China Construction Market Size, Share, and COVID-19 Impact Analysis, By Construction Type (New Construction and Renovation & Remodeling), By Sector (Residential, Commercial, Industrial, Infrastructure, Energy, and Utilities), and China Construction Market Insights, Industry Trend, Forecasts to 2033.

Industry: Construction & ManufacturingChina Construction Market Insights Forecasts to 2033

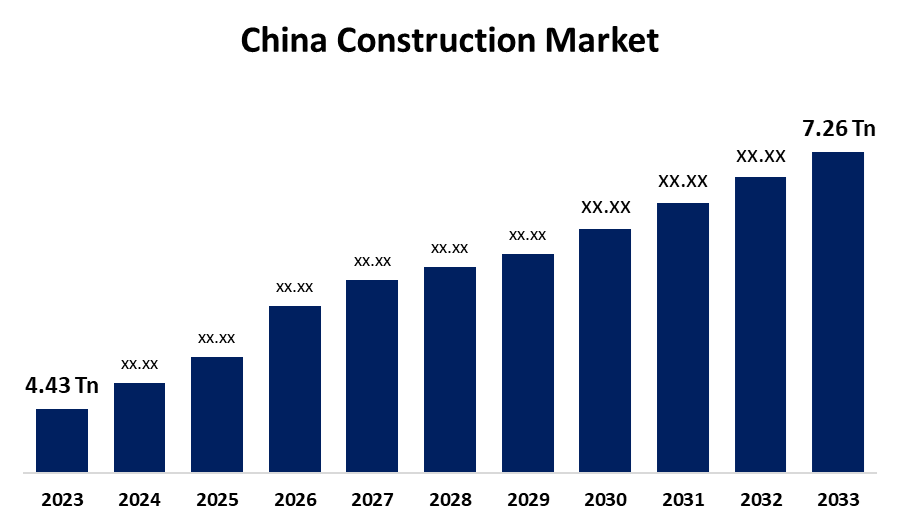

- The China Construction Market Size was valued at USD 4.43 Trillion in 2023.

- The Market Size is Growing at a CAGR of 5.06% from 2023 to 2033

- The China Construction Market Size is Expected to Reach USD 7.26 Trillion by 2033

Get more details on this report -

The China Construction Market Size is Anticipated to Reach USD 7.26 Trillion by 2033, growing at a CAGR of 5.06% from 2023 to 2033.

Market Overview

The China construction market involves the development, design, building, and renovation of infrastructure, residential, commercial, and industrial properties. It is driven by factors such as rapid urbanization, growing population, and increasing foreign investments in the real estate sector. Infrastructure development, such as transportation networks, is essential for supporting economic growth in major cities. Technological advancements, such as Building Information Modeling (BIM) and green construction technologies, enhance efficiency and sustainability in construction projects. Government initiatives, such as the "Made in China 2025" initiative and the Belt and Road Initiative (BRI), have played a significant role in shaping the market. The government's focus on advanced technologies and innovation in construction practices, as well as programs promoting sustainable building practices, contribute to long-term market growth. Overall, the China construction market is a vital sector for the country's economic growth.

Report Coverage

This research report categorizes the market for the China construction market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China construction market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China construction market.

China Construction Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.43 Trillion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.06% |

| 023 – 2033 Value Projection: | USD 7.26 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Construction Type, By Sector and COVID-19 Impact Analysis |

| Companies covered:: | China State Construction Engineering, China Railway Group, China Railway Construction, China Communications Construction Company, Power Construction Corporation of China, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

Fast urbanization, which generates a steady demand for residential, commercial, and industrial structures, is one of the main drivers propelling the expansion of the Chinese construction market. The country's growing middle class and sizable population also raise demand for infrastructure and housing. Initiatives supported by the government, such as the Belt and Road Initiative (BRI), encourage the construction of extensive infrastructure both at home and abroad. The efficiency, precision, and sustainability of construction projects are further improved by technological developments including the use of smart building technologies and Building Information Modeling (BIM), which propels market expansion.

Restraining Factors

High building expenses, environmental issues, legal restrictions, and safety requirements pose challenges to the construction sector. Projects may be impractical in less developed areas or smaller cities. Market instability and changes in government expenditure can impact project timelines and profitability. Additionally, the lack of experienced laborers could hinder the industry's expansion due to the growing demand for competent workers in complex projects.

Market Segmentation

The China construction market share is classified into construction type and sector.

- The new construction segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The China construction market is segmented by construction type into new construction and renovation & remodeling. Among these, the new construction segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is mostly due to the nation's fast urbanization, which has raised demand for infrastructure, business, and residential growth in cities and their environs. The new construction sector is further driven by the government's emphasis on major infrastructure projects including highways, transportation networks, and urban expansion. New construction and updated infrastructure are also in high demand due to the rise of smart cities and the expanding middle class.

- The infrastructure segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the sector, the China construction market is divided into residential, commercial, industrial, infrastructure, energy, and utilities. Among these, the infrastructure segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is mostly due to the government's emphasis on major infrastructure projects, like building public utilities, urban infrastructure, and transportation networks (roads, railroads, and airports) to support the nation's fast urbanization and economic expansion. The necessity for significant infrastructure development in China and abroad is further heightened by the Belt and Road Initiative (BRI).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China construction market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China State Construction Engineering

- China Railway Group

- China Railway Construction

- China Communications Construction Company

- Power Construction Corporation of China

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, Guangxi Resources Planning and Design Group and One Click LCA, a pioneer in environmental product declaration (EPD) software, collaborated to advance sustainable product development in China. Through this partnership, Chinese producers will be able to provide reliable and accurate EPDs, facilitate exports to EU nations, and ensure compliance with new laws such as the Carbon Border Adjustment Mechanism (CBAM).

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the China construction market based on the below-mentioned segments:

China Construction Market, By Construction Type

- New Construction

- Renovation & Remodeling

China Construction Market, By Sector

- Residential

- Commercial

- Industrial

- Infrastructure

- Energy

- Utilities

Need help to buy this report?