Global Closed-Loop Plastic Recycling for Automotive Market Size, Share, and COVID-19 Impact Analysis, By Plastic Type (Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Polyurethane (PU), Nylon (PA)), By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs)), By Recycling Process (Mechanical Recycling, Chemical Recycling, Regrinding & Compounding), By Application (Interior Components, Exterior Components, Under-the-Hood Components, Structural & Safety Components, Electrical & Electronic Components), By End-User (OEMs, Aftermarket Suppliers, Recycling Companies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Closed-Loop Plastic Recycling for Automotive Market Insights Forecasts to 2033

- The Global Closed-Loop Plastic Recycling for Automotive Market Size was Anticipated to Hold a Significant Share in 2023

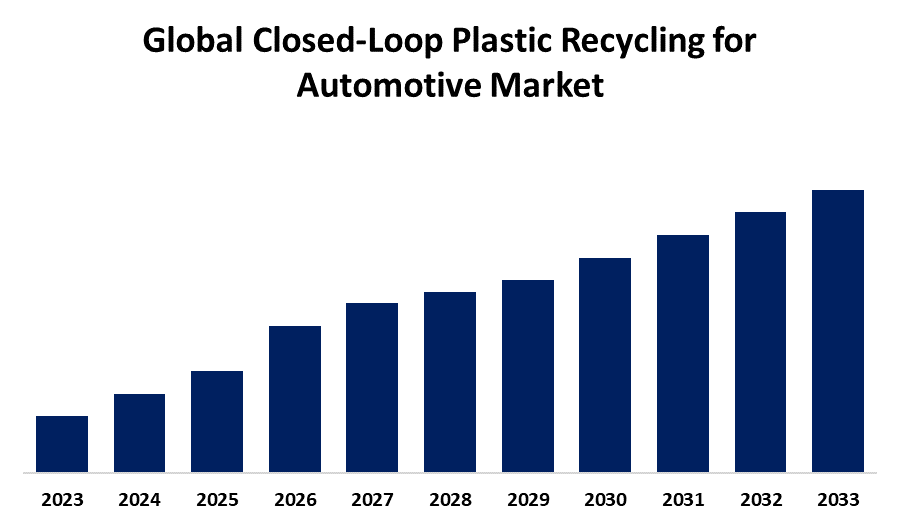

- The Market Size is Growing at a CAGR of 6.3% from 2023 to 2033

- The Worldwide Closed-Loop Plastic Recycling for Automotive Market Size is Expected to Reach Significant Share by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Closed-Loop Plastic Recycling for Automotive Market Size is Anticipated to Hold a Significant Share by 2033, at 6.3% CAGR from 2023 to 2033.

Market Overview

Closed-loop plastic recycling for automotive refers to a process where plastic materials used in vehicles are recycled back into new automotive components, creating a sustainable cycle. Closed-loop plastic recycling for the automotive sector is propelled due to sustainability goals, regulatory pressures, and cost efficiency. Compliance with stricter regulations, reusing plastics, and consumer demand for sustainable products encourage brands to incorporate recycled materials.

Closed-loop plastic recycling for the automotive industry improves sustainability and efficiency by reducing reliance on virgin plastics in interior and exterior parts, engine components, fluid reservoirs, wiring insulation, and reusable packaging. Automakers are developing proprietary recycling systems and collaborating with suppliers for take-back programs.

For Instance, In April 2024, Covestro collaborated with automotive partners for car-to-car plastic recycling the Joint program aims for effective, sustainable vehicle plastic recycling.

Report Coverage

This research report categorizes the market for closed-loop plastic recycling for automotive based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the closed-loop plastic recycling for automotive market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the closed-loop plastic recycling for automotive market.

Global Closed-Loop Plastic Recycling for Automotive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.3% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Plastic Type, By Vehicle Type, By Recycling Process, By Application, By End-User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | BASF SE, LyondellBasell Industries N.V., Covestro AG, DOW Inc., SABIC, Veolia Environnement S.A., Plastic Omnium, Eastman, DuPont de Nemours, Inc., ALPLA Group, Mitsubishi Chemical Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of closed-loop plastic recycling for the automotive market is driven by several factors including a growing emphasis on sustainability and regulatory compliance, which are pushing manufacturers to adopt environmentally friendly practices. Cost efficiency plays a significant role, as using recycled materials can lower production costs compared to virgin plastics. Technological advancements in recycling processes enhance the viability of closed-loop systems while rising consumer demand for eco-friendly vehicles further encourages automakers to integrate recycled materials. Furthermore, corporate social responsibility initiatives and the shift toward a circular economy support the adoption of closed-loop plastic recycling in the automotive sector.

Restraining Factors

The closed-loop plastic recycling for automotive market is constrained by several factors that might hinder its growth including high initial costs for implementing advanced recycling technologies can deter manufacturers from adopting these systems. Inadequate recycling infrastructure in certain regions complicates effective waste collection and processing. Concerns about the quality and performance of recycled plastics compared to new materials can also impact acceptance.

Market Segmentation

The closed-loop plastic recycling for automotive market share is classified into plastic type, vehicle type, recycling process, application, and end-user.

- The polypropylene (PP) segment is estimated to hold the highest market revenue share through the projected period.

Based on the plastic type, the closed-loop plastic recycling for automotive market is classified into polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), polyurethane (PU), nylon (PA). Among these, the polypropylene (PP) segment is estimated to hold the highest market revenue share through the projected period. The segment attributed to PP's extensive use in automotive parts, its efficient recycling capabilities, and the growing emphasis on sustainability within the automotive industry. The widespread use of automotive components, efficient recycling processes, and strong alignment with sustainability initiatives in the industry enhance the segment's dominant position in the market.

