Global Chemical Warehousing Market Size, Share, Growth, and Industry Analysis, By Warehousing Type (General Warehouse, Specialty Chemicals Warehouse), By Chemical Type (Synthetic Rubber, Petrochemicals, Agrochemicals, Consumer Chemicals, Construction Chemicals), and Regional Chemical Warehousing and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Chemical Warehousing Market Insights Forecasts to 2033

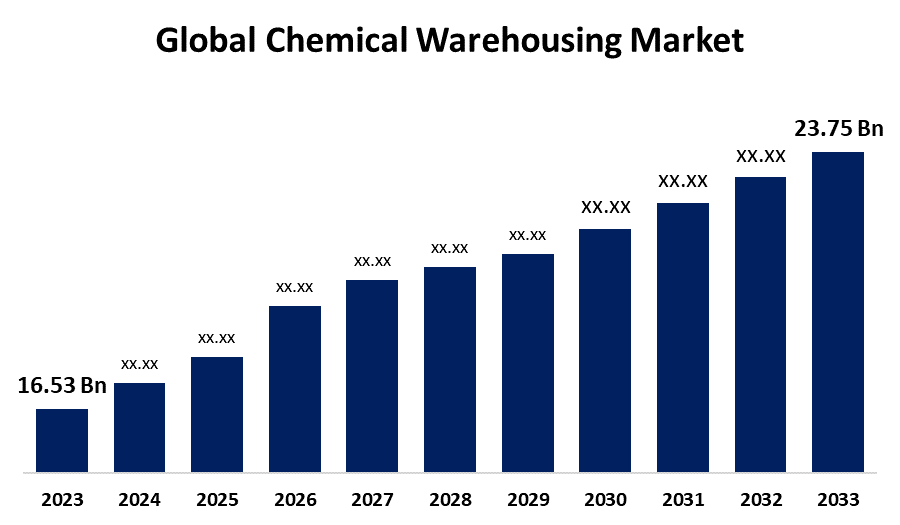

- The Global Chemical Warehousing Market Size Was Valued at USD 16.53 Billion in 2023

- The Market Size is Growing at a CAGR of 3.69 % from 2023 to 2033

- The Worldwide Chemical Warehousing Market Size is Expected to Reach USD 23.75 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Chemical Warehousing Market Size is Anticipated to Exceed USD 23.75 Billion by 2033, Growing at a CAGR of 3.69 % from 2023 to 2033.

CHEMICAL WAREHOUSING MARKET REPORT OVERVIEW

Chemical warehousing, which encompasses the storage of hazardous products, is an extremely regulated activity that necessitates significant investments in the physical storage environment and strict adherence to related procedures, policies, and documentation to guarantee compliance and security. One of the key strategies for safe chemical storage is to implement a zoned layout. This technique entails grouping compounds based on compatibility, degree of hazard, and required storage conditions. By establishing distinct zones for each category, chemical reactions are less likely to occur and cross-contamination is avoided. To safeguard individuals, groups, and the environment, specialized solutions are needed due to the risks connected with hazardous materials. Reputable chemical warehousing companies prioritize quality control, create innovative layouts, and concentrate on safety to deliver essential services to a range of industries. Rhenus India closely adheres to all legal requirements and safety guidelines when it comes to the shipping and storage of chemical products. Allcargo Supply Chain (ASPL), the contract logistics business arm of Allcargo Group, has established a state-of-the-art Grade A chemical warehousing facility at its massive multi-user chemical warehousing complex in Navi Mumbai. A best practice guide for hydrogen-driven logistics is being developed in partnership between the Dutch Association for Chemical Warehousing (VNCW) and the International Foundation for Chemical Logistics (IFCL). The goal of this project is to meet the growing need for logistics solutions that are more ecologically friendly and sustainable. Third-party logistics (3PL) service providers are essential to outsource storage and logistics needs in the chemical industry are expected to drive the market growth.

Report Coverage

This research report categorizes the market for the global chemical warehousing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global chemical warehousing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global chemical warehousing market.

Global Chemical Warehousing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 16.53 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.69 % |

| 023 – 2033 Value Projection: | USD 23.75 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Warehousing Type, By Chemical Type |

| Companies covered:: | Odyssey Logistics & Technology Corporation, Barentz, Brenntag, Tanner Industries, Caldic, CLH Group, Katoen Natie, Helm AG, Odfjell SE., Univar Solutions, Van den Bosch Transporten, Bertschi AG, BDP International, Stolt-Nielsen Limited, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

DRIVING FACTORS:

The need for chemical storage is going to boost as a result of increasing expenditures in the worldwide chemical sector.

