Global Chloroquine Market Size, Share, and COVID-19 Impact Analysis, By Dosage Form (Injections, Tablets, and Capsules), By Application (Lupus Erythematosus, Malaria, Rheumatoid Arthritis, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Chloroquine Market Insights Forecasts to 2033

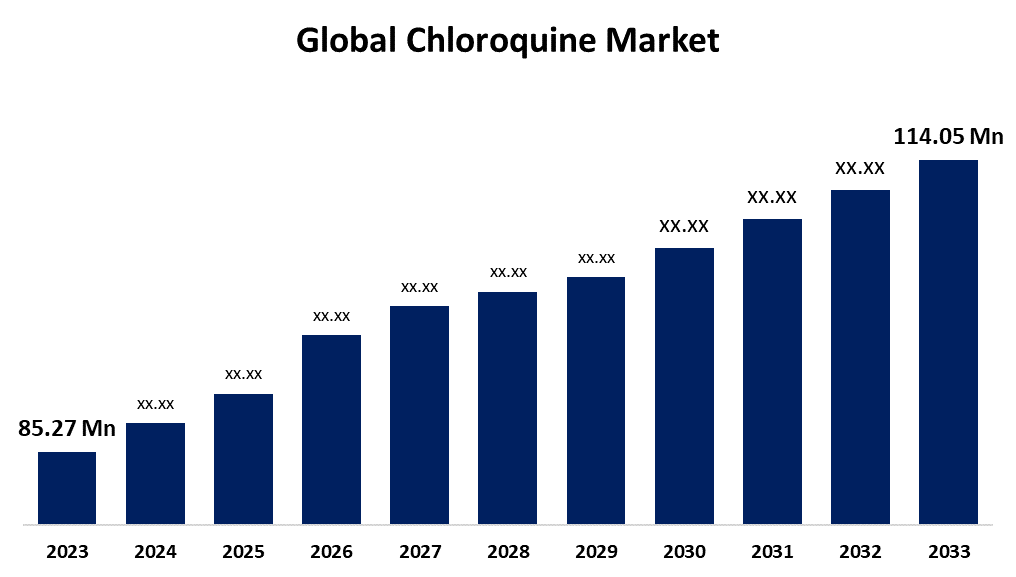

- The Global Chloroquine Market Size was Estimated at USD 85.27 Million in 2023

- The Market Size is Expected to Grow at a CAGR of around 2.95% from 2023 to 2033

- The Worldwide Chloroquine Market Size is Expected to reach USD 114.05 Million by 2033

- North America is predicted to Grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global Chloroquine Market Size is predicted to Exceed USD 114.05 Million by 2033, Growing at a CAGR of 2.95% from 2023 to 2033. The chloroquine market growth is driven by the rising global malaria incidence and its use in treating autoimmune diseases, including lupus erythematosus and rheumatoid arthritis, as well as rising healthcare infrastructure advancements in developing regions.

Market Overview

The chloroquine market involves the development, production, and distribution of chloroquine, which is primarily used to prevent and treat malaria. Chloroquine is an alkaloid natural product derived from quinine, widely used as an antimalarial treatment for malaria caused by Anopheles mosquitoes and inflammatory diseases. It is FDA-approved for uncomplicated malaria in countries with chloroquine-sensitive malaria strains. Chloroquine prevents the polymerization of heme into hemozoin, a food source for the malarial parasite, by forming a drug-hemozoin complex. This prevents additional polymerization and prevents further polymerization. Chloroquine also functions as an anti-autoimmune therapy by binding to transcriptional factors on T helper 17 cells and preventing differentiation. It is currently administered orally for malaria prophylaxis and chronic autoimmune disease treatment. The marketed products of chloroquine are MOSQUIN (Chloroquine Phosphate 250mg) tablet, LARIAGO Inj., MALAQUINE 150, Chloromal tablet, etc.

Several government initiatives are launching the control program and financial scheme for the better outcome of the patient health suffering from malaria leading to increase in the demand of the antimalarial medications such as chloroquine for the treatment of malaria results in the chloroquine market growth. For instance, the Union Minister of Health and Family Welfare, Government of India, launched the National Framework for Malaria Elimination in India and National Strategic Plan (NSP) for Elimination of Malaria. The National Strategic Plan for Malaria aims to achieve universal coverage of case detection and treatment services in endemic districts, ensuring 100% parasitical diagnosis and complete treatment of confirmed cases, to combat malaria nationally, the Ministry of Health & Family Welfare is giving States and UTs financial and technical assistance. Key measures include disease management, integrated vector management, and supportive interventions focusing on behaviour change communication, inter-sectoral convergence, and human resource development through capacity building. Disease management involves early case detection, effective treatment, strengthening referral services, epidemic preparedness, and rapid response. Integrated vector management includes Indoor Residual Spraying (IRS) in high-risk areas and long long-lasting insecticidal Nets (LLINs) in high malaria endemic areas.

The rising prevalence of malaria escalates the need for medications for the management of the malaria, which propels the market expansion. For example, the data provided by the World Health Organization (WHO) states that globally in 2023, 263 million cases of malaria were estimated and 597000 malaria deaths in 83 countries. The growing number of clinical trials examining chloroquine's effectiveness in treating various diseases could significantly promote its application and market growth.

Report Coverage

This research report categorizes the global chloroquine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the global chloroquine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the global chloroquine market.

