Global Cloud Logistics Market Size, Share, and COVID-19 Impact Analysis, By Type (Public, Private, Hybrid, and Multi), By OS Type (Native and Web-based), By Enterprise Size (Large Enterprise and Small and Medium Enterprises), By Industry Vertical (Retail, Consumer Electronics, Healthcare, Automotive, Food & Beverage, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032.

Industry: HealthcareGlobal Cloud Logistics Market Insights Forecasts to 2032

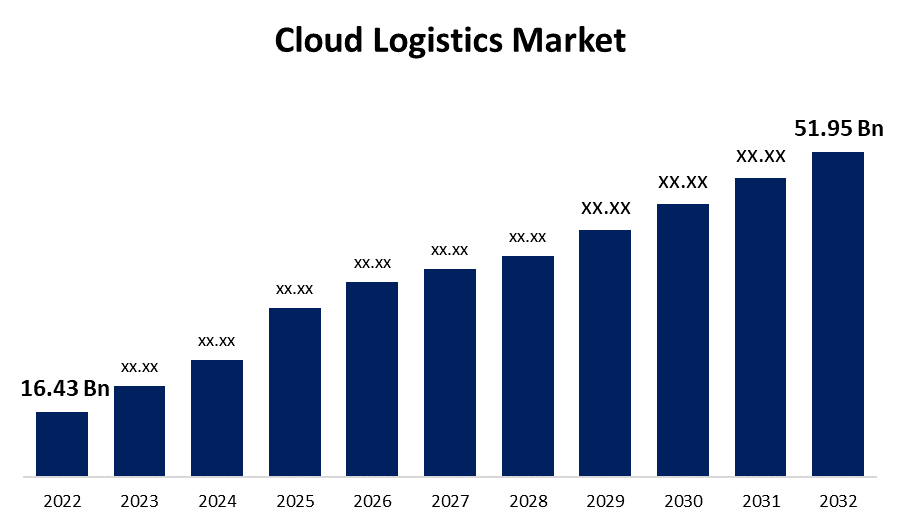

- The Cloud Logistics Market Size was valued at USD 16.43 Billion in 2022.

- The Market is Growing at a CAGR of 12.2% from 2023 to 2032

- The Global Cloud Logistics Market Size is expected to reach USD 51.95 Billion by 2032

- Asia-Pacific is expected to Grow fastest during the forecast period

Get more details on this report -

The Global Cloud Logistics Market Size is expected to reach USD 51.95 Billion by 2032, at a CAGR of 12.2% during the forecast period 2023 to 2032.

Market Overview

Cloud logistics refers to the use of cloud computing technology to optimize and streamline various aspects of supply chain management and logistics operations. It leverages cloud-based platforms and services to enhance the efficiency, visibility, and scalability of logistical processes. This innovative approach allows organizations to seamlessly manage tasks such as inventory management, order processing, transportation planning, and real-time tracking through web-based applications and data analytics. Cloud logistics provides businesses with the flexibility to adapt to changing market conditions, reduce operational costs, and improve customer satisfaction by ensuring the timely delivery of goods. Additionally, it facilitates collaboration among stakeholders in the supply chain, enabling better coordination and communication. As a result, cloud logistics plays a pivotal role in modernizing and transforming the logistics industry, making it a critical component of successful, data-driven supply chain management.

Report Coverage

This research report categorizes the market for cloud logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cloud logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the cloud logistics market.

Global Cloud Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 16.43 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 12.2% |

| 2032 Value Projection: | USD 51.95 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By OS Type, By Enterprise Size, By Industry Vertical, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Bwise, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Thomson Reuters Corporation, Trimble Transportation, Descartes Systems Group, C. H. Robinson, MetricStream, Inc., 3GTMS, CargoSmart Limited, BluJay Solutions, ShipBob, Inc., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The cloud logistics market is experiencing robust growth, driven by several key factors that are reshaping the logistics and supply chain landscape. The cost efficiency is a significant driver, as cloud-based solutions eliminate the need for heavy upfront investments in hardware and software, allowing companies to pay for what they use on a subscription basis, reducing IT infrastructure costs and enhancing the cost-effectiveness of logistics operations. The scalability and flexibility are critical drivers. Cloud logistics solutions can quickly adapt to changing business needs, making it easier for organizations to scale up or down as demand fluctuates. This adaptability is especially valuable in today's volatile markets, where agility is essential for success. Real-time visibility and data analytics are transforming the logistics industry. Cloud-based platforms provide real-time tracking and monitoring of shipments, inventory, and other critical logistics data, enabling companies to make data-driven decisions, optimize routes, reduce lead times, and enhance customer service. The global nature of business operations is driving the adoption of Cloud Logistics solutions. Cloud technology enables centralized management of logistics processes across geographies, facilitating international supply chain management and compliance with varying regulations and customs requirements. The rising importance of sustainability and environmental concerns are pushing companies to optimize logistics operations. Cloud Logistics can help minimize fuel consumption, reduce carbon emissions, and optimize transportation routes, contributing to a greener and more sustainable supply chain. Additionally, the ongoing digital transformation in various industries, including e-commerce, is generating enormous volumes of data. Cloud-based logistics solutions offer the necessary infrastructure to handle and analyze this data, leading to better decision-making and improved customer experiences. The COVID-19 pandemic accelerated the adoption of Cloud Logistics as companies sought to enhance supply chain resilience and adapt to disruptions. Cloud technology allowed businesses to quickly pivot their logistics operations to meet changing market conditions and shifting consumer demands.

