Global Chromatography Instruments Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid Chromatography, Gas Chromatography), By Consumable & Accessory (Columns, Detectors, Pressure Regulators), By Industry (Life Science, Oil & Gas), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Chromatography Instruments Market Insights Forecasts to 2033

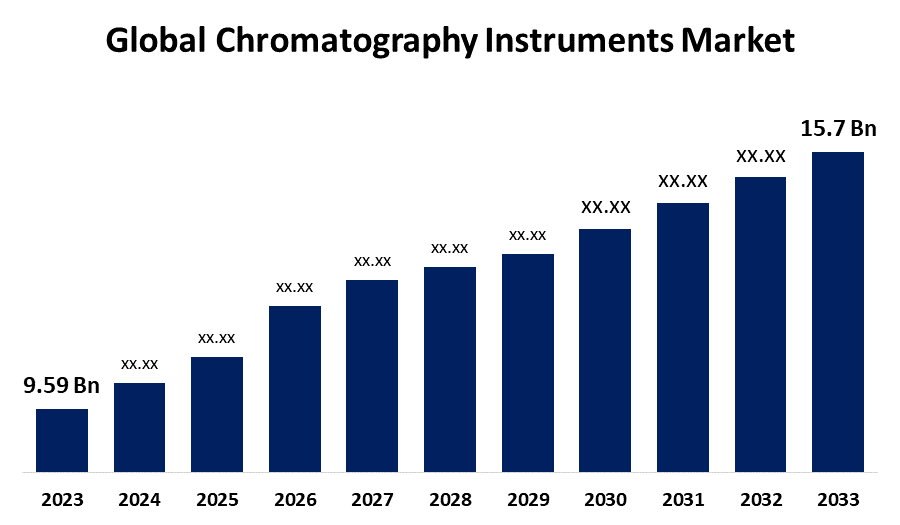

- The Global Chromatography Instruments Market Size was Valued at USD 9.59 Billion in 2023

- The Market Size is Growing at a CAGR of 5.05% from 2023 to 2033

- The Worldwide Chromatography Instruments Market Size is Expected to Reach USD 15.7 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Chromatography Instruments Market Size is Anticipated to Exceed USD 15.7 Billion by 2033, Growing at a CAGR of 5.05% from 2023 to 2033.

Market Overview

A chromatography instrument, or chromatograph, is a device that performs chromatographic separations and produces a chromatogram, a graph showing the result of separating the components of a mixture by chromatography. Chromatography is a technique that separates the components of a mixture based on the different speeds at which they move when passing the mixture through a medium like a special paper or a column filled with tiny particles. It is used to separate both gas and liquid mixtures. The term "chromatography" is derived from the Greek words for "color" and "writing" because the separation process can create distinct color bands on the stationary material. There are various types of chromatography instruments such as process chromatography instruments, gas chromatography instruments (GC), and high-performance liquid chromatography (HPLC). Recently, there have been several innovations and product launches in the global chromatography instruments market. For instance, in August 2024, Agilent Technologies Inc. announced the release of its new Agilent J&W 5Q GC/MS Columns, representing a major advancement in gas chromatography/mass spectrometry (GC/MS) column technology. Agilent has a 50-year history of innovation in gas chromatography.

Report Coverage

This research report categorizes the market for the global chromatography instruments market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global chromatography instruments market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global chromatography instruments market.

Global Chromatography Instruments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.59 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.05% |

| 2033 Value Projection: | USD 15.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 277 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Consumable & Accessory, By Industry, and By Region |

| Companies covered:: | Agilent Technologies, Waters Corporation, Thermo Fisher Scientific, PerkinElmer, Inc., Sartorius AG, Hitachi, Cytiva, SCION Instruments, Danaher, Gilson, Inc., Phenomenex, Shimadzu Corporation, Merck KGaA, Bio-Rad Laboratories, Restek Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The factors driving the global chromatography instruments market include the development of more precise, efficient, and reliable chromatography instruments, such as high-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS). These innovations have improved analytical capabilities and accuracy, making them crucial in high-stakes applications like pharmaceutical quality control and biotechnological research. Increasing research and development activities in the pharmaceutical and biotechnology industries are driving the demand for precise graphing, calculations, and analytical tools, supported by funding from the government and Venture Capitalists aimed to accelerate drug discovery and development processes. Strict regulations for food safety, environmental monitoring, and clinical research are boosting the demand for high-quality chromatography instruments to ensure compliance and maintain public health standards. The rising incidence of chronic diseases and the need for personalized medicine combinations create opportunities for market expansion, as these applications heavily rely on chromatography techniques for precise and accurate analysis.

