Global Chemical Software Market Size, Share, Growth, and Industry Analysis, By Type (Molecular Dynamics Software, and Molecular Modeling Software), By Product (Chemical Process Simulation, Inventory Management, and ISO Management), By Deployment (On-Premise, and Cloud-Based), and By Regional Chemical Software and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Chemical Software Market Chemical Software Forecasts to 2033

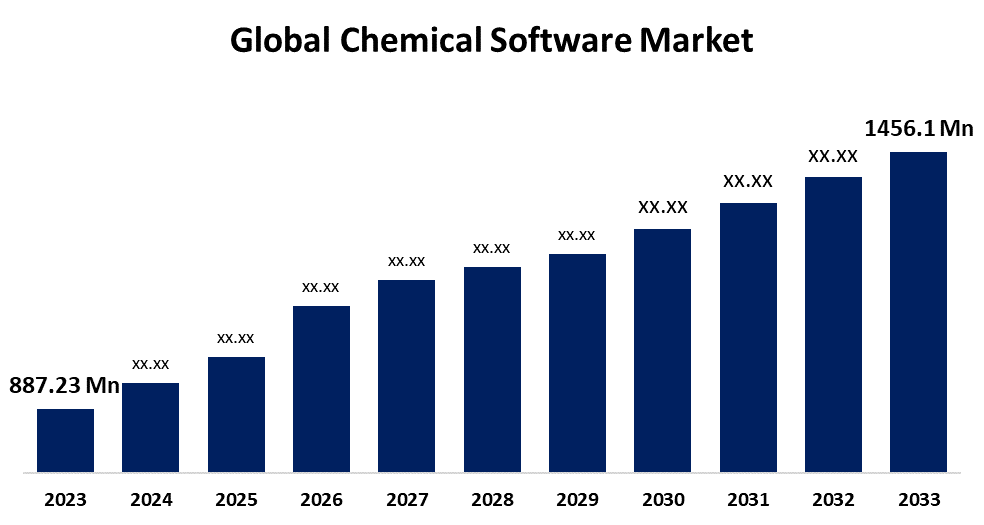

- The Global Chemical Software Market Size was Valued at USD 887.23 Million in 2023

- The Market Size is Growing at a CAGR of 5.08% from 2023 to 2033

- The Worldwide Chemical Software Market Size is Expected to Reach USD 1456.1 Million By 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Chemical Software Market Size is Anticipated to Exceed USD 1456.1 Million by 2033, Growing at a CAGR of 5.08% from 2023 to 2033.

CHEMICAL SOFTWARE MARKET REPORT OVERVIEW

The term "chemical software" describes specialized applications used to study and examine chemical reactions and processes. It helps with process optimization, chemical product creation, and chemical behavior. Cheminformatics, process simulation, and molecular modeling are a few examples of applications that chemical researchers and engineers can utilize to increase efficiency, security, and creativity in their work. For several purposes, including inventory management, production scheduling, quality control, and regulatory compliance, the chemical industry uses chemical software. SAP, Oracle, Sage X3, Odoo, and CDD Vault are some of the most popular chemical industry software applications. The chemical sector has seen an increase in the importance of AI and ML. They expedite the analysis of massive amounts of data, aid in forecasting, and enhance the procedures involved in product development. Chemical software is in higher demand as a result of industries being more automated. By assuring high productivity and reducing downtime, manufacturers are looking for these solutions to optimize their production methods and achieve a competitive edge. The Indian government announced the launch of Chemindia, a significant and far-reaching program. With consideration for a wide range of chemical sectors including output, installed capacity, exports, imports, acquisitions, sales, and other chemical properties, the project's goal is to compile an exhaustive chemical inventory of India.

Report Coverage

This research report categorizes the market for the global chemical software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global chemical software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global chemical software market.

Global Chemical Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 887.23 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.08% |

| 2033 Value Projection: | USD 1456.1 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 238 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Type, By Product, By Deployment, By Regional. |

| Companies covered:: | Vicinity, Sivco Inc., Labcup, Ltd., QIAGEN, Alchemy Cloud, Inc., YASH Technologies, Yordas Limited, Kintech Lab, Hypercube, Inc., ANSYS, Inc, Frontline Data Solutions, FindMolecule, Metso, eLogger, Chemstations Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

DRIVING FACTORS:

The primary driver of market expansion is the growing number of new chemical manufacturing plants being established worldwide.

The increased need for chemicals is driving growth in the chemical sector. Chemical software will be required for improved inventory management, more efficient operations, optimized chemical operation processes, and support in introducing automation as a result of the opening of new chemical manufacturing facilities. The design of effective chemical reactors and the prediction of reaction outcomes require sophisticated process simulation software. The market for chemical software is driven by this complexity, as businesses look for solutions to increase process accuracy, boost productivity, and reduce errors to ensure successful and economical chemical production.