The increasing expenditures being made in the worldwide expansion of the chemicals and materials industry are expected to propel the growth of the chemical warehousing market. Given that a vast array of businesses, including building, food and beverage, oil and gas, healthcare, and other high-revenue sectors, use chemicals, they are an indispensable part of the modern world. For instance, the unwavering dedication of Aarti Industries to the Indian chemical sector is demonstrated by the company's large investment plans, which total between Rs 2,500 crore and Rs 3,000 crore and are scheduled for FY24 and FY25. This substantial investment, which was mostly used to improve infrastructure and industrial facilities, is evidence of the company's faith in the chemical industry's continued expansion in India.

RESTRAINING FACTORS

High operating costs are expected to reduce the market growth.

The increased operating costs related to the chemicals storage sector are going to restrict the worldwide chemical warehousing industry. Due to the industry's extreme specialization, sophisticated storage solutions—like drums and barrels—that can safely hold harsh and dangerous chemicals must be used. Furthermore, the strict guidelines created to prevent chemical exposure in the environment or to humans further raise overall costs.

Market Segmentation

The chemical warehousing market share is classified into warehousing type and chemical type.

The specialty chemicals warehouse segment accounted for the largest market share during the forecast period.

Based on warehousing type, the chemical warehousing is classified into general warehouse, specialty chemicals warehouse. Among these, the specialty chemicals warehouse segment accounted for the largest market share during the forecast period. The increased demand for electronics and advancements in technology caused the specialized warehouse segment to lead the industry in terms of market share. Furthermore, a wide range of industries, including food and beverage, agriculture, cosmetics, automotive, textile, aerospace, and manufacturing, use specialty chemicals for a variety of purposes. These industries also use these chemicals to produce a wide range of products, including polymers, food additives, lubricants, colors, paints and adhesives, industrial gases, and textile auxiliaries. Specialty chemicals, renewable energy components, electric vehicle batteries, and semiconductor materials are expected to have significant growth in the worldwide and Indian chemical sectors by 2024. Innovation and home manufacturing are being propelled by trends like "Make in India" efforts, robust supply networks, and sustainability.

The agrochemicals segment has the highest market growth during the forecast period.

Based on chemical type, the chemical warehousing is classified into synthetic rubber, petrochemicals, agrochemicals, consumer chemicals, construction chemicals. Among these, the agrochemicals segment has the highest market growth during the forecast period. The agrochemical market segment has only become stronger over time due to the growing reliance on these chemicals to improve crop quality and output, which continues to be the case as long as there is a need for food. In Canada, a dealer network made up of local representatives of bigger multi-branch retail corporations as well as independent dealers store pesticides for sale. Pesticides are currently kept in storage at about 1,300 locations across the country. The Agrichemical Warehousing Standards Association (AWSA) was established and is run collaboratively by governments, producers, distributors, and warehouse operators. Its goal is to continuously enhance the performance of agrichemical warehouses in Canada by establishing guidelines to reduce business risk, preserve the environment, and enhance working conditions.

Regional Segment Analysis of the Global Chemical Warehousing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