Restraining Factors

The cloud logistics market faces several restraints that can impede its growth. One significant challenge is data security and privacy concerns, as storing sensitive logistics information in the cloud may expose it to potential breaches and cyberattacks. Integration complexities with existing legacy systems pose another restraint, as transitioning to cloud-based solutions can be disruptive and costly for organizations with established infrastructure. Moreover, the dependency on internet connectivity and potential downtime can hinder operations. Concerns about vendor lock-in and the ongoing cost of subscriptions also play a role. Additionally, regulatory compliance and data sovereignty issues can limit the adoption of cloud logistics solutions, especially in highly regulated industries and regions.

Market Segmentation

- In 2022, the public segment accounted for around 24.6% market share

On the basis of the type, the global cloud logistics market is segmented into public, private, hybrid, and multi. The dominance of the public sector in the market can be attributed to its significant investments in cloud logistics solutions to enhance the efficiency and transparency of government supply chains. Public organizations, including government agencies and defense sectors, increasingly rely on cloud-based logistics to optimize resource allocation, reduce costs, and improve service delivery. Furthermore, the public sector's commitment to adopting innovative technologies to streamline logistics operations has resulted in a substantial revenue share in the market

- The web-based segment held the largest market with more than 47.5% revenue share in 2022

Based on the OS type, the global cloud logistics market is segmented into native and web-based. The dominance of the web-based operating system (OS) segment in the market can be attributed to its widespread adoption in various industries. Web-based OS offers accessibility, flexibility, and cost-effectiveness, making it a preferred choice for businesses. It allows users to access logistics applications and data from anywhere with internet connectivity. This accessibility and ease of integration with other cloud-based services have propelled the web-based OS segment to a leading position in the market, capturing a significant revenue share.

- The small & medium enterprises segment is expected to grow at a CAGR of around 12.7% during the forecast period

Based on the enterprise size, the global cloud logistics market is segmented into large enterprise and small and medium enterprises. The small and medium enterprises (SMEs) segment is poised for growth over the projected period due to several factors. SMEs are increasingly recognizing the benefits of cloud logistics, such as cost-efficiency, scalability, and streamlined operations. With the evolving technology landscape and more affordable cloud solutions, SMEs are now better positioned to adopt these systems. Additionally, as competition intensifies, SMEs are looking to enhance their logistics capabilities, making cloud logistics a crucial tool for their growth and competitiveness.

- The retail segment held the largest market with more than 23.4% revenue share in 2022

Based on the industry vertical, the global cloud logistics market is segmented into retail, consumer electronics, healthcare, automotive, food & beverage, and others. The retail sector's dominance in the market can be attributed to its substantial reliance on cloud logistics solutions. The retail industry has witnessed a significant shift toward e-commerce and omnichannel retailing, necessitating efficient supply chain management. Cloud logistics offers real-time visibility, inventory optimization, and order processing capabilities, all of which are essential for meeting customer demands and maintaining competitiveness. This has led to a higher adoption rate in the retail sector, resulting in a considerable revenue share in the market.

Regional Segment Analysis of the Cloud Logistics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 25.7% revenue share in 2022.

Get more details on this report -

Based on region, North America's dominance in the cloud logistics market can be attributed to a mature and technologically advanced logistics industry, making it more receptive to adopting cloud-based solutions. The presence of numerous large enterprises and e-commerce giants that rely heavily on efficient supply chain operations has driven significant demand. Additionally, the region's robust IT infrastructure, skilled workforce, and favorable regulatory environment have further accelerated the adoption of cloud logistics solutions, cementing North America's position as a leader in the market.

Asia Pacific region is projected for the fastest growth in the cloud logistics market due to the region's booming e-commerce sector and the rise of digitally-savvy consumers are driving increased demand for efficient logistics solutions. The expanding manufacturing and trade activities in countries like China, India, and Southeast Asian nations necessitate advanced logistics management, which cloud technology can provide. Additionally, the region's growing investment in infrastructure and connectivity improvements is fostering an environment conducive to the adoption of cloud-based logistics solutions, making it a prime growth market in the forecast period.

Recent Developments

- In February 2022, Oracle Corporation announced new logistics capabilities to help its clients improve supply chain efficiency and total value. These new capabilities are intended to optimise supply chain operations, resulting in increased supply chain performance and cost-effectiveness. Oracle's clients may achieve better levels of operational efficiency, cost savings, and improved value in managing their logistics and supply chain activities by using these advances.

- In November 2022, Microsoft introduced the Microsoft Supply Chain Platform, a novel design approach aimed at improving supply chain agility, automation, and sustainability. This innovative platform promises to transform supply chain operations by empowering organisations to become more flexible, efficient, and ecologically friendly in their logistics and supply chain practises.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cloud logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Bwise

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Thomson Reuters Corporation

- Trimble Transportation

- Descartes Systems Group

- C. H. Robinson

- MetricStream, Inc.

- 3GTMS

- CargoSmart Limited

- BluJay Solutions

- ShipBob, Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global cloud logistics market based on the below-mentioned segments:

Cloud Logistics Market, By Type

- Public

- Private

- Hybrid

- Multi

Cloud Logistics Market, By OS Type

- Native

- Web-based

Cloud Logistics Market, By Enterprise Size

- Large Enterprise

- Small and Medium Enterprises

Cloud Logistics Market, By Industry Vertical

- Retail

- Consumer Electronics

- Healthcare

- Automotive

- Food & Beverage

- Others

Cloud Logistics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?