Global Chemical Tankers Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Organic Chemicals, Inorganic Chemicals, Vegetable Oils, and Fats), By Fleet Type (IMO 1, IMO 2, IMO 3), By Fleet Size (Inland Chemical Tankers (1000-4999 DWT), Coastal Chemical Tankers (5000-9999 DWT), and Deep-Sea Chemicals Tankers (10,000- 50,000 DWT)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Chemical Tankers Market Insights Forecasts to 2033

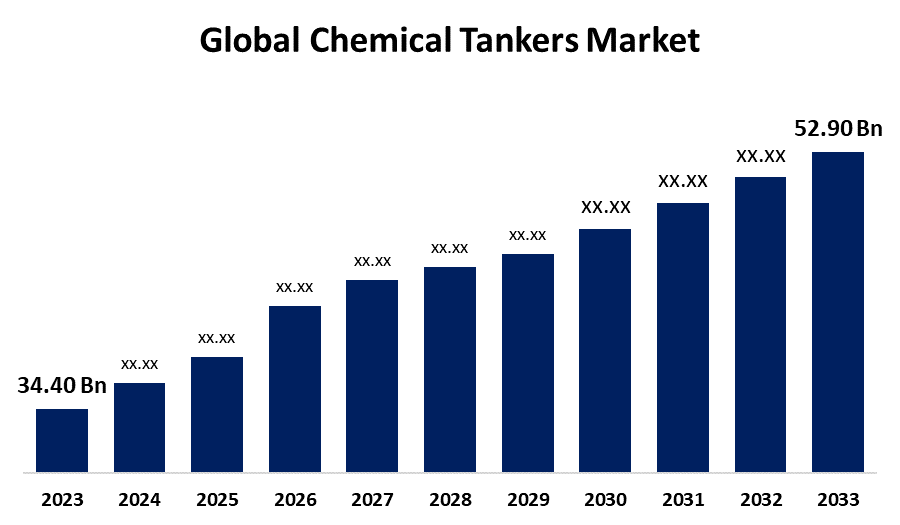

- The Global Chemical Tankers Market Size was Valued at USD 34.40 Billion in 2023

- The Market Size is Growing at a CAGR of 4.40% from 2023 to 2033

- The Worldwide Chemical Tankers Market Size is Expected to Reach USD 52.90 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Chemical Tankers Market Size is Anticipated to Exceed USD 52.90 Billion by 2033, Growing at a CAGR of 4.40% from 2023 to 2033.

Market Overview

Chemical tankers are specialist vessels that transport hazardous chemicals across oceans safely. Over the last 50 years, they have evolved from bulk carriers transporting chemicals in barrels to purpose-built ships. Chemical tankers are designed to transport a wide range of materials and have severe criteria due to the hazards that chemicals present. The ships contain various cargo tank types and materials, pipeline systems, and heating and ventilation systems. The crew needs personal protective equipment when loading or unloading chemical tankers are designed to meet high safety and environmental regulations, ensuring the safe transportation of their cargo over international and local shipping routes. They play an important role in supporting the global trade of chemicals by providing efficient and secure transportation options customized to the specific needs of chemical cargo. The chemical tanker market refers to the sea transportation of chemicals and chemical products on dedicated and specialized tonnage vessels known as chemical tankers. They are carefully constructed and supplied with specific equipment to safely load, transport, and discharge a wide range of liquid chemicals and chemical products between manufacturers or production sites and end users worldwide.

Report Coverage

This research report categorizes the chemical tankers market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the chemical tankers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the chemical tankers market.