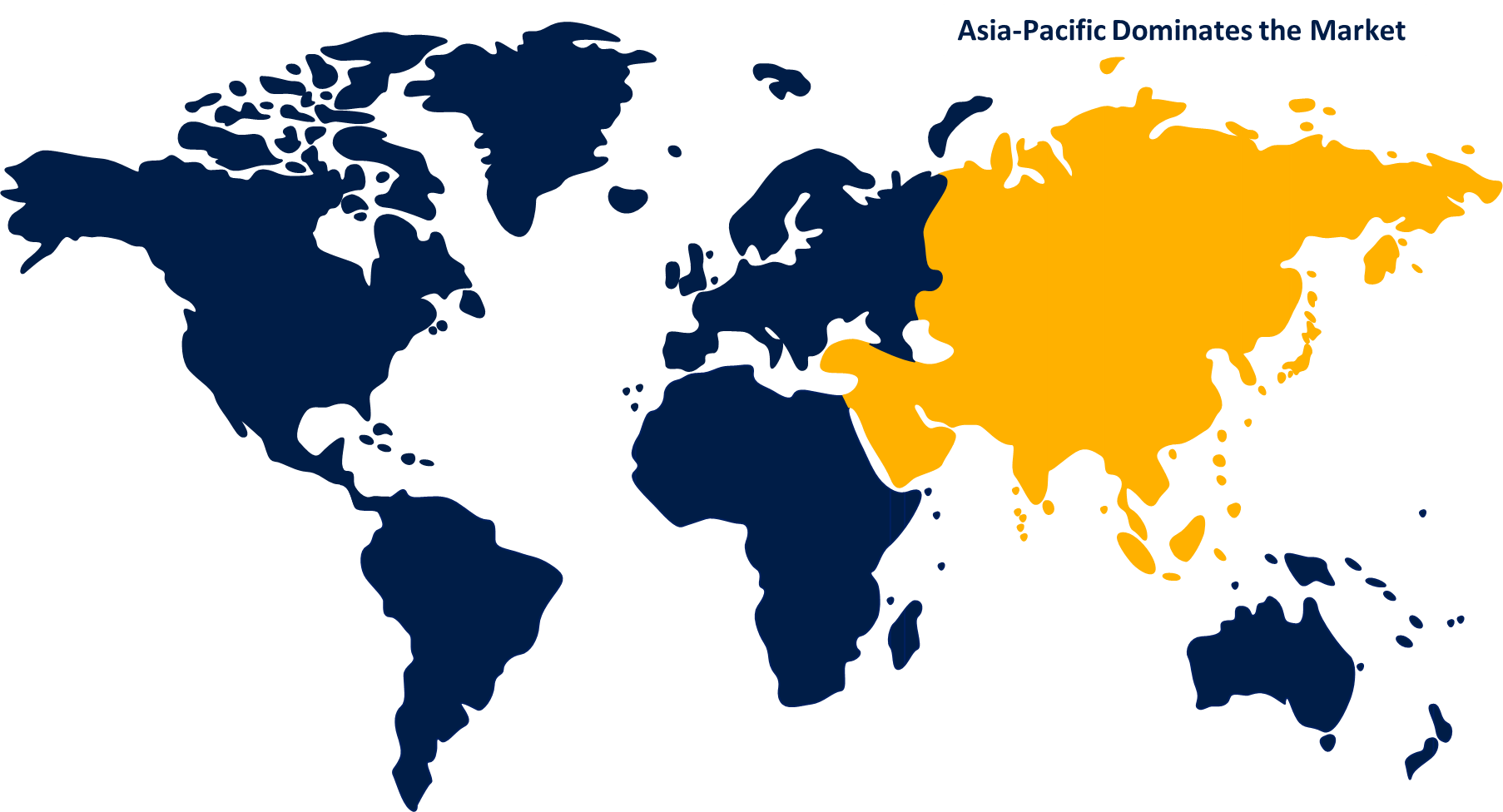

Asia-Pacific has the highest share of the chemical warehousing market throughout the forecast period.

Get more details on this report -

The rising chemical product production and consumption are driving the market in the region. The distribution and warehousing practices of several emerging economies in the region are anticipated to be impacted by the increasing demand for specialty and commodity chemicals. Significant factors contributing to the expansion of the market in the region are China, Japan, South Korea, India, and Australia. Chemical storage and warehousing facilitators in the area are drawn to the region primarily because of the strong market potential created by the emerging middle class's growing purchasing power.

The North America is the fastest growing region over the projected timeframe.

The North American region is expected to grow at the fastest rate due to the expanding e-commerce industry. The increased use of biopesticides and the growing need for specialty chemicals in the retail sector are supporting the growth of this market. The region's significant usage of biocides, lubricating oil additives, synthetic lubricants, corrosion inhibitors, institutional cleansers, and cosmetic chemicals also contributes to the market's expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global chemical warehousing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Odyssey Logistics & Technology Corporation

- Barentz

- Brenntag

- Tanner Industries

- Caldic

- CLH Group

- Katoen Natie

- Helm AG

- Odfjell SE.

- Univar Solutions

- Van den Bosch Transporten

- Bertschi AG

- BDP International

- Stolt-Nielsen Limited

- Others

Key Market Developments

- In February 2024, to accommodate the growing semiconductor sector in the Phoenix Metro Area, Rinchem created a gigantic custom-built hazardous (chemical) warehouse in Surprise, Arizona. The warehouse is 123,516 square feet and has 16,000 pallet spaces.

- In January 2022, in Port Klang, Malaysia, Leschaco opened a brand-new, 120,000-square-foot, two-story facility for hazardous materials and chemicals. Pallets of hazardous goods and chemicals can be stored in this new facility for up to 13,000 items.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global chemical warehousing market based on the below-mentioned segments:

Global Chemical Warehousing Market, By Warehousing Type

- General Warehouse

- Specialty Chemicals Warehouse

Global Chemical Warehousing Market, By Chemical Type

- Synthetic Rubber

- Petrochemicals

- Agrochemicals

- Consumer Chemicals

- Construction Chemicals

Global Chemical Warehousing Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global chemical warehousing market over the forecast period?The global chemical warehousing market size is expected to grow from USD 16.53 Billion in 2023 to USD 23.75 Billion by 2033, at a CAGR of 3.69 % during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global chemical warehousing market?Asia-Pacific is projected to hold the largest share of the global chemical warehousing market over the forecast period.

-

3.Who are the top key players in the chemical warehousing market?Odyssey Logistics & Technology Corporation, Barentz, Brenntag, Tanner Industries, Caldic, CLH Group, Katoen Natie, Helm AG, Odfjell SE, Univar Solutions, Van den Bosch Transporten, Bertschi AG, BDP International, Stolt-Nielsen Limited, and Others.

Need help to buy this report?