China Commercial Avionics Systems Market Size, Share, and COVID-19 Impact Analysis, By Sub System (Flight Management and Control, Health Monitoring, Electrical and Emergency, Communication Navigation and Surveillance, and Others), By Aircraft Type (Narrow Body, Wide Body, Regional & Business Jet, and Freighter), By Fit (Retrofit and Forward Fit), and China Commercial Avionics Systems Market Insights, Industry Trend, Forecasts to 2033.

Industry: Aerospace & DefenseChina Commercial Avionics Systems Market Insights Forecasts to 2033

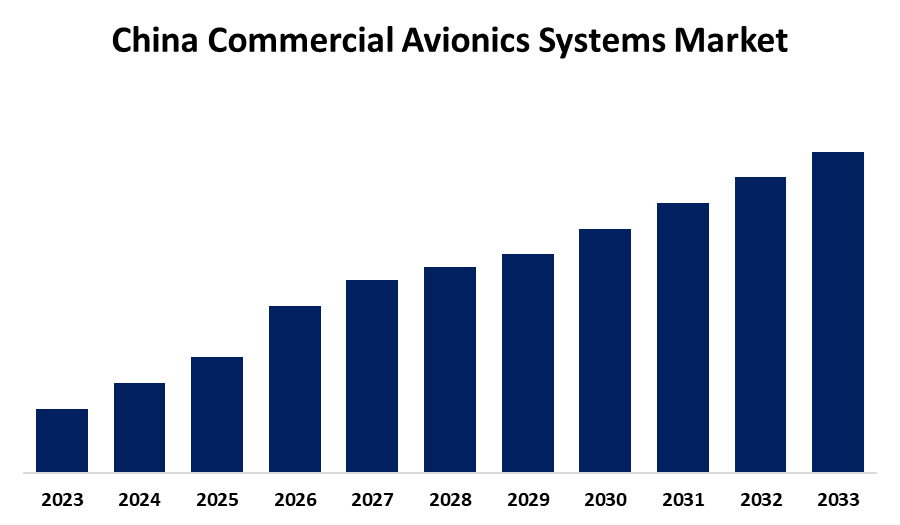

- The China Commercial Avionics Systems Market is Growing at a CAGR of 5.35% from 2023 to 2033

- The China Commercial Avionics Systems Market Size is Expected to Reach a Significant Share by 2033

Get more details on this report -

The China Commercial Avionics Systems Market is anticipated to reach a significant share by 2033, growing at a CAGR of 5.35% from 2023 to 2033.

Market Overview

China commercial avionics systems market involves the development and use of electronic systems in commercial airplanes, such as those for navigation, communication, and flight control. These systems are essential for ensuring safe and efficient air travel. As the demand for air travel continues to grow, there is an increasing focus on next-generation avionics solutions, such as flight management systems, autopilot systems, and electronic flight instrument systems (EFIS), to enhance operational efficiency, reduce pilot workload, and improve safety. The trend toward digitization and automation in aviation further drives the demand for these advanced systems. Additionally, China's government has been actively supporting the aviation industry through initiatives like the "Civil Aviation Development Strategy," which promotes the advancement of avionics technologies. Significant investments in the domestic aircraft manufacturing sector have also contributed to the market’s growth, as these investments help modernize aircraft fleets with state-of-the-art avionics. Moreover, the strategic collaborations between domestic and international avionics companies are providing ample opportunities for innovation and growth, fostering the development of cutting-edge technologies that cater to the evolving needs of the commercial aviation sector.

Report Coverage

This research report categorizes the market for the China commercial avionics systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China commercial avionics systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China commercial avionics systems market.

China Commercial Avionics Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.35% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Sub System, By Aircraft Type and COVID-19 Impact Analysis |

| Companies covered:: | L3 Harris Technologies, BAE Systems PLC, Raytheon Technologies Corporation, General Electric, Thales Group, Teledyne Technologies Inc, Meggitt PLC, Honeywell International Inc, Universal Avionics Systems Corporation, Panasonic Corporation, and Other key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rapid expansion of the aviation industry and increasing air travel demand are central to the market's development, requiring advanced avionics systems for safety, efficiency, and reliability. Second, the modernization of China's aircraft fleet is driving the need for state-of-the-art avionics technologies, such as flight management systems, autopilot systems, and electronic flight instrument systems (EFIS).

Restraining Factors

The complexity of integrating new avionics systems with existing aircraft fleets can be a time-consuming and resource-intensive process, potentially hindering upgrades and modernization efforts.

Market Segmentation

The China commercial avionics systems market share is classified into sub system, aircraft type, and fit.

- The communication navigation and surveillance segment accounted for the major revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The China commercial avionics systems market is segmented by sub system into flight management and control, health monitoring, electrical and emergency, communication navigation and surveillance, and others. Among these, the communication navigation and surveillance segment accounted for the major revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The segment growth can be attributed to the increasing demand for advanced communication and navigation technologies, driven by rising air traffic, the need for enhanced safety, and regulatory requirements for more efficient flight management.

- The narrow body segment accounted for the highest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The China commercial avionics systems market is segmented by aircraft type into narrow body, wide body, regional & business jet, and freighter. Among these, the narrow body segment accounted for the highest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The growth in this segment is driven because narrow-body aircraft are widely used for short- to medium-haul flights, which are in high demand due to the growing number of domestic and international passengers. The rising demand for affordable air travel options and the modernization of narrow-body fleets with advanced avionics systems are key factors driving the growth of this segment.

- The forward fit segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The China commercial avionics systems market is segmented by fit into retrofit and forward fit. Among these, the forward fit segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The increasing demand for modern, technologically advanced aircraft is a key factor driving the growth of this segment, as airlines and aircraft manufacturers are increasingly opting for next-generation avionics systems to ensure higher levels of safety, efficiency, and performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China commercial avionics systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L3 Harris Technologies

- BAE Systems PLC

- Raytheon Technologies Corporation

- General Electric

- Thales Group

- Teledyne Technologies Inc

- Meggitt PLC

- Honeywell International Inc

- Universal Avionics Systems Corporation

- Panasonic Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2024, COMAC (Commercial Aircraft Corporation of China) advanced its avionics systems for the C919 aircraft, featuring enhanced autopilot capabilities and next-generation cockpit displays.

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the China commercial avionics systems market based on the below-mentioned segments:

China Commercial Avionics Systems Market, By Sub System

- Flight Management and Control

- Health Monitoring

- Electrical and Emergency

- Communication Navigation and Surveillance

- Others

China Commercial Avionics Systems Market, By Aircraft Type

- Narrow Body

- Wide Body

- Regional & Business Jet

- Freighter

China Commercial Avionics Systems Market, By Fit

- Retrofit

- Forward Fit

Need help to buy this report?