output, trade liberalization, and requirement for strong logistical networks to enable the flow of chemicals within the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global chemical logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FedEx

- GEODIS

- Kuehne + Nagel

- Maersk Logistics

- Nippon Express

- Rhenus Logistics

- Sinotrans

- UPS Supply Chain Solutions

- XPO Logistics

- Brenntag

- C.H. Robinson

- DB Schenker

- DHL Global Forwarding

- A&R Logistics

- Agility

- Others

Key Market Developments

- In March 2024, Leschaco established a chemical logistics hub in the Netherlands. The facility is perfectly situated for multimodal transportation, with easy access to important rivers such as the Rhine and Meuse as well as significant seaports.

- In March 2022, Univar Solutions Inc. announced the opening of its newest Solution Center, which functions as both the company's flagship location for Europe and one of its hubs for a worldwide hub-and-spoke innovation model.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global chemical logistics market based on the below-mentioned segments:

Global Chemical Logistics Market, By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

Global Chemical Logistics Market, By Services

- Transportation and Distribution

- Storage & Warehousing

- Customs & Security

- Green Logistics

- Consulting & Management Services

Global Chemical Logistics Market, By End-User

- Chemical Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Oil & Gas Industry

Global Chemical Logistics Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global chemical logistics market over the forecast period?The global chemical logistics market size is expected to grow from USD 267.89 Billion in 2023 to USD 369.83 Billion by 2033, at a CAGR of 3.28% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global chemical logistics market?Asia-Pacific is projected to hold the largest share of the global chemical logistics market over the forecast period.

-

3. Who are the top key players in the chemical logistics market?FedEx, GEODIS, Kuehne + Nagel, Maersk Logistics, Nippon Express, Rhenus Logistics, Sinotrans, UPS Supply Chain Solutions, XPO Logistics, Brenntag, C.H. Robinson, DB Schenker, DHL Global Forwarding, A&R Logistics, Agility, and others.

Need help to buy this report?