RESTRAINING FACTORS

The market expansion might be limited by high expenses for implementation.

Chemical software solutions are frequently expensive to buy, license, and integrate with current systems. Smaller businesses or those with tighter budgets can discover this cost strain to be more stressful which could delay the adoption of these technologies. The high installation costs might be a major barrier to entry and impede the growth of the chemical software business. The implementation and maintenance of robust security measures can be costly and complex, which could discourage potential users and restrict the development of the chemical software business.

Market Segmentation

The chemical software market share is classified into type, product, and deployment.

Molecular dynamic software has the highest share of the market over the forecast period.

Based on type, the chemical software is classified into molecular dynamics software, and molecular modeling software. The overall market for molecular dynamics simulation software is growing at a strong rate due to the increasing need for in-depth molecular analysis in a variety of scientific fields. These software programs enable accurate simulations of molecular interactions, frameworks, and dynamics by facilitating the computational modeling of molecular systems. These instruments are extensively used in the pharmaceutical, biotechnology, chemical engineering, and academic research sectors to study complicated phenomena like protein folding, drug interactions, atomic-level material characteristics, and others. Technological developments, including as better algorithms, quicker processing power, and enhanced visualization utilities that enable more precise and effective simulations, are also driving the market's expansion.

The chemical process simulation segment dominated the market growth during the forecast period.

Based on the product, the chemical software is classified into chemical process simulation, inventory management, and ISO management. The entire life cycle of a production procedure, from research and development to initial planning and plant operations, can be developed with the use of chemical process simulation. Chemical firms can forecast possible outcomes of process changes by using process simulation. As a result, manual checks on repetitious jobs are eliminated. Manufacturers are also able to evaluate expenses and guarantee that systems retain a steady-state heat to the chemical process modeling software. In addition, there are other uses for process simulation software, such as temperature control, chemical mixing, and recycling. The software suite for process simulation from chemstations is called CHEMCAD. The features including this software are process development, creation of equipment, dynamic simulations, thermophysical property calculations, and process intensification studies.

The on-premises software has the largest share of the market throughout the forecast period.

Based on deployment, the chemical software is classified into on-premise and cloud-based. Software that is installed on-site and needs specific hardware, IT assistance, and installation before it can be used is known as on-premise software. Pharma has several use cases for on-premise software. On-premise software can be used, for instance, for machine performance evaluation, temperature monitoring, and batch processing. Pharma firms handle sensitive data, such as trade secrets and patient information, and frequently choose to keep this data on-site, or in-house. That's why pharmaceutical companies frequently use on-premise software. For an organization to utilize on-premise software, a license or copy of the program must be purchased. There is typically more safety than with a cloud computing architecture because the program is licensed and the full instance of software resides within an organization's premises.

Regional Segment Analysis of the Global Chemical Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America has the biggest share of the chemical software market throughout the forecast period.

Get more details on this report -

The chemical software market in North America supports a range of uses in the chemical industry, including product development, regulatory compliance, process optimization, and operational efficiency. One of the main uses is in the modeling and simulation of chemical processes, where researchers and chemical engineers can use software to analyze data, optimize production settings, and simulate intricate processes. Chemical software is also widely used in safety management and regulatory compliance. Chemical firms use compliance management software to make sure that safety standards, government rules, and environmental regulations are followed. Regulatory software solutions help businesses promote workplace safety, environmental sustainability, and regulatory compliance throughout manufacturing facilities.

The Asia-Pacific is the fastest-growing region during the projected timeframe.

The chemical software market is anticipated to grow at the quickest rate in Asia-Pacific due to the region's rapid industrial development, rising investments in chemical production hubs like China and India, and a strong emphasis on operational effectiveness. The growing chemical sector in the region necessitates sophisticated software solutions for process optimization, safety improvements, and adherence to strict environmental standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global chemical software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vicinity

- Sivco Inc.

- Labcup, Ltd.

- QIAGEN

- Alchemy Cloud, Inc.

- YASH Technologies

- Yordas Limited

- Kintech Lab

- Hypercube, Inc.

- ANSYS, Inc

- Frontline Data Solutions

- FindMolecule

- Metso

- eLogger

- Chemstations Inc.

- Others

Key Market Developments

- In August 2024, MolCompass is a tool created by researchers at the University of Vienna that helps find blind spots in machine learning models that are used to assess chemical danger.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global chemical software market based on the below-mentioned segments:

Global Chemical Software Market, By Type

- Molecular Dynamics Software

- Molecular Modeling Software

Global Chemical Software Market, By Product

- Chemical Process Simulation

- Inventory Management

- ISO Management

Global Chemical Software Market, By Deployment

- On-Premise

- Cloud-Based

Global Chemical Software Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?