Chloroquine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 85.27 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.95% |

| 2033 Value Projection: | USD 114.05 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 276 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Dosage Form, By Application |

| Companies covered:: | Novartis AG, Cadila Healthcare Ltd, Mylan NV, Teva Pharmaceuticals Ltd., Abcam Plc, Sanofi, Sun Pharmaceuticals Ltd., GlaxoSmithKline plc, Cipla Inc., Bayer AG, AstraZeneca, Ipca Laboratories Ltd., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors:

Rising prevalence of malaria:

The increasing prevalence of malaria in endemic areas, particularly in sub-Saharan Africa, is driving the demand for chloroquine as a therapeutic option. Plasmodium falciparum and Plasmodium vivax are the most dangerous types of malarial species, causing severe blood loss and clogged blood vessels. The rising prevalence of malaria in developing countries, particularly in Sub-Saharan Africa, is a major driver of the market. The disease affects millions of people annually, and there is a significant need for effective treatments. The demand for anti-malarial drugs is expected to grow due to the ongoing public health challenge, especially in tropical and subtropical regions.

Broad range of chloroquine therapeutic applications and technological advancements in R&D:

Chloroquine, known for its anti-malarial properties, has gained attention for its potential in treating autoimmune diseases like rheumatoid arthritis and lupus. Clinical trials show chloroquine's efficacy in managing symptoms and slowing disease progression in these conditions, expanding its market scope. Malaria, a global health concern, drives demand for Chloroquine-based treatments, especially in regions with high disease prevalence. Technological advancements in drug formulation and delivery enhance Chloroquine's efficacy and safety profile, expanding market growth. Research and development efforts have led to the introduction of new antimalarial drugs, with advanced diagnostic tools and treatments increasing their effectiveness.

Increased investment in research facilitates the development of novel therapies and drug combinations, addressing the market growth. Collaborations between academic institutions, healthcare organizations, and pharmaceutical companies accelerate the translation of research findings into clinical applications, aligning with global health objectives to eradicate malaria and stimulating market growth and innovation in anti-malarial drug development such as chloroquine.

Restraining Factors

Malaria-endemic regions' resistance to chloroquine limits its effectiveness, necessitating alternative treatments. Regulatory hurdles may slow product approval and distribution, while consumer preferences shifting toward more effective treatments could decrease chloroquine demand.

Market Segmentation

The global chloroquine market share is classified into dosage form and application.

- The capsules segment dominated the market with 36.11% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period.

Based on the dosage form, the global chloroquine market is categorized into injections, tablets, and capsules. Among these, the capsules segment dominated the market with 36.11% of the share in 2023 and is anticipated to grow at a significant CAGR throughout the forecast period. The segment growth is owing to enhanced bioavailability, rapid absorption, patient compliance, ease of administration, accurate dosing, availability of targeted and controlled drug delivery formulations, greater efficacy, higher stability, masking effect prevents from the unpleasant taste, and biocompatibility characteristic.

- The malaria segment accounted for the largest market share of 64.42% in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the application, the global chloroquine market is categorized into lupus erythematosus, malaria, rheumatoid arthritis, and others. Among these, the malaria segment accounted for the largest market share of 64.42% in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The segmental expansion is attributed to the widespread availability of chloroquine in the management of malaria. Chloroquine is the first-line drug of choice for malaria, and unhygienic conditions increase the production of the malarial species, which leads to the rising occurrence of malaria.

Regional Segment Analysis of the Global Chloroquine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global chloroquine market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global chloroquine market over the predicted timeframe. The Asia Pacific region is dominating owing to the high malaria prevalence in tropical countries, increasing healthcare infrastructure investments, and increased awareness of Chloroquine's prophylactic benefits. The region presents lucrative growth opportunities for Chloroquine manufacturers and suppliers, with countries like India and Southeast Asia contributing significantly. This is driven by improvements in healthcare infrastructure, increased accessibility to antimalarial medications, innovative treatment approaches, and rural healthcare service expansion.

North America is anticipated to grow at the fastest CAGR throughout the projected timeframe. The region's market growth is driven by robust healthcare infrastructure and high malaria prevention awareness. The demand for chloroquine is driven by travelers visiting malaria-endemic areas and patients with autoimmune disorders. The rising prevalence of rheumatoid arthritis and lupus supports this demand. Advanced healthcare systems and strong regulatory frameworks facilitate chloroquine availability and use. Research and development initiatives explore new therapeutic applications. Despite modest growth rates, these developed regions remain important markets for chloroquine.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global chloroquine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis AG

- Cadila Healthcare Ltd

- Mylan NV

- Teva Pharmaceuticals Ltd.

- Abcam Plc

- Sanofi

- Sun Pharmaceuticals Ltd.

- GlaxoSmithKline plc

- Cipla Inc.

- Bayer AG

- AstraZeneca

- Ipca Laboratories Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, GlaxoSmithKline plc and Medicines for Malaria Venture launched the first single-dose medicine for preventing Plasmodium vivax (P. vivax) malaria relapse, tafenoquine, co-administered with chloroquine for radical cure, in Thailand and Brazil. This drug is part of malaria elimination efforts, as P. vivax is the dominant parasite in most countries outside sub-Saharan Africa and is characterized by clinical relapses.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global chloroquine market based on the below-mentioned segments:

Global Chloroquine Market, By Dosage Form

- Injections

- Tablets

- Capsules

Global Chloroquine Market, By Application

- Lupus Erythematosus

- Malaria

- Rheumatoid Arthritis

- Others

Global Chloroquine Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global chloroquine market?The global chloroquine market is projected to expand at a CAGR of 2.95% during the forecast period.

-

2. Who are the top key players in the global chloroquine market?The key players in the global chloroquine market are Novartis AG, Cadila Healthcare Ltd, Mylan NV, Teva Pharmaceuticals Ltd., Abcam Plc, Sanofi, Sun Pharmaceuticals Ltd., GlaxoSmithKline plc, Cipla Inc., Bayer AG, AstraZeneca, Ipca Laboratories Ltd., and others.

-

3. Which region holds the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global chloroquine market over the predicted timeframe.

Need help to buy this report?