Global Chemical Tankers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 34.40 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.40% |

| 2033 Value Projection: | USD 52.90 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Fleet Type, By Fleet Size, By Region |

| Companies covered:: | JO Tankers, MOL Chemicals Tankers, MISC Berhad, IINO KAIUN KAISHA, Eitzen Chemicals, Tokyo Marine Asia Pte. Ltd., Berlian Laju Tanker, Norden, Pacific Carrier Limited, Team Tankers International, Stolt-Nielsen Limited, Seatrans Chemicals Tankers, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The chemical tankers market is driven by a complex interplay of factors that shape its growth and operational dynamics globally. Key drivers include the expansion of the chemical industry, which dictates the demand for specialized vessels to transport chemicals safely and efficiently across international trade routes. Stringent safety and environmental regulations, coupled with technological advances in vessel design and operational efficiency, also significantly influence the market. Economic factors such as energy prices, trade patterns, and global economic trends further impact tanker demand and operational costs. Additionally, industry consolidation, safety concerns, and evolving sustainability expectations contribute to the evolving landscape of the chemical tankers market, influencing strategic decisions and regulatory developments within the sector.

Restraining Factors

The chemical tanker industry has several constraints that limit its growth and operational stability including overcapacity, price competition, technological adoption barriers, environmental sustainability pressures, and high regulatory compliance costs related to demanding safety. Oil price fluctuations lead to financial uncertainty, which has an impact on profitability due to the high fuel costs associated with tanker operations. Economic instability, trade interruptions, and geopolitical tensions can all lower demand for chemical transportation services, influencing market dynamics and investment decisions.

Market Segmentation

The chemical tankers market share is classified into product type, fleet type, and fleet size.

- The organic chemicals segment is estimated to hold the highest market revenue share through the projected period.

Based on the product type, the chemical tankers market is classified into organic chemicals, inorganic chemicals, vegetable oils, and fats. Among these, the organic chemicals segment is estimated to hold the highest market revenue share through the projected period. Organic chemicals dominate the global market due to rising demand for pharmaceuticals, fertilizers, crop protection, pesticides, fuel additives, food and drinks, personal care products and cosmetics, water treatment, polymers, and other items. The shale gas boom in China and North America has increased the production of organic compounds, with ethylene serving as the primary raw source. The vegetable oil category is expected to increase at the fastest compound annual growth rate, both in terms of value and volume, fueling the expansion of the chemical tanker market.

The IMO 2 segment is anticipated to hold the largest market share through the forecast period.

Based on the fleet type, the chemical tankers market is divided into IMO 1, IMO 2, and IMO 3. Among these, the IMO 2 segment is anticipated to hold the largest market share through the forecast period. The IMO 2 fleet type segment of the chemical tanker market is expected to develop at the fastest CAGR in terms of value and volume over the forecast period. The usage of IMO 2 chemical tankers to ship vegetable oils and fats, as well as other types of chemicals such as alcohols, alkanes, and alkenyl amide, has contributed to the expansion of the IMO 2 fleet type section of the chemical tanker market.

- The deep-sea chemicals tankers (10,000- 50,000 dwt) segment dominates the market with the largest market share through the forecast period.

Based on the fleet size, the chemical tankers market is categorized into inland chemical tankers (1000-4999 dwt), coastal chemical tankers (5000-9999 dwt), and deep-sea chemicals tankers (10,000- 50,000 dwt). Among these, the deep-sea chemicals tankers (10,000- 50,000 dwt) segment dominates the market with the largest market share through the forecast period. Deep sea chemical tankers (10,000-50,000 DWT) account for the market, owing to increased cross-border chemical trade volumes. Chemical container demand has evolved dramatically away from traditional bulk trades and toward multiple hub-and-spoke long-haul routes connecting key producer and consumer economies across the world. Deep sea tankers are specifically constructed to transport chemicals across seas while adhering to demanding safety, environmental, and material compatibility requirements. Their huge cargo capacity enables operators to gain significant economies of scale by consolidating regional cargoes. Deep-sea trade lanes connecting North America, Europe, and the Asia Pacific have emerged as significant growth drivers for the sector, with demand fulfilled through the periodic deployment of deep-sea fleets. Deep sea boats are crucial to facilitating the efficient transfer of feedstock and finished products on a worldwide scale, as chemical production and consumption centers in emerging countries expand fast. Their critical role in lubricating globalization encourages continuing investment in deep-sea chemical tankers, hence ensuring the segment's dominant position.

