China Continuous Glucose Monitoring Devices Market Size, Share, and COVID-19 Impact Analysis, By Component (Transmitters, Receivers, Insulin Pumps, and Sensors), and By End User (Hospitals & Clinics, Homecare Settings, and Others), and China Continuous Glucose Monitoring Devices Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareChina Continuous Glucose Monitoring Devices Market Insights Forecasts to 2033

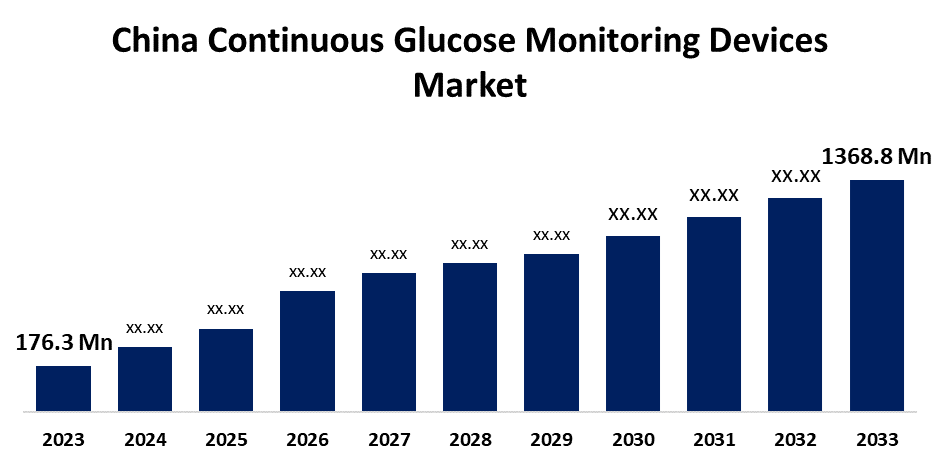

- The China Continuous Glucose Monitoring Devices Market Size was valued at USD 176.3 Million in 2023.

- The Market is Growing at a CAGR of 22.75% from 2023 to 2033

- The China Continuous Glucose Monitoring Devices Market Size is Expected to Reach USD 1368.8 Million by 2033

Get more details on this report -

The China Continuous Glucose Monitoring Devices Market is Anticipated to Reach USD 1368.8 Million by 2033, growing at a CAGR of 22.75% from 2023 to 2033

Market Overview

Blood sugar levels are monitored continuously by wearable devices called continuous glucose monitoring (CGM) devices. Diabetes can be easily and successfully managed with the help of CGM systems, which are minimally intrusive. Moreover, they can recognize impulsive fluctuations in blood glucose levels, which helps to avoid hypoglycemia. With the help of a sensor, the CGM devices allow for easier analysis of blood glucose levels at various intervals. There is a growing need for continuous glucose monitoring equipment to track and keep ideal blood glucose levels. The market growth for continuous glucose monitoring (CGM) devices is partly driven by the rising incidence of diabetes as an effect of aging, obesity, and bad lifestyle choices. The growing prevalence of prediabetes and the aging population are driving the market's growth.

Report Coverage

This research report categorizes the market for the China continuous glucose monitoring devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China continuous glucose monitoring devices market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China continuous glucose monitoring devices market.

China Continuous Glucose Monitoring Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 176.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 22.75% |

| 2033 Value Projection: | USD 1368.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Component, By End User, COVID-19 Empact, Challenges, Future, Growth, & Analysis |

| Companies covered:: | Goodix Technology, Abbott, Medtronic, Dexcom, Ascensia, Senseonics, Texas Instruments, Sibionics, Microchip Technology Inc, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

With the use of continuous glucose monitoring devices, patients and medical professionals can better control their diabetes by getting real-time glucose levels which drives market growth. The growing population awareness of diabetes and its increasing incidence are driving the growth of the continuous blood glucose monitoring devices market. Obesity and being overweight are the main causes of diabetes, it is expected that the increase in the number of overweight and obese individuals would increase demand for continuous glucose monitoring devices market. The need for continuous glucose monitoring devices is expected to increase as diagnostic lab penetration increases the demand in the country.

Restraining Factors

The potential expense of continuous glucose monitoring devices hinders their use, which can restrict the growth in the market.

Market Segmentation

The China continuous glucose monitoring devices market share is classified into component and end user

- The sensors segment is expected to hold the largest market share through the forecast period.

The China continuous glucose monitoring devices market is segmented by component into transmitters, receivers, insulin pumps, and sensors. Among these, the sensors segment is expected to hold the largest market share through the forecast period. Continuous glucose monitoring (CGM) devices are not complete without sensors. The copper filament used in CGM sensors is thinner than a needle and is placed into the fatty tissue close to the skin. To track the amount of glucose in the surrounding area, sticky tape is used to secure the sensor in place.

- The homecare settings segment is expected to dominate the China continuous glucose monitoring devices market during the forecast period.

Based on the end user, the China continuous glucose monitoring devices market is divided into hospitals & clinics, homecare settings, and others. Among these, the homecare settings segment is expected to dominate the China continuous glucose monitoring devices market during the forecast period. Devices for home healthcare settings allow patients to take lower insulin doses and provide continuous blood glucose monitoring. The need for CGM devices is anticipated to increase in homecare settings due to the convenient and effective blood glucose monitoring available at that place.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China continuous glucose monitoring devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Goodix Technology

- Abbott

- Medtronic

- Dexcom

- Ascensia

- Senseonics

- Texas Instruments

- Sibionics

- Microchip Technology Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Goodix Technology launched its automotive-grade Bluetooth LE SoC and Continuous Glucose Monitoring (CGM) solutions at electronica China. Goodix displayed its latest products and business achievements, demonstrating a commitment to innovation in sensing and wireless technologies and accelerating the adoption of new applications in the automotive electronics and healthcare industries.

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the China continuous glucose monitoring devices market based on the below-mentioned segments:

China Continuous Glucose Monitoring Devices Market, By Component

- Transmitters

- Receivers

- Insulin Pumps

- Sensors

China Continuous Glucose Monitoring Devices Market, By End User

- Hospitals & Clinics

- Homecare Settings

- Others

Need help to buy this report?