Global Circuit Breaker and Fuse Market Size, Share, and COVID-19 Impact Analysis, By Component (Circuit Breaker and Fuse), By Circuit Breaker Voltage (Low Voltage, Medium Voltage, and High Voltage), By Technology (Air Blast Circuit Breakers, Vacuum Circuit Breakers, Oil Circuit Breaker, SF6 Circuit Breaker, and Others), By Fuse Voltage (Low voltage and High voltage), By Application (Construction, Consumer Electronics, Industrial, Power Generation & Distribution, Transport, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Semiconductors & ElectronicsGlobal Circuit Breaker and Fuse Market Insights Forecasts to 2032

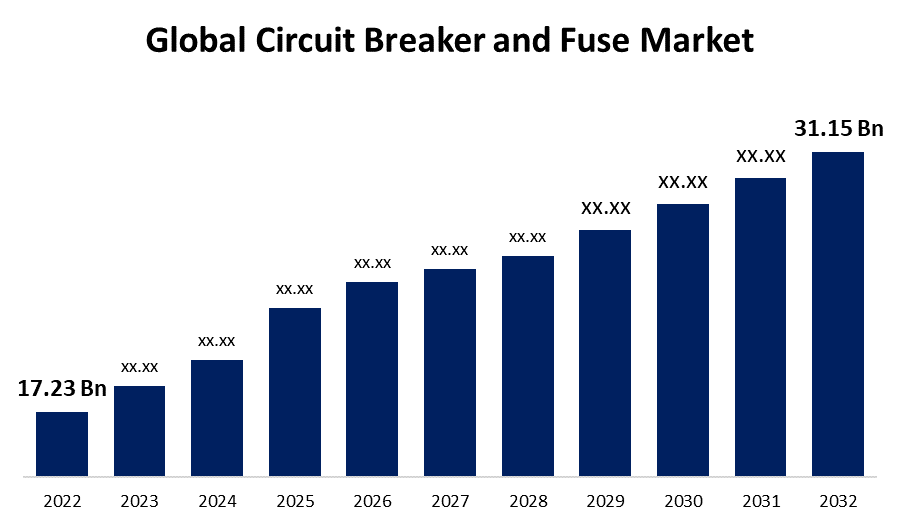

- The Circuit Breaker and Fuse Market Size was valued at USD 17.23 Billion in 2022.

- The Market is Growing at a CAGR of 6.1% from 2023 to 2032

- The Worldwide Circuit Breaker and Fuse Market Size is expected to reach USD 31.15 Billion by 2032

- Asia-Pacific is expected toGgrow the fastest during the forecast period

Get more details on this report -

The Global Circuit Breaker and Fuse Market is expected to reach USD 31.15 Billion by 2032, at a CAGR of 6.1% during the forecast period 2022 to 2032.

Market Overview

Circuit breakers and fuses are safety devices used to protect electrical circuits from damage caused by excessive current. A circuit breaker is an automatic switch that trips and interrupts the circuit when an overcurrent is detected. It can be manually reset after tripping. A fuse, on the other hand, is a one-time-use device that contains a wire that melts and breaks the circuit when the current exceeds its rating. It must be replaced after use. Both circuit breakers and fuses serve the same purpose of protecting electrical equipment, but they work in different ways.

Report Coverage

This research report categorizes the market for circuit breaker and fuse market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the circuit breaker and fuse market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the circuit breaker and fuse market.

Global Circuit Breaker and Fuse Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 17.23 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.1% |

| 2032 Value Projection: | USD 31.15 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 132 |

| Segments covered: | By Component, By Circuit Breaker Voltage, By Technology, By Fuse Voltage, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | ABB Ltd., Bel Fuse Inc., Schneider Electric SE, Mitsubishi Electric Corporation, Eaton Corporation PLC, General Electric Company, Siemens AG, Rockwell Automation, Inc., Larsen & Toubro Limited, NXP Semiconductors N.V., SCHURTER Holding AG, Sensata Technologies Holding PLC, Texas Instruments Incorporated |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers of circuit breakers and fuses are the overcurrent and short-circuit conditions in electrical circuits. Overcurrent occurs when the current flowing through a circuit exceeds its rated capacity, while a short circuit occurs when a low resistance path is created in the circuit. These conditions can cause damage to electrical equipment and pose a fire hazard. Circuit breakers and fuses are designed to detect these conditions and interrupt the circuit to prevent damage. The driver for selecting a specific type of circuit breaker or fuse is the required level of protection for the equipment and the load being served. Other drivers may include cost, reliability, and compatibility with the electrical system.