Moreover, advancements in gas chromatography columns for petrochemical applications cater to the petroleum industry's need for precise analytical performance and chromatographic efficiency. Hyphenated chromatography techniques, like LC-MS and GC-MS, offer benefits including less analysis time, better reproducibility, enhanced selectivity, and greater automation, increasing their application across various other fields, including clinical screening, pesticide residue analysis, forensic investigations, and food testing.

Restraining Factors

Some challenges are anticipated to restrict the growth of the global chromatography instruments market. The advanced analytical features and functionalities of chromatography instruments come at a premium price, although the cost varies based on the applications. Chromatography instruments used in the pharmaceutical industry are expensive due to the capillary columns used to separate compounds like oxygen, hydrogen, and methane. Small and medium-sized companies (SMEs) in the oil & gas, food & beverage, biotech & pharmaceutical industries, and research institutions need multiple such systems, leading to significant capital investment requirements. Also, academic research laboratories operate under controlled budgets and might find it challenging to afford these systems. The maintenance and indirect expenses increase the total cost of ownership, reducing adoption among end users with budget constraints. Moreover, alternative technology and techniques such as high-resolution ultrafiltration and capillary electrophoresis offer fewer steps with lower costs than traditional column chromatography.

Market Segmentation

The global chromatography instruments market share is classified into type, consumable & accessory, and industry.

- The liquid chromatography segment is expected to hold the largest share of the global chromatography instruments market during the forecast period.

Based on the type, the global chromatography instruments market is divided into liquid chromatography and gas chromatography. Among these, the liquid chromatography segment is expected to hold the largest share of the global chromatography instruments market during the forecast period. This large share is because it has a wide range of applications and superior analytical capabilities. Liquid chromatography, especially high-performance liquid chromatography (HPLC), is extensively used in the pharmaceutical and biotechnology sectors for drug development, quality control, and bioanalytical testing due to its high precision. It is preferred for its versatility in handling different sample types, including biological, environmental, and food samples. Technological advancements, such as the integration of mass spectrometry (LC-MS), have further improved its accuracy and sensitivity, making it a crucial instrument for complex analyses. Moreover, strict requirements of regulatory bodies for contaminant detection and quantification in pharmaceuticals and food products boost the demand for liquid chromatography instruments.

- The columns segment is expected to hold the largest share of the global chromatography instruments market during the forecast period.

Based on consumables & accessories, the global chromatography instruments market is divided into columns, detectors, and pressure regulators. Among these, the columns segment is expected to hold the largest share of the global chromatography instruments market during the forecast period. This is because columns are integral components of chromatography instruments and are critical for the separation process. They are used for various chromatography techniques, including liquid chromatography (LC) and gas chromatography (GC) as they support high-resolution separations. The demand for high-performance, durable, and efficient columns in the pharmaceutical, biotechnology, food, and environmental testing sectors drives this segment's growth. Additionally, the need to replace and upgrade columns due to wear and tear from prolonged usage generates constant demand. Technological innovation has resulted in the development of specialized columns with better selective capability and stability, catering to a wide range of analytical applications.

- The life science segment is expected to grow at the fastest CAGR in the global chromatography instruments market during the forecast period.

Based on industry, the global chromatography instruments market is divided into life science, oil & gas. Among these, the life science segment is expected to grow at the fastest CAGR in the global chromatography instruments market during the forecast period. The life science industry is witnessing rapid growth due to increasing research and development activities, particularly in pharmaceuticals and biotechnology. The rise in biological, personalized medicine, and genomic research boosts the need for advanced analytical chromatography instruments for precise and accurate analysis. The focus on drug discovery, development, quality control, and the growing number of chronic diseases, fuels the demand for chromatography instruments. Government and private sector funding for life sciences research and strict regulations for drug testing and approval contribute to the growth of this segment. Moreover, the advancements in chromatography techniques, such as high-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS), cater to the complex analytical needs of the life sciences industry.