- The passenger vehicles segment is anticipated to hold the largest market share through the forecast period.

Based on the vehicle type, the closed-loop plastic recycling for automotive market is divided into passenger vehicles, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). Among these, the passenger vehicles segment is anticipated to hold the largest market share through the forecast period. The passenger vehicle segment dominance is due to the larger production volumes of passenger vehicles compared to light and heavy commercial vehicles. Furthermore, passenger vehicles often have more plastic components, driving greater demand for recycling solutions. The focus on sustainability and regulatory pressures in the automotive sector also encourage advancements in closed-loop recycling technologies, particularly for passenger vehicles.

- The mechanical recycling segment dominates the market with the largest market share through the forecast period.

Based on the recycling process, the closed-loop plastic recycling for automotive market is categorized into mechanical recycling, chemical recycling, regrinding & compounding. Among these, the mechanical recycling segment dominates the market with the largest market share through the forecast period. The dominance of the mechanical recycling segment is propelled due to the established processes, cost-effectiveness, and efficiency of mechanical recycling, which allows for the effective reprocessing of plastics back into usable materials.

- The OEMs segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the end-user, the closed-loop plastic recycling for automotive market is categorized into OEMs, aftermarket suppliers, and recycling companies. Among these, the OEMs segment is anticipated to grow at the fastest CAGR growth through the forecast period. The segment's rapid expansion growth can be attributed to the increasing focus of OEMs on sustainability, regulatory pressures to reduce waste, and the rising demand for recycled materials in vehicle production. As automotive manufacturers seek to enhance their environmental practices and integrate recycled plastics into their supply chains, further contribute to segment rapid expansion.

Regional Segment Analysis of the Closed-Loop Plastic Recycling for Automotive Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the closed-loop plastic recycling for automotive market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the closed-loop plastic recycling for automotive market over the predicted timeframe. The North American region's dominance can be attributed to several factors including the region's advanced automotive manufacturing infrastructure, increasing regulatory pressures for sustainable practices, and a growing emphasis on circular economy initiatives. Furthermore, the rising consumer demand for environmentally friendly vehicles and materials further supports the expansion of closed-loop recycling in the automotive sector.

Asia Pacific is expected to grow at the fastest CAGR growth of the closed-loop plastic recycling for automotive market during the forecast period. The rapid growth of the Asia Pacific region is propelled by several factors including the region's expanding automotive industry, increasing urbanization, and rising awareness of environmental sustainability. Countries like China, India, and Japan are investing in advanced recycling technologies and implementing regulations to promote recycling practices. Furthermore, the rising demand for eco-friendly vehicles and materials among consumers is encouraging automotive manufacturers in the Asia Pacific region to adopt closed-loop recycling processes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the closed-loop plastic recycling for automotive market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- LyondellBasell Industries N.V.

- Covestro AG

- DOW Inc.

- SABIC

- Veolia Environnement S.A.

- Plastic Omnium

- Eastman

- DuPont de Nemours, Inc.

- ALPLA Group

- Mitsubishi Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Sumitomo Chemical announced that it supplying Noblen Meguri, a polypropylene material manufactured utilizing its material recycling technology, for the front grille of Honda Motor Co., Ltd.'s new electric vehicle N-VAN e which is set to be delivered in the autumn of 2024.

- In February 2024, KRAIBURG TPE launched a new line of thermoplastic elastomer (TPE) products with at least 73% recycled material. The new Recycling Content TPE for Automotive series has been created to meet a wide range of technical requirements.

- In April 2023, Eastman announced the successful completion of its closed-loop recycling program for automotive mixed plastic waste. Eastman, the United States Automotive Materials Partnership LLC (USAMP), automotive recycler Padnos, and global automotive interior supplier Yanfeng collaborated to demonstrate the first-ever plastic recycling using a byproduct of shredded end-of-life vehicles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the closed-loop plastic recycling for automotive market based on the below-mentioned segments:

Global Closed-Loop Plastic Recycling for Automotive Market, By Plastic Type

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Nylon (PA)

Global Closed-Loop Plastic Recycling for Automotive Market, By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

Global Closed-Loop Plastic Recycling for Automotive Market, By Recycling Process

- Mechanical Recycling

- Chemical Recycling

- Regrinding & Compounding

Global Closed-Loop Plastic Recycling for Automotive Market, By Application

- Interior Components

- Exterior Components

- Under-the-Hood Components

- Structural & Safety Components

- Electrical & Electronic Components

Global Closed-Loop Plastic Recycling for Automotive Market, By End-User

- OEMs

- Aftermarket Suppliers

- Recycling Companies

Global Closed-Loop Plastic Recycling for Automotive Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the closed-loop plastic recycling for automotive market over the forecast period?The closed-loop plastic recycling for automotive market is projected to expand at a CAGR of 6.3% during the forecast period.

-

2. What is the market size of the closed-loop plastic recycling for automotive market?The Global Closed-Loop Plastic Recycling for Automotive Market Size is Expected to Hold a Significant Share by 2033, Growing at 6.3% CAGR from 2023 to 2033.

-

3. Which region holds the largest share of the closed-loop plastic recycling for automotive market?North America is anticipated to hold the largest share of the closed-loop plastic recycling for automotive market over the predicted timeframe.

Need help to buy this report?