Restraining Factors

The restraints of circuit breakers and fuses include their limited capacity to handle large surges or spikes in current, which may cause them to fail prematurely. In addition, the interruption time for circuit breakers and fuses may vary depending on their type and the level of current flowing through the circuit. This interruption time may be critical in some applications where equipment or safety may be impacted by a prolonged interruption. Circuit breakers and fuses also have a limited lifespan and require periodic maintenance and replacement.

Market Segmentation

- In 2022, the circuit breakers segment accounted for around 81.4% market share

On the basis of components, the global circuit breaker and fuse market is segmented into circuit breaker and fuse. The circuit breakers segment is dominating with the largest market share in 2022, due to its widespread use in power generation, transmission, and distribution applications. Circuit breakers are essential components for protecting electrical equipment from damage due to overcurrent or short circuits. The growing demand for renewable energy sources and the need for grid modernization has led to the adoption of advanced circuit breakers that offer better performance and higher reliability. Additionally, the increasing focus on safety regulations and standards has further boosted the demand for circuit breakers.

- In 2022, the vacuum circuit breakers segment dominated with more than 32.7% market share

Based on technology, the global circuit breaker and fuse market is segmented into air blast circuit breakers, vacuum circuit breakers, oil circuit breakers, SF6 circuit breakers, and others. Out of this, vacuum circuit breakers are dominating the market with the largest market share in 2022, due to their numerous advantages over other types of circuit breakers. VCBs offer faster and more reliable interruption of current, lower maintenance requirements, and longer lifespan compared to other types of circuit breakers. They also do not use any external medium for arc quenching, which makes them more environmentally friendly. PCBs are widely used in high-voltage and medium-voltage applications, such as power generation, transmission, and distribution. Their efficiency, reliability, and cost-effectiveness have made them the preferred choice for many power utilities and industries.

Regional Segment Analysis of the Circuit Breaker and Fuse Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 43.5% revenue share in 2022.

Get more details on this report -

Based on region, the Asia-Pacific region dominates the circuit breaker and fuse market due to its rapid economic growth, increasing population, and industrialization. This has led to a rise in electricity demand, which has driven the growth of the power sector, and consequently, the demand for circuit breakers and fuses. Furthermore, the region has seen significant investments in renewable energy, particularly in China and India, which has boosted the demand for circuit breakers and fuses in the renewable energy sector. Additionally, the increasing need for reliable power supply, coupled with the adoption of advanced technologies and smart grids, has led to the widespread use of circuit breakers and fuses in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global circuit breaker and fuse market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- ABB Ltd.

- Bel Fuse Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Eaton Corporation PLC

- General Electric Company

- Siemens AG

- Rockwell Automation, Inc.

- Larsen & Toubro Limited

- NXP Semiconductors N.V.

- SCHURTER Holding AG

- Sensata Technologies Holding PLC

- Texas Instruments Incorporated

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, Eaton declared its goal to acquire 50% ownership of Jiangsu Huineng Electric Co., Ltd, specifically in their circuit breaker division. This collaboration is expected to generate profitable growth prospects for both companies involved.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global circuit breaker and fuse market based on the below-mentioned segments:

Circuit Breaker and Fuse Market, By Component

- Circuit Breaker

- Fuse

Circuit Breaker and Fuse Market, By Circuit Breaker Voltage

- Low Voltage

- Medium Voltage

- High Voltage

Circuit Breaker and Fuse Market, By Technology

- Air Blast Circuit Breakers

- Vacuum Circuit Breakers

- Oil Circuit Breaker

- SF6 Circuit Breaker

- Others

Circuit Breaker and Fuse Market, By Fuse Voltage

- Low voltage

- High voltage

Circuit Breaker and Fuse Market, By Application

- Construction

- Consumer Electronics

- Industrial

- Power Generation & Distribution

- Transport

- Others

Circuit Breaker and Fuse Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?