Regional Segment Analysis of the Global Chromatography Instruments Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the global chromatography instruments market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global chromatography instruments market over the predicted timeframe. The regional market is driven by the global leading pharmaceutical manufacturing leaders in countries such as India, China, and Japan. For instance, Inda’s pharmaceuticals industry is the third largest by volume and the 13th largest by value in the world. This has led to a significant increase in research and development activities, fueled by investments from private entities and subsidies and tax deductions by the government. The growing focus on drug discovery, development, and quality control fuels the demand for advanced chromatography instruments.

Furthermore, the rising food and beverage industry, and its safety and quality regulations, fuel the adoption of chromatography instruments for accurate analysis and monitoring. The presence of several hospitals, academic institutions, and medical research organizations, and their collaborations and partnerships with global firms, supports the market position of the Asia-Pacific region.

North America is expected to grow at the fastest pace in the global chromatography instruments market during the forecast period. The advancements in pharmaceutical and biotechnology research drive the need for cutting-edge analytical instruments. Increasing funding and investments in healthcare research and development, particularly for personalized medicine, are contributing to the region’s growth. Strict regulations for drug approval, environmental safety, and food quality encourage the use of high-accuracy chromatography technologies. The presence of leading research institutions and universities, along with strong government support, funding, tax benefits, and initiatives, fosters innovation and market expansion. Furthermore, the North American oil and gas industry uses various mechanical and electrical instruments for analytical calculations, quality control, and research purposes, including chromatography instruments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global chromatography instruments market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agilent Technologies

- Waters Corporation

- Thermo Fisher Scientific

- PerkinElmer, Inc.

- Sartorius AG

- Hitachi

- Cytiva

- SCION Instruments

- Danaher

- Gilson, Inc.

- Phenomenex

- Shimadzu Corporation

- Merck KGaA

- Bio-Rad Laboratories

- Restek Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, U.K.-based CatSci acquired Reach Separations, a specialist chromatography provider for the analysis and purification of chiral and achiral therapeutics. The acquisition was supported by Keensight Capital, a private equity manager that focuses on pan-European Growth Buyout investments.

- In April 2024, Valmet completed the acquisition of the Process Gas Chromatography and Integration business from Siemens AG. The closing of the transaction follows the agreement that was announced on 17 July 2023.

- In March 2024, Everest Instruments, a pioneer in innovative dairy and food testing solutions, announces the launch of three revolutionary products. Including the Gas Chromatography for Milk Fat Fatty Acids and Triglycerides (Everest GC4500), which provides detailed profiling of fatty acids and triglycerides, crucial for understanding milk, milk products, and ghee quality.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global chromatography instruments market based on the below-mentioned segments:

Global Chromatography Instruments Market, By Type

- Liquid Chromatography

- Gas Chromatography

Global Chromatography Instruments Market, By Consumable & Accessory

- Columns

- Detectors

- Pressure Regulators

Global Chromatography Instruments Market, By Industry

- Life Science

- Oil & Gas

Global Chromatography Instruments Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Agilent Technologies, Waters Corporation, and Thermo Fisher Scientific are considered the top three global companies in the chromatography instruments market. Following them are PerkinElmer, Inc., Sartorius AG, Hitachi, Cytiva, SCION Instruments, Danaher, Gilson, Inc., Phenomenex, Shimadzu Corporation, Merck KGaA, Bio-Rad Laboratories, Restek Corporation, and Others.

-

2. What is the size of the global chromatography instruments market?The Global Chromatography Instruments Market is expected to grow from USD 9.59 Billion in 2023 to USD 15.7 Billion by 2033, at a CAGR of 5.05% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia-Pacific is anticipated to hold the largest share of the global chromatography instruments market over the predicted timeframe.

Need help to buy this report?