China Online Insurance Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Life Insurance and Non-Life Insurance), By Type of Provider (Insurance Companies, Third Party Administrators, and Brokers), and China Online Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsChina Online Insurance Market Insights Forecasts to 2033

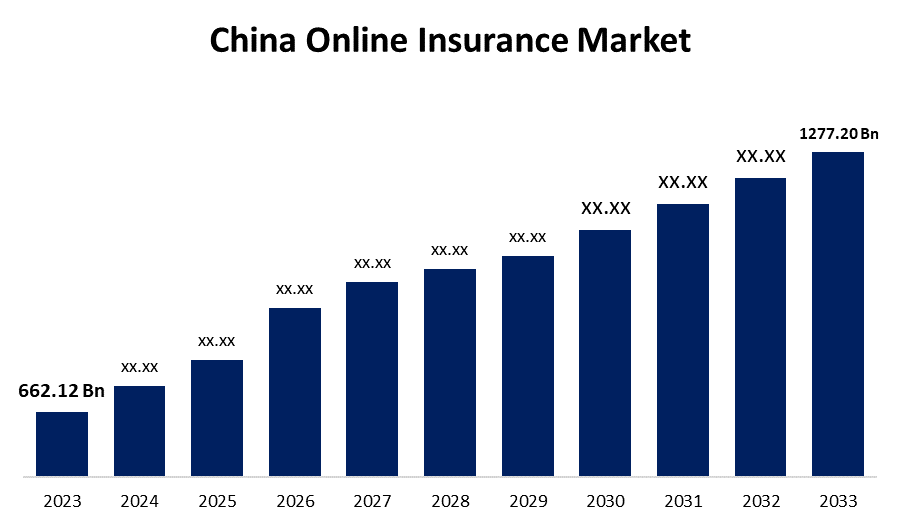

- The China Online Insurance Market Size was valued at USD 662.12 Billion in 2023.

- The Market is Growing at a CAGR of 6.79% from 2023 to 2033.

- The China Online Insurance Market Size is Expected to Reach USD 1277.20 Billion by 2033

Get more details on this report -

The China Online Insurance Market is Anticipated to Reach USD 1277.20 Billion by 2033, growing at a CAGR of 6.79% from 2023 to 2033.

Market Overview

A software or application called online insurance helps in the creation, management, and oversight of the online insurance ecosystem by a business. An insurance managing general agent (MGA) can develop, control, and manage the online insurance ecosystem with the use of the online insurance platform. Purchasing and administering insurance plans using online channels, including websites or mobile apps, is known as online insurance. These platforms integrate many systems and components inside the online insurance ecosystem. It is expected that as digital solutions become more widely used, lucrative prospects are going to arise for the online insurance market to expand. Significant development prospects are being created for online insurance providers by the increased awareness of financial hazards and the demand for protection in unpredictable economic times. Due to the increasing use of smartphones, tablets, and other connected devices, the online insurance market is seeing a driving adoption of digital technology.

Report Coverage

This research report categorizes the market for the China online insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China online insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China online insurance market.

China Online Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 662.12 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.79% |

| 2033 Value Projection: | USD 1277.20 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Type of Provider |

| Companies covered:: | ZhongAn, FWD, Instony, Cheche Group Inc., Huize, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Online insurers use a variety of marketing techniques to stay relevant in this competitive field, including significant savings on insurance premiums, multi-policy discounts, and advertising campaigns. The market is growing due to more consumers being attracted by these savings to move from traditional to online insurance services. The rapidly expanding online insurance market is driven by several interrelated variables that change the market's composition and appearance. Growth is also driven by the emergence of insurance businesses, which use technology to provide unique products and individualized experiences. The emergence of inventive digital insurance solutions is being accelerated by the proliferation of insurance companies, augmenting the growth of the online insurance market.

Restraining Factors

The development of the digital revolution is slow, and problems with security and privacy restrict the growth of the online insurance market.

Market Segmentation

The China online insurance market share is classified into product type and type of provider.

- The life insurance segment is expected to hold the largest market share through the forecast period.

The China online insurance market is segmented by product type into life insurance and non-life insurance. Among these, the life insurance segment is expected to hold the largest market share through the forecast period. The size and complexity of life insurance policies have an important effect on the way the online insurance market is developed. Life insurance plays a crucial role in risk management and financial planning, contributing significantly to both individual and family financial portfolios.

- The insurance companies segment is expected to dominate the China online insurance market during the forecast period.

Based on the type of provider, the China online insurance market is divided into insurance companies, third-party administrators, and brokers. Among these, the insurance companies segment is expected to dominate the China online insurance market during the forecast period. The main suppliers of insurance products and services are insurance companies, which also manage risk, underwrite policies, and pay out claims to policyholders.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China online insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ZhongAn

- FWD

- Instony

- Cheche Group Inc.

- Huize

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, the top car insurance technology platform in China, Cheche Group Inc., announced that it collaborated with Wuhan Dongfeng Insurance Broker Co., Ltd. ("Dongfeng Insurance") as part of an effort to expand its network of partners and include industry leaders in the new energy vehicle ("NEV") space.

Market Segment

This study forecasts revenue at China, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the China online insurance market based on the below-mentioned segments:

China Online Insurance Market, By Product Type

- Life Insurance

- Non-Life Insurance

China Online Insurance Market, By Type of Provider

- Insurance Companies

- Third-Party Administrators

- Brokers

Need help to buy this report?