China Diabetes Devices Market Size, Share, and COVID-19 Impact Analysis, By Management Devices (Insulin Pumps, Insulin Syringes, Infusion Sets, Insulin Cartridges, Disposable Pens, and Insulin Jet Injectors) and By Monitoring Devices (Self-Monitoring Blood Glucose and Continuous Glucose Monitoring), and China Diabetes Devices Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareChina Diabetes Devices Market Insights Forecasts to 2033

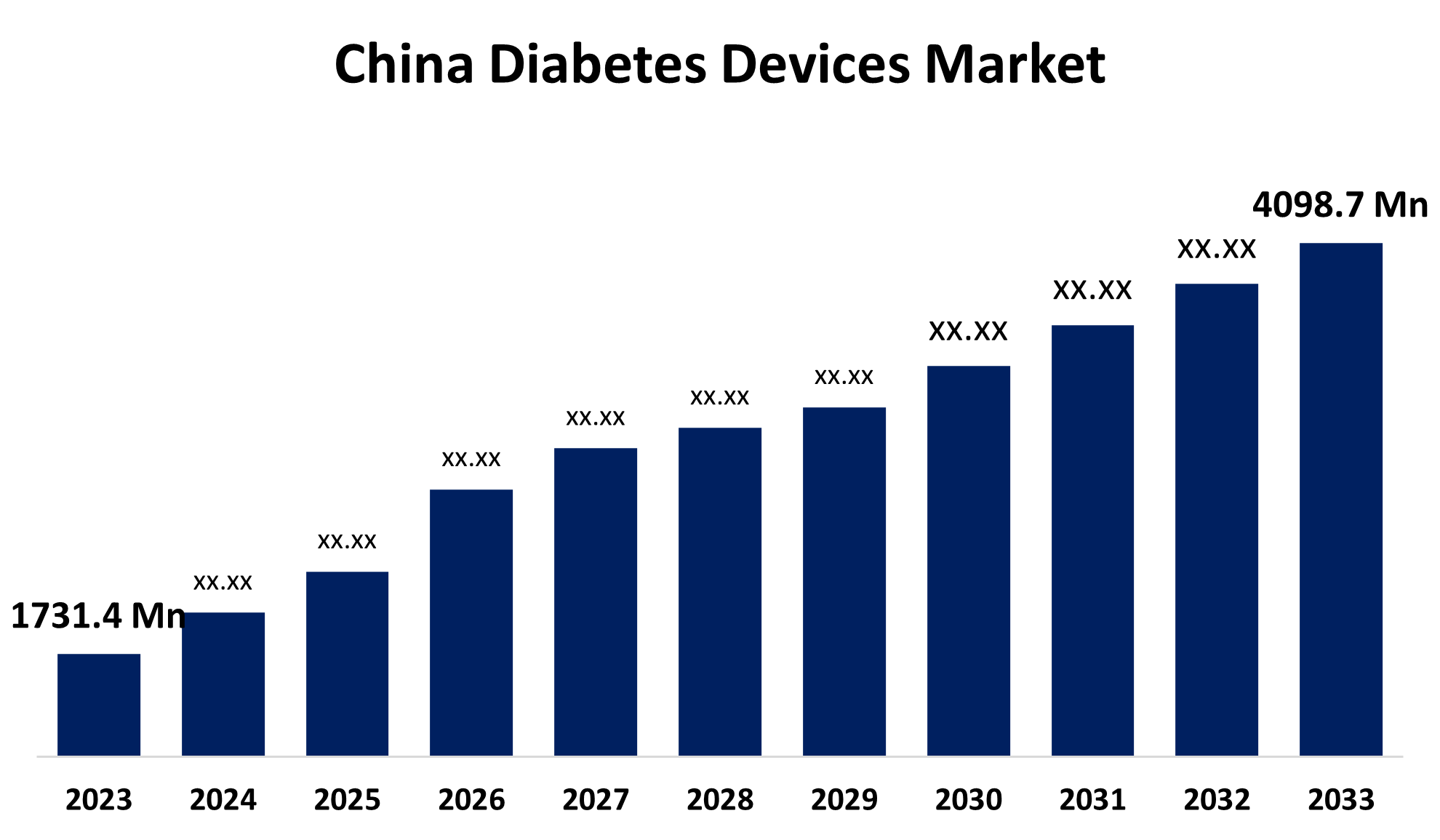

- The China Diabetes Devices Market Size was valued at USD 1,731.4 Million in 2023.

- The Market Size is Growing at a CAGR of 9.00% from 2023 to 2033

- The China Diabetes Devices Market Size is Expected to Reach USD 4,098.7 Million by 2033

Get more details on this report -

The China Diabetes Devices Market Size is Anticipated to Reach USD 4,098.7 Million by 2033, growing at a CAGR of 9.00% from 2023 to 2033.

Market Overview

The production, manufacturing, and distribution of devices used for diabetes treatment and monitoring are all included in the China diabetes devices market. Among these devices are insulin pens, continuous glucose monitoring (CGM) systems, insulin pumps, and blood glucose meters. The market for these devices has expanded rapidly in response to the rising number of diabetes cases in China, as patients seek effective management strategies for their illnesses. The rising incidence of diabetes, especially among the elderly and those with unhealthy lifestyle choices, is one of the primary factors propelling the Chinese market for diabetes devices. China's rapid urbanization and the growing use of modern healthcare solutions have increased the demand for diabetes management devices. Technological advancements, such as glucose monitoring devices and insulin delivery equipment, have improved patient compliance and treatment outcomes. Government policies, such as reimbursement schemes for diabetes-related devices, and initiatives to raise awareness about diabetes prevention and management, have also contributed to market expansion. China's active involvement in international collaborations in the healthcare industry further promotes the development and distribution of advanced diabetes devices within the country.

Report Coverage

This research report categorizes the market for the China diabetes devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China diabetes devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China diabetes devices market.

China Diabetes Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1,731.4 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.00% |

| 2033 Value Projection: | USD 4,098.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Management Devices, By Monitoring Devices |

| Companies covered:: | Abbott, Roche, Becton, Dickinson & Company, Dexcom, Lepu Medical Technology (CN), MicroPort (CN), Johnson & Johnson, Medtronic, Ascensia Diabetes Care, and other Key players. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for effective diabetes management solutions is greatly increased by the growing number of diabetes patients, particularly in metropolitan areas and among the aging population. The number of instances of diabetes is also increased by rising lifestyle-related risk factors, such as a poor diet and a lack of physical activity. Moreover, technical developments have produced more accurate and practical tools, including insulin pumps and continuous glucose monitoring (CGM), that improve patient outcomes and compliance. Along with more access to healthcare services and a growing need for self-management devices, the market is growing as a result of growing awareness of the importance of early diagnosis and appropriate diabetes management.

Restraining Factors

Advanced diabetes devices are expensive, limiting access, particularly for lower-income groups, despite government reimbursement options. The complexity of integrating new technology into healthcare infrastructure and patient education requirements may hinder adoption. The presence of counterfeit or inferior devices can also damage consumer confidence. Additionally, approval and distribution regulatory challenges may hinder innovation and market expansion.

Market Segmentation

The China diabetes devices market share is classified into management devices and monitoring devices.

- The insulin pumps segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The China diabetes devices market is segmented by management devices into insulin pumps, insulin syringes, infusion sets, insulin cartridges, disposable pens, and insulin jet injectors. Among these, the insulin pumps segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growing need for advanced, automated insulin administration devices is mostly to blame for this. Insulin pumps improve the health of people with diabetes, especially those with type 1 diabetes, by offering a more accurate and customizable method of administering insulin. Continuous and variable insulin delivery is made possible by insulin pumps, which are particularly helpful in maintaining blood glucose levels within a desired range and so improving long-term health outcomes.

- The self-monitoring blood glucose segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the monitoring device, the China diabetes devices market is divided into self-monitoring blood glucose and continuous glucose monitoring. Among these, the self-monitoring blood glucose segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is mostly because diabetics have been using them frequently for daily blood glucose checks. SMBG meters are the most common for diabetics in their homes since they are widely accessible, reasonably priced, and easy to use, whether they are the traditional type or their more recent versions. Patients can use the SMBG meters to take repeated measures throughout the day, depending on their current needs to monitor their blood glucose levels and make real-time dietary and insulin administration adjustments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China diabetes devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- Roche

- Becton, Dickinson & Company

- Dexcom

- Lepu Medical Technology (CN)

- MicroPort (CN)

- Johnson & Johnson

- Medtronic

- Ascensia Diabetes Care

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, China's National Medical Products Administration (NMPA) approved Novo Nordisk's Ozempic (semaglutide) therapy for type 2 diabetes. The medication, a GLP-1 receptor agonist, has shown promise in lowering blood sugar and promoting weight loss.

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the China diabetes devices market based on the below-mentioned segments:

China Diabetes Devices Market, By Management Devices

- Insulin Pumps

- Insulin Syringes

- Infusion Sets

- Insulin Cartridges

- Disposable Pens

- Insulin Jet Injectors

China Diabetes Devices Market, By Monitoring Devices

- Self-Monitoring Blood Glucose

- Continuous Glucose Monitoring

Need help to buy this report?