China Natural Fiber Market Size, Share, and COVID-19 Impact Analysis, By Plant-based Fiber (Cotton, Linen, Jute, and Hemp), By Animal-based Fiber (Wool and Silk), and China Natural Fiber Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsChina Natural Fiber Market Insights Forecasts to 2033

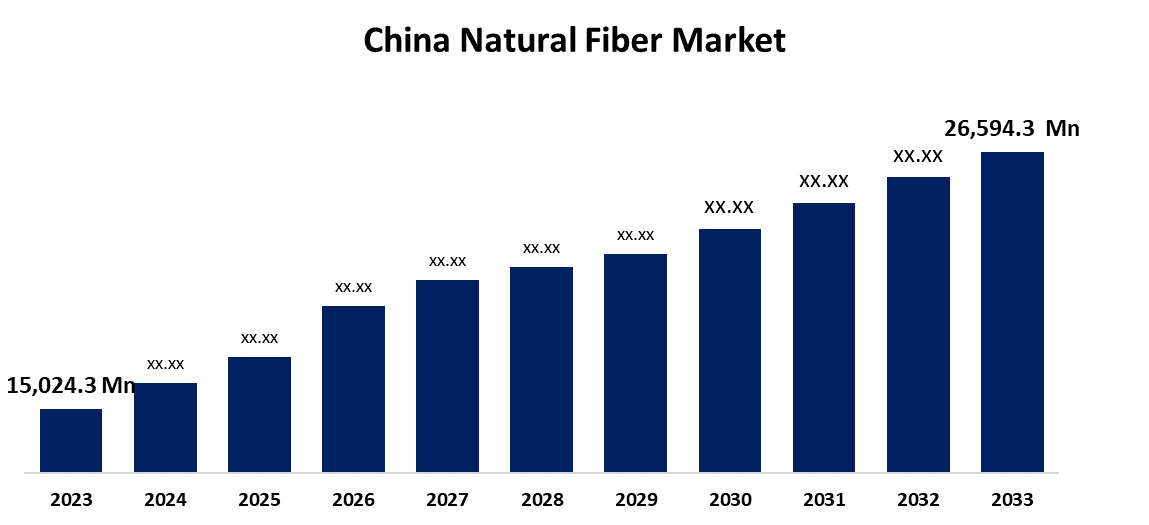

- The China Natural Fiber Market Size was Valued at USD 15,024.3 Million in 2023.

- The Market Size is Growing at a CAGR of 5.88% from 2023 to 2033

- The China Natural Fiber Market Size is Expected to Reach USD 26,594.3 Million by 2033

Get more details on this report -

The China Natural Fiber Market Size is Anticipated to Exceed USD 26,594.3 Million by 2033, Growing at a CAGR of 5.88% from 2023 to 2033.

Market Overview

The China natural fiber market refers to the industry involved in the production, processing, and distribution of fibers derived from plant and animal sources, including cotton, hemp, flax, wool, and silk. These fibers are widely used in textile, automotive, packaging, and home furnishing industries due to their biodegradable and sustainable nature. Rising consumer preference for eco-friendly products and advancements in fiber processing technologies are contributing to market expansion. The market is driven by increasing demand for sustainable and biodegradable materials, particularly in the textile and apparel industries. Growing awareness of environmental concerns and the harmful effects of synthetic fibers has led to a shift toward natural alternatives. The expanding middle class and rising disposable income further support the demand for premium natural fiber-based products. Additionally, innovations in fiber processing and the integration of natural fibers in sectors such as automotive and construction enhance market growth. The Chinese government has introduced policies promoting sustainable textile production and the use of eco-friendly materials. Initiatives such as the Made in China 2025 strategy emphasize green manufacturing and technological advancements in fiber production. Subsidies for natural fiber cultivation, stricter environmental regulations on synthetic fiber production, and incentives for sustainable textile enterprises further support the market. Additionally, China’s commitment to carbon neutrality by 2060 is expected to drive investment in natural fiber research and development.

Report Coverage

This research report categorizes the market for the China natural fiber market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China natural fiber market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the China natural fiber market.

China Natural Fiber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15,024.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.88% |

| 2033 Value Projection: | USD 26,594.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Plant-based Fiber, By Animal-based Fiber and COVID-19 Impact Analysis |

| Companies covered:: | Vardhaman Textiles Limited, Grasim Industries Limited, ANANDHI TEXSTYLES, Bcomp, The Natural Fibre Company, Procotex,, FlexForm Technologies, Bast Fibre Technologies Inc., Lenzing AG, Barnhardt Natural Fibers, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The China natural fiber market is driven by increasing demand for sustainable and biodegradable materials, particularly in the textile, automotive, and packaging industries. Rising environmental awareness and concerns over synthetic fiber pollution have accelerated the shift toward natural alternatives. The expanding middle-class population and growing consumer preference for premium, eco-friendly products further fuel market growth. Government initiatives promoting green manufacturing, subsidies for natural fiber cultivation, and stricter regulations on synthetic fiber production enhance industry expansion. Technological advancements in fiber processing and innovations in blended textiles also contribute to market growth, making natural fibers more durable and versatile for various applications.

Restraining Factors

High production costs and the limited scalability of natural fibers pose challenges for market growth. Fluctuations in raw material availability due to climate conditions impact supply stability. Additionally, competition from synthetic fibers, which offer lower costs and higher durability, restricts market expansion.

Market segmentation

The China natural fiber market share is classified into plant-based fiber and animal-based fiber.

- The cotton segment is expected to hold the largest market share through the forecast period.

The China natural fiber market is segmented by plant-based fiber into cotton, linen, jute, and hemp. Among these, the cotton segment is expected to hold the largest market share through the forecast period. Cotton dominates due to its widespread use in the textile and apparel industries, strong domestic production, and high consumer preference for soft, breathable fabrics. China is one of the largest producers and consumers of cotton, supported by government subsidies and advancements in cotton farming techniques.

- The silk segment is expected to hold the largest market share through the forecast period.

The China natural fiber market is segmented by animal-based fiber into wool and silk. Among these, the silk segment is expected to hold the largest market share through the forecast period. China is the world’s leading producer and exporter of silk, with a well-established sericulture industry and advanced processing technologies. The high demand for silk in luxury textiles, apparel, and home furnishings, coupled with its superior strength, luster, and softness, drives market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China natural fiber market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vardhaman Textiles Limited

- Grasim Industries Limited

- ANANDHI TEXSTYLES

- Bcomp

- The Natural Fibre Company

- Procotex,

- FlexForm Technologies

- Bast Fibre Technologies Inc.

- Lenzing AG

- Barnhardt Natural Fibers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the China natural fiber market based on the below-mentioned segments:

China Natural Fiber Market, By Plant-based Fiber

- Cotton

- Linen

- Jute

- Hemp

China Natural Fiber Market, By Animal-based Fiber

- Wool

- Silk

Need help to buy this report?