Regional Segment Analysis of the Chemical Tankers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the chemical tankers market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the chemical tankers market over the predicted timeframe. Asia Pacific has the highest share of the worldwide market and is likely to maintain its dominance during the forecast period. The Asia-Pacific market accounts for around one-third of global chemical tanker revenue due to the rapid development of the petrochemical and refining markets, as well as increased investment expenditures. Furthermore, the GDP growth of emerging countries such as India, China, and Singapore has increased demand for diverse chemicals, boosting the chemical tanker industry in this region.Top of Form

Bottom of Form

North America is expected to grow at the fastest CAGR growth of the chemical tankers market during the forecast period. North America's growth expanded due to the rapid expansion of the shale gas industry in the region. Furthermore, due to the abundant supply and low prices of natural gas, the production of chemical products has begun to increase, and firms intend to expand their production capacity. North America's well-established petrochemical industry, based on the Gulf Coast, requires a large tanker capacity to deliver chemicals both domestically and globally.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the chemical tankers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JO Tankers

- MOL Chemicals Tankers

- MISC Berhad

- IINO KAIUN KAISHA

- Eitzen Chemicals

- Tokyo Marine Asia Pte. Ltd.

- Berlian Laju Tanker

- Norden

- Pacific Carrier Limited

- Team Tankers International

- Stolt-Nielsen Limited

- Seatrans Chemicals Tankers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Fairfield Chemical Carriers and MOL Chemical Tankers announced a key milestone in our rebranding efforts. The vessel formerly known as the "Fairchem Blade" has been renamed the "Blade Galaxy," demonstrating our dedication to a consistent brand. Furthermore, the vessel's funnel has been repainted to clearly show the MOL Chemical Tanker logo, representing our unified brand and forward-looking perspective.

- In June 2024, The Maritime Standard is launching the program for the 2024 edition of its well-established Tanker Conference. Aimed at important decision-makers and influencers within the tanker shipping industry.

- In March 2024, MOL Chemical Tankers Pte. Ltd. (MOLCT) and Fairfield-Maxwell Ltd. announced today that they have obtained all necessary regulatory approvals and that MOLCT has completed its all-cash acquisition of all of the shares of Fairfield Chemical Carriers Pte. Ltd. with an effective date of March 1 for approximately US$400 million.

- In February 2024, NYK Stolt Tankers, a joint venture between NYK and Stolt Tankers B.V. ("Stolt Tankers"), inked a deal with China's Nantong Xiangyu Shipyard to build six parcel chemical tankers. The deal will improve NYK's chemical tanker business, which is set to grow rapidly, as well as deepen its cooperation with Stolt Tankers, an industry leader.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the chemical tankers market based on the below-mentioned segments:

Global Chemical Tankers Market, By Product Type

- Organic Chemicals

- Inorganic Chemicals

- Vegetable Oils

- Fats

Global Chemical Tankers Market, By Fleet Type

- IMO 1

- IMO 2

- IMO 3

Global Chemical Tankers Market, By Fleet Size

- Inland Chemical Tankers (1000-4999 DWT)

- Coastal Chemical Tankers (5000-9999 DWT)

- Deep-Sea Chemicals Tankers (10,000- 50,000 DWT)

Global Chemical Tankers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the chemical tankers market over the forecast period?The chemical tankers market is projected to expand at a CAGR of 4.40% during the forecast period.

-

2. What is the market size of the chemical tankers market?The Global Chemical Tankers Market Size is Expected to Grow from USD 34.40 Billion in 2023 to USD 52.90 Billion by 2033, at a CAGR of 4.40% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the chemical tankers market?Asia Pacific is anticipated to hold the largest share of the chemical tankers market over the predicted timeframe.

Need help